Federal Plans for Payments Canada 🇨🇦 and 2024 Open Banking Legislation

Good morning FinTech Fanatic!

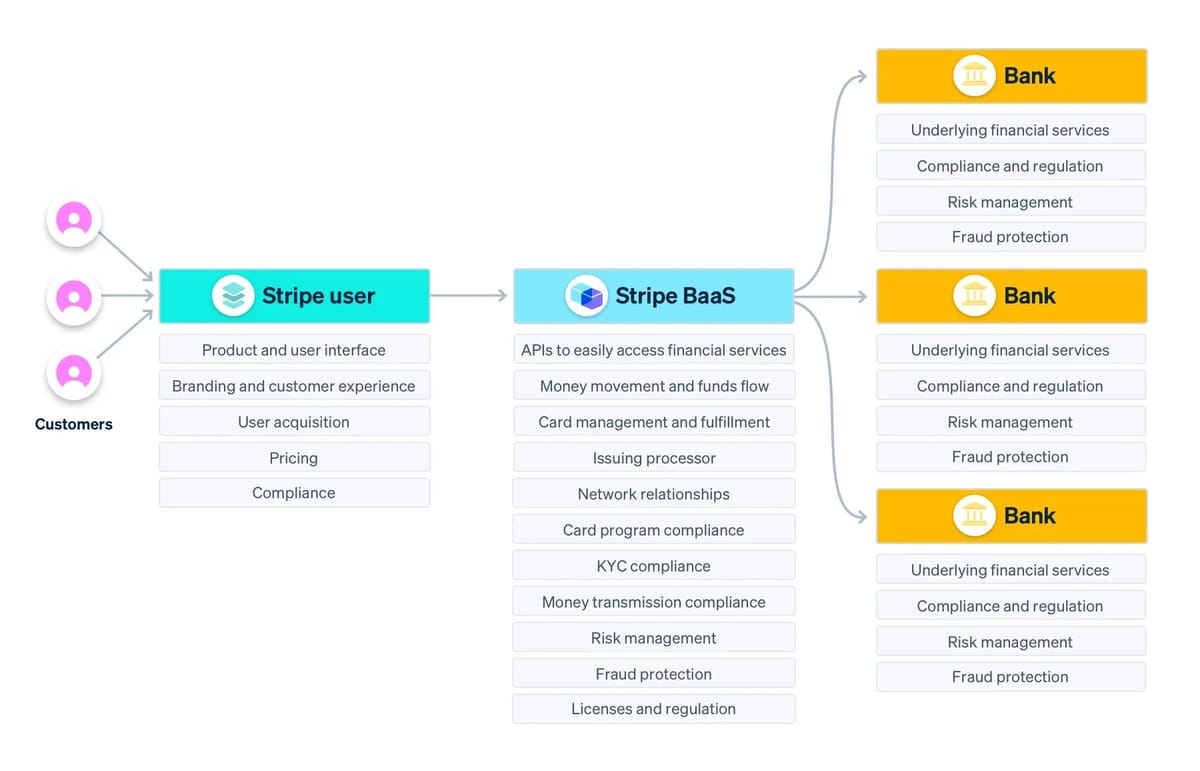

In my latest deep dive article, we delve into the transformative world of Stripe's Banking-as-a-Service (BaaS), a game-changer in the fintech industry. I've unpacked how Stripe is reshaping business financial services, making complex banking processes accessible and efficient. Don't miss out on this insightful exploration of Stripe's innovative approach to integrating financial services seamlessly into existing business platforms.

The Government of Canada’s Fall Economic Statement, delivered by Deputy Prime Minister and Finance Minister Chrystia Freeland, includes promises to implement a consumer-driven banking framework next year, expand Payments Canada eligibility, and bolster the country’s competition watchdog, as well as updates regarding the Clean Technology Investment Tax Credit and the Canada Growth Fund.

The statement indicated that the Liberal government intends to amend the Canadian Payments Act to expand membership eligibility for Payments Canada (which is spearheading the delivery of a new Real-Time Rail payment system) to firms other than big banks, give the Competition Bureau more power to tackle anti-competitive deals and practices, and introduce legislation through Budget 2024 to make open banking a reality.

