From LA → Copenhagen: Meetups & Miles 🏃♂️

Hi FinTech Fanatic!

Shoutout to my LA crew, today is one you don’t want to miss. My friend Seth Ross (yes, the same Seth I ran the charity race with the day before the LA Marathon in March) is hosting another local FinTech LA Meetup. If you’re in town, this is where you should be tonight.

And since we’re on the topic of runs & meetups… our FinTech Running Club has now grown to 20+ cities globally 🌍. Check the calendar, lace up, and join one near you.

I’m in prep mode for the Amsterdam Marathon, so you’ll probably catch me at a few of them — plus some pop-up runs in surprise cities (more on that soon 😉).

Oh, and speaking of events: I’m thinking about dropping by Nordic FinTech Week in Copenhagen next week. Might even host a run while I’m there.

Who’s in?

Cheers,

FINTECH NEWS

🇦🇪 Comera Pay secures Visa principal membership to launch multicurrency offerings in the UAE. The new membership is expected to enable Comera Pay to launch a multicurrency product, allowing consumers to transact locally and internationally, according to a statement.

🇰🇪 PayU exits Kenya six years after launch and appoints Sonal Tejpal as the liquidator. The decision to shut down was filed under Kenya’s Insolvency Act and published in a local newspaper. As liquidator, Tejpal is now responsible for winding up the company’s affairs and settling any outstanding liabilities.

🇺🇸 Bankrupt FinTech Linqto cuts deal over hard-to-get private firm shares. The company would offer customers one of two options for being repaid. Customers can choose to accept shares in a closed-end fund that can be sold like any other public stock, or to get stakes in a trust that would only let them cash out at certain times.

🇺🇸 Klarna CEO eyes $1 billion wealth revamp after US listing. Flat Capital AB proposed acquiring Double Sunday AB, which owns 6.5% of Klarna and is currently wholly owned by Sebastian Siemiatkowski, in a deal that values Double Sunday at 9.5 billion Swedish kronor.

🇹🇷 Capital.com plans to enter Türkiye, seeking a local licence. “As part of our global expansion strategy, Capital.com is exploring new licences in several markets, including Türkiye,” said Salim Sebbata, Head of Corporate Development at Capital.com.

PAYMENTS NEWS

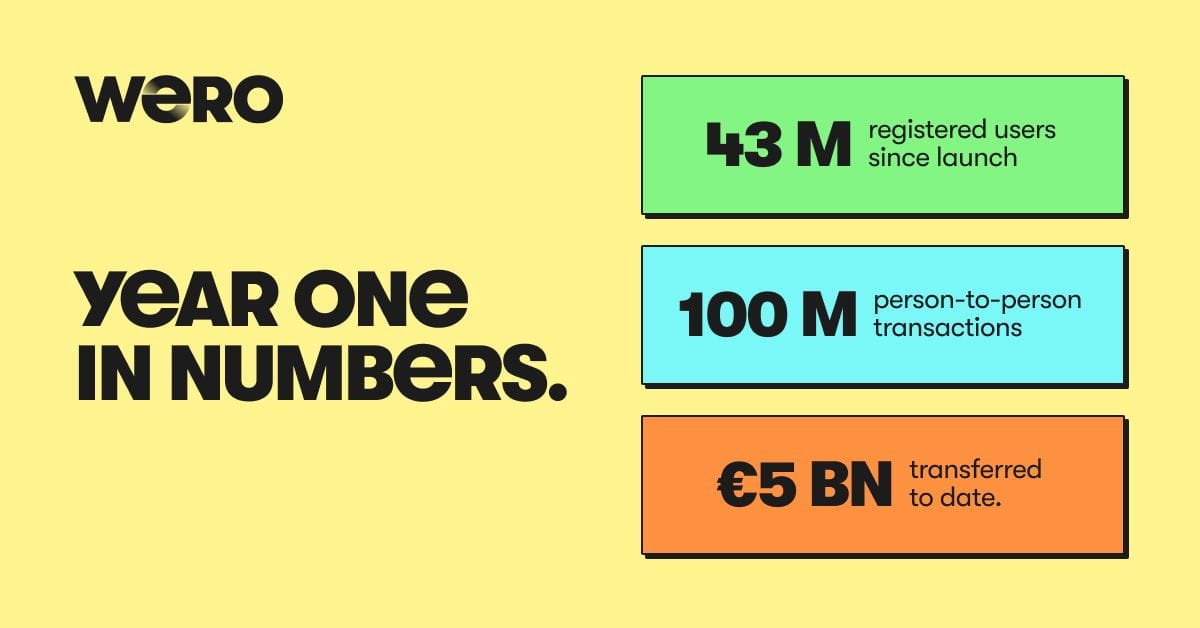

📈 Wero digital wallet has become a trusted everyday payment solution for over 44 million Europeans 🤯 EPI Company is preparing to launch Wero for e-commerce, starting in Germany later this year.

