From Tokyo to New York: PayPay Joins Binance, Citi Backs BVNK

Hey FinTech Fanatic!

The line between payments and crypto is disappearing fast.

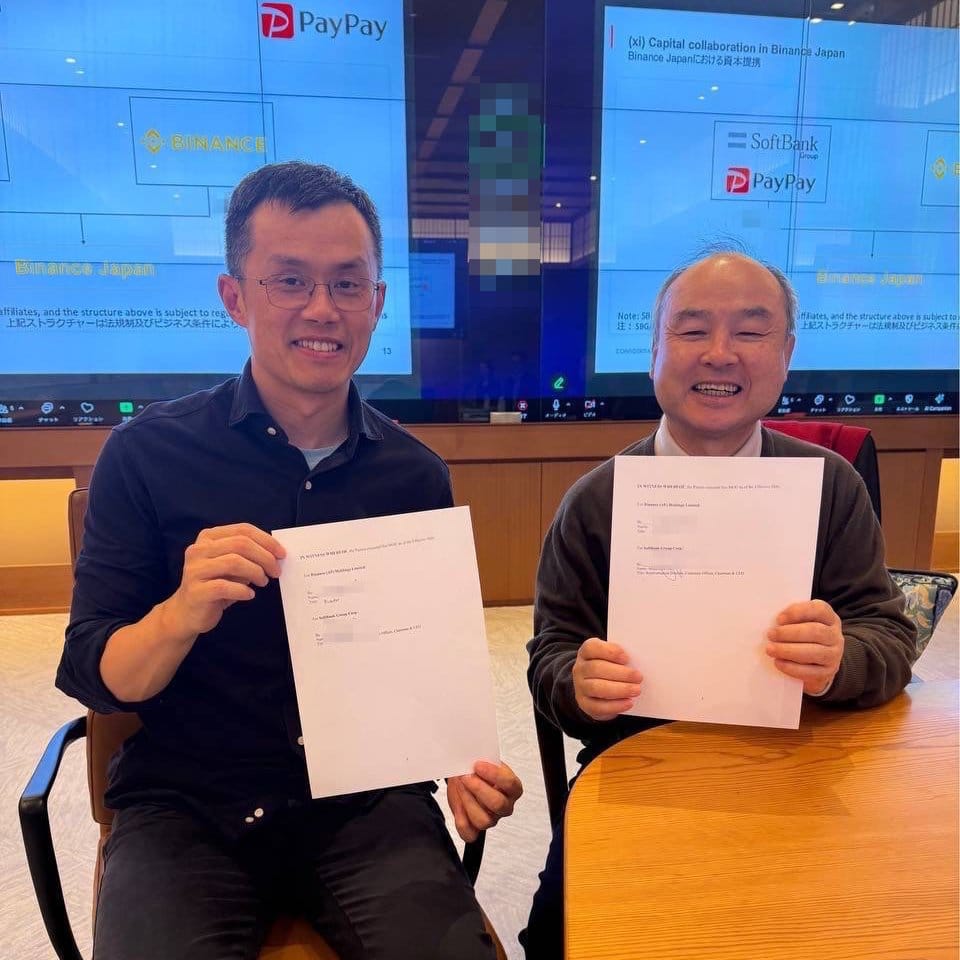

🇯🇵 In Japan, PayPay, the country’s biggest digital wallet with 70 million (‼️) users, just acquired a 40% stake in Binance Japan.

Together, they’re building a bridge between cashless payments and crypto: users will soon buy and sell digital assets using “PayPay Money,” with Web3-powered financial services on the way.

💬 “By combining PayPay’s scale with Binance’s tech, we’ll make Web3 accessible to everyone,” said Binance Japan GM Takeshi Chino.

Meanwhile, on the other side of the world, Citi Ventures joined Visa in backing BVNK, the stablecoin infrastructure platform already processing $20B+ annually for players like Worldpay, Flywire, and dLocal.

It’s a clear signal: banks and payments giants are gearing up for the stablecoin era.

And with Money20/20 Vegas just two weeks away, don’t be surprised if every panel, side chat, and afterparty echoes the same word all week long: Stablecoins.

Vegas might be calling, but the weekend’s here first 😉 See you Monday!

Cheers,

PODCAST

🎤 FinTech Garden by DashDevs Ep. 118 – Built for Change: Inside tbi bank’s Challenger Strategy. In this FinTech Garden episode, Igor Tomych speaks with Petr Baron, CEO of tbi fs, about how the bank grew across Southeast Europe by combining digital-first services with a physical presence. They explore tbi’s sustainable, credit-led strategy, merchant-led BNPL, and how trust and local focus drive its success.

