Finom Raises $105M from General Catalyst to Accelerate SMB Banking Growth in Europe

Hey FinTech Fanatic!

Amsterdam’s digital bank Finom just secured €92.7M (~$105M) in fresh growth funding from General Catalyst’s Customer Value Fund — and here’s the kicker: no equity taken.

Co-founder Kos Stiskin told TechCrunch: “Our core operations are already cash-flow positive. Every new euro goes straight into winning more clients, not plugging gaps.”

Launched in 2020, Finom now serves 100,000+ small and mid-sized businesses across Germany, France, Spain, the Netherlands, and Italy. On top of digital banking, it’s rolling out an AI accounting agent and AI-powered lending — with credit services set to expand across Europe by year-end.

The momentum is real: Finom doubled its annual recurring revenue in 2024 and hit EBITDAM profitability. Stiskin proudly sees Finom as Qonto’s toughest challenger: “We’ve got stronger localization and a fuller product suite. We’re here to win.”

Backing the charge, General Catalyst’s Partner Zeynep Yavuz added: “Finom’s nailed execution in a market still wide open. Its modular setup scales fast, adapting to each market. And their homegrown anti-money laundering and KYC tech? It’s not just good for compliance — it’s a game-changer for customer experience.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

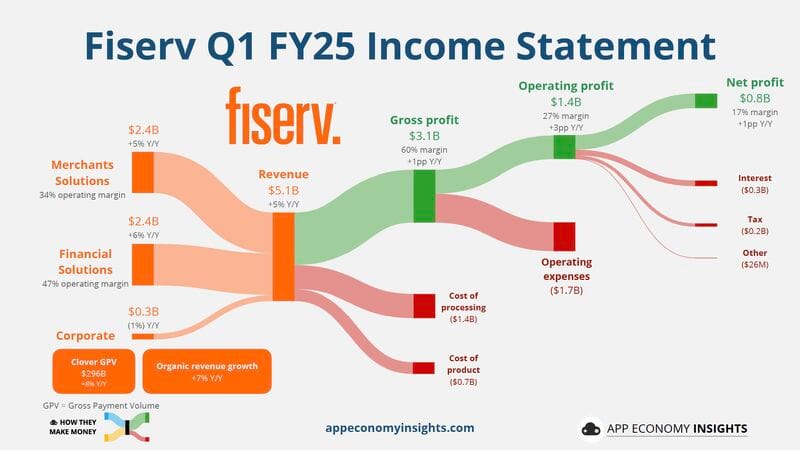

🇺🇸 Fiserv has begun processing card transactions under its merchant acquirer limited purpose bank (MALPB) charter.

FINTECH NEWS

🌍 Sygnum Bank achieves Unicorn Status, boosting brand growth in FinTech. The bank plans to leverage the new capital to broaden its reach within the European Economic Area (EEA) and Hong Kong, enhance its product offerings, and strengthen its operational infrastructure.

🇩🇪 Solaris co-founder Andreas Bittner takes legal action over SBI Holdings' takeover. Bittner has filed legal action with a regional court in Berlin. The lawsuit relates to a funding round Solaris undertook earlier this year of around $150 m, as it faced financial difficulty.

🇧🇷 Mercado Pago has introduced "Point Tap," a solution that transforms smartphones into payment terminals using NFC technology. This innovation allows merchants to accept credit and debit card payments directly through their Android or iPhone devices without the need for additional hardware.

🇦🇪 BNPL firm Tabby’s IPO could be as soon as 12 months away. CEO Hosam Arab said the firm was continuing to build and prepare for IPO, while also waiting to make sure the markets had turned around. Continue reading

🇺🇸 Visa makes landmark BVNK investment in ‘powerful validation’ of stablecoins’ payments future. It follows a variety of other stablecoin-related partnerships by Visa as it works to connect its ecosystem of around 4.8 billion cards, 150 million accepting merchants, and 14,500 financial institutions with the crypto ecosystem.

🇫🇷 Qonto power players: the leadership team behind the French FinTech unicorn. Founded in 2016 by Alexandre Prot and Steve Anavi, Qonto provides banking and financial services to small and medium-sized businesses (SMBs) and freelancers. The company has raised over $600m in funding from investors to date.