🇬🇧 Enhancements to the Ecommpay subscription service help address failed recurring payments. With evolutionary network tokenization and card updates happening automatically in real-time, Ecommpay Subscriptions delivers flexible, intelligent, and globally accessible billing through easy-to-use APIs, dashboard tools, and hosted checkout.

🇺🇸 Creating successful strategies for payment resilience. The Finextra webinar, in partnership with ACI Worldwide, explored how financial institutions can build effective multi-cloud and hybrid cloud strategies to boost payments resilience amid growing regulatory, operational, and geopolitical pressures. Join this webinar

🇺🇸 Real-time security for real-time fraud in payments with Damon Madden, regional solution consultant and fraud expert at ACI Worldwide, and Yvonne Elford, Sales Executive at ACI Worldwide, dispel some myths, discuss the future of payment innovation, and unpack the latest trends in payment fraud.

🇺🇸 Affirm live for in-store purchases with Apple Pay on iPhone. This payment option offers even more flexibility and choice for Apple Pay customers, and is available with Apple Pay in the U.S. Continue reading

🇮🇳 Introducing Apple Pay on Razorpay: a new era of frictionless global payments. This milestone enables Indian businesses selling globally to offer their international customers one of the world’s most trusted, loved, and seamless payment methods, directly through Razorpay’s checkout.

🇺🇸 Zelle® hits new highs. Two billion in transactions and nearly $600 billion in payments in the first half of 2025. With over 125 average payments per second per day, Zelle captures the pulse of how Americans are navigating today's economy. Keep reading

🇮🇳 Paytm launches postpaid, a credit line on UPI, in partnership with Suryoday Small Finance Bank, offering ‘spend now, pay next month’ convenience. With Paytm Postpaid, consumers can now make payments using a credit line on UPI across all merchant touchpoints. This includes scanning any UPI QR code, shopping online, or paying for recharges, bill payments, and bookings on our app.

REGTECH NEWS

🇩🇪 eToro EU approved for crypto in Germany, and custody remains with Tangany. The firm now allows European users to deposit funds in eight currencies via card or bank transfer. The company announced that all cryptoasset trading for German clients will be conducted directly through eToro EU, ending the use of DLT Finance for trading services on the platform.

DIGITAL BANKING NEWS

🇫🇷 Revolut meets fiercest rival yet in French push. Revolut has now set up its EU base in Paris, promises to spend 1 billion euros in the next three years, and hopes to reach 10 million customers by 2027. Read more

🇬🇧 Zopa Bank sets out Manchester growth ambitions with Mayor Andy Burnham. The scaling of its Manchester location will support Zopa’s vision to become the home of money for its customers, creating effortless experiences and valuable products to build deeper relationships with customers.

🇺🇸 MoneyGram reinvents cross-border finance with next-generation App. Consumers who were once constrained by fragmented systems and local currencies will now be empowered to leverage stablecoins to access a fast and modern way to move and hold money across borders.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 UK watchdog to waive some rules for cryptoasset providers. The watchdog plans to grant exemptions from certain sections of its official handbook, which outlines rules for UK-regulated financial services. Continue reading

🇺🇸 Binance nears deal to escape compliance monitor imposed by DOJ. The Justice Department is reviewing whether to release Binance from its requirement to maintain an outside compliance monitor, which has a three-year duration, and Binance would likely have to adopt enhanced compliance reporting requirements.

🇨🇭 Swiss banks complete first binding blockchain payment. In a milestone for the Swiss financial sector, UBS, PostFinance, and Sygnum have successfully executed the first legally binding interbank payment using tokenized bank deposits on a public blockchain.

🌍 BitGo secures BaFin approval to launch regulated crypto trading in Europe. New license aims to boost institutional adoption with MiCA-compliant, secure trading and settlement under one platform. This move positions BitGo as one of the few firms in Europe offering custody, staking, and now trading under a single license, alongside competitors like Coinbase and Kraken.

