Fiserv Unveils FIUSD, A Stablecoin Built for Banks

Hey FinTech Fanatic!

Fiserv is officially joining the stablecoin race, but with a twist. The payments powerhouse is rolling out FIUSD, a bank-friendly stablecoin designed to slot directly into its existing infrastructure.

Launching by year’s end, FIUSD will be available across Fiserv’s global network, already serving 10,000 financial institutions and 6 million merchants. It promises 24/7 settlement, faster payment rails, lower costs, and seamless integration with core Fiserv platforms like Finxact and Commercial Center.

What sets FIUSD apart is its institutional-first approach. It’s being delivered through an SDK, allowing banks and businesses to adopt stablecoin rails without overhauling their systems or sacrificing compliance. Built-in features, including fraud monitoring and settlement controls, are included in the package.

“With our scale, reach, and technology leadership, Fiserv is uniquely positioned to advance stablecoin-powered payments and help democratize access to blockchain financial services,” as Fiserv COO Takis Georgakopoulos put it.

To make this happen, Fiserv is partnering with Paxos and Circle, two of the most trusted names in stablecoin infrastructure, and launching FIUSD on Solana, a blockchain known for its speed and cost efficiency. The aim is full interoperability with leading stablecoins and potential expansion into tokenized deposits down the line.

With FIUSD, Fiserv is doing more than just entering the stablecoin market; it's laying the groundwork for a modern, compliant, and scalable digital asset ecosystem. And this is just the first of several moves the company says it’ll announce in the coming months.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