“This is the boldest move from the government to date: consumer-driven banking legislation in 2024, a policy statement signalling their direction, and amendments to the Canadian Payments Act later this year,” Fintechs Canada executive director Alex Vronces told BetaKit.

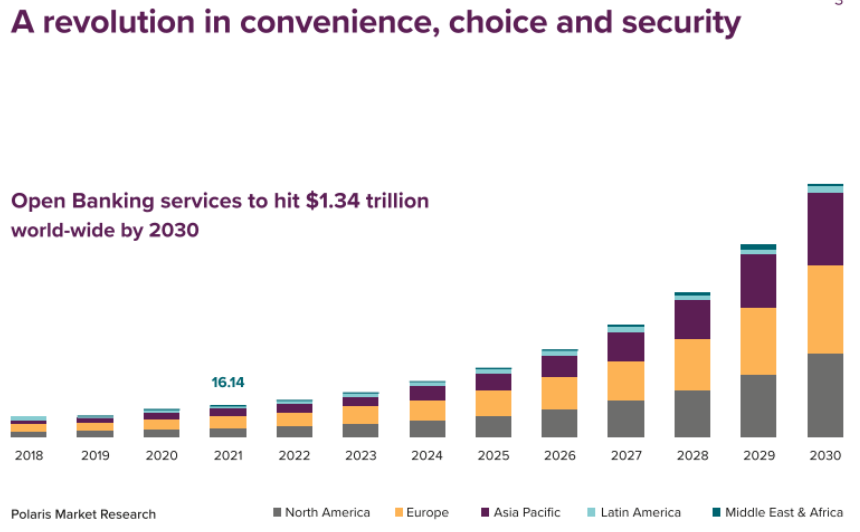

If you like to learn more about open banking, you should definitely check out the Open Banking report I listed for you below👇

Tonight, I'll be attending the much-anticipated launch event of Swan, a cutting-edge embedded finance company, in the vibrant city of Amsterdam. I can't wait to meet the Swan team, and to mingle with fellow enthusiasts and experts in the local FinTech industry.

For those who are as curious as I am about Swan and its innovative approach, tune into this enlightening podcast where Swan's CEO Nicolas Benady delves into the company's history, mission, and future plans. And/or check out this recent use case webinar to learn more:

Enjoy your day, and I'll be back with more FinTech industry updates tomorrow!

