FinTech Drama: JPMorgan Freezes Out Gemini After Public Clash

Hey FinTech Fanatic!

It’s not every day a banking relationship gets iced over a tweet, but that’s where we are. JPMorgan has reportedly paused re-onboarding Gemini after Tyler Winklevoss slammed the bank’s new data access fees as "anti-competitive" and "immoral."

The dust-up adds fuel to long-standing friction between crypto players and legacy banks. Scroll down for the whole back-and-forth, what it means for FinTech access, and why Gemini may be the first of many to push back.

Also, the latest updates in FinTech 👇

Cheers,

Stay Ahead in FinTech! Subscribe to my Telegram channel for daily updates and real-time breaking news. Get the essential insights you need and connect with FinTech enthusiasts now!

#FINTECHREPORT

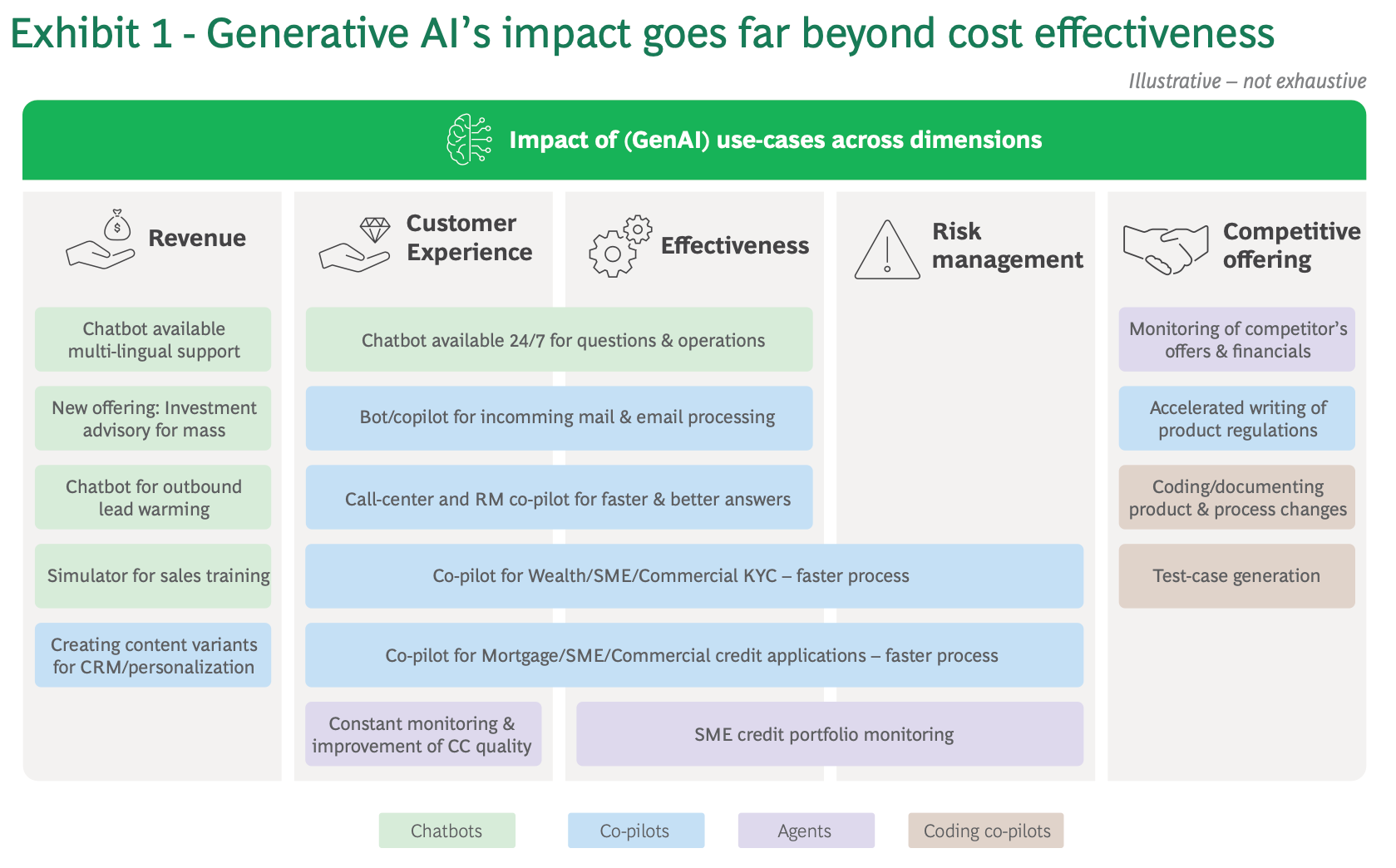

📊 Generative AI in Banking: Six Myths You Need to Ignore.

FINTECH NEWS

🇸🇬 Airwallex launches Yield in Singapore, unlocking smarter returns after MAS licence approval. With this license, Airwallex can now offer regulated investment solutions and custodial services to businesses through its Airwallex Yield product. Airwallex Yield is an investment fund management service that allows businesses to earn competitive returns on surplus funds held within their business.

🇺🇸 How Lithic enhanced real-time transaction monitoring with Taktile. To elevate its fraud and anti-money laundering (AML) strategy, Lithic turned to Taktile’s AI-powered Decision Platform, enabling its risk team to monitor transactions more effectively, iterate faster, and protect customers at scale.

🇲🇽 FinUp plans to expand to Mexico and Brazil. The startup plans to manage more than COP 50 billion in debt by 2025 and reach 1,000 new users. The company has grown by more than 500% since its founding and seeks to position itself as a leader in the debt settlement sector with significant discounts.

🇮🇳 Kenro Capital eyes up to $40 mn stake in Pine Labs as early backers seek exits. The deal may likely have a slight discount in valuation, as it usually happens in a secondary transaction. Shareholders in a secondary transaction sell their stakes to other investors, and no new capital is injected into the company.

