From BNPL to AI: Tabby & Klarna Just Leveled Up

Hey FinTech Fanatic!

The AI wave in FinTech is accelerating.

First up: Tabby, the GCC’s most valuable FinTech ($3.3B), just announced plans to build its own AI factory in Saudi Arabia, powered by NVIDIA HGX systems.

Think local compute, faster responses, and total data control. From fraud detection to personalized shopping, Tabby is moving way beyond BNPL into AI-driven financial services, and setting the stage for that long-anticipated IPO.

Meanwhile, Klarna is plugging into Google’s Agent Payments Protocol (AP2) — an open standard for AI-led transactions. Translation: your digital assistant could soon handle a Klarna-powered purchase for you, with instant underwriting and flexible pay-later options.

Two different continents, one clear signal: FinTech’s future is being rewritten by AI.

What do you think is going to be the next big (AI-) thing in FinTech?

Cheers,

#FINTECHREPORT

📊 2025 National Day and Mid-Autumn Festival Holiday Report.

FINTECH NEWS

🌍 We’re Expanding again! The FinTech Running Club is looking for new hosts in Paris, San Francisco, and Lisbon. If you’re passionate about creating a local community and have a natural sense of leadership, apply and grow your network with us!

🇦🇪 Tabby launches Saudi AI factory using NVIDIA HGX systems. The move aims to accelerate its AI roadmap while retaining data sovereignty and meeting regulatory constraints. The company said it will initially use the systems to power AI tools across customer support, fraud detection, risk scoring, and shopping personalisation.

🇺🇸 Israeli FinTech firm Navan targets $6.5b valuation in IPO. The company aims to raise about US$960 million by offering 36.9 million shares priced between US$24 and US$26 each. The firm’s shares are expected to trade on the Nasdaq under the symbol “NAVN.”

🇺🇸 Brazilian FinTech PicPay is reportedly seeking $500 million in a US IPO. PicPay offers financial services including digital wallets, cards, loans, and investments, and reported 208.4 million reais in profit on 4.5 billion reais in revenue in the six months through June 30.

PAYMENTS NEWS

🇬🇧 Solidgate Treasury joins the global SWIFT network. Solidgate Treasury is designed to simplify the complexities of managing global operations. With direct integration with SWIFT, businesses can now transfer funds globally in multiple currencies with fewer intermediaries, reducing delays, risks, and costs.

🇱🇺 Wero is set to launch in Luxembourg through a partnership with Payconiq International, Buckaroo, and EPI Company. With this rollout, merchants in Luxembourg will be able to accept Wero payments, while consumers can use the app for peer-to-peer transfers and instant payments at checkout.

🇺🇸 Jack Dorsey’s Block targets card network fees in latest push. Block is helping local businesses offer their own branded rewards programs, which consumers manage through the company’s Cash App. It’s now looking to incentivize shoppers to pay directly with their stored balances on the app to sidestep card networks, while collecting rewards.

🌍 Major banks explore issuing stablecoin pegged to G7 currencies. The project, which is in its early stages, will explore whether there is value in issuing assets on public blockchains that are pegged 1:1 to real-world currencies, a type of cryptocurrency known as stablecoins.

🇸🇦 Paymentology scales card programs in Saudi Arabia. By providing modular, configurable platforms, Paymentology enables clients to create unique propositions, giving cardholders dynamic control over spend limits, timeframes, and other personalized features.

🇧🇷 Volkswagen selects Nuvei to launch payment solutions for connected vehicles. This collaboration enables Volkswagen to offer subscription-based connectivity services through an integrated app in the VW Play Connect multimedia system, which debuted in the New Nivus in 2024 and is already available for the New T-Cross and New Tera in 2025.

REGTECH NEWS

🇰🇷 FSS urges caution on easing FinTech rules after N26 resignations. According to the FSS report, Germany’s Federal Financial Supervisory Authority (BaFin) recently found deficiencies in N26’s company-wide internal control systems and processes and organization in an inspection. Based on this, BaFin signaled sanctions against its co-founder and CEO.