Cheers,

POST OF THE DAY

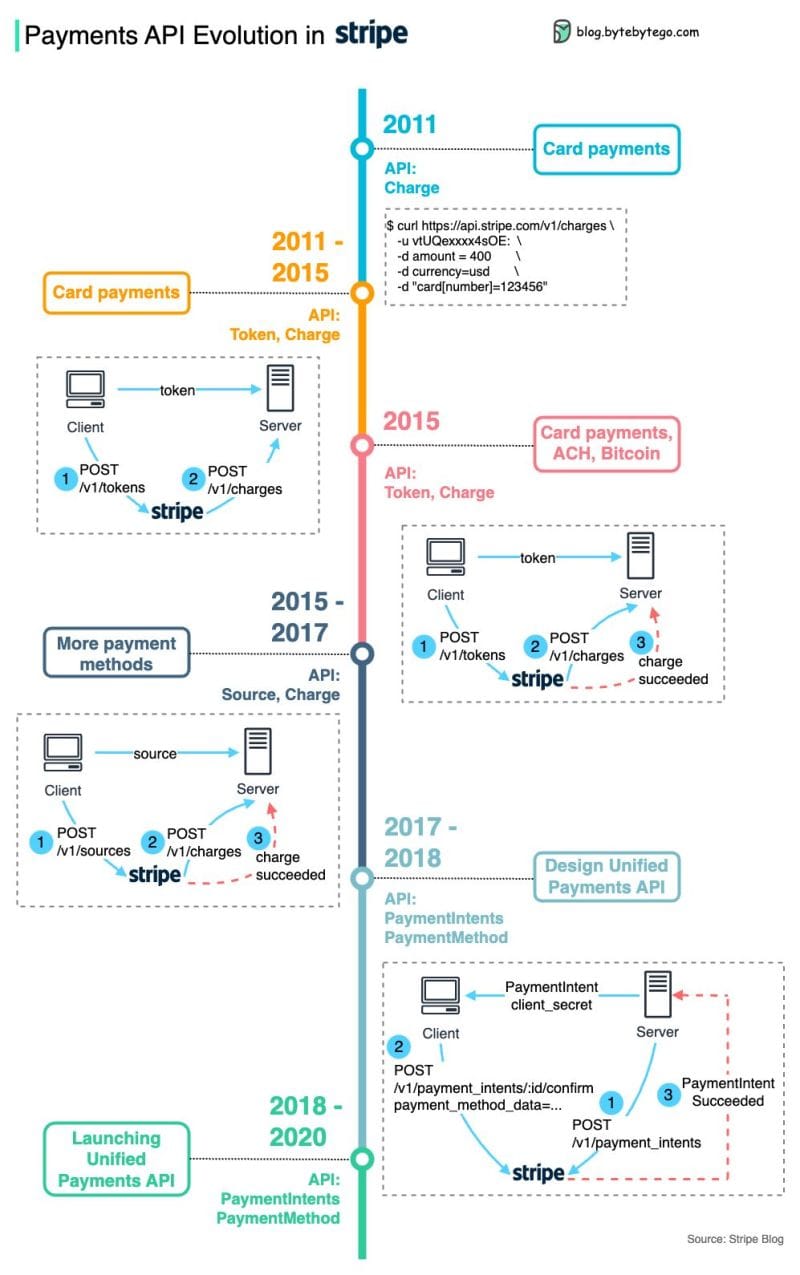

🤔 How do we design payments API? The diagram below shows Stripe's payments API evolution👇

#FINTECHREPORT

The ‘Open Banking revolution needs flexible API connectivity’ report by BPC, explores the power of open banking through flexible API connectivity. It also covers the importance of open APIs for the success of open banking, its global adoption, and more. Download and read the complete report here

INSIGHTS

After revolutionizing Kenya 🇰🇪, M-PESA is about to do the same in Ethiopia 🇪🇹. M-Pesa hit the ground running on Aug 15, 2023. They now have: Easy transfers, deposits, and more on M-Pesa, over 100 global corridors opened for remittances among other achievements. Read the full article here

FINTECH NEWS

Marqeta has announced a new partnership with Credi2 that is poised to reshape European bank offerings through an end-to-end instalments platform. The collaboration will launch an innovative solution tailored for the growing demand for flexible and seamless digital payments.

🇸🇪 Findity announces the launch of its revolutionary solution, the Expense API. This groundbreaking technology empowers businesses to leverage Findity's platform and seamlessly integrate tailored expense management functionality into their existing software suites.

🇧🇷 Paytech Transfeera becomes IP and plans to participate directly in Pix in Brazil. This significant milestone, long anticipated since 2020, empowers Transfeera to manage prepaid accounts and directly integrate with the Central Bank’s systems like the Brazilian Payments System (SPB) and the Reserve Transfer System (STR).

Hong Kong Monetary Authority and Abu Dhabi Global Market ink fintech MoU to deepen their partnership in cross-border trade data exchange and business collaboration, aiming to promote inclusive and innovative financial services using fintech and data in both markets.

PAYMENTS NEWS

🇰🇷 Viva Republica, the operator of Korean fintech unicorn Toss, announced that its QR-based offline payment service is now available at Alipay+ merchants in 40 more countries for Korean tourists, in addition to China and Malaysia.

SeQura enhances its payments experience with Checkout.com as its Payment Service Provider (PSP). The companies announced a strategic partnership aimed at helping merchants increase conversion rates through flexible payment solutions, establishing the basis for both firms to work closely together in further developing the best payment experience.

