Flutterwave Acquires Mono to Deepen Open Banking Across Africa

Hey FinTech Fanatic!

Flutterwave has acquired Mono, strengthening its payments infrastructure and making open banking a core pillar of its long-term strategy across Africa.

The move points to a broader shift... Africa’s next payments phase looks less card-led and more bank-based, authenticated, and data-driven. Open banking becomes the connective layer.

By integrating Mono’s APIs, Flutterwave expands into faster onboarding, better verification, reduced fraud, and seamless account-to-account payments. It also opens the door to richer alternative payment methods and stablecoin use cases.

Mono will continue to operate independently, with no changes to leadership or day-to-day operations. The focus here is strategic alignment, not operational control.

Flutterwave CEO Olugbenga 'GB' Agboola highlighted the strategy: "Open banking provides the connective tissue, and Mono has built critical infrastructure in this space. This acquisition allows us to expand what's possible for businesses operating across African markets."

Now, keep an eye on where FinTech is heading and dive into today’s updates 👇 I'll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

📊 The 2025 Stablecoin Year-End Report. This report, by Stablecoin Insider, captures why 2025 became an inflection point, the year when stablecoins stopped being a niche crypto narrative and began reshaping how money moves globally. Read on

INSIGHTS

🌍 The Stablecoins Stack: Mapping the Landscape

FINTECH NEWS

🌍 New 2026 FRC runs! The FinTech Running Club is back from its break with new runs! If you’re passionate about FinTech, community, and networking, why not join the chapter in your city? Are you curious? 👉 Sign up for a run here!

🇳🇱 Tencent-backed FinTech Airwallex to invest in the Netherlands. Airwallex said on Monday it will invest around 200 million euros ($233.64 million) over the next five years in the Netherlands, marking a major European expansion as it shifts focus from its Asia-Pacific base.

🇺🇸 JPMorgan says Javice Firms billed millions just for attendance. JPMorgan is disputing $74 million in legal fees billed by Charlie Javice after her fraud conviction, arguing that the costs were high and included unnecessary expenses. The bank is seeking to avoid paying disputed charges and to end its obligation to cover future legal fees.

🇬🇧 FinTech PrimaryBid sheds 40% of staff amid £18m loss. PrimaryBid’s average headcount fell to 91 staff in the year to March 2025, from 152 during the same period a year earlier, according to newly published registry filings. Read more

🇧🇷 FinTech iCred raises R$1.15 billion in FIDCs and hires Vinci Compass in search of an investor. The FinTech company from Sergipe projects to originate R$4 billion in credit in 2026 and is betting on the portability of INSS (Brazilian Social Security Institute) payroll loans to accelerate its expansion.

🇶🇦 VoPay establishes global headquarters in Qatar to advance digital financial infrastructure across MENA, Africa, and Southeast Asia. As part of this expansion, VoPay plans to hire more than 400 professionals in the country, reinforcing the country’s role as a long-term center for financial infrastructure development.