PAYMENTS NEWS

🇸🇪 The 150 leading organisations confirmed to attend NextGen Nordics 2025. The event addressed key industry themes such as the DORA, VoP, CBDCs, instant payments, fraud prevention, and the use of Generative AI in financial services. ACI Worldwide's participation highlighted its ongoing commitment to secure and innovative payment solutions in the rapidly evolving Nordic financial landscape.

🌎 Immediate payment systems in Latin America. Over the last decade, the region has seen notable progress in strengthening these systems. In 2023, real-time payments reached 266.2 billion globally — a 42.2% increase compared to 2022 — according to the Prime Time for Real-Time 2024 report by ACI Worldwide.

🇬🇧 Visa Compelling Evidence 3.0: How to save $10M in revenue in one year with Solidgate. This article explores the functionality of CE3.0 and explains why it may serve as a critical component in a comprehensive strategy to safeguard revenue. Read the full article here

🇩🇪 Brite Payments expands instant payments reach in Germany with OXID eSales. The partnership brings the extensive benefits of Brite Instant Payments and Brite Instant Payouts to users of OXID’s shop system through an easy-to-integrate plugin.

🇴🇲 Beyond ONE™ launches FRiENDi Pay in Oman, transforming digital payments for the sultanate’s residents. FRiENDi Pay offers a comprehensive financial solution for all Oman residents and citizens seeking hassle-free money transfers.

REGTECH NEWS

🇮🇩 Worldcoin suspends ID verification to clarify rules. The company has suspended its verification services in Indonesia due to licensing and regulatory uncertainties. This decision aims to clarify the requirements to operate in the country.

🇬🇧 UK payments regulator to be axed. The government announcement that regulation will soon be ‘cut back’ will not result in a free-for-all in the payments space, as two financial services regulatory partners talk to CDR about the likely changes to come.

🇻🇳 Vietnam approves two-year sandbox for P2P lending. Only P2P lending firms with explicit approval from the SBV will be eligible to operate during the pilot. Foreign banks are barred from participating, and involvement in the sandbox does not constitute legal recognition or assurance of future regulatory compliance.

DIGITAL BANKING NEWS

🇲🇾 Digital Boost Bank has dispersed RM150 million to underserved SMEs. Fozia Amanulla, CEO of Boost Bank, emphasized that SMEs are central to Malaysia’s economy, driving job creation, innovation, and community vitality. She stated that the mission was always clear: to support business owners in overcoming common financing challenges.

🇧🇷 Nubank expands benefits for Nubank+ customers. New options have been incorporated into the benefits package, including a new way to boost returns, exclusive rates on credit lines, and the elimination of the monthly fee for the toll and parking tag. These new features will be gradually made available to customers.

BLOCKCHAIN/CRYPTO NEWS

🇬🇭 Ghana to begin digital asset regulation in September. The proposed framework covers consumer protection, preventing illicit ‘crypto’ use, financial stability, cybersecurity, and the interaction of virtual asset service providers (VASPs) with mainstream finance.

PARTNERSHIPS

🌍 Bitget Wallet teams up with Paydify to expand global crypto acceptance. This initiative allows merchants to accept stablecoin payments from Bitget Wallet users, optimising crypto payments infrastructure and expanding the practical use of digital assets in daily transaction settings.

🇬🇧 One Mortgage System and Monument Technology partner to combine OMS’s advanced originations solution. The partnership provides banks, building societies, and specialist lenders with a seamless, end-to-end proposition. Keep reading

🇳🇴 Mastercard and Bits extend NICS clearing partnership. The firms have signed a new five-year agreement under which Mastercard will continue providing interbank clearing services for Norway’s financial institutions. The partnership supports the operation of the Norwegian Interbank Clearing System (NICS).

🇺🇾 dLocal and PayPal expand access to local payments across emerging markets. By leveraging dLocal’s platform, global customers of PayPal can easily accept cards and process local and alternative payment methods across Latin America, EMEA, and APAC markets without needing to establish local entities.

