FinTech IPOs Are Warming Up… Agibank and Copper Test the Waters

Hey FinTech Fanatic!

Feels like public markets are slowly waking up again...

Agibank is gearing up for a U.S. IPO, targeting a valuation of up to $3.3B and aiming to raise as much as $785M.

The plan is to list on the NYSE under AGBK.

This is a meaningful signal. Brazilian FinTech IPOs have been largely absent since 2021. Rates are easing. Risk appetite is creeping back.

And Agibank’s model is different. Digital-first, but backed by 1,100+ physical service hubs, focused on payroll-linked lending for retirees and salaried workers.

And it’s not just Brazil. Crypto’s quieter layer is moving too. 😉

London-based custody firm Copper is in early discussions around a potential IPO. Nothing confirmed. But the pattern keeps repeating.

As crypto matures, investors are gravitating toward custody, settlement, and regulated infrastructure. Different geographies. Same message from the market.

If you’re watching how the FinTech industry is evolving, scroll down to see what else is moving 👇 I’ll be back tomorrow with more updates in your inbox.

Cheers,

TO KICK OFF THE WEEK: QUICK FINTECH TRIVIA 👀

Last month’s headline still keeps popping up.

Question: If Revolut hits $9B in revenue by 2026 at a $75B valuation, which revenue multiple is the market implicitly assigning today?

A) Below mature FinTech comps

B) In line with global neobanks

C) Premium SaaS-like multiple

D) Public markets wouldn’t tolerate it

FINTECH NEWS

🇬🇧 You can't miss out on the upcoming FRC run with Tobi John Oluwafemi at Canary Wharf Estate. RSVP Here to network in a casual way!

🇦🇪 Nik Storonsky strikes back. Nik Storonsky, CEO of Revolut, addressed speculation about relocating to the UAE after registry filings, noting he continues to split his time between London and other key markets, with company records still listing him as a UK resident.

🇬🇧 Ryan Reynolds’ Wrexham is tied up in the collapse of FX Broker Argentex. The club used Argentex for basic FX services and didn’t have any derivatives with the firm, and administrators overseeing the wind-down are confident that customers in Wrexham’s category will be repaid.

PAYMENTS NEWS

🇭🇰 3S Money celebrates the launch of its Hong Kong office with an unforgettable evening alongside partners and friends from The British Chamber of Commerce in Hong Kong, set against the city’s iconic skyline. With a growing team on the ground, the company looks forward to supporting businesses in Hong Kong and across the region as they expand globally.

🇦🇪 UAE's central bank has approved a USD-backed stablecoin under the bank’s Payment Token Services Regulation. The regulatory move means a USD stablecoin is now live and operational under a central bank payments regime, putting the UAE ahead of the U.S., EU, and much of Asia, the release stated.

🇳🇬 Moniepoint’s transaction volume jumps to 14 billion, worth $294 billion, internal data shows. Moniepoint averaged 1.67 billion monthly transactions in 2025, a 169.44% jump from the 433 million recorded in 2023, highlighting the rapid growth of Nigeria’s digital payment ecosystem.

🇦🇪 CAB Payments secures ADGM licence and new global clearing partnership. The licence enables CAB to conduct cross-border payments, FX transactions, trade finance, and credit arrangements across the Gulf and wider region. In parallel, the Group has entered into a new strategic global clearing partnership with a major international bank to expand USD and euro clearing access for clients.

🇨🇴 Card payments and Bre-B will be on equal footing after the draft decree. The measure aims to correct a distortion that has been discouraging the use of payment methods through the financial system. Keep reading

🇨🇴 Skandia announced the integration of Cobre infrastructure into its fiduciary services. Cobre is an instant business payments platform for Latin America. The purpose of this action is to enable fiduciary operations 24/7. This model allows for collections through Bre-B, referenced transfers, and even centralized management of disbursements within the country.

🇲🇽 BBVA México rolls out pago directo for in-app payments. Developed in collaboration with Conekta, the tool allows users to authorize purchases directly within the bank’s mobile app without sharing card details with third-party merchants.

DIGITAL BANKING NEWS

🇦🇷 Nubank arrives in Argentina and challenges local players. The Brazilian neobank Nubank announced it will finally open an office in Buenos Aires as part of its regional expansion plan. Company sources emphasized that the new office in Buenos Aires will act as a regional development hub.

🇬🇧 Lloyds Banking Group expects over £100 million in value from next‑generation AI in 2026. The group will scale agentic AI across the bank, maximising today’s tools and launching many more use cases, including significant strategic investments in agentic AI, to deliver faster, more seamless experiences for its 28 million customers.

🇺🇸 SoFi's profit jumps on strong growth in fee‑based businesses. SoFi's financial services business, which includes credit card and investing products, posted a 78% rise in revenue in the quarter ended December 31 to $456.7 million. Read more

🇺🇸 SEC charges Bay Area FinTech entrepreneur with conducting a $37 million Ponzi Scheme targeting members of the Hindu temple he attended. The commission alleges that Satish Appalakutty defrauded at least 100 victims out of $37 million.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto custody firm Copper in early talks for IPO as crypto 'plumbing' becomes new Wall Street favorite. Goldman Sachs, Citi, and Deutsche Bank are said to be among the investment banks potentially involved. The move follows the $2 billion IPO of competitor BitGo last week, signaling a market shift away from speculative tokens toward the financial plumbing of digital assets.

