FinTech VC Funding Slows to the Lowest Level since 2017

Hey FinTech Fanatic!

Traveling today so I'll keep it short.

Enjoy my list of most important FinTech industry updates I think you should read today👇

Cheers,

FEATURED NEWS

🇷🇺 Russian antitrust agency complains to Apple over users' limited payment services. Russia’s Federal Antimonopoly Service (FAS) has escalated its confrontation with Apple by demanding answers regarding limited access to banking and payment services for Russian users of Apple devices.

INSIGHTS

🇹🇷 Read all about the Future of Digital Finance with E-Wallet Innovations in this interesting article by Innovance. Explore the full article here.

FINTECH NEWS

🇺🇸 Feds freeze $5 million at Evolve Bank & Trust in “Pig Butchering” crypto fraud, money laundering case, Jason Mikula reveals: Per newly discovered court documents obtained exclusively by FinTech Business Weekly, a US Secret Service investigation linked Evolve and its FinTech clients, including Wise, Airwallex, Solid, Mercury & Relay, to a "large fraud conspiracy ring." Read full story here

🇬🇧 UK based Embedded banking firm ClearBank is reportedly planning to expand into Europe and the U.S. Charles McManus, the firm’s CEO, told Bloomberg News that the company has applied for a banking license in the Netherlands, and considers launching in the U.S. by 2026, possibly through an acquisition.

🇺🇸 Skipify and Visa Partner to Extend Reach and Capabilities of Skipify's Connected Wallet. Through this effort, Skipify aims to reinvent the way consumers transact, leveraging cutting-edge technologies to simplify and accelerate the payment process. It also allows Skipify to significantly expand its reach and offer its innovative payment solutions to a broader audience than ever before.

🇬🇧 Klarna late fees spark uptick in on-time payments. Klarna is reportedly sending fewer British customers to debt collectors after introducing late fees. The firm has been criticized for turning over users who fall behind on their payments to debt collectors, Bloomberg reported.

🇬🇧 The UK has a plan to help its financial industry seize $14tn tokenisation opportunity. The UK government is consulting on an sandbox for tokenisation. The announcement comes amid a wave of excitement for the concept among large financial institutions like BlackRock.

🇨🇳 Chinese FinTech Ant Group targets global growth after Jack Ma’s exit. Ant is embarking on a global expansion drive as it appears to be nearing the end of its “rectification campaign” following the overhaul of its business to satisfy regulators.

🇨🇦 I highly recommend reading this ‘FinTech in Canada Q1 2024’ overview article to be completely up to date. Read on

PAYMENTS NEWS

🇧🇷 PayRetailers receives license from Brazil’s Central Bank and strengthens its presence in the Brazilian payment market. With this authorization, the FinTech reinforces its solidity and is able to offer new services to Brazilian consumers and cross-border clients.

🇺🇸 The Clearing House RTP network breaks instant payments records. Consumers and businesses took advantage of instant payments through The Clearing House RTP network, which resulted in numerous records set in the first quarter of 2024.

🇺🇸 Trustly and Cross River Bank have expanded their collaboration in instant payments to include the FedNow® Service. With this addition, Trustly’s merchants will benefit from new capabilities to optimize the routing of funds instantly via Cross River’s application programming interface (API) endpoint.

🇪🇺 Ecommpay strengthens its position in the UK and EU by adding Bacs & SEPA Direct Debit capabilities in collaboration with GoCardless. The strategic move allows Ecommpay to increase UK and EU market coverage by approximately 44% without cannibalising existing payment methods.

