Feedzai Acquires Demyst in $100M RiskOps Expansion

Hey FinTech Fanatic!

A new chapter is unfolding in the world of fraud prevention. Feedzai, a unicorn company known for safeguarding billions in financial transactions, has confirmed the acquisition of Australian data orchestration firm Demyst for $100 million, according to sources close to the deal.

The agreement includes Demyst’s full operations, intellectual property, and the Zonic platform — a system designed to simplify and accelerate the way financial institutions access and organize data. Feedzai plans to embed these capabilities into its RiskOps platform, aiming to streamline how banks assess risk in real time.

Founded in 2011, Feedzai has grown into a global risk management platform, helping institutions process over $6 trillion annually. With more than $274 million raised to date, its technology supports fraud detection, onboarding, and transaction monitoring — all powered by machine learning. Demyst, founded in Sydney, brings expertise in data access at critical decision points, adding depth to Feedzai’s offering.

“There is no shortage of data in our industry — the trick is how to access the right data as quickly as possible so that you can accelerate risk decisions with the fewest consumer friction points,” said Nuno Sebastiao, Feedzai CEO and co-founder.

This acquisition follows Feedzai’s earlier purchase of Revelock in 2021. With operations across ten international offices and a team of 600+, the company continues to scale its RiskOps vision — now with tighter control over both the consumption and the provision of data.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Network & Run - Looking for a space where networking meets fitness?🏃♂️💬Join our weekly runs and connect with FinTech Fanatics while staying active! 📅Check out April/May schedule & Sign Up Here to be part of a vibrant community of over 19+ cities.

PODCAST

🎙️In this episode of Payments Nerds, Tom Warsop, President and CEO of ACI Worldwide, and David Watson, President and CEO of The Clearing House, dive into the current state – and future – of instant payments in the United States. From scalable tech to adoption hurdles and cross-border potential, this conversation unpacks why instant payments are just getting started in the U.S. Listen to the full episode here.

INSIGHTS

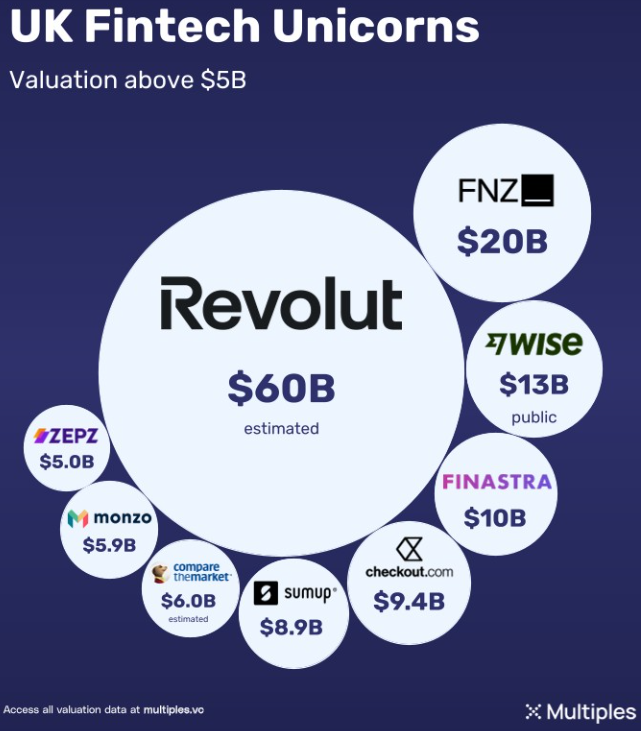

🇬🇧 UK FinTech Unicorns by Multiples.

Let's dive into some incredible stats👇

PAYMENTS NEWS

🇨🇦 Trulioo teams up with cross-border embedded payment solutions provider PingPong. By deploying Trulioo’s advanced Business Verification and Watchlist Screening technology, PingPong will improve its ability to quickly verify individuals and companies worldwide while shortening onboarding time and reducing other operational challenges.