🇺🇸 Crypto Platform Bullish wins New York BitLicense, clearing path for U.S. expansion. The licenses will allow the institutional digital asset platform to offer spot trading and custody services to customers in New York, the company said in a press release.

PARTNERSHIPS

🇺🇸 Affirm partners with ServiceTitan to bring smart, flexible payment options to the trades. Through this partnership, ServiceTitan customers will offer approved consumers the ability to split home repair bills into budget-friendly biweekly or monthly payments.

🇸🇦 MoneyGram and Enjaz partner to expand cross-border payments in Saudi Arabia. Through this collaboration, Enjaz will integrate MoneyGram’s global payments network infrastructure into its nationwide retail and digital channels, including the Enjaz Pay App, enabling millions of consumers to send money quickly and reliably. Additionally, MoneyGram and D360 Bank signed a strategic MoU at Money20/20 Middle East. The collaboration will focus on enhancing cross-border payment capabilities and delivering digital financial solutions to customers.

🌍 Tuum and Abwab.ai partner to deliver end-to-end SME lending solutions in the Middle East. The collaboration brings together Abwab.ai’s advanced AI-powered credit decisioning and analytics capabilities with Tuum’s modular. This integration enables financial institutions to rapidly launch, scale, and optimize SME lending offerings with greater efficiency, transparency, and speed.

DONEDEAL FUNDING NEWS

🇺🇸 Stablecore raises $20M to bring stablecoins, tokenized deposits, and digital assets into banks and credit unions. The new funding allows Stablecore to grow its customer base within the 8,000+ regional and community banks and credit unions in the U.S. and hire additional talent to support them.

🇬🇧 Covecta raises $6.5M to speed up business lending with AI platform. The funds will help to expand its AI-powered platform, aiming to help banks automate workflows, accelerate lending, and free frontline staff from administrative burdens. Keep reading

🇸🇦 Saudi FinTech Spare closes $5 million pre-Series A. The new capital will be used to scale Spare’s Open Banking platform and API integrations, accelerate product development, and drive expansion across the GCC. The funding will go towards strengthening bank integrations, building new products, and expanding regionally.

🇺🇸 WorkFusion raises $45 million in funding to fuel growth for agentic AI for financial crime compliance. The company’s AI Agents reduce manual work and allow FCC operations teams to scale capacity by 3-5X in job functions, enhanced due diligence/high risk review, and fraud alert review.

🇵🇭 FinTech Salmon raises $50M in oversubscribed Nordic bond offering. The FinTech said the oversubscription reflects strong investor confidence in Salmon’s growth trajectory and financial performance and underscores demand for Southeast Asia’s emerging consumer lending platforms.

🇮🇳 Lending infra startup FinBox raises $40M in Series B led by WestBridge Capital. The fresh funding will be deployed to accelerate technology development, expand internationally, and build new AI-enabled products. FinBox said it will deepen offerings in its lending platform, its partnership lending stack, and data intelligence products.

🇫🇷 Defacto has raised a €16M funding round as the French lending FinTech seeks to increase its lending volume tenfold amid a sea change in the SME lending space. Citi Ventures and La Maison Partners led the funding round, with participation from new investor Blast.

🇸🇦 Lendo strikes $53M deal with Jadwa Investment to fuel SME growth. The Saudi FinTech has secured a financing deal to scale its SME credit platform across Saudi Arabia, extending capital supply and testing how FinTech infrastructure can accelerate credit access.

M&A

🇧🇪 Belgian FinTech RiskConcile acquires Fitz Partners. By integrating Fitz Partners’ proprietary fund fee data with RiskConcile’s reporting and risk-calculation capabilities, the group aims to deliver a solution for asset managers facing compliance burdens and competitive pressures.

MOVERS AND SHAKERS

🇧🇷 Getnet Appoints Caio Costa, Former PagBank, Visa, and Mastercard Executive, as VP of “Open Sales”. Getnet has announced the appointment of Caio Costa as its new Vice President of Open Sales. In this role, Costa will lead the company’s commercial strategy focused on acquiring clients through alternative sales channels.

🇬🇧 Ex-OakNorth & Starling executive Ben Chisell appointed CEO at Paysend. Ronnie Millar said: “Ben’s strategic vision, product expertise, and deep understanding of both our business and the global payments ecosystem make him the ideal leader to take Paysend forward.”

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()