OPEN BANKING NEWS

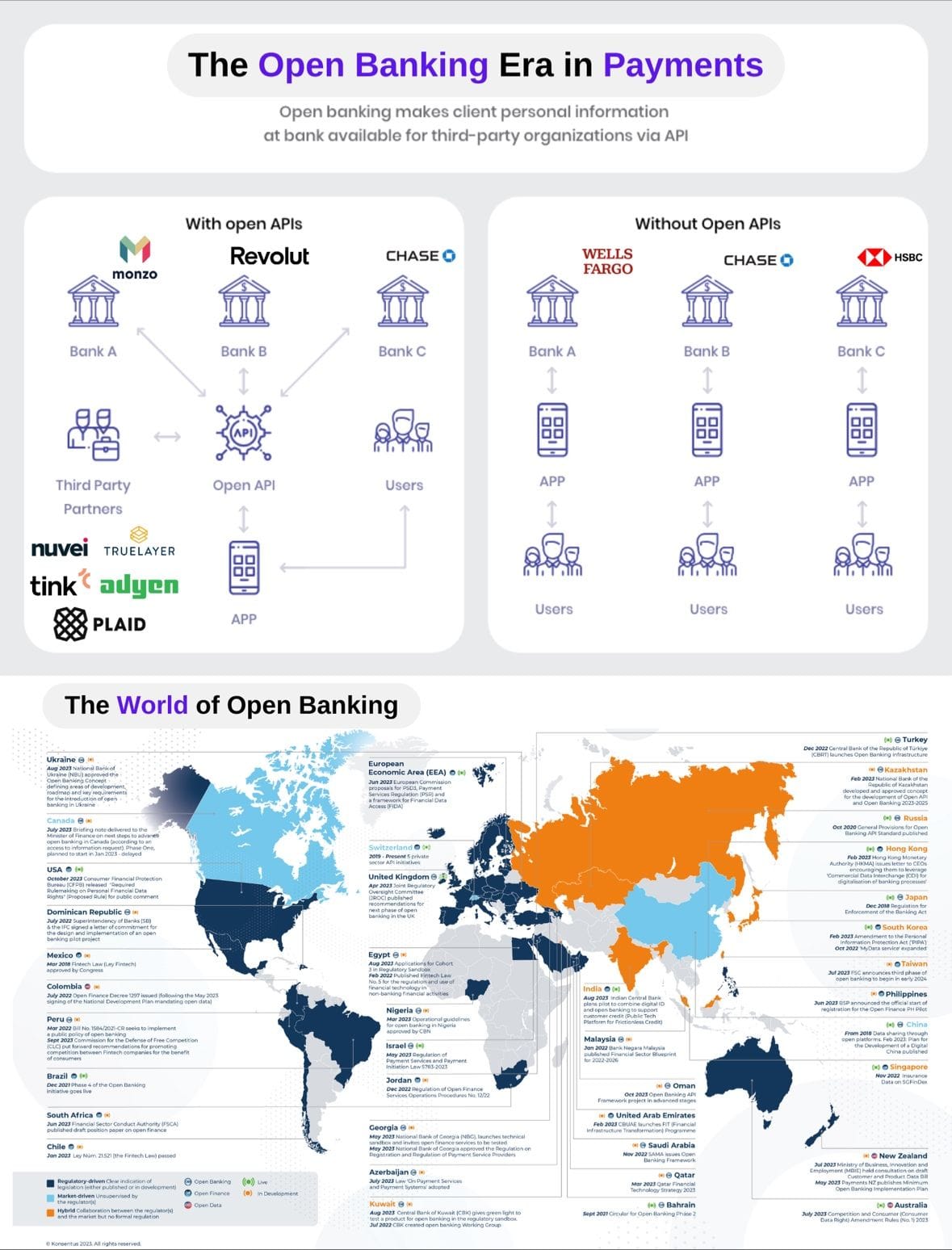

The Open Banking Era in Payments.

Let’s dive in:

DIGITAL BANKING NEWS

🇬🇧 Atom Bank reduces commercial mortgage rates. Atom offers bespoke pricing on its commercial mortgages, while brokers can generate an indicative quote for their clients via the Atom Bank broker portal. Fully packaged applications currentlly get a principle agreement in one working day and offers within 14 working days.