ARTICLE OF THE DAY

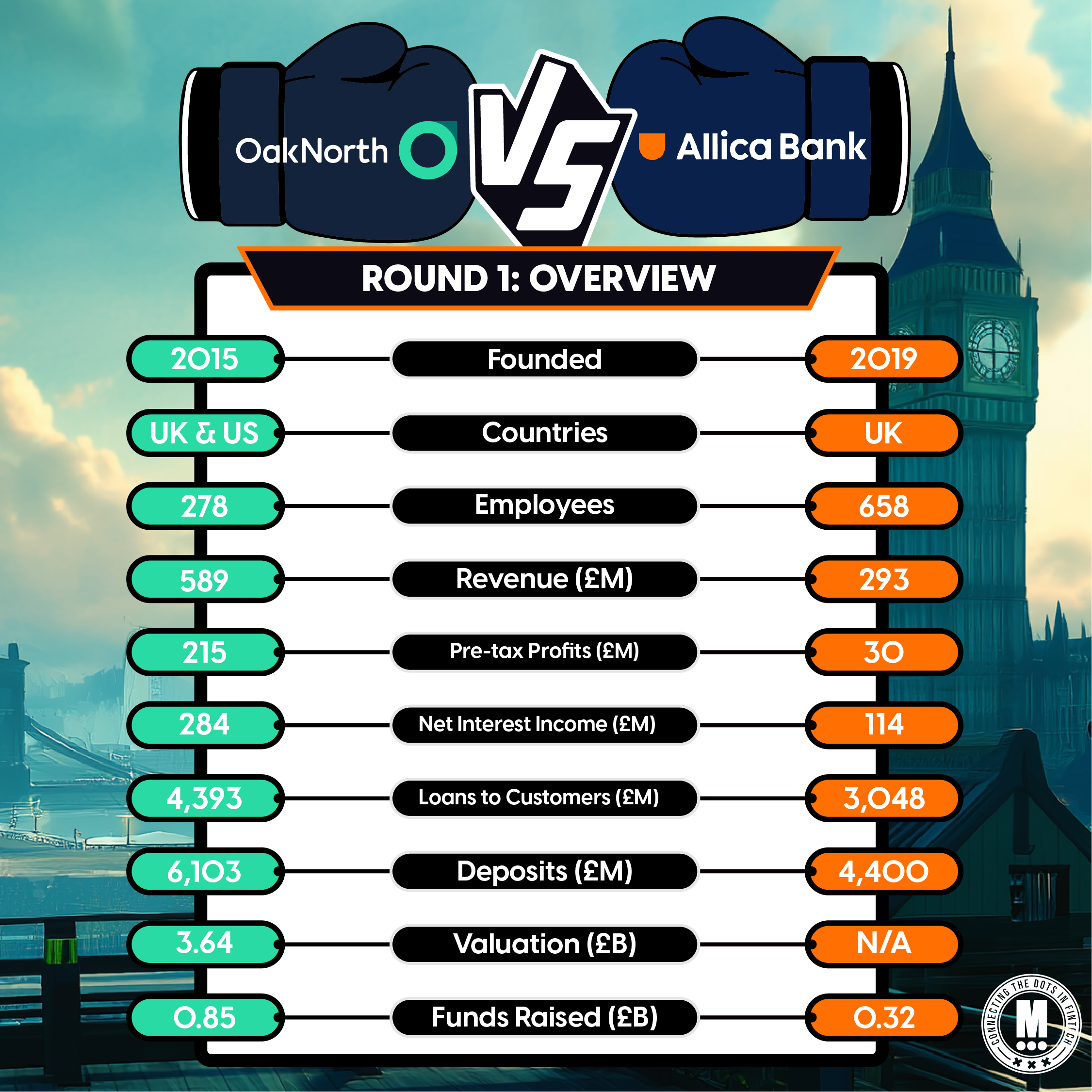

📈 OakNorth 🆚 Allica Bank

Here is a comparison of Key Stats👇

INSIGHTS

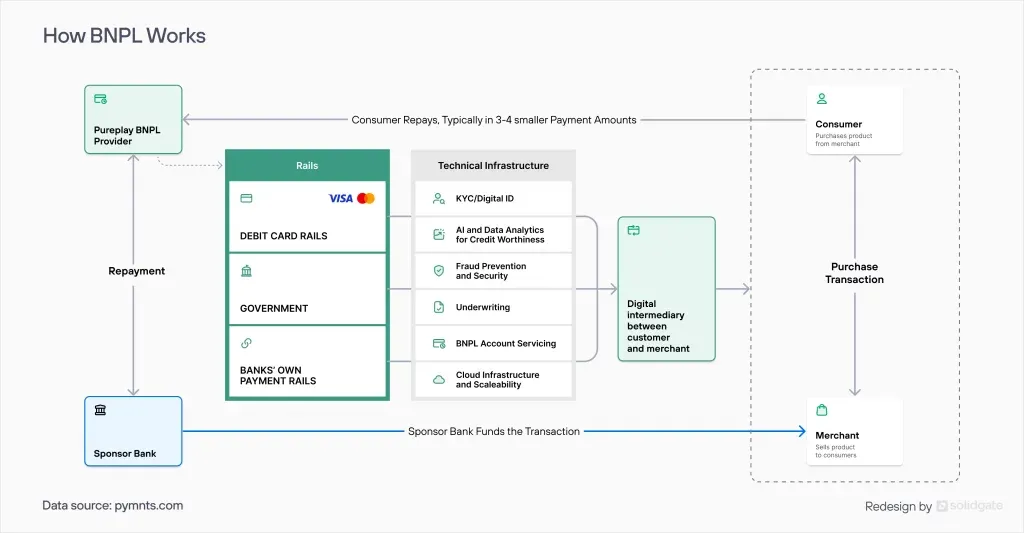

🇬🇧 Buy Now, Pay Later for businesses: A merchant’s guide in 2025 by Solidgate. In this guide, Solidgate breaks down how the BNPL ecosystem operates, whether adding BNPL to your payments stack aligns with your business objectives, and provides practical tips for choosing the right BNPL provider to drive real results.

FINTECH NEWS

🇺🇸 OKX eyes U.S. IPO post-April market re-entry. While the exchange has yet to confirm the move publicly, the reports follow its re-launch of operations in the U.S. on April 15, 2025, after resolving a legal dispute with the Department of Justice (DOJ).

🇮🇳 Prosus delays Indian payments firm PayU IPO to enhance business operations. While Prosus hoped to list PayU by 2025, "that is not going to be our focus in the next year. Our focus is going to be to improve that business," Nico Marais, Prosus's Chief Financial Officer, said.

🇺🇸 Revolut's Chief is in line for Musk-style payday at $150bn valuation. Nik Storonsky, who founded the $45bn start-up in 2015, has an outsized incentive deal that would increase his stake in Revolut by several percentage points if the valuation more than triples from its current level.

🇮🇳 Walmart’s PhonePe is said to seek $1.5 billion for India IPO. The deal would value the FinTech company at about $15 billion, and PhonePe is planning to submit a draft red herring prospectus for the listing by as early as August. Keep reading

PAYMENTS NEWS

🌍 Bizum and European banks agree to enable cross-border payments in 15 countries. EuroPA and EPI have agreed to begin a collaboration with the aim of "exploring solutions to quickly address the challenge of European sovereignty in the field of payments" and to accelerate the implementation of cross-border instant transfers compatible with all platforms belonging to both alliances.

🇺🇸 Fiserv launches new FIUSD stablecoin for financial institutions. FIUSD presents Fiserv customers with access to a new, more efficient, and interoperable digital asset service for their banking and payment flows. It will provide instant scale for FIUSD while creating a digital asset network that clients can use to build new products and services.

🇨🇲 Flutterwave secures Cameroon licence as part of Africa-wide expansion. The move expands its footprint to over 30 African countries. It follows recent licences in Ghana, Zambia, and Uganda. The licence enables digital payments for global and regional merchants in Cameroon.

🇺🇸 Klarna is now available on Google Pay. By joining forces with one of the most widely used digital wallets in the country, Klarna continues to accelerate its growth in the U.S. market. This integration builds on Klarna’s commitment to responsible spending and empowers consumers with more choices in how they shop.

BLOCKCHAIN/CRYPTO NEWS

🇰🇷 KakaoPay shares jump over 200% as stablecoin anticipation grows. This rise is linked to speculation regarding potential stablecoin developments associated with the company. KakaoPay's stock rose 208% to 94,700 Korean won ($68.6) from 30,800 won ($22.25) on May 23.