🇫🇷 Kard partners with Snowdrop for improved transaction clarity. By integrating Snowdrop’s technology, Kard now transforms raw transaction data into clear, secure, easy-to-understand insights. This collaboration focuses on clarifying merchant names and removing confusing or incomplete details to enhance the user experience.

DONEDEAL FUNDING NEWS

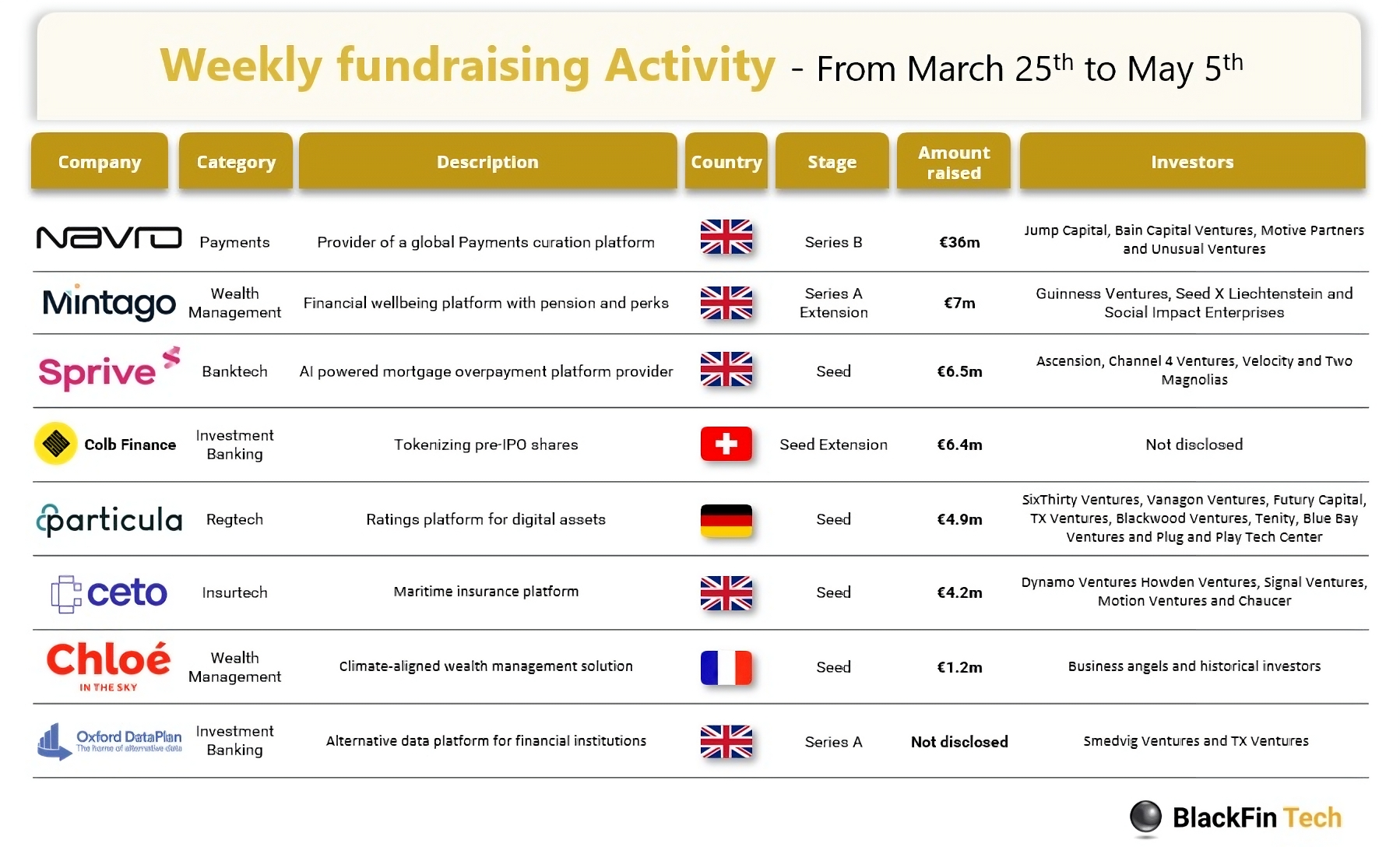

💰 Over the last week, there were 8 FinTech deals in Europe, raising a total of €68.2 million in equity, five deals in the UK, and one deal in each of Switzerland, Germany, and France.