🇬🇧 Revolut fraud payout row leaves 1,000 victims in limbo. A thousand Fraud victims could be stuck in limbo because of an ongoing row between Revolut and the Financial Ombudsman Service. In total these Revolut customers are fighting to reclaim £34m in fraud losses. Data reveals there was a surge in fraud complaints about Revolut in April to December 2023.

🇨🇴 Nubank lands DFC loan. The US government’s Development Finance Corporation (DFC) approved plans to lend $150 million to Nubank to fund its growth in Colombia as part of a package of new financing for businesses in developing countries.

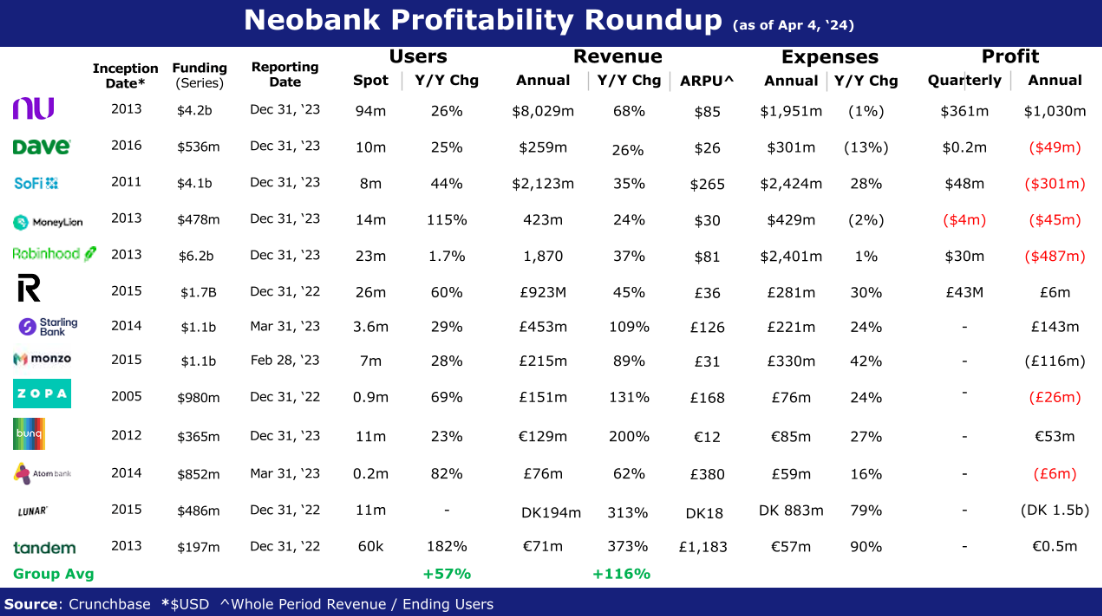

🇺🇸 Neobanks are on the rise globally, but in the U.S. digital banking landscape, payment providers are the most successful. In an analysis of U.S. neobanks and payment services by Statista's Market Insights that only counts those services that are 100 percent independent of companies from other sectors as well as as 100 percent digital.

📈 Check out the latest Neobank Profitability Index by Matthew Wilcox👇

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Goldman Sachs named as authorized participant on BlackRock bitcoin ETF. The asset management giant also adds UBS Securities, Citigroup Global Markets and Citadel Securities, a Thursday regulatory filing indicates. More on that here

🇦🇷 Argentina’s top financial regulator says that it wants to “work together” with the nation’s crypto industry as it steps up its control over the sector. In an official government release, the National Securities Commission of Argentina (CNV) called its new registry of crypto exchanges and service providers “simple.”

🇺🇸 SBF is going to prison, but the fight over money at FTX drags on: Crypto exchange’s collapse is still a source of anger and frustration for many onetime customers, more than a year later. Read the full piece here

🇺🇸 Coinbase selects Lightspark to now integrate the Lightning Network. The collaboration aims to provide Coinbase users with faster and cheaper transactions while alleviating congestion on the main Bitcoin blockchain. The Lightning Network, a layer-2 solution for Bitcoin, allows for off-chain transactions, enabling instant and low-cost transfers.

