FinTech vs. Wall Street: How FinTechs like Robinhood and Chime are Winning the Wallets of Americans

Hey FinTech Fanatic,

I'm about to board my plane to Los Angeles and looking forward to catching up with my US network at FinTech Meetup in Las Vegas soon! And if you are heading to SXSW this year, right after FinTech Meetup, be sure to request an invite to The FR's exclusive Franklin & Fintech networking dinner, where you'll mingle with top FinTech experts, financial services leaders, and investors—all over some delicious BBQ at Franklin Barbecue on March 9.

Spots are filling up fast, so request an invite today. Hope to see you there!

Talking about FinTech in the US: approximately one in four Americans has engaged with a digital savings or investment platform, with larger firms attracting the bulk of consumer attention, according to a study by research company Hearts & Wallets.

In the United States, the familiarity with FinTech entities such as Robinhood and Chime significantly surpasses that of traditional financial services offered by longstanding institutions like JPMorgan, Goldman Sachs, Fidelity, and Vanguard.

Data released by Hearts & Wallets last week reveals that while Robinhood is recognized by 40% of American households and Chime by 39%, only 19% are acquainted with J.P. Morgan Wealth Plan.

Furthermore, Goldman Sachs' Marcus initiative is known to 15% of the populace, Fidelity Go to 14%, and Vanguard Personal Advisor Services to a mere 13%.

FinTech FTW! 😉

Finally, Revolut applied for a license from the Bank of England in 2021. In March last year, they announced that regulators would give it the green light “any day now.” Almost a year later, the wait continues...

Three years after applying, Revolut is still struggling with the central bank’s Prudential Regulatory Authority (PRA) demands.

Do you think Revolut will obtain a UK Banking License this year❓

Vote in my Poll, and tell me why in the comments below👇

Enjoy more industry updates below and I'll be back in your inbox tomorrow!

Cheers,

FEATURED NEWS

🇬🇧 Starling Bank founder Anne Boden released her third book: Female Founders’ Playbook – Insights from the superwomen who made it. In her book, Boden weaves together the experiences of leading women entrepreneurs and VC investors, offering insights on every aspect of launching a high-growth business.

#FINTECHREPORT

Check out the ‘Latin America's Remittance Market’ FinTech report by Inter-American Dialogue👇

INSIGHTS

JPMorgan Chase has called its former global chief compliance officer out of retirement to help the bank assert its rights as a major shareholder in Greek payments FinTech Viva Wallet, after disagreements between the two firms culminated in dueling lawsuits. Frank Pearn, who retired as JPMorgan’s top financial and legal risk manager a year ago, joined the Viva Wallet board this week as a nonexecutive director, according to regulatory filings.

FINTECH NEWS

🇺🇿 Former Tinkoff CEO, Oliver Hughes, shares FinTech vision for Uzbekistan's growth. Oliver Hughes, the former head of Tinkoff who now leads international business at TBC Bank Group, has outlined his vision for the development of FinTech in Uzbekistan. Read on

🇸🇬 Grab made a profit in Q4 but challenges remain. In the fourth quarter, Grab’s financial services revenue doubled to US$56 million. The solid annual growth was primarily attributed to improved monetization of the company’s payments business, higher contributions from lending, and “lowered incentive spend” – which is crucial to ensuring the company’s business model becomes sustainable.

🇬🇧 Iwoca joins with business account provider Countingup to offer flexible loans. iwoca, one of Europe’s largest SME lenders, announced a partnership with business account provider Countingup to make business finance available to almost 10,000 of Countingup’s users at the touch of a button.

🇬🇧 ‘We definitely are eyeing the public markets’: eToro CEO considers IPO after scrapped SPAC deal. Stock brokerage platform eToro is getting interest from bankers and investors about a public market listing after its scrapped plans to go public via merger with a blank-check company, CEO Yoni Assia told CNBC.

🇺🇸 Amdocs and BMC announced a new alliance to accelerate connected digital ops across the telecommunications and financial services industries, driving growth, automation, and efficiencies for customers. The collaboration will leverage Amdocs' leading position in IT and network services to enhance access to BMC's top-notch automation, operations, and service management solutions.

🇺🇸 Cross River wades into investment banking, launching a FinTech-focused investment bank. Adding investment banking will allow it to offer a full-stack approach to include equity fundraising, M&A and other corporate advisory functions. Read more

PAYMENTS NEWS

🇺🇸 Afterpay, Block's BNPL platform, begins growing again. The amount users spent on Afterpay, Block's BNPL platform, began growing once again last year after integration efforts stunted its expansion in 2022. More on that here.