The European Parliament and the Council of the European Union have reached a provisional agreement on the European instant payment proposal, marking a significant step toward establishing instant payments as the standard in Europe. Explore the key takeaways of the provisional agreement here

🇨🇿 Škoda rolls out in-car payments for fuel. The new Pay to Fuel service makes paying after refuelling quicker and more convenient for Škoda drivers, with motorists able to save time by paying directly through the car’s infotainment system.The service is now available in six European countries.

🇺🇾 dLocal reports 2023 third quarter financial results. Revenue reached $163.9 million, marking a remarkable 46% year-over-year increase. Check out the complete Earnings Call Results here

OPEN BANKING NEWS

🇦🇺 Open payments firm Volt lands in Australia, integrating with the country's PayTo platform. The company is also setting up a physical presence in Australia and says it is looking to make a number of "significant hires". Read more

🇳🇿 New Zealand credit bureau Centrix is set to introduce live bank data feeds powered by global data aggregator Envestnet | Yodlee in a development benefiting both borrowers and lenders. Through this collaboration, Centrix gains direct access to transaction data from borrowers’ bank accounts with their consent.

REGTECH NEWS

SEB implements Blacksmith’s KYC platform for automation of its financial institutions KYC process. With its automated KYC platform, Blacksmith is able to facilitate SEB’s data-driven approach to KYC, deliver time savings in data collection and significantly reduce the need for customer outreach.

DIGITAL BANKING NEWS

🇺🇸 MoneyLion wins "Best Financial Literacy Tool" at Benzinga’s 2023 Global Fintech Awards. The company continuously promotes financial literacy through innovative and personalized content, bridging the financial literacy gap by providing customized recommendations specific to consumer financial needs and goals.

🇨🇦 Canadian youth aged 13 and up can now supercharge their savings with a Neo High-Interest Savings Account. This is Neo’s latest move to transform the financial services market to better serve Canadian teens with the next generation of financial tools — empowering youth to navigate their finances with confidence.

Mashreq partners Visa and ecolytiq on climate banking platform. This collaboration is another step in Mashreq’s ambitious climate commitment, one that strives to offer customers climate-focused products, helping them reach their own sustainability goals and contribute to the environment.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Kraken continues to fight for its mission and crypto innovation in the United States. After the SEC filed a complaint alleging that Kraken operates as an unregistered securities exchange, broker, and clearing house, the company disagrees, and intends to vigorously defend its position in court. Read on

🇺🇸 Tether freezes $225M linked to human trafficking syndicate in Southeast Asia amid DOJ investigation. The investigation was ongoing for months and used blockchain analysis tools provided by Chainalysis. It marks the largest-ever freeze of a stablecoin, a press release said.