FinTech Garden by DashDevs Ep. 118

FINTECH NEWS

🇺🇸 Robinhood fails to persuade the full Ninth Circuit to take the IPO case. The rejection by the US Court of Appeals for the Ninth Circuit sets the stage for a possible US Supreme Court petition if Robinhood is inclined to pursue its fight over the standards for suing over disclosures in IPO registration and prospectus documents. The case could interest the high court, attorneys have said.

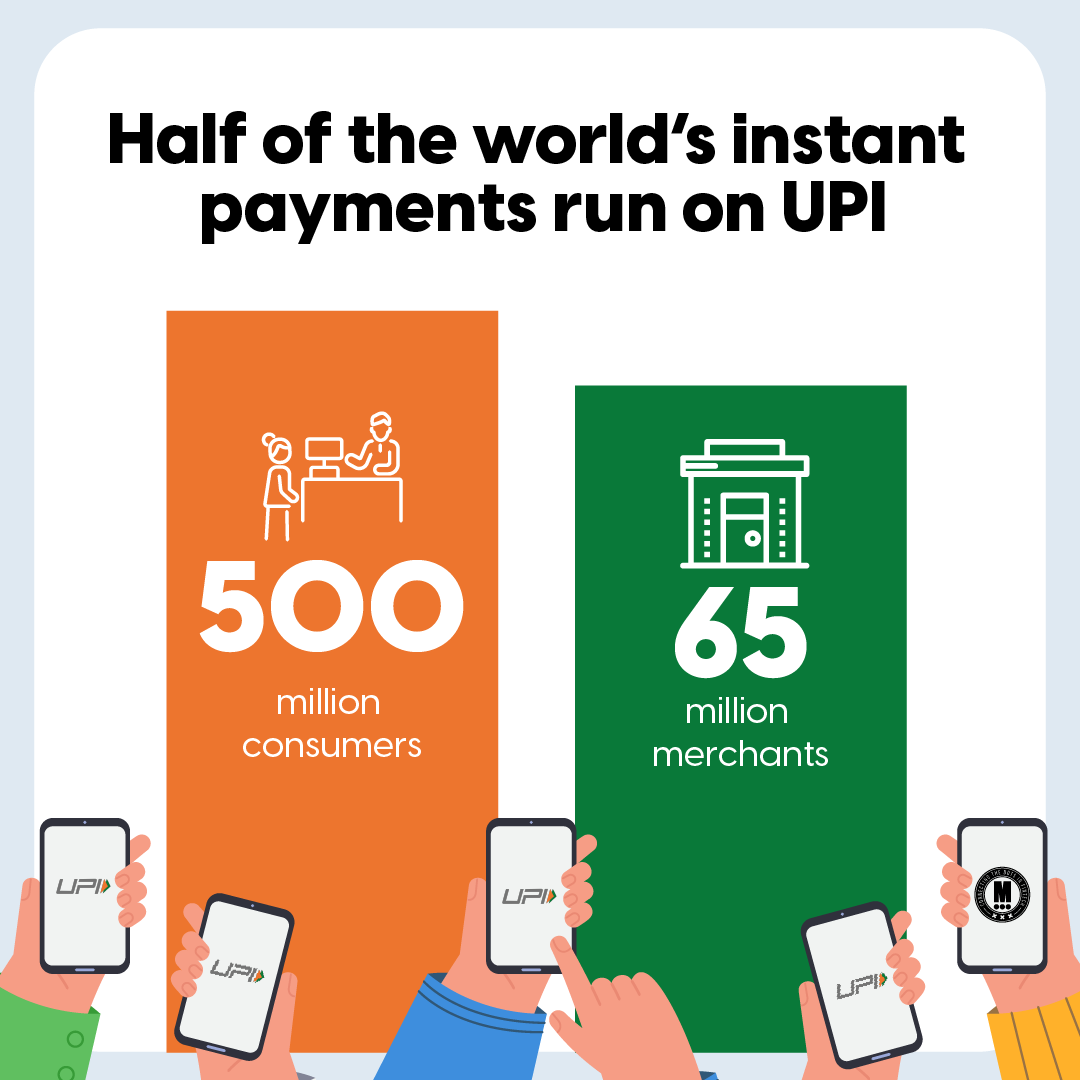

🇮🇳 India rolls out pilot for e-commerce payments via ChatGPT. The pilot will evaluate how the service can be expanded across verticals and how UPI can be used to enable AI agents with payment credentials "to autonomously complete transactions on behalf of users in a safe, secure, and user-controlled manner," the companies said in a statement.

