FinTech Pismo officially acquired by Visa for US$1B in Brazil 🇧🇷

Greetings from the vibrant heart of Amsterdam!

I had a great time attending the FinTech Startup Bootcamp here in Amsterdam. It was nice to immerse myself in the energy and creativity of this year's batch of fintech startups. I strongly recommend checking out these great startups in person when you are around for their pitches today.

But wait, there's more from Amsterdam! My neighbors, Fourthline, a leading regtech company, just dropped some great news. They've announced a partnership with Qonto, revolutionizing the way businesses handle financial compliance and security.

To get the full scoop, tune into the latest episode of one of my favorite fintech podcasts. Host Solenne Niedercorn-Desouches sits down with Fourthline's CEO, Krik Gunning, in an engaging conversation. They delve deep into Fourthline's innovative services and unpack the details of this exciting new partnership with Qonto. It's a must-listen for anyone in the fintech space.

Finally, like many people in The Netherlands, I enjoyed "pakjesavond" (the Dutch version of Santa called "Sinterklaas") with the family. All in all a great day in Amsterdam as long as we don't mention the weather.

Of course I found time to list more interesting FinTech industry news for you below👇

Enjoy the news updates and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

Fintech Meetup (March 3-6, 2024) is Fintech's new BIG event with "the highest ROI" for attendees & sponsors. Meet everyone you need to meet, easily and efficiently. Ticket prices go up Friday 12/8 at midnight. Don't Miss Out!

Get tickets Now!

BREAKING NEWS

Goldman Sachs-backed ZestMoney, once valued at $450M, to shut down following unsuccessful efforts to find a buyer. The startup’s new leadership informed the employees about the decision to shut down Tuesday. It will fully wind down by the end of the month, the leadership said.

Fintech Pismo officially acquired by Visa for US$1B in Brazil 🇧🇷

The General Superintendence of the Administrative Council for Economic Defence (Cade) has approved without restrictions the purchase of fintech Pismo by American Visa, in a US$ 1 billion deal announced at the end of June this year.

FEATURED NEWS

Mondu partners with Mangopay to fuel growth in B2B marketplaces through flexible payments. Through the partnership, the two companies will offer marketplaces across Europe a proven, modular payments infrastructure which can be tailored to meet their needs. Read on

FINTECH NEWS

🇩🇪 Lexware, a self-employed business software leader, introduces lexoffice Geschäftskonto, catering to freelancers, start-ups, and small enterprises. This innovative product integrates banking and accounting, providing a comprehensive solution for managing finances from a single platform.

🇨🇦 San Francisco-based FinTech firm Brex has publicly launched a fully localized cross-border corporate card aimed at servicing the Canadian employees of United States (US)-based companies. The new offering comes over a year after Brex chose to “pivot away from SMBs.”

🇵🇰 Neem and Mastercard launch the first embedded finance partnership in Pakistan. The partnership with Mastercard is a major milestone for Neem and the embedded finance movement in the country, according to Neem co-founder Vladimira Briestenska.

🇺🇸 Necto unveils premium API multi bank platform delivering real time cash management and payments to clients globally. "Necto is powering the next generation of treasury management applications and payment services providers with a global catalogue of APIs," says Guido Schulz, Company’s CEO.

🇬🇧 Halfords picks Kriya's multichannel payments to power up its B2B trade credit. By working with Kriya’s PayLater solution, Halfords is helping their Trade Card holders and Business customers better manage their cash flow with the ability to purchase on flexible payment terms.

🇳🇬 Nigerian SME lender Lidya shutters European business to focus on growing its new credit assessment and loan recovery offering, Lydia Collect, initially developed for Lydia’s in-house SME lending business. Read more

🇸🇬 Revolut welcomes holiday season in luxury with launch of exclusive 24k gold card in Singapore. The new gold card underscores the company’s goal of continuously providing its users with a variety of eye-catching card designs that are not only innovative but also involve the customers in the creative process.

PAYMENTS NEWS

Klarna has fully integrated SOFORTüberweisung into its platform. This merger means that users will now benefit from Sofortüberweisung's established reliability and speed, along with a seamless integration into Klarna's ecosystem. Klarna's user-friendly design ensures a stress-free and quick payment experience.

Emerchantpay and Rubean go to market with SoftPOS package. This partnership strengthens the solutions provided by emerchantpay and Rubean AG, extending their reach to merchants and partners across the UK and Europe.

🇧🇷 Banco Safra has recently been authorized to operate as a Payment Transaction Initiator (ITP) in Brazil's Open Finance system. The list of institutions entitled to act as ITP in the context of Open Finance reaches 26. Recently, Genial Investimentos, Santander and fintech Initiador also joined this group, which includes large banks, neobanks, fintechs and cooperative systems.

🇨🇦 Flinks enters the instant payment market with Flinks Pay as part of its commitment to ensure Canadians have access to better financial products. This initiative makes instant payments accessible to any company by embedding them directly into their products and services.

🇦🇺 Australian BNPL regulations delayed until 2024. Officials mentioned that the government is still aiming to bring BNPL under credit laws and restrictions, as well as to introduce proportionate responsible lending obligations on the popular short-term type of loans.

🇧🇪 Digital payments software provider OpenWay has announced its partnership with JIVF to launch new payment services and optimise customer experience. The partnership facilitates rapid launch of customised credit products and secure cross-border payment services.