🇺🇸 Interactive Brokers considers launching a new stablecoin for customers. In an interview, Interactive Brokers' billionaire founder Thomas Peterffy said the company is working on potentially issuing stablecoins, but has yet to make a final decision on how that will be offered to customers.

🇺🇸 PayPal drives crypto payments into the mainstream, reducing costs and expanding global commerce. Supporting transactions across 100+ cryptocurrencies and wallets such as Coinbase and MetaMask, the solution expands merchant revenue opportunities and taps into a global base of more than 650 million crypto users.

🇺🇸 Wise shareholders overwhelmingly approve plans to ditch UK primary listing. More than 90% of Class A shareholders and 84.6% of Class B shareholders approved the deal, which will see the firm swap its London primary listing for New York.

🇺🇸 Robinhood CEO Vlad Tenev says it’s a ‘tragedy’ that retail can’t tap private markets. “A big tragedy is that private markets are where the bulk of the interesting appreciation and exposure is nowadays,” Tenev said in an interview. “It’s a shame that it’s so difficult to get exposure in the US. We’re working to solve that.”

PAYMENTS NEWS

📰 How to increase transaction success rates for online merchants. A study by ACI Worldwide and Edgar, Dunn & Company found that 85% of merchants with multiple acquirer relationships saw increased conversion rates, with 23% reporting a rise of over 10%.

📰 Why FX management means competitive exchange rates for everyone by David García Amado, Global Head FX & International Solutions, PagoNxt Payments. Platform-based FX services fundamentally alter the dynamics of corporate banking, creating new opportunities for financial institutions to serve previously underserved market segments cost-effectively.

🇵🇭 GCash’s IPO is not expected this year. In an interview, the president and CEO, Martha Sazon, noted that while the IPO is still being considered, no specific timeline has been established. GCash continues to wait for the best timing before it proceeds with the filing of what could be the largest IPO in the country.