🇺🇸 Expensify launches simplified $5 pricing plan for SMBs. This move is designed to make Expensify more accessible to small and medium-sized businesses (SMBs), a market traditionally underserved by the financial tech industry. Read more

🇬🇧 PayPal to open major office in London landmark. The firm has signed up to become the first occupier of a redeveloped office building on London’s Southbank. It has also agreed a lease for 40,000 sqft on the top floor of the building, a newly revamped Grade II-listed structure next to the National Theatre.

🇲🇾 Google Pay rolls out integration of eWallets, ShopeePay and TNG eWallet in Malaysia. This new feature will enable Android users to checkout seamlessly with their preferred eWallets when shopping on mobile sites via Google Chrome, starting with selected online merchants.

REGTECH NEWS

🌏 Trulioo reports record 64% revenue increase in APAC as demand for global identity verification surges. The milestone stems from significant growth in verification transactions across industries, including a 37% rise for online marketplaces and a 55% increase among FinTech enterprises.

DIGITAL BANKING NEWS

🇲🇽 Mexican lender Banorte to scrap unprofitable digital bank. Executives said it would either sell or fuse year-old FinTech Bineo, part of a larger overhaul of the bank's digital strategy to cut costs and simplify operations. If Bineo were fused into Banorte, it would bring its clients and technology with it and could face a name change.

🌏 Tuum introduces foundations for Islamic banking and finance solutions to support Sharia-compliant financial services. This initiative is said to focus on the main principles of Islamic banking, laying the groundwork for a platform intended to support the needs as well as requirements of Islamic financial institutions.

🇵🇹 Rauva has helped create 1,500 companies, 40% of which are based in Lisbon. The program aims to foster entrepreneurship and innovation across Portugal. The platform simplifies the business setup process by providing services such as business account opening, certified invoicing, and access to accounting services.

🇸🇱 Velmie and Metro Cable Africa - Smart Network Carrier launch Vult, Sierra Leone gets first digital banking super app. The app lets users do everything from mobile money transfers and card payments to managing bank accounts. It aims to boost financial inclusion by combining multiple financial services into one easy-to-use platform.

🇬🇧 Revolut gears up for Spring bank holidays and summer travel. Customers will now be able to travel across the globe without additional currency exchange fees, seven days a week. This change comes in anticipation of the summer travel season, with May bank holidays and summer travel on the horizon.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MoonPay's Ivan Soto-Wright bets on a non-custodial API-first future for crypto. With over 30 million verified users across 160 countries and a fully licensed global stack, the company is enabling everything from fiat onramps to embedded DeFi experiences.

🇿🇦 Binance tightens South African compliance rules for crypto transfers. Starting April 30, Binance users will be prompted to provide additional information when transferring crypto. For deposits, users must disclose the sender’s full name, country of residence, and, if applicable, the name of the originating crypto exchange.

🇺🇸 Banks expand crypto operations in the US due to easing regulations. A report from the Wall Street Journal cites that recent national adoption in the developing industry is influencing the stance of financial institutions. Continue reading

🇬🇧 Mercuryo launches new Mastercard cryptocurrency debit card "Spend." The new card is available via the companion app Ledger Live and allows its users to seamlessly make purchases using their digital holdings, which are converted to fiat currency. Moreover, users can fund the new debit card directly from self-custody.

🇺🇸 Cantor to start crypto firm with banking called Twenty One Capital from Tether and SoftBank. Twenty One will be majority-owned by leading stablecoin issuer Tether and Bitfinex, with significant minority ownership by SoftBank. The firm will be led by co-founder and CEO Jack Mallers.

🇺🇸 PayPal unlocks rewards for Holding PayPal USD. PayPal and Venmo users will be able to earn rewards on their PYUSD balances, which they can use to pay at millions of merchants, fund remittances on Xoom without transaction fees, convert 1:1 to their fiat balance and other cryptocurrencies, and send on-chain to supported wallets on the Ethereum and Solana blockchains.

PARTNERSHIPS

🇵🇭 GCash partners with Mastercard for contactless payments via app. This collaboration further solidifies GCash's commitment to offering Filipinos convenient and secure cashless payment solutions, making everyday transactions easier and more seamless.

