Figure Files for US IPO with Revenue Surge

Hey FinTech Fanatic!

Blockchain lender Figure Technology revealed in its Nasdaq filing that revenue jumped 22% YoY to $191M in H1 2025, swinging to a $29M profit from last year’s $13M loss.

Founded by Mike Cagney (ex-SoFi), Figure has originated $16B+ in home equity and is pushing blockchain into capital markets by tokenizing historically illiquid assets.

With Circle’s blockbuster debut and Gemini’s filing, crypto's share in the IPO market is rising. Figure’s listing under ticker FIGR could be the next test of Wall Street’s appetite for blockchain finance.

Scroll for more details on Figure's IPO play. More FinTech news awaits you below.👇

See you tomorrow!

Cheers,

FINTECH NEWS

🇮🇪 Klarna establishes new Irish financial vehicle to broaden funding base. Klarna Warehouse Funding Trust I, a designated activity company controlled by the buy-now-pay-later lender, was incorporated on July 11 and is based at the registered office in the Dublin offices of CSC, the company formations and corporate administration specialists, recent filings show.

🇬🇧 ANNA Money becomes the first UK financial institution to prove LLM/Agent capability in company registration to complete one of the most complex, highly regulated onboarding processes in a UK business company registration with full authorisation, identity verification, and payment.

🇬🇧 Robinhood launches stock-insights "Digests" tool. The tool is the first UK product launched by Robinhood Cortex, Robinhood’s investment assistant, which it launched in the US earlier this year. The tool, powered by Cortex, produces summaries or digests, as Robinhood calls them, of why a particular stock is moving in the market.

PAYMENTS NEWS

🇺🇸 Replika grows fast, and Solidgate makes sure payments don’t slow it down. Through this collaboration, Replika gained access to our acquiring, orchestration, subscription management, and chargeback prevention solutions, all under one roof. This approach streamlines Replika’s payment infrastructure, reducing the need for multiple vendors and cutting down on operational costs.

🇺🇸 BMO launches escape credit card with Mastercard to help travelers' spending go further. New card features accelerated rewards on travel-related spending with no foreign transaction fees, plus additional traveler benefits. Continue reading

🇿🇦 Peach Payments introduces real-time clearance payouts. Peach Payments’ revamped payout capability offers a seamless, automated solution to disburse funds in South Africa. With real-time payouts, automated processes, and batch payment handling, it reduces manual intervention and enhances efficiency.

OPEN BANKING NEWS

🇵🇰 Pakistan launches PRISM+ to upgrade the payment and settlement system. With the implementation of PRISM+, the country now moves toward the next stage of progress. This system is built on the ISO 2022 financial messaging standard, which supports structured and data-rich financial communications.

REGTECH NEWS

🇰🇷 South Korean financial authorities have temporarily suspended new crypto lending services in a direct response to a major liquidation event at a local exchange. This move highlights growing global concerns over excessive leverage in the digital asset market.

🇬🇧 Santander introduces screen-sharing detection technology. The new screen-sharing detection technology will automatically blur a customer’s mobile screen and prevent them from carrying out any banking actions where screen-sharing technology is being used on their device.