PAYMENTS NEWS

🇵🇹 Elecctro and Getnet are leading the way in seamless EV charging in Portugal. Now, users can simply tap their bank card to pay at charging stations, no subscriptions, no apps, no long-term commitments required. Together, they're reshaping the EV charging landscape with a focus on simplicity, security, and scalability.

🇪🇸 Bizum celebrates its 9th anniversary with 30 million users and is leading the transformation of digital payments in Spain and Europe. Since its launch in 2016, Bizum has experienced exponential growth, incorporating new uses and features to facilitate and improve the lives of the Spanish society.

🇧🇷 Pomelo expands its solutions in Brazil, enabling companies to issue postpaid credit cards through partnerships with Central Bank–licensed institutions. This new structure removes licensing barriers, enabling customers to charge interest, launch products more quickly, and compete in the credit market with greater flexibility and lower costs.

🇺🇸 Moving from payments coordination to payments orchestration by ACI Worldwide. Merchants need a modern, centralized payment platform to keep up with savvy shoppers demanding a frictionless experience with the latest alternative payment methods. Download the whitepaper here

🇩🇪 Sibos 2025: Tokenisation moves centre stage. At Sibos 2025 in Frankfurt, tokenisation dominated discussions as the future of global finance. ACI Worldwide’s Philip Bruno highlighted tokenisation’s potential to accelerate economic growth through faster money movement. Keep reading

🇬🇧 Innovation and Security at Ecommpay. At a recent fireside chat with Erica Stanford and Charles Kerrigan, Willem Wellinghoff highlighted the growing threat of AI-driven scams, deepfakes, and crypto-fuelled fraud networks. Ecommpay echoed this message, emphasizing that innovation and security must advance together.

🇮🇳 India’s UPI is accounting for nearly 50 per cent of global real-time payment volumes 🤯

🇩🇪 Vivid Money launches Card Terminals with 1-Second Payouts, which transfer payment revenue to business accounts in one second, ending multi-day settlement delays for small businesses. The launch extends Vivid Money's all-in-one platform from digital finance into in-person payments.

🇺🇸 PayPal unleashes the power of retail media for small businesses, enabling them to join the billion-dollar advertising boom. PayPal Ads Manager will help small businesses create billions of new advertising impressions for brands of all sizes by utilizing a fast-growing and highly profitable segment of digital advertising.

🇬🇧 G20's cross-border payments push set to miss 2027 target. Goals set in 2021 included cutting the global average cost of a retail payment to no more than 1% and for 75% of wholesale and retail payments to be credited within an hour of being made. Read more

🇧🇭 STC Pay intends to expand regionally and double its growth. In an exclusive interview, Metin Zavrak noted that this expansion marks a bigger push from the whole group. He affirmed that some other discussions are going on, as the team is actively working to scale business in neighboring countries and North Africa later on.

🇬🇧 LemFi introduces AI-powered 'send now, pay later' service. Send Now, Pay Later aims to address this critical pain point and provide vital service to customers who are new to the country and have a limited UK credit history. Keep reading

🇮🇳 Wise is to launch a travel card in India. In June, Wise received in-principle approval from the RBI to operate as a cross-border payment aggregator for export transactions. It also opened a full-stack hub in Hyderabad, its second in the APAC region.

FINTECH RUNNING CLUB

🚀 NYC, Let’s Run! Join Pedro Dávila and the FinTech Running Club for a high-energy run, networking, and connections you can’t miss.

👉 Sign up now and run with NYC’s FinTech community!

DIGITAL BANKING NEWS

🇨🇴 Revolut gets an initial license to establish a bank in Colombia. The bank said the authorisation from the Superintendencia Financiera de Colombia (SFC), the country’s financial regulator, permitted it to “start building out its banking operations and infrastructure” in the Latin American country with 53 million people. Additionally, Revolut plans to invest $670 million in India over five years to expand local operations and fuel new payment and forex products

🇦🇺 Revolut has announced the launch of RevPoints, a new rewards programme in Australia providing uncapped rewards points on debit card expenditure, with points redeemable for airline miles, gift cards, and other lifestyle benefits. RevPoints enables customers to earn points without incurring debt, thereby expanding access to travel and retail rewards for a broader population.

🇧🇩 Banglalink seeks a digital bank licence from the Bangladesh Bank. Bangladesh Bank officials confirmed that on 14 September, Banglalink and VEON wrote to the governor expressing their interest in establishing a digital bank to support the country's transition toward a digitally driven, cashless economy.