🇬🇧 FinTech Tide targets unicorn status with $ 1 B+ valuation in upcoming share sale. It is planned to be mainly a secondary share sale, which would offer liquidity to existing investors, but could also see Tide issue new equity. The share sale is likely to take place in the second half of this year.

🇳🇱 Amsterdam-based Duna has announced its €10.7 Million Seed round. The funding will be used to accelerate product development and expand its network across Europe and beyond. Duna’s platform is already used by Plaid, Bol, Moss, Sequra, and Brand New Day Bank. Read more

🇺🇸 Republic Digital acquisition company, raises $300 million following IPO. The SPAC deal was initially reported to have raised $264 million. However, after the float was completed and the underwriters’ allotments were filled, the sale amount was pegged higher.

🌏 XWeave secures US$3 million funding for stablecoin cross-border payments. The funding will be used to expand XWeave’s network across non-G10 payment corridors in Asia and the Middle East, including the UAE, Indonesia, Japan, and Hong Kong.

🇺🇸 Doppel lands $35m funding round to boost AI-powered digital risk platform. The company plans to use the funds to scale its platform and meet growing enterprise demand. Doppel’s valuation now stands at $205m, bringing its total funding to $54.4m.

🇦🇺 Blinq lands $25M to further its mission to make business cards passé. The app lets users create several customized digital business cards for different needs and connect with contacts using them. The app can also automatically capture details and sync them with CRM systems.

🇳🇱 Finom, a challenger bank aimed at SMBs, lands $105M in growth funding from General Catalyst. The capital infusion “will be used exclusively and only for growth” and not for operational expenses or product development, Kos Stiskin, Finom’s Chairman and Co-Founder, said.

M&A

🇬🇧 £1.2bn Alpha unanimously rejects US takeover bid. The all-cash preliminary proposal came from Corpay, a firm that offers tools that allow businesses to make payments to vendors. “The board carefully considered the proposal, together with its financial advisers, and unanimously rejected it,” Alpha said in a notice.

🇺🇸 Employer.com scoops up another FinTech in purchase of MainStreet.com. Employer.com Chairman and Co-Founder Jesse Tinsley said the two companies were “merging forces to simplify business back office solutions into one powerhouse platform.”

🇨🇦 Figment eyes up to $200m worth of acquisitions in crypto M&A push. The company helps institutions earn rewards by staking, whereby tokens are locked to help secure blockchain networks and validate transactions supported by networks. It currently manages around $15 billion in staked assets.

MOVERS AND SHAKERS

🇺🇸 Former Global Head of Visa Commercial Alan Koenigsberg joins Cardlay Advisory Board. Koenigsberg’s deep expertise in the payments industry will be instrumental in scaling operations and forging key partnerships across North America.

🌏 eToro hires Yaki Razmovich to head Singapore and Asia. Yaki brings with him more than two decades of experience in the financial services sector. In his role, Yaki will be responsible for building eToro’s franchise in Singapore and further expanding its global footprint in Asia.

🇬🇧 Argentex Directors and CFO quit after FX Firm’s near-collapse. Henry Beckwith, Digby Jones, Rina Ladva, and Jeff Parker left the board on Friday, the company said in a filing on Monday. Chief Financial Officer Guy Rudolph also quit and will serve a six-month notice period.

🇬🇧 HSBC chairman Sir Mark Tucker to step down. Tucker will remain as a "strategic adviser to the group CEO and the board whilst the succession process for a permanent chair continues", the bank said. Read more

🇸🇬 Visa’s Shailesh Paul set to take over as CEO of PayU-owned Wibmo. He replaces Suresh Rajagopalan, who left in March. Wibmo, acquired by PayU in 2019, is expanding its focus to include full-stack payment solutions and business payments for future growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()