🇰🇪 Safaricom Adds New PayPal Withdrawal Feature to M-Pesa App. The withdrawal feature allows users to access their PayPal funds directly. The new integration is expected to benefit Kenya’s growing population of freelancers and remote workers who rely on PayPal for international payments.

🇬🇧 Mastercard strengthens trust in Account-to-Account payments. By combining cutting-edge fraud prevention technology and a new, clear dispute resolution framework, Mastercard A2A Protect will enable banks to provide consumers with the appropriate levels of protection against fraudsters.

🇰🇷 Pay-by-face expands in Korea. Payments made solely through facial recognition, or "pay-by-face," are being adopted rapidly as financial companies compete to gain an early foothold in next-generation financial services. While the initiative was bold, the requirement to register one's face in person at banks proved inconvenient.

🇺🇸 Paze's move beyond big bank owners gets a credit union boost. Paze is getting a boost from Star One Credit Union, which says a subtle difference in the bank-owned Paze, the fact that it does not share credit card numbers with merchants, helped win it over.

🇪🇺 PayDo secures MFSA licence to grow in the EU. Their EMI licence authorizes PayDo to issue electronic money and provide payment services throughout the EU via passporting rights. This means that PayDo complies with key EU standards in anti-money laundering (AML), customer protection, and financial security.

🇺🇸 Citizens delivers open finance payment features and direct deposit tools. It helps customers manage payments in one place using their debit card or checking account. With Citizens’ new switch payments capability, customers can update payment methods directly with the likes of Netflix, Amazon, Spotify, Lyft, and Verizon.

OPEN BANKING NEWS

🇺🇸 JPMorgan pauses Gemini partnership amid FinTech data fee dispute. According to the publication, the relationship between Gemini and JPMorgan has been tense for several years. The bank advised Gemini to find another banking partner because the service had become unprofitable.

🇲🇽 Mexican FinTech Clip integrates Belvo employment data tools. SoftBank-backed FinTech unicorn Clip has adopted Belvo's full suite of solutions to better reach small and medium-sized business (SMB) borrowers in Mexico who have never had formal access to credit.

DIGITAL BANKING NEWS

🇲🇦 Revolut names first executive in Morocco as it prepares to enter the market. This pivotal role has been entrusted to Amine Berrada, the former operations director for Uber in Southern and Eastern Europe. He has been tasked with steering Revolut's strategic direction and growth in Morocco.

🇬🇧 Digital challenger bank Chetwood Bank announces Manchester opening as balance sheet hits £5bn. The digital challenger has reached this latest milestone just as plans were announced to open a fourth office in Manchester in the coming months, adding to the company’s current presence in London.

🇺🇸 Tide turns as TPG leads talks to lead digital bank fundraising. Sources said that Tide's existing investors were expected to sell shares to TPG, while a separate deal would involve another existing shareholder in the company acquiring newly issued shares.

🇧🇷 Nubank Ultravioleta expands the Travel eSIM benefit with 10 GB that never expires and automatic annual renewal. The benefit also automatically renews after 365 days. This new feature offers greater flexibility and convenience, ensuring continuous connectivity for Ultravioleta customers who travel frequently.

BLOCKCHAIN/CRYPTO NEWS

🇿🇦 Peach Payments and MoneyBadger partnership goes live. This collaboration expands consumer payment choices and reflects the growing use of crypto for daily purchases. With this partnership, Peach Payments and MoneyBadger are making Bitcoin and crypto payments available to a much wider group of consumers.

🇺🇸 Coinbase sues German man over coinbase.de domain. The lawsuit alleges Tobias Honscha used the domain to redirect users to his physical coin trading app, operate an email service, and profit via Coinbase affiliate links, actions that violate Coinbase’s affiliate agreement.