🇮🇩 Crypto bourse holding firm Indokripto prepares for IPO. The company plans to allocate approximately 85% of the IPO proceeds toward operational expenditures of its subsidiary, Crypto Futures Exchange. The remaining 15% will be channeled to its depository subsidiary PT Kustodian Koin Indonesia for similar purposes.

PARTNERSHIPS

🇹🇷 BBVA Kripto chooses Wyden for digital asset trading infrastructure. Garanti BBVA Kripto will include both crypto trading pairs in Turkish Lira, US Dollar, and trading between cryptocurrencies, expanding local market access to digital assets and creating a seamless and efficient experience for Turkish investors.

🌏 SAP Taulia partners with PayMate for improved business payments. This aims to support both cross-border transactions and local payments, allowing businesses to use their existing credit lines to improve working capital, supplier payments, and financial efficiency.

🇬🇧 iDenfy teams up with MN2S to strengthen the identity verification process. Through this partnership, MN2S increases security by enabling real-time identity verification using biometric facial recognition and document scanning. iDenfy's hybrid model integrates AI automation with manual review.

🇺🇸 Anchorage Digital adopts Uniswap’s API, enabling institutional access to DeFi Liquidity. The integration of Uniswap’s Trading API simplifies workflows, eliminating dependence on external dApps and offering unrivaled security via air-gapped, tamper-proof hardware security modules.

🇸🇬 HTX integrates BitGo’s Go Network off-exchange settlement, ushering in a new era of secure and efficient digital asset trading. The integration of Go Network allows HTX clients to trade crypto seamlessly while keeping their assets safeguarded in BitGo Singapore’s regulated cold custody.

DONEDEAL FUNDING NEWS

🇬🇧 SMB-focused Finom closes €115M as European FinTech heats up. According to CEO Andrew Petrov, one of its uses could be strategic, opportunistic acquisitions that would allow it to expand either its customer base or its product portfolio. That represents a shift in strategy, given that Finom has only acquired one company so far.

🇺🇸 Stackup raises $4.2M to streamline ops for crypto firms. This funding gives us the ability to eliminate operational inefficiencies that have historically hindered the adoption and growth of this industry, the CEO said. Read more

🇺🇸 Spinwheel raises $30M to streamline debt management. The company helps FinTech platforms and banks authenticate users, automate data retrieval, and facilitate payments, reducing the friction of managing consumer debt. Its unique feature is combining data aggregation capabilities with payment processing functionality.

🇳🇬 Nigerian FinTech startup Hizo raises $100k seed funding. The funds will be used to boost its mission of simplifying intra-African money transfers, enabling users to send, receive, and spend local currencies seamlessly across borders. Keep reading

🇺🇸 CoinFund-backed Veda raises $18M as stablecoin yield becomes ‘inevitable’. The fresh funds will be used to accelerate the adoption of its vault platform, which enables asset issuers to build cross-chain yield products, including yield-bearing stablecoins.

🇺🇸 Conquest planning raises $80 million series B led by Growth Equity at Goldman Sachs Alternatives. It will leverage this fresh capital to accelerate its U.S. expansion, while also funding the continued evolution of its AI-based Strategic Advice Manager (SAM).

🇺🇸 FinTech platform Wealthfront Corporation confidentially files to go public in the US. The California-based firm, which did not disclose the terms of the offering, was valued at $1.4 billion in 2022 when its planned acquisition by Swiss bank UBS was scrapped following reported shareholder pushback over the deal's terms.

M&A

🇪🇬 Amazon exercises option to acquire stake in FinTech firm Valu. Based on the terms and conditions, the transaction will result in Amazon owning approximately 3.95% of Valu. The transaction will be executed on the first trading session of Valu shares on the Egyptian Exchange at a price per Valu share through the block trade mechanism, following receipt of the necessary approval.

🇮🇹 Pignataro’s ION plans to invest in Azimut-backed Italian FinTech FSI. ION’s purchase would reduce the stake taken by FSI. The deal is part of Azimut’s plan to spin off a portion of its advisers' network and merge it into a new digital bank. The new company will have about €26 billion in total assets.

🇦🇺 Shift4 to acquire Australian payments leader Smartpay. Smartpay sells tailored payment solutions through an extensive distribution network across Australia and New Zealand, supporting a diverse base of more than 40,000 merchants in the region. The acquisition is expected to close in the fourth quarter of 2025.

MOVERS AND SHAKERS

🇬🇧 Tandem to name ex-Vanquis Chief Neil Chandler as new boss. Chandler has most recently served at the helm of digital Banking-as-a-Service (BaaS) provider Aion Bank. He will assume the new role, subject to regulatory approval, on June 30. Keep reading

🇬🇧 Tesseract appoints James Harris as Group CEO. The crypto asset service provider says that the appointment will help accelerate global scaling and expand its international partner base. Harris has over two decades of experience across the financial services industry and most recently served as COO at Zodia Custody.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()