🇰🇷 Binance plans major expansion in South Korea after GoFi repayments in 2026. That move allowed Binance to re-enter the Korean market, though regulatory approvals slowed progress until late last year. Continue reading

PARTNERSHIPS

🇮🇳 FICO and Tech Mahindra partner to accelerate AI-driven decisioning and core banking transformation. The partnership aims to help banking, financial services, and insurance (BFSI) organizations accelerate value creation through AI-powered decisioning and advanced analytics.

🇺🇸 Expedia Group and Affirm deepen partnership, with US exclusivity and plans for further expansion. Eligible travelers shopping for hotels and packages on Expedia, and properties on Hotels.com and Vrbo, will receive a real-time approval decision and can choose from customized monthly payment plans up to 24 months.

DONEDEAL FUNDING NEWS

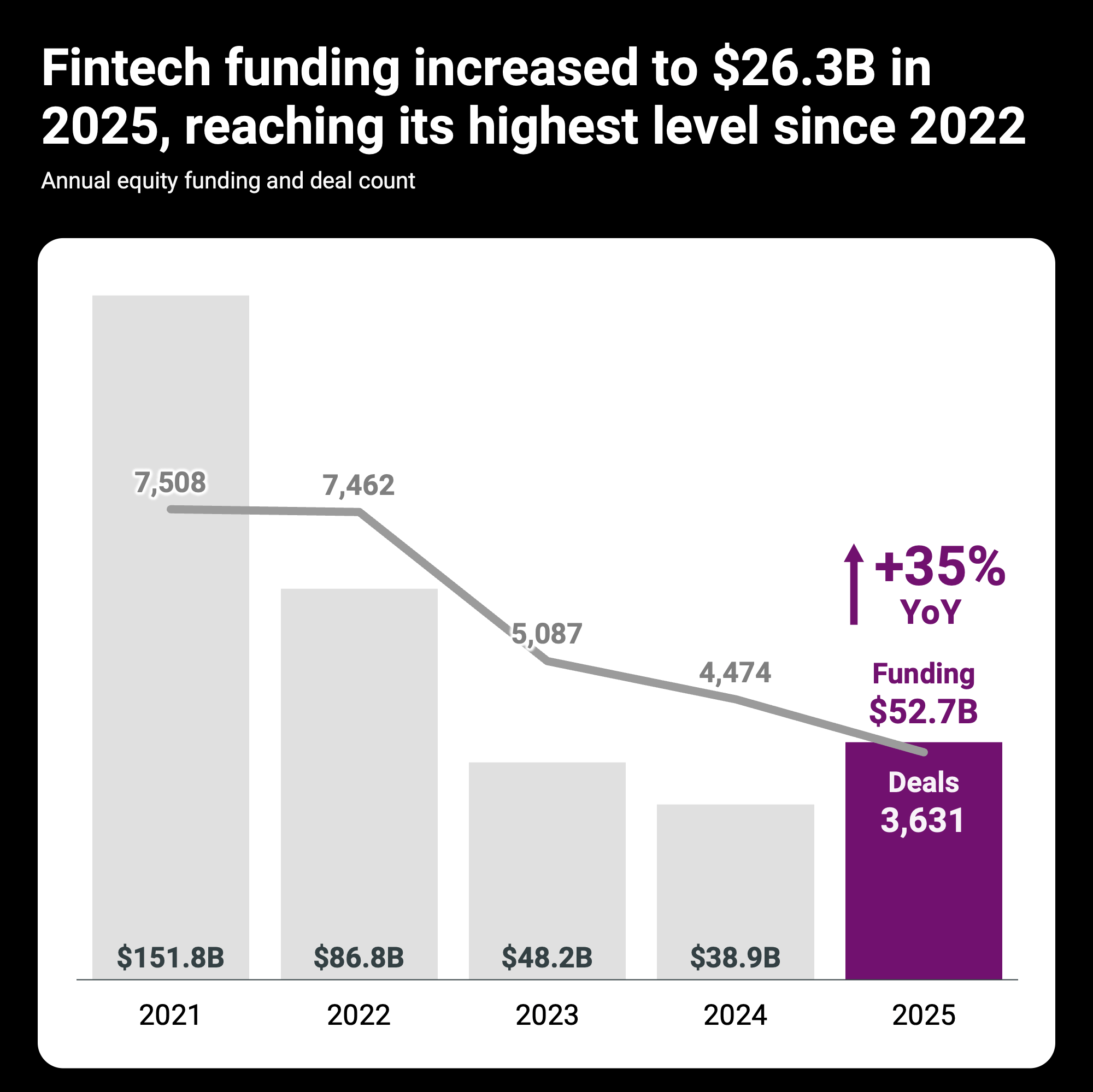

📈 FinTech funding increased in 2025 to $52.7B, reaching its highest annual level since 2022 🤯

🇧🇷 Brazil's Agibank seeks a valuation of up to $3.3 billion in US IPO. The digital bank is aiming to raise to $785.5 million in the IPO by offering roughly 43.6 million shares priced between $15 and $18 apiece. Continue reading

🇺🇸 Talos extends Series B to $150m in strategic fundraise. Proceeds from the Series B extension will be used to expand product development across the Talos platform, from portfolio construction and risk management to execution, treasury, and settlement tools.

M&A

🇨🇱 PagoNxt becomes Getnet Chile´s new strategic partner after acquiring 49.99% of the network. The revised offer was deemed fair by independent valuations, and the agreement will run for seven years without affecting Getnet’s customer contracts or services.

MOVERS AND SHAKERS

🇬🇧 Crypto payments firm BCB Group appoints Tim Renew as CEO in leadership reshuffle. Co-founder Oliver Tonkin will move into the role of president, where he will continue to focus on strategy, culture, and long-term development at the London-based company.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()