DIGITAL BANKING NEWS

🇺🇸 Yodlee launches credit subsidiary. The milestone reflects Yodlee’s commitment to advancing credit decisioning and supporting financial ecosystems with actionable, consumer cashflow data. By partnering with Yodlee Credit, lenders can incorporate alternative consumer data into their credit models to responsibly expand access to credit.

BLOCKCHAIN/CRYPTO NEWS

🌍 Binance pays $283,000,000 reimbursement to customers, denies causing the bitcoin and crypto market crash. Binance says it will also compensate users affected by delays in internal transfers and Earn product redemptions. The exchange is also pledging to implement new optimizations in an ongoing effort to continuously improve system performance and risk controls.

🇬🇧 MQube tokenises £1.3bn mortgage debt in European first. The tokenisation converts mortgage debt into digital tokens recorded on a distributed ledger. While equity, bonds, and real estate have been tokenised in previous transactions. Keep reading

🇺🇸 Coinbase to launch American Express-backed credit card offering bitcoin rewards. The card, expected to launch in the fall of 2025, will operate on the American Express network and allow users to earn up to 4% back in Bitcoin rewards. The Coinbase One Card will be available exclusively to Coinbase One members, subscribers to the platform’s premium service.

🇵🇪 BCP launches Criptococos powered by BitGo. Criptococos was developed by BCP as part of its initiative to explore digital assets and emerging financial technologies. The goal is to offer clients the trusted security of the Peruvian financial system within the evolving landscape of modern digital assets.

PARTNERSHIPS

🇬🇧 FCA announces partnership to accelerate delivery of open finance. The UK’s Financial Conduct Authority (FCA) has announced a new partnership and the launch of two “TechSprints” aimed at accelerating the implementation of open finance, extending data sharing beyond banking into broader financial services.

🇪🇬 FABMISR taps Noon Payments to advance FinTech evolution. By combining FABMISR’s banking expertise and technological infrastructure with Noon Payments’ dynamic FinTech platform, the initiative will streamline digital transactions, improve security, and simplify payment processing for merchants across Egypt’s fast-growing online retail sector.