DIGITAL BANKING NEWS

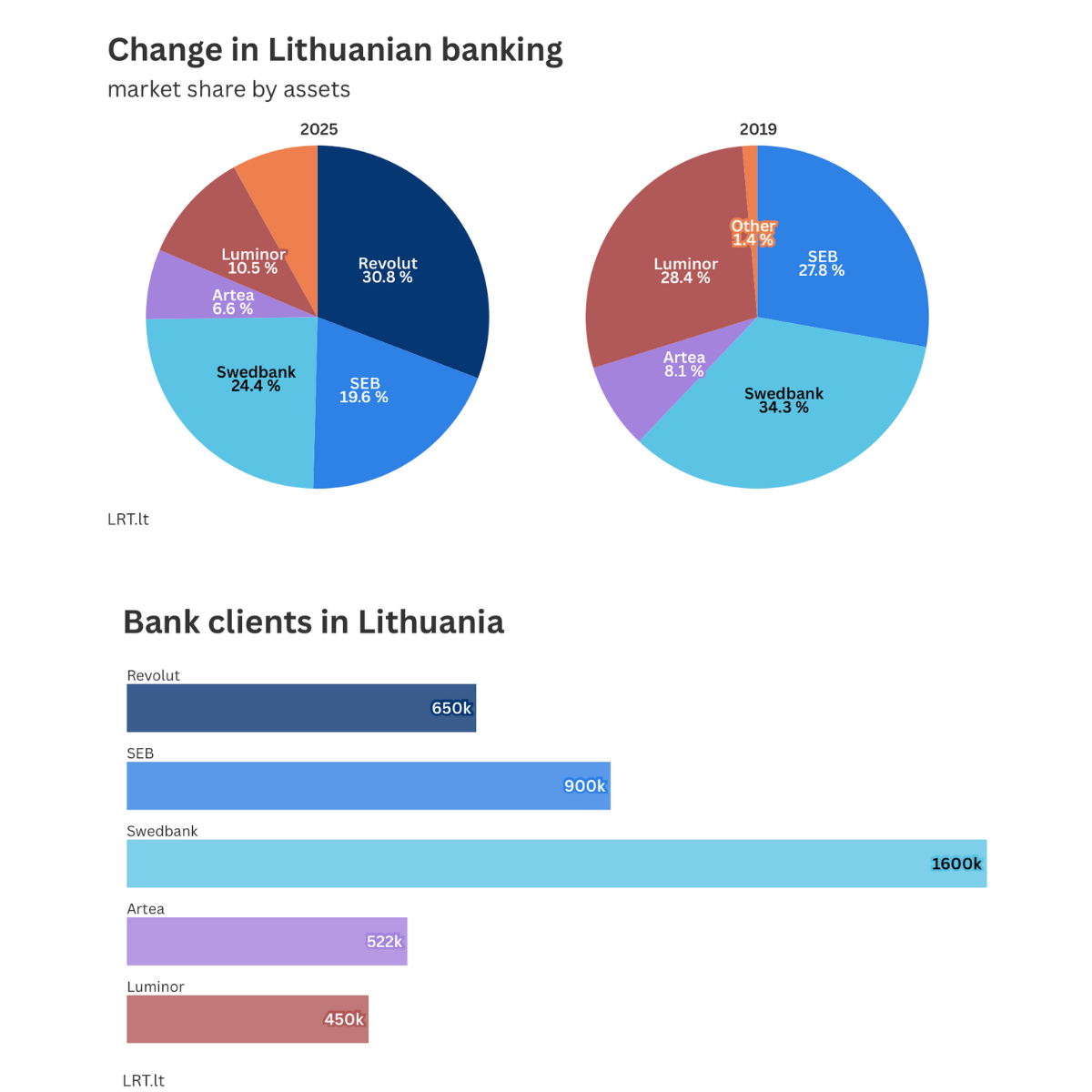

🇱🇹 Revolut has become the largest bank in Lithuania in just five years🤯

But the headline figure does not necessarily reflect the full picture👇

🇸🇪 Banking giant Revolut is recruiting for a branch in Stockholm to drive the company's growth in the Nordics, with salary accounts and mortgages as future launches. British banking service Revolut already has 60 million customers. Keep reading

🇪🇸 CaixaBank surpasses nine million Bizum users. During the first six months of the year, CaixaBank customers made more than 170.4 million transfers using Bizum, representing an average of nearly one million transactions per day. This is in addition to nearly 5 million online purchases, a 70% increase.

🇬🇭 Affinity boost expands Affinity Africa’s digital banking suite in Ghana. With this new product, Affinity continues to reimagine digital banking in Africa by offering inclusive, flexible, and high-yield financial products that put customers in control of their money.

🇲🇽 BBVA rolls out global data platform to Mexico and Colombia. This strategic advance seeks to improve and accelerate the bank's ability to offer personalized and relevant products and services to its customers. The cloud-based data platform enables the centralized consolidation of analytical processes, ensures real-time access to data, and scales the use of artificial intelligence.

🇬🇧 FNZ launches advisor AI to redefine advisor productivity and scale personalized advice. The solution will help financial advisors enhance productivity, deliver more personalized advice, and serve more clients at scale. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Blockchain lender Figure Technology reveals revenue surge in US IPO filing. Figure Technology Solutions' revenue surged 22% in the first half of 2025, the blockchain lender disclosed on Monday in its U.S. initial public offering paperwork, the latest crypto-linked firm set to hit the new listings market.

🇺🇸 SoFi taps Bitcoin lightning network for global remittances with Lightspark, aiming to bring real-time international money transfers to its members. SoFi's remittance product will allow users to send U.S. dollars through the SoFi app, with recipients receiving local currency deposits abroad.

PARTNERSHIPS

🌎 dLocal and Tiendamia partner to drive cross-border eCommerce growth in Latin America. The partnership expands local payments across five key Latin American markets, enabling businesses to efficiently collect and pay out while delivering shoppers faster, more convenient, and inclusive payment experiences.

🇮🇳 Juspay partners with Outpayce from Amadeus to power global travel payments. This collaboration unlocks a future-ready foundation for global travel businesses, including airlines, hotels, etc., to streamline complex payment processes through a single integration with Outpayce’s XPP.