PAYMENTS NEWS

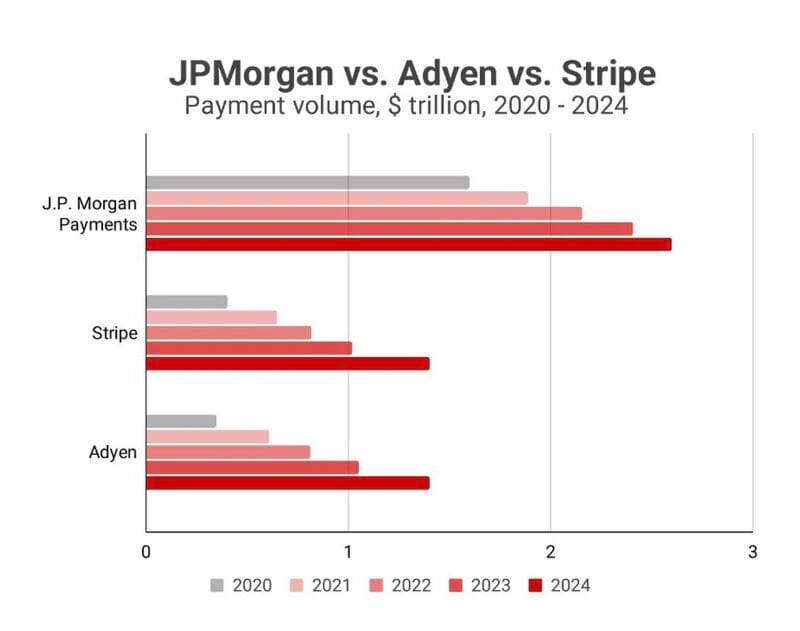

📊 JPMorgan Payments 🆚 Stripe 🆚 Adyen

Three very different strategies, let's dive in👇

🇦🇪 FAB and Mastercard transform UAE business payments with mobile-first virtual corporate cards. This innovative solution enables enterprises and government entities to issue and manage virtual corporate cards while integrating them into mobile wallets - for flexible, efficient, and secure payments.

🇸🇾 QNB and Mastercard expand payment services in Syria. The alliance marks an important milestone for Mastercard and QNB in their joint efforts to enhance the digital banking experience, drive financial inclusion, and create new opportunities through technology.

🇰🇷 South Korea’s Hana Financial explores stablecoin adoption. Chair and CEO Ham Young-joo highlighted the need for the company to build an ecosystem for coin-based assets. He noted that the regulatory environment for digital assets remains uncertain, making the impact of stablecoins difficult to predict.

🇧🇷 Over 9 million Pix keys are canceled due to CPF irregularities. This measure complies with a Central Bank directive aimed at ensuring the security of the financial system and preventing fraud. The Central Bank's survey indicates that the exclusions affected individuals with suspended, invalid, or canceled CPF numbers, as well as deceased holders.

🇺🇸 Retail giant Walmart embraces Bitcoin, opening crypto payments to 150M users. By embedding Bitcoin payments into Walmart’s own financial ecosystem, the retailer removes friction for customers unfamiliar with crypto wallets or exchanges, enabling simple, intuitive BTC payments.

DIGITAL BANKING NEWS

🇺🇦 Revolut is closing Ukrainian accounts due to local legislation requirements, notifying users from December 22 and allowing time to withdraw funds. The company continues to operate only EU-based accounts, has informed regulators of its plans to obtain a Ukrainian banking license, and acknowledges that offering hryvnia accounts requires local regulatory approval.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Shift4 launches global stablecoin settlement platform, unlocking faster payments for merchants. This solution will enable merchants to opt for settlement in popular stablecoins, such as USDC, USDT, EURC, and DAI, rather than receiving a bank transfer.

🇺🇸 JPMorgan cut off two stablecoin startups despite using a banking intermediary. JPMorgan’s decision to freeze accounts linked to two crypto payment startups has once again exposed the fragile link between FinTech and traditional banking. BlindPay and Kontigo lost access to banking services after the bank flagged compliance risks tied to their operations.

🇺🇸 Trump Firm to start new cryptocurrency for shareholders. The company said the new token will be allocated to investors in a partnership with crypto exchange Crypto.com, according to a statement. It is expected to operate on the Cronos blockchain, a network supported by Crypto.com.

🇸🇻 Tether just pulled $779 mln in Bitcoin, and the supply shock is growing. The move reflects a broader trend of large holders shifting assets off exchanges, tightening liquid supply, and supporting bitcoin’s price growth, while measured demand suggests strategic accumulation rather than speculative buying.

🇦🇷 Coinbase will terminate its peso-to-USDC conversion and local bank withdrawal services in Argentina effective January 31, 2026, creating immediate uncertainty for the nation’s digital asset users. This suspension comes just one year after the platform launched these regulated services with local approval.

PARTNERSHIPS

🇲🇲 Temenos partners with Myanmar Citizens Bank on digital upgrade. As part of the partnership, MCB will implement Temenos’ modern banking platform to enable fast, secure, and real-time payment processing across domestic and international networks.

🇪🇬 Bank NXT partners with IBM and Inspire to power next-generation digital banking. This integrated approach is designed to improve resilience, minimize downtime, optimize IT resources, and deliver faster, more reliable digital banking experiences for its customers.