🇱🇺 Stablecoin issuer dtcpay receives green light for EMI licence. The EMI license will authorise dtcpay to deliver a comprehensive suite of regulated payment services across the European Economic Area (EEA), including issuing electronic money, facilitating payment transactions, and enabling cross-border transfers.

PARTNERSHIPS

🇧🇭 Stc Bahrain becomes the first telecom to launch Samsung Pay, pioneering digital payments. This service enables users to complete transactions for bills, add-ons, and digital gift cards with ease, reflecting stc Bahrain’s commitment to introducing innovative solutions that align with modern digital lifestyles.

🇬🇧 NatWest adopts Pexa digital remortgage platform. Pexa says that its platform will help NatWest increase the speed and certainty of digital remortgage and sale and purchase transactions to homeowners, driving efficiency and transparency. Read more

🇮🇹 Crédit Agricole Italia and Nexi renew their strategic partnership until 2029. The agreement will enable the bank to further enhance its offering on digital payments, allowing customers to benefit from highly innovative, cutting-edge, and secure products and services provided by Nexi.

🇬🇧 FNZ announces a strategic partnership with Microsoft to accelerate the transformation of the wealth management industry. The partnership combines FNZ’s industry-leading technology, wealth management expertise, and global reach with Microsoft’s advanced AI capabilities, cloud infrastructure, and engineering excellence.