DIGITAL BANKING NEWS

Unlimit and UnionPay International announce global issuing partnership. Both companies expect that the partnership will make the platform more dynamic, comprehensive, and customisable, able to meet the evolving needs of a global customer base.

Banking as a Service startup Bloc debuts business banking services for African businesses. This launch marks a new phase in Bloc's mission to help businesses seize global opportunities. Bloc Business Banking offers advanced features and value-added services for an enhanced customer banking experience.

🇦🇺 Neobank Up launches automatic money management system: The system can automatically divy a person's income into spending and saving 'envelopes'. “It’s an Australian banking first – and it will allow Aussies to cruise between pay days, take care of their bills and hit their budgeting goals with ease,” said Up CPO.

🇮🇳 Neobank Digivriddhi bags $6 Mn funding to offer financial services to dairy farmers. The Bengaluru-based firm will deploy the fresh proceeds to expand its footprint, and also plans to use the capital for tech innovation and growing its product portfolio. Read more

🇬🇧 LHV Bank announced a new partnership with Flagstone, the UK’s leading cash deposit platform. Flagstone will enhance LHV's consumer savings offering and customers will gain access to the competitive range of LHV Bank’s personal savings products, delivered through Flagstone’s superior digital platform.

🇺🇸 SoFi expands ETF business with options-driven income fund. The brand-new active fund is designed to provide investors with a high level of monthly income. WisdomTree and some smaller fund families offer similar ETFs. More here

🇿🇦 Mastercard and Bidvest Bank transform international remittances for South Africans. Titled Bidvest Bank BidSend, the new solution is powered by Mastercard cross border services, a real-time payment network that enables users to send money to 103 countries and allows senders to select their beneficiary’s preferred choice of pay-outs.

🇳🇬 YC-backed fintech Pivo Africa is shutting down one year after raising a $2 million seed round. One person with direct knowledge of the business confirmed the closure to TechCabal but did not provide further details.

🇧🇷 Nubank launches Money Boxes for SME customers. The feature is the first investment product for Nu's PJ customers; in a survey conducted with micro and small businesses, 56% report the habit of investing to plan for the future of their business.

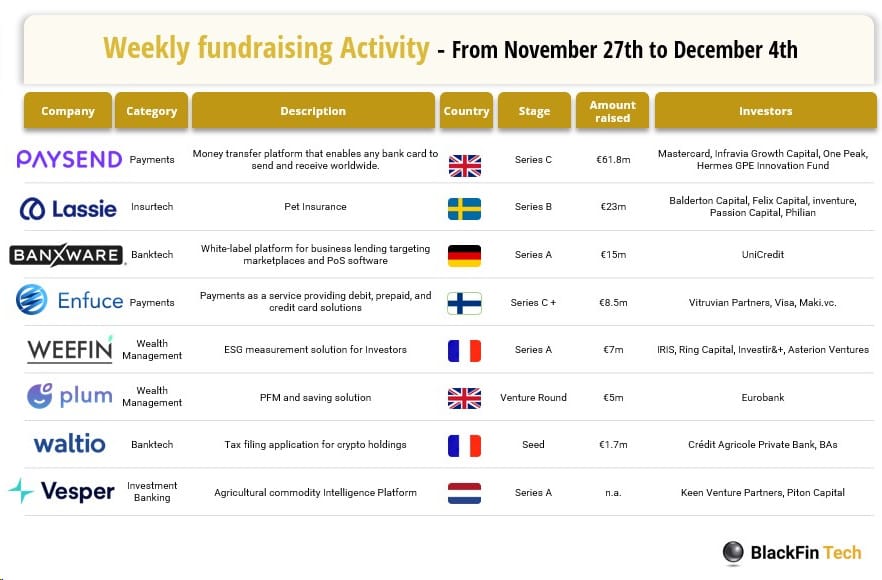

DONEDEAL FUNDING NEWS

In the past week, we saw 8 deals in Europe for a total amount of €122m announced officially with two deals in the UK, two in France, one in the Netherlands, one in Sweden, one in Finland, and one in Germany. Link here

🇺🇾 Brinta, a Uruguayan fintech startup, has secured a $5 million investment led by Kaszek for its innovative approach to simplifying tax compliance in Latin America. Founded earlier this year, Brinta is quickly expanding across the region, including entering the Brazilian market.

🇧🇷 Brazilian Fintech RecargaPay raises US$14.1M with FIDC to boost credit vertical. RecargaPay is a platform that allows customers to gather their credit cards in one place, pay bills, make transactions with Pix or apply for loans. The company already acts as a banking correspondent by intermediating loans since 2018.

M&A

🇳🇬 Payday to be acquired by BitMama after $3m funding round in February. BitMama, led by CEO Ruth Iselema, has reportedly offered PayDay investors $1 million worth of equity in the crypto company at a $30 million valuation. Read more

MOVERS & SHAKERS

Former Bank of Ireland executive John O’Beirne joins US fintech Square as Europe head. “We have several projects under way already with the aim to provide growth opportunities for sellers of all sizes across all our European markets, which is critical in today’s trading environment,” said Mr O’Beirne.

🇺🇸 Sequoia Partner Luciana Lixandru joins Stripe board as Michael Moritz exits. Sequoia’s investing empire is shoring up control at one of its startup crown jewels during a critical time for the Silicon Valley firm. Link here

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()