🇺🇸 Axos Bank joins Qualia's Bank Partner Network to enhance digital real estate closings. This strategic collaboration integrates Axos Bank's specialized title and escrow banking services with Qualia's digital real estate closing platform, creating a streamlined transaction experience for settlement service providers nationwide.

DONEDEAL FUNDING NEWS

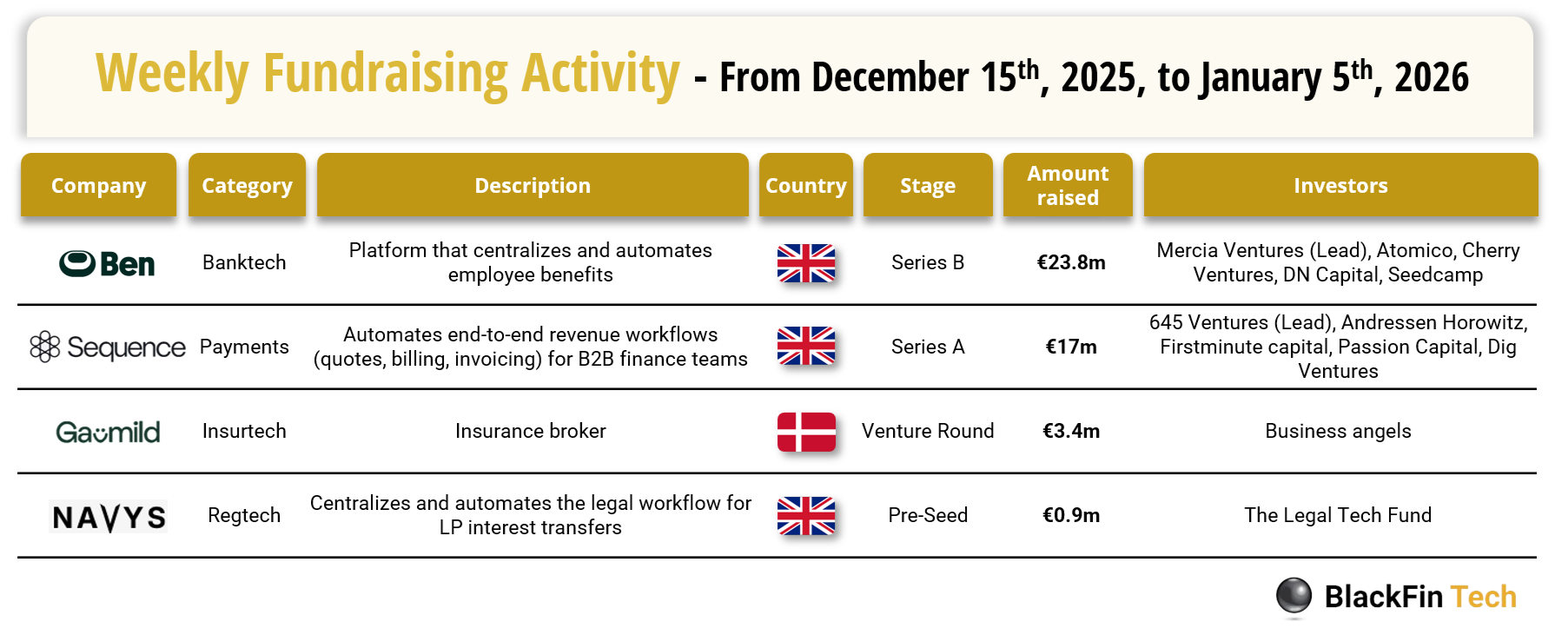

💰 Over the last three weeks, there were four FinTech deals in Europe, raising a total of €45.1 million, including three transactions in the UK and one in Denmark.

🇬🇧 Revolut clashes with former staff over tax on share awards. The issue arose after former staff were invited to sell shares in a buyback that valued Revolut at $52 billion. Revolut has acknowledged providing incorrect information, clarified that participation in the buyback is voluntary, and advised affected individuals to seek independent tax advice.

🇮🇳 Knight FinTech secures $23.6 million in Series A funding. The new capital will be deployed to further strengthen Knight FinTech’s AI-native product roadmap, with a clear focus on outcomes, better risk intelligence, fraud detection, automated credit underwriting, early-warning systems, portfolio monitoring, and debt recovery systems.