DONEDEAL FUNDING NEWS

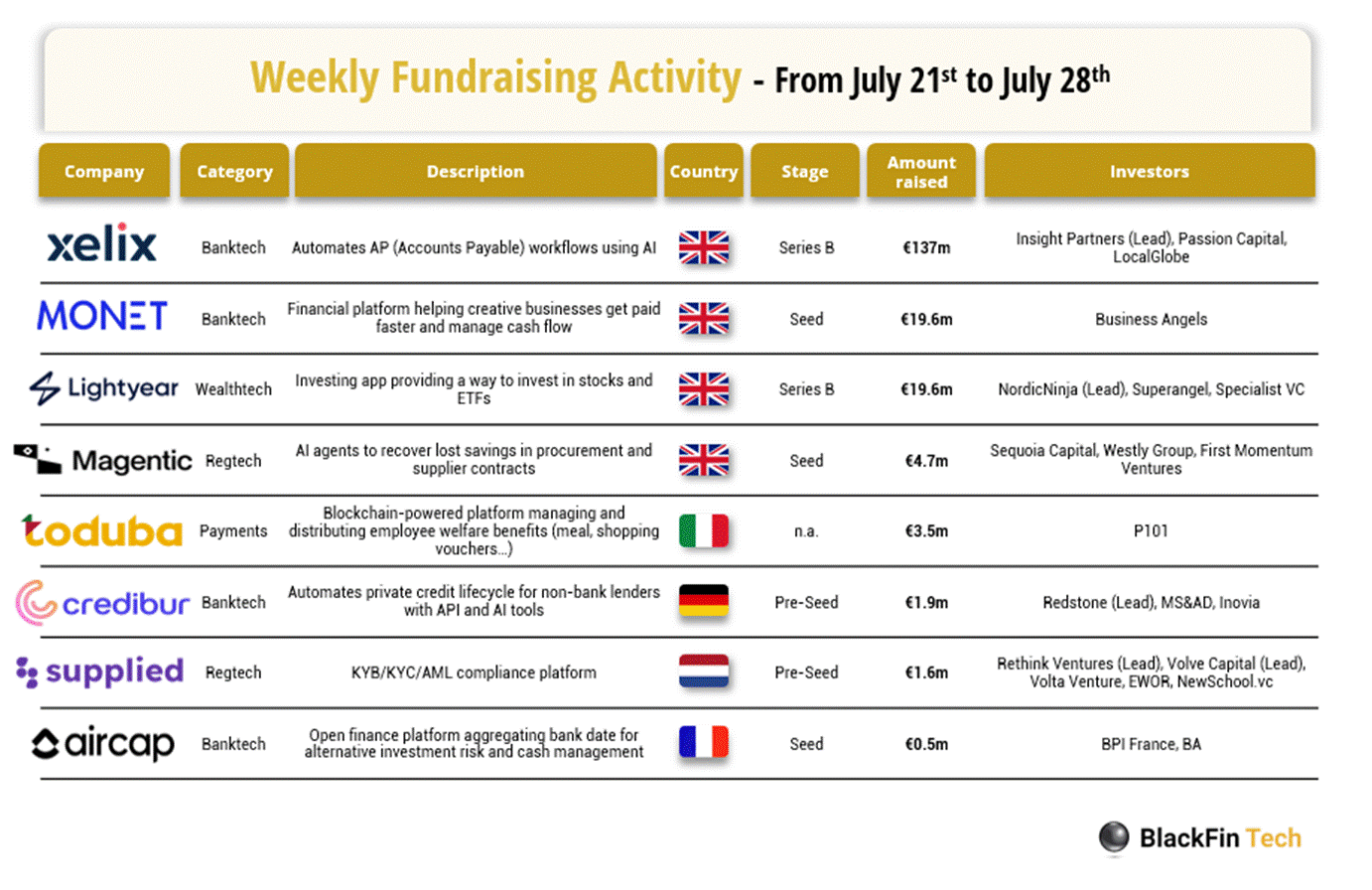

💰 Over the last week, there were eight FinTech deals in Europe, raising a total of €188 million, including four deals in the UK, and one each in France, Germany, Italy, and the Netherlands.

🇺🇸 Zodia Markets receives backing from Circle Ventures in an $18M funding round. The funding round was led by Pharsalus Capital, a New York-headquartered venture capital firm, with participation from Circle Ventures, The Operating Group, XVC Tech, Token BayCapital, Human Capital, and other strategic investors.

M&A

🇺🇿 Halyk Bank to acquire 49% stake in Uzbek super-app Click for $176m. The bank says the transaction structure allows both parties to work in "close partnership" while remaining independent entities. Through this partnership, Halyk and Click aim to strengthen their respective positions in Uzbekistan's digital ecosystem, and it is a rapidly evolving market for financial and FinTech services, the bank continues.

🇨🇭 Blockstream acquires Elysium Lab and launches European HQ in Switzerland. This network aims to support product development, research, and community involvement in Bitcoin-focused technologies. Keep reading

MOVERS AND SHAKERS

🇬🇧 Nottingham Building Society appoints Russ Thornton as CTO. In addition to a new CTO, the building society has further strengthened its C-Suite team by appointing former Santander UK executive Aaron Shinwell as Chief Lending Officer, effective August 2025.

🇬🇧 Henry Allen joins travel money FinTech Caxton as new CFO. He will work across the Caxton Group, including Nimbl, a youth money app. Allen has a lengthy history of serving as CFO for companies such as TipJar, Augmentive, Inicio AI, and, most recently, for vehicle management app Fleetsmart.

🇺🇸 Former Goldman Executive, Sarah Shenton, secured funding for AccessFinTech, and now she becomes its CEO. In the role, she worked directly with leadership teams at high-growth companies to improve their operations and drive commercial success.

🌍 10x Banking appoints Tom Bentley as Chief Revenue Officer to accelerate global growth. Tom will lead the company’s global commercial and growth strategy as it enters its next phase of expansion across key markets, including Europe, APAC, the Middle East, and Africa.

🇬🇧 FCA appoints Liam Coleman as Interim Chair of the Financial Ombudsman Service. Liam will chair the Financial Ombudsman’s board until a permanent appointment is made, after the initial recruitment campaign proved unsuccessful. Read more

🇨🇾 Crypto.com taps Coinbase’s Former Executive Louis Hawila as VP Capital Markets for Europe. His background includes non-executive directorship at Coinbase’s Cypriot-licensed entity and other financial firms, highlighting his compliance and market expertise.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()