🇬🇧 SyFu partners with Salt Edge to enable card payment data integration across Geographies. Through Salt Edge’s PSD2-compliant and globally connected open banking platform, SyFu can securely integrate credit and debit card payment data without requiring any changes to users’ existing payment methods.

🇸🇪 Knowit and Mambu to power Coop’s new core banking. The initiative represents a significant step in Coop’s digital transformation journey, ensuring that the financial backbone of one of Norway’s largest cooperative networks is modern, agile, and future-ready.

🇬🇧 Andaria partners with tell.money to support European verification of payee, rollout, building on successful UK CoP Delivery. The partnership follows Andaria’s successful implementation of Confirmation of Payee in the UK during the 2024 Group 2 wave, demonstrating the company’s commitment to proactive fraud prevention and regulatory alignment.

🇮🇳 CRED to launch co-branded credit card with IndusInd Bank. The move marks CRED’s next major product expansion beyond its flagship credit card, bill payments, lending, and commerce offerings. CRED also offers a range of services, including credit score tracking, hidden charge detection, bill payment reminders, and cashback.

🇺🇸 Finzly announces integration with Q2's digital banking platform. By leveraging Finzly’s solution through Q2’s Digital Banking Platform, financial institutions can quickly enhance their offerings, capture new revenue, and meet account holder expectations without the hassle of complex implementation.

🇦🇺 FloQast teams with Deloitte for Australian push. The collaboration will bring together FloQast’s powerful AI platform and Deloitte Australia’s deep expertise to streamline the financial close process and drive efficiency gains. Continue reading

🇺🇸 Lithic integrates the Visa API to speed up card upgrades. The integration enables Lithic clients to enroll eligible cardholders into Visa’s Signature and Signature Preferred programs, and more, without card re-issuance or disruption to the cardholder experience.

DONEDEAL FUNDING NEWS

🇮🇳 Virtual credit card app Kiwi set to raise around $23 Mn in Series B. This fresh fundraising follows Kiwi’s Series A round in November 2023, when it secured $13 million led by the above-mentioned existing backers. Read more

🇺🇸 Ripple extends $75M credit facility to Gemini as exchange pursues IPO. Gemini revealed a $282.5 million net loss for the first half, an almost seven-fold increase from the $41.4 million shortfall a year earlier. The filing puts Gemini, which plans to use the ticker "GEMI" on Nasdaq, in line to become the third crypto exchange to trade publicly in the U.S. after Coinbase.

🇸🇬 Temasek-backed FinTech lender Kissht files for Rs 1,000 crore IPO to augment NBFC subsidiary’s capital base. Kissht, which offers digital loans through its mobile application, may also consider a pre-IPO placement worth Rs 200 crore. If it manages to close the pre-IPO round, the fresh issue size will be reduced to the extent of the amount raised.

M&A

🇺🇸 Circle acquires consensus engine Malachite to power Arc blockchain. The deal includes the underlying technology and intellectual property of Malachite, and nine people from Informal Systems will join Circle, an Informal Systems spokesperson told CoinDesk. The firms didn't reveal details about pricing.

🇬🇧 Broadridge acquires Signal. The combination of Signal's digital-first communications and strong relationships with UK financial services firms, along with its proven scale and regulatory domain expertise, transforms its ability to serve our global clients and extend its footprint in Europe.

🇨🇱 Buk acquires Bemmbo and launches Buk Finanzas. Buk plans to double the team to speed up product development and develop more synergies between their existing HR product and their new finance product. Continue reading

🇬🇧 Starling extends business banking suite with Ember acquisition. The acquisition, which is reportedly in the sub-£10 million range, will provide Starling with a ready-made suite of bookkeeping and tax tools for solo entrepreneurs and small businesses.

MOVERS AND SHAKERS

🇺🇸 Missouri's NBKC Bank reshapes executive team with new CFO John Mahoney and COO Jana Merfen appointments. Mahoney brings more than 16 years of accounting, finance, and audit experience. Merfen's responsibilities include risk and vendor management, along with information technology and security.

🇲🇾 CoinGecko strengthens leadership with New CEO, President, and CTO. Bobby Ong is stepping into the role of Chief Executive Officer, TM Lee, who will transition to President, and Cedric Chan will be appointed Chief Technology Officer. Read more

🇩🇪 N26 co-founder leaves joint CEO role after investor tensions. N26 co-founder Valentin Stalf is leaving his role as Chief Executive of Germany’s most valuable FinTech and will join the group’s supervisory board, following tensions between investors and the entrepreneurs who started the business.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()