🇮🇳 Neobank unicorn Open posts Rs 46 Cr revenue in FY25; outstanding losses mount to Rs 1,921 Cr. The company builds digital payment solutions that offer businesses a fully digital current account along with a suite of integrated tools for finance, accounting, and credit, all in collaboration with banking and lending partners.

🌎 Prometeo launches Agentic Banking solution. A transformative infrastructure layer that enables large language models (LLMs) and other AI agents to operate real-world financial actions autonomously. Agentic Banking empowers AI to execute actions like payments, account validation, and treasury operations with full traceability and compliance.

🇺🇸 Cash App users to receive up to $147 after settlement. A $12.5 million settlement has been reached to end a class-action lawsuit accusing Block, Inc., the parent company of Cash App, of helping users send unwanted text messages to Washington residents through its “Invite Friends” program.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Winklevoss-backed crypto company OranjeBTC eyes expansion in Brazil. OranjeBTC wants to expand its Bitcoin holdings and roll out new educational programs to promote broader adoption of digital assets in the country. The company plans to combine its growing Bitcoin reserve with an education arm offering courses, events, and training.

🇺🇸 Square offers Bitcoin payments for merchants as crypto adoption accelerates. Square launched a feature enabling local businesses to accept Bitcoin at the point of sale and hold the digital asset in an integrated wallet, helping advance Bitcoin’s use as a medium of exchange.

🇺🇸 Coinbase launches Crypto Staking in New York amid regulatory relief. The approval is in effect, and now New York customers are able to delegate tokens such as ETH, SOL, and other supported digital assets directly through Coinbase and engage in network validation and receive staking rewards payable in native cryptocurrencies.

🇺🇸 Bakkt, Galaxy, Castle Island, and FalconX select Fireblocks for institutional crypto custody. Fireblocks Trust Company provides a custody framework that integrates seamlessly with Fireblocks’ security stack and its network of more than 2,400 institutions.

PARTNERSHIPS

🌍 Yapily supports Google to provide bank account verification services for business customers to power its bank account verification service for business customers across Europe, marking a major milestone in open banking’s expansion. Yapily continues to strengthen its position in the sector.

🇸🇬 MyRepublic and Revolut partner to redefine the digital lifestyle for Singapore's mobile-first generation. With the new MyRepublic™ MOBILE x Revolut plan, users enjoy up to 2 months off their 4G/5G MyRepublic Mobile plan bundled with a 3-month Revolut Premium Trial.

🇺🇸 Affirm extends its collaboration with Google as a supporter of Agent Payments Protocol (AP2). By contributing to AP2, Affirm is helping embed BNPL directly into the architecture of agentic commerce and shaping a payments ecosystem designed for accountability and trust.

🇺🇸 FIS has integrated Glia's AI-powered customer interaction platform into FIS’s Digital One online banking platform, enabling financial institutions to deliver a multi-channel digital interaction solution that blends AI-based service with high-touch human support for superior banking experiences.

🇬🇧 PayCaptain and ClearBank partner to deliver real-time payroll payments and embedded savings accounts for employees at over 300 corporate clients, specialising in the hospitality and retail sectors. Long-term partnership delivers an easy, transparent approach for employees to build savings and enhance their financial resilience.

DONEDEAL FUNDING NEWS

🇺🇸 Citi Ventures invests in BVNK to power the next generation of financial infrastructure. Arvind Purushotham, Head of Citi Ventures, noted the growing interest in using stablecoins for settling on-chain and crypto asset transactions, highlighting BVNK’s enterprise-grade infrastructure and strong track record as key reasons for Citi’s investment.

M&A

🇯🇵 PayPay and Binance Japan form a strategic alliance to drive the future of digital finance. Together, the companies aim to make Web3 and digital assets more accessible to everyday users in the country. Initial integration will enable Binance Japan users to purchase crypto using PayPay Money and withdraw directly into PayPay Money.

🇮🇳 UST acquires Bengaluru-based banking solutions provider Modus Information Systems to strengthen its position in the financial sector. UST notes that with Modus in its fold, it will be able to meet the growing demand for digital transformation and scalable banking solutions.

MOVERS AND SHAKERS

🇺🇸 DEUNA appoints Chase Foster as Head of US, including GTM & Sales. He’ll lead DEUNA’s U.S. expansion, driving growth and awareness of Athia, its agentic intelligence system transforming payments through actionable data. His leadership marks a pivotal step as the company scales in the world’s most competitive commerce ecosystem.

🇦🇺 Gemini expands in Australia with James Logan as Country Head. James will lead Gemini's Australian strategy, partnerships, and customer growth, helping Australians trade and invest with confidence as adoption accelerates. He brings extensive experience in financial services and crypto to Gemini.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()