Aevi, an in-person payment orchestration, announced a strategic partnership with Silverflow, a cloud platform for global card processing. The partnership allows European and North American acquirers to re engage in direct payment processing, creating a modern data-driven solution with an Android-led in-person payment system.

🇸🇦 Tabby launchees Pay in 4 subscription service. The financial services app has introduced Tabby+, a monthly subscription service in the UAE. With Tabby+, shoppers unlock the power of Pay in 4 anywhere, whether its groceries, utilities, fuel, food delivery apps or anywhere VISA is accepted using their Tabby Card.

🇺🇸 Jack Dorsey's plan to reshape Square: After retaking day-to-day control as CEO of Square last fall, Jack Dorsey, who also heads Square's parent company, Block, surprised analysts with fourth-quarter profits that exceeded expectations, in part through aggressive cost-cutting. And he's just getting started.

DIGITAL BANKING NEWS

🇵🇰 Raqami Islamic Digital Bank in Pakistan partners Codebase Technologies for Digibanc platform. The agreement will see the bank utilise the UAE-based vendor’s Digibanc platform as its new technology stack, including core banking. Raqami is preparing to utilise its new partner’s banking technology to launch a range of digital-native financial services for customers in the country.

DONEDEAL FUNDING NEWS

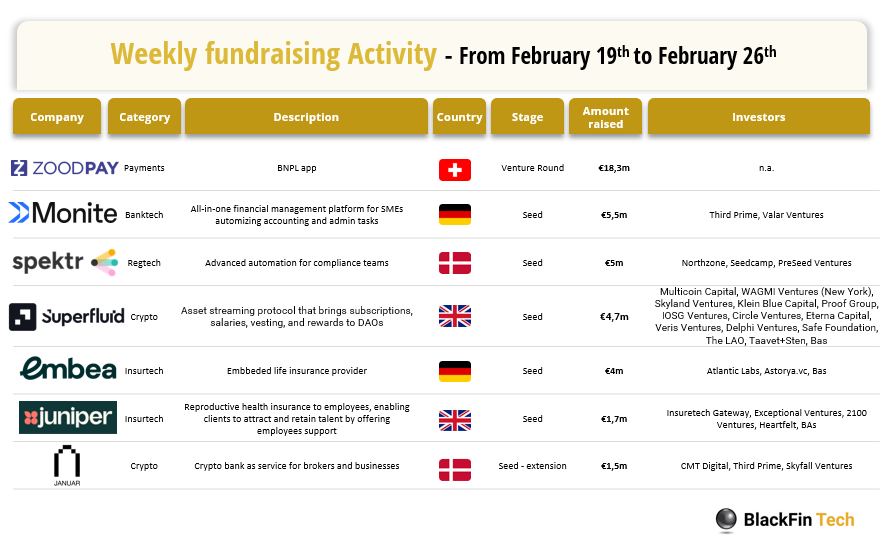

Last week we saw 7 official FinTech deals in Europe for a total amount of 40,7m€ raised with 2 deals in the UK, 2 in Germany, 2 in Denmark, and 1 in Switzerland. Access the complete BlackFin Tech article here

🇧🇷 House, a Brazilian proptech company, has raised $10 million to fund its international expansion, in a round led by Redpoint eventures and TM3 Capital, with participation from Açolab Ventures. Keep reading

MOVERS & SHAKERS

🇺🇸 Geoff Seeley joins PayPal as Chief Marketing Officer. Seeley brings over 25 years of global brand, digital, and performance marketing expertise to PayPal and its family of brands, including Venmo. He will be focused on making sure the PayPal and Venmo value propositions are clear, compelling, and simple for customers.

BNY Mellon appoints Gary Delaney as International Chief Information Security Officer (CISO). Delaney will report to Matthew McCormack who leads the Information Security Division within BNY Mellon’s Engineering organisation, operating an enterprise-level cybersecurity division that enables and protects the assets of BNY Mellon's businesses and its clients.

🇺🇸 Prove Identity announced it has been appointed to the FIDO Alliance Board of Directors. Tim Brown, global identity officer at Prove, will serve as the company’s Primary Board Delegate. Today, over 80% of data breaches are caused by weak or stolen passwords. The FIDO Alliance is focused on solving this issue by reducing the world’s reliance on passwords.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()