DONEDEAL FUNDING NEWS

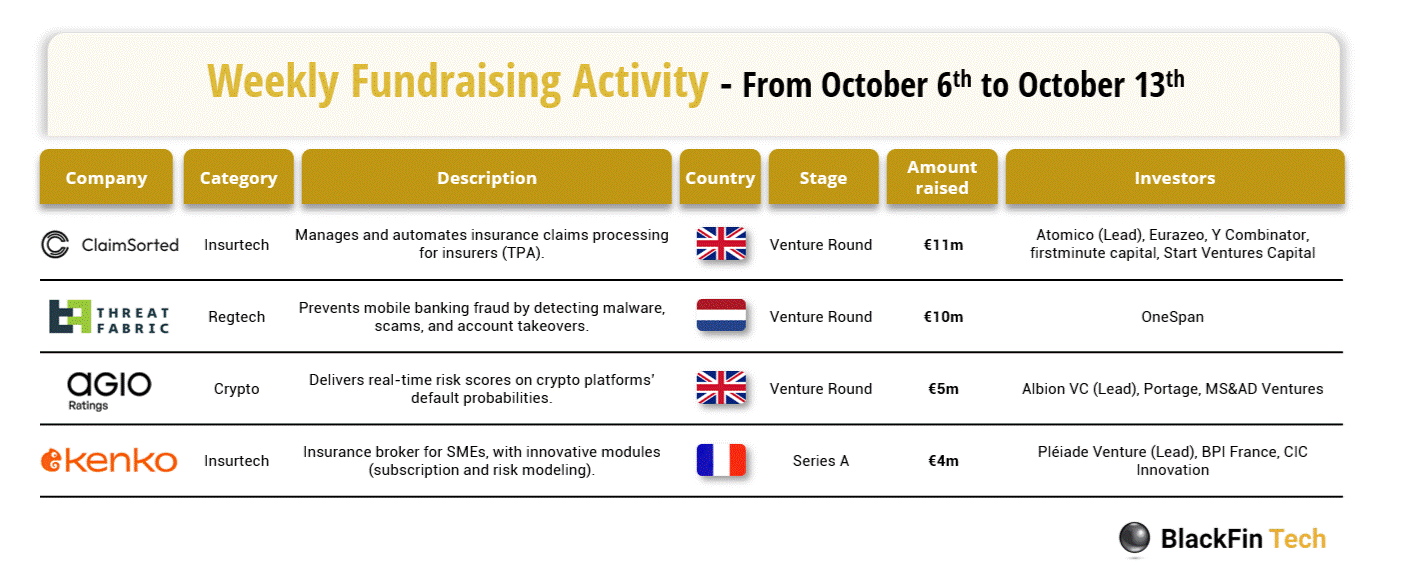

💰 Over the last week, there were four FinTech deals in Europe, raising a total of €31 million, including two transactions in the UK, one in France, and one in the Netherlands.

🇮🇳 GoodScore raises $13M to transform how Indians track and manage credit. GoodScore offers an integrated, AI-powered credit management platform that brings together credit bureau data, transactional insights, and behavioural patterns to deliver real-time credit monitoring, personalised score improvement guidance, and repayment tracking, all in one place

🇪🇺 Resistant AI raises $25M Series B to fortify FinTechs and AI agents against financial crime. The company, which was breakeven in September, will use the capital to solidify its position as a profitable EU AI champion by expanding its document fraud detection and transaction services.

🇮🇳 Wealthtech firm Dezerv raises $40 M led by Premji Invest and Accel. The proceeds will be used to enhance the client experience, strengthen its technology stack, and expand investment offerings across multiple asset classes. The company also plans to hire 200 additional relationship managers over the next 12 months.

🇨🇴 Colombian FinTech Bold raises $40M funding round. Bold will use the funding to accelerate expansion into other Latin American countries, starting with Peru, where the company recently acquired VendeMás, the payment facilitator owned by Niubiz. Continue reading

🌍 REasy raises USD 1.8 million pre-seed round to simplify international payments for African SMEs. This new system allows small businesses to conduct compliant and instant international payments, even for transactions below USD 10,000, a breakthrough that significantly reduces delays and costs for cross-border trade.

M&A

🇬🇧 Leeds-based FinTech Nochex acquired by PAYSTRAX. According to CEO Johannes Kolbeinsson, the move aligns with PAYSTRAX’s long-term growth strategy of combining organic expansion with strategic acquisitions. He highlighted Nochex’s strong brand heritage, trusted reputation, and pioneering role in the UK’s online payments industry as key reasons for the integration.

🇺🇸 FIS provides update on regulatory review of issuer solutions acquisition; transaction remains on track to close by the first half of 2026. In the normal course of the UK Competition and Market Authority’s (CMA) review of the transaction, the company proactively identified additional information that it will be providing to the CMA, resulting in a need to refile the UK Merger Notice.

MOVERS AND SHAKERS

🇬🇧 Former Klarna UK boss Alex Marsh named CEO of Salad Group. The appointment is part of a restructuring of the company that will see Tim Rooney continue as Chief Executive of Salad Finance while Marsh will oversee the company’s core propositions in its group structure.

🌍 HSBC’s former top European banker, Colin Bell, joins Starling. Starling has added the former head of HSBC in Europe to its board as the digital bank looks to grow its international footprint. Colin Bell has joined Starling as an independent non-Executive Director.

🇬🇧 OpenPayd appoints ClearBank's Yasemin Swanson as Chief Operations Officer. In a statement, OpenPayd says Swanson will focus on operational infrastructure to support global expansion, while working with the leadership team, including founder Dr Ozan Özerk and CEO Iana Dimitrova, to deliver the continued development of payment innovations.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()