DONEDEAL FUNDING NEWS

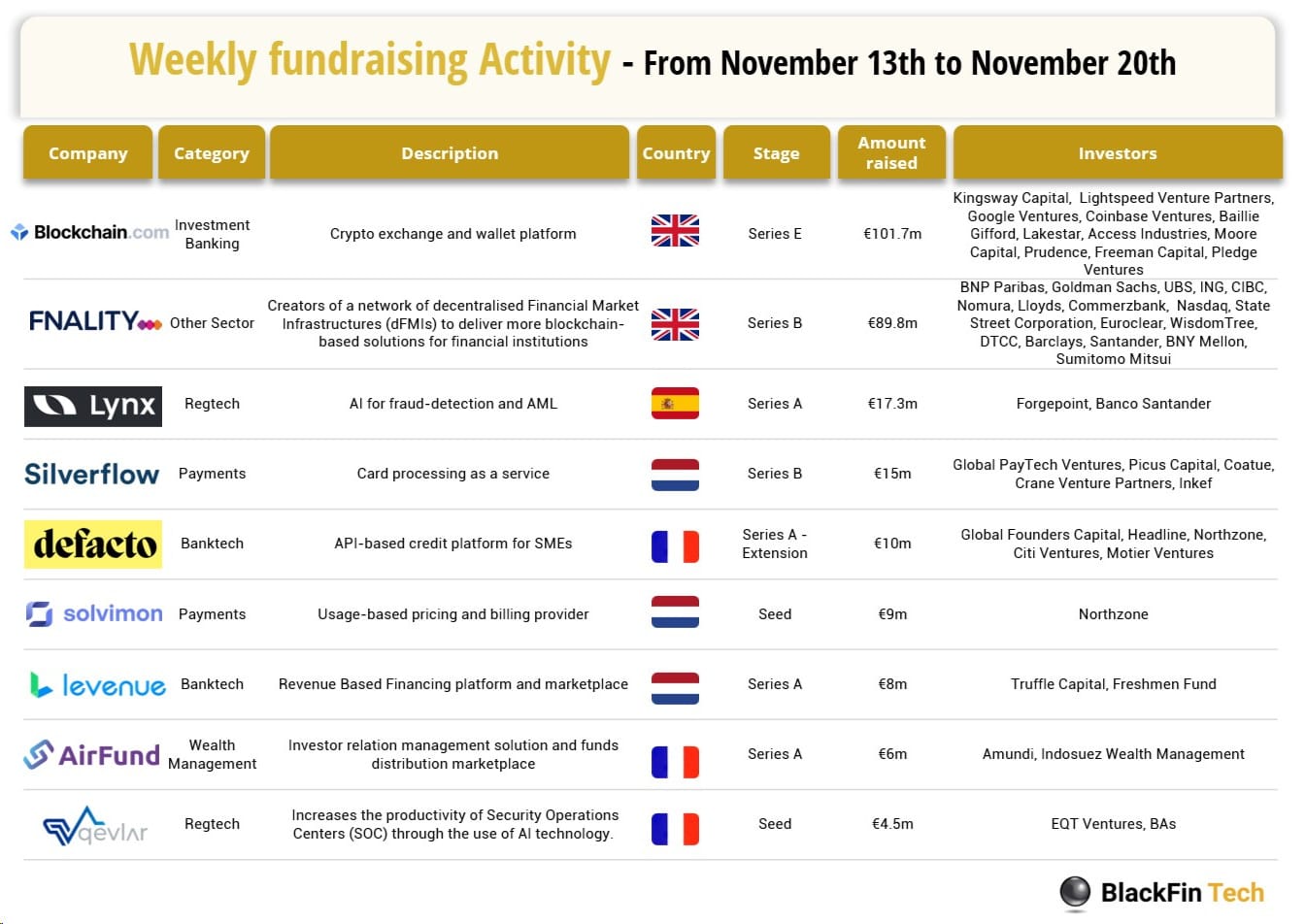

In the past week, we saw 11 deals in Europe for a total amount of €265.1m raised officially with four deals in the UK, three in The Netherlands, three in France and one in Spain. Link here

🇺🇸 Figure Taps Goldman, JPMorgan and Jefferies for IPO. Figure is considering taking public its so-called LendCo division in the first half of 2024 at a valuation of $2 billion to $3 billion, according to people familiar with the matter.

🇬🇧 Barclays leads WealthOS to secure £2m seed funding. WealthOS specialises in delivering technology for various critical functions in wealth management, including compliant client onboarding, portfolio management, trading, reconciliation, and more.

🇺🇸 Privy, the crypto startup powering buzzy consumer tools, raises $18 million. Privy’s primary goal is to provide tools that will let clients connect their users to the blockchain regardless of which device or browser they are using—and then let clients decide which crypto-style features to add.

🇬🇧 Magic ID, a startup specializing in Digital Identity Verification secures €350K. The startup plans to use the funding to launch its Magic ID product range in the UK and EU, expand its team, and advance research and development for enhancing their decentralized identity infrastructure.

M&A

CoinGecko acquires Zash to enhance its crypto data API. CoinGecko plans to introduce new endpoints to its crypto data API by the second quarter of 2024. These will include features such as enterprise-grade NFT data indexing, historical trade data, and lending data indexing from various platforms.

🇨🇦 Wonderfi acquired their 5th Canadian crypto exchange in 2 years, Calgary based Bitvo. The Transaction was completed by way of an asset purchase agreement. Bitvo was nearly acquired by FTX last year, but the deal fell apart amid the US firm's bankruptcy.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()