🇬🇧 fumopay selects Cashflows as an acquiring partner to enhance payment processing capabilities. Through this collaboration, businesses using fumopay’s single integrated checkout solution can now accept both traditional card payments and instant bank payments, all through a unified interface.

🇺🇸 Papaya Global and AKT partner to deliver end-to-end workforce payments for SAP customers. This collaboration empowers customers to streamline global workforce management and payment processes across a wide range of business sectors.

🇬🇧 Nationwide Building Society extends partnership with Visa to advance account-to-account payments. The new agreement will help drive growth in current account and credit card issuing, to bring the value of Nationwide to a greater number of consumers across the UK.

🇺🇸 Black Dragon Capital℠ announces new FinTech strategic partnership with First Tech Federal Credit Union. Through this collaboration, the firms hope to create and scale financial technology companies that can help credit unions transform their business and regain their member service advantage.

DONEDEAL FUNDING NEWS

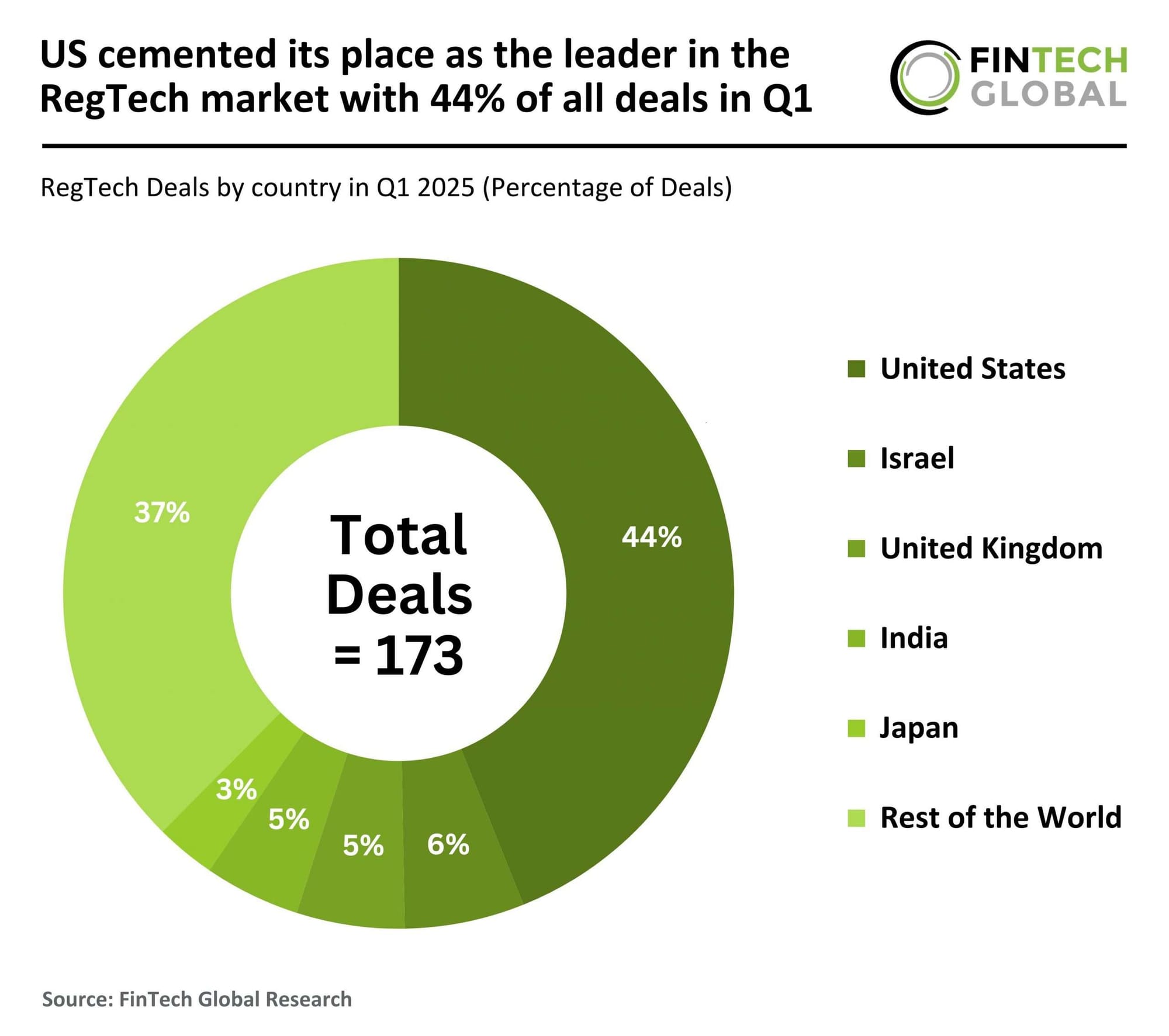

🇺🇸 US cemented its place as the leader in the RegTech market with 44% of all deals in Q1.

🇦🇺 Australian Open Banking FinTech WeMoney secures $12 million in Series A, backed by Lance East Office and Mastercard. This investment will allow WeMoney not only to maintain leadership in Australia but also to assess prospects on a global stage.

🇺🇸 Salsa raises $20M to expand embedded payroll services across US and Canada. The new funding will support Salsa’s efforts to help software platform developers in all 50 U.S. states and Canada embed payroll features in their products that they didn’t previously have.

🇺🇸 Houston FinTech FundThrough lands $25M Series B round, acquires lender to expand capabilities. With this investment, the company plans to accelerate its technology development and build partnerships to reach more businesses across North America.

🇬🇧 Hokodo secures €10M equity raise led by Korelya Capital and Opera Tech Ventures for digital trade credit product innovation. This new cash injection will allow Hokodo to continue developing innovative digital trade credit solutions, onboard new merchants, and leverage AI to further digitise the credit management value chain.