DONEDEAL FUNDING NEWS

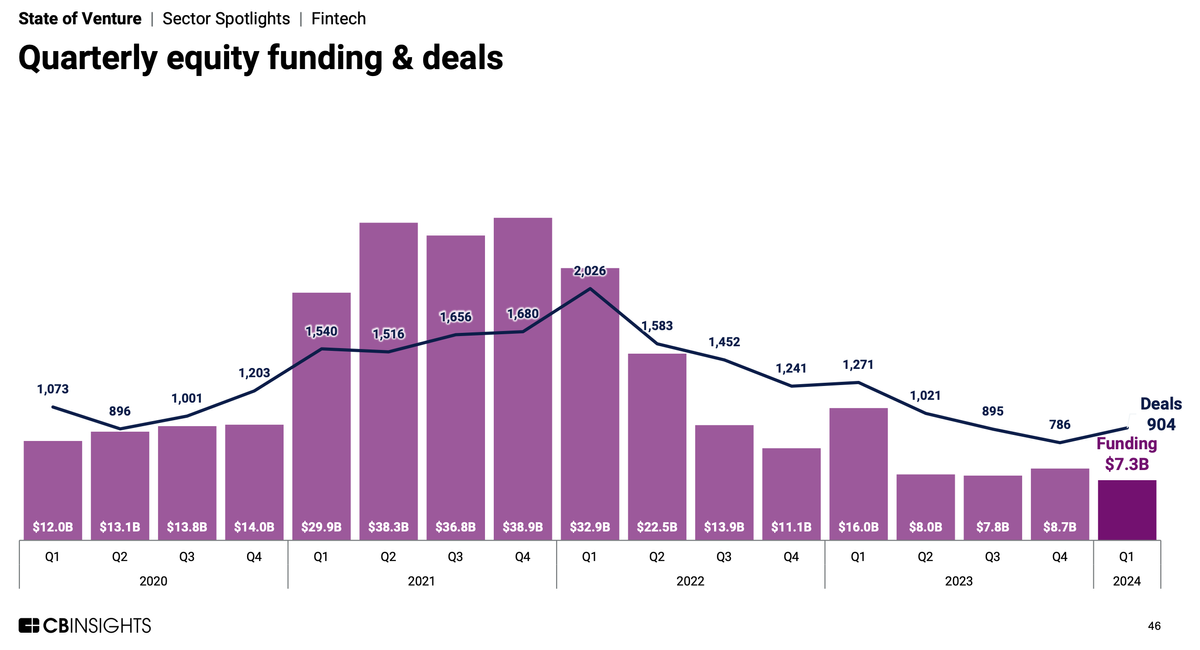

➡️ FinTech funding slows to the lowest level since 2017. FinTech funding decreased by 16% quarter-over-quarter, and reached $7.3 billion globally, the lowest level since early 2017, according to CB Insights’ Q1 2024 State of Venture Report.

🇧🇷 CashU, a FinTech company specializing in B2B digital credit, has successfully raised 7.5 million Brazilian reals (US $1.4M) in a bridge funding round led by Bertha Capital, a pre-existing investor in its capital table. Read more

M&A

🇦🇺 Credit data firm Experian bulks Australia presence with $542 mln deal. Australia is Experian's fifth largest country of operation by revenue, and the company said the central bank reforms have "enhanced appetite" for analytical tools and data-driven services and helped expand its addressable market opportunity.

MOVERS & SHAKERS

🇺🇸 ingo payments announced Becca Best as the new Chief Financial Officer. Becca has over 12 years of Financial and Operational leadership experience in both private and publicly traded B2B SaaS companies. She brings both IPO and M&A transaction experience and deep expertise in BaaS/Embedded Finance, having worked with some of the largest brands in FinTech.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()