🌏 Tether invests in QR payment platform SQRIL for emerging markets. The move aligns with Tether’s broader efforts to expand real-world use cases for stablecoins. Beyond trading and crypto-native transfers. Especially in regions where traditional banking access remains limited.

🇩🇰 Danish FinTech Sumary secures $4.2 million to automate finance workflows with AI. The company plans to use the capital to accelerate product development, expand into European markets, and grow its engineering and AI teams, while working closely with accounting firms as design partners to refine its automation and intelligence capabilities.

🇺🇸 DailyPay announces new $195 million senior secured revolving credit facility. The company said the financing underscores the strength and scalability of its business model and will enable continued investment in modernizing the employee pay experience.

M&A

🌍 Flutterwave expands payments infrastructure with acquisition of open banking firm Mono. By integrating Mono's open banking APIs, Flutterwave strengthens its ability to support faster onboarding, improved verification, reduced fraud, and seamless account-to-account payments.

🇺🇦 Estonian FinTech Group Iute Group is close to acquiring Ukraine’s RWS Bank. The company has won the tender to purchase the bank and has already submitted the required documents to the National Bank of Ukraine for approval of the transaction.

🇮🇳 Agri FinTech startup Unnati to acquire Info Edge-backed farm input platform Gramophone. Info Edge said its wholly owned subsidiary Startup Investments will transfer its entire stake in Gramophone to Unnati. In return, SIHL will receive a 15.7% equity stake in Unnati on a fully diluted basis.

🇬🇷 Euronet to buy merchant acquiring biz in Greece, Lloyds to shutter invoice financing biz. Under the terms of the deal, CrediaBank will transfer its merchant acquiring business to Euronet Merchant Services Payment Institution, which operates in Greece as epay.

🇧🇪 Belgium’s itsme® is acquiring the Dutch bank-backed ID service iDIN in a strategic move toward a pan-European digital identity standard, combining iDIN’s reach of about 13 million Dutch users with itsme’s adoption by more than 80% of Belgian adults and operations across 30 countries.

🇺🇸 Coinbase to acquire The Clearing Company. The move builds on the recent launch of regulated prediction markets for users and supports Coinbase’s broader vision of an “Everything Exchange,” where customers can trade prediction markets alongside crypto, equities, and derivatives in a single, unified interface.

🇧🇷 Bemobi buys FinTech Celer from Casas Bahia for R$8.8 million. According to Bemobi, Celer's assets will be used by the company's new PaaS business unit and also in its current payments business, complementing the solutions of the Bemobi Pay platform.

MOVERS AND SHAKERS

🇯🇵 Ken Uchiyama has been appointed as President and CEO of Airwallex Japan. He expressed his commitment to advancing cashless payments in the country while thanking colleagues, customers, and partners from his previous role at Mastercard for their support and continued encouragement.

🇪🇸 Tuum appoints Renato Cassinelli as Head of Marketing to drive strategic growth. A seasoned B2B FinTech marketing leader, Renato brings over 15 years of experience building high-impact marketing engines across financial services and SaaS.

🇩🇪 N26 continues leadership transition. N26 co-founder and Co-CEO Maximilian Tayenthal will step away from his operational roles. The announcement follows the recent appointment of Mike Dargan as the sole CEO of N26 SE and N26 Bank SE by the Supervisory board, who is set to join the digital bank in April 2026.

🇬🇧 Tap Global CFO to step down despite rapid revenue rise. The AIM-listed company, cards and crypto settlement services, reported revenues of £3.48 million for the year ended 30th June 2025, up 31% on the prior year. Revenue growth for the Gibraltar and London-based company was driven by higher trading volumes, increased commission income, and continued expansion of its user base.

🇬🇧 London FinTech boots Polish leadership after non-compete allegations. The company replaced Everfex’s management, launched legal action over alleged non-compete breaches, and said the changes aim to strengthen oversight as it works toward sustainable profitability.

🇺🇸 OakNorth appoints former Seccl exec Tom Harris as CTO. In his new position, Harris will oversee OakNorth's various technical initiatives, including its partnership with OpenAI, inked last year, and ongoing US expansion. Read more

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()