🇸🇪 Froda raises €20m to scale embedded SME finance across Europe. Froda's platform integrates directly with banks, neobanks, and payment providers, enabling SMEs to access instant financing at the point of need. Read more

🇺🇸 Alpaca raises $52 million in series C funding to fuel global expansion and category leadership. With this raise, Alpaca sets its sights on continued global expansion, serving both enterprise institutions and FinTechs across key regions like the US, the Middle East, and Asia.

M&A

🇺🇸 Feedzai acquires Demyst to break down data silos and accelerate risk decisions. This is part of Feedzai’s vision to unify data orchestration and risk management into a single platform, providing financial institutions with the real-time data, analytics, and trusted artificial intelligence they need to make the best possible risk decisions.

🇺🇸 Argentex weighs sale to IFX Payments after margin call chaos. The company is taking steps to preserve cash and increase collateral from counterparties due to a cash squeeze caused by margin calls linked to its foreign exchange derivatives book.

🇩🇪 Aazzur integrates with Okooro. This collaboration will stimulate growth for both companies in areas such as portfolios, solutions, and product expertise for their mutual clients. The fusion will bring intelligent FX infrastructure to German FinTechs and banks, fully embedded, revenue-generating, and built for scale.

MOVERS AND SHAKERS

🇲🇾 Curlec by Razorpay names Kevin Lee as new Country Head and CEO. Lee confirmed his appointment this week, marking a new chapter after his recent departure from GHL Systems. He previously served as the CEO for GHL Systems Malaysia from June 2009 until recently, a tenure spanning nearly 16 years.

🇺🇸 Coinbase expands to Charlotte. Coinbase is targeting Charlotte with this hiring push for its growing tech and financial sectors. Although the company is remote-first, Chief People Officer LJ Brock says their strategy focuses on "meeting talent where they are."

🇬🇧 Kuflink appoints Gurmit Raina as CFO. ¨Her experience at board level, managing complex financial operations, allied to her hands-on approach and innovative problem solving, is just what Kuflink needs at this stage of its expansion,¨ said co-founder Rawinder Binning as CEO.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()