Federal Oversight Increases for PayPal Venmo, Apple Pay, Google and other Tech Giants

Hey FinTech Fanatic,

The U.S. government is considering applying bank-like oversight to major tech companies like Apple, Google, and PayPal, which manage digital payments through their apps.

This proposed regulation, spearheaded by the Consumer Financial Protection Bureau (CFPB), aims to introduce routine checks similar to those conducted on traditional banks. The intent is to safeguard the growing number of Americans using mobile payment services for everyday transactions.

This move has triggered significant pushback from the tech industry, concerned about the broad scope of the regulatory powers, which could lead to invasive scrutiny. Tech industry lobbyists are actively trying to curtail these powers, fearing potential investigations and penalties that could extend beyond payment services to other business areas.

The CFPB's proposal comes in response to increasing complaints about issues such as fraudulent charges and account errors with mobile payment apps. The agency believes that the same oversight given to banks should extend to tech companies handling substantial consumer transactions, to ensure compliance with federal consumer protection laws.

Despite the tech industry's strong resistance—predicting possible legal challenges—the CFPB maintains that the regulation is essential for equal consumer protection, whether payments are processed by banks or tech firms.

The agency is considering using its existing authority to start regulating high-risk companies even before finalizing its rules. This stance is supported by consumer advocacy groups and some state officials who see a pressing need for more stringent oversight to protect consumers from risks associated with digital payments.

Read more interesting FinTech industry updates below and I'll be back in your inbox on Monday (straight from Bali 😉).

Cheers,

#FINTECHREPORT

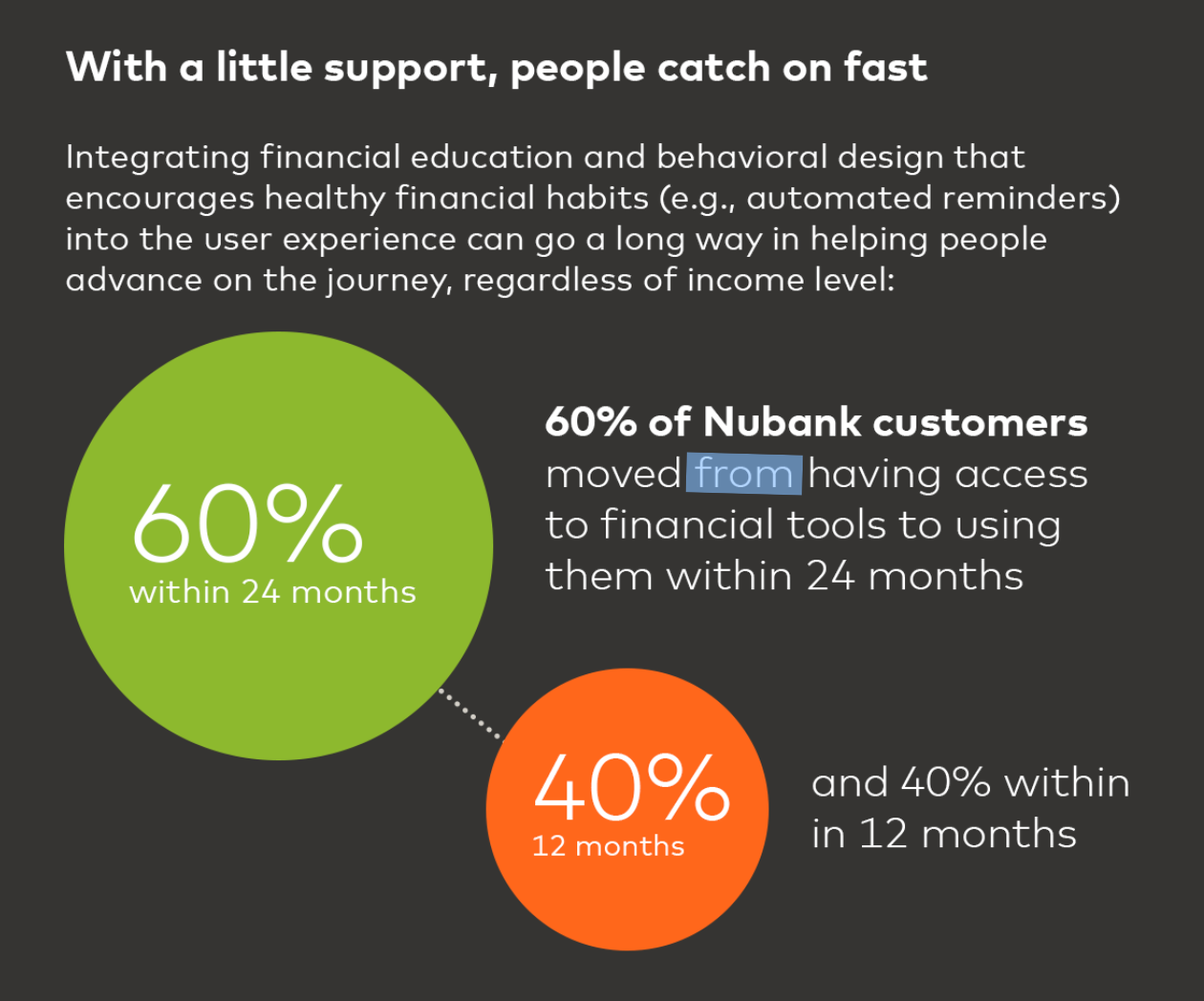

📊 Nubank and Mastercard exclusive study reveals path to advancing beyond access toward financial health. Check out the full study here

FINTECH NEWS

🇺🇸 Airwallex to provide faster international payments for BILL. Airwallex's updated tech stack will enable BILL customers to schedule FX conversions and payouts the ideal timing and cadence for the end customer, allowing them to automatically process and reconcile international bill payments at scale.

🇺🇸 Federal prosecutors are examining financial transactions at Block, owner of Cash App and Square. Internal documents indicate Block processed crypto transactions for terrorist groups and Square processed transactions involving nations subject to economic sanctions. Find out more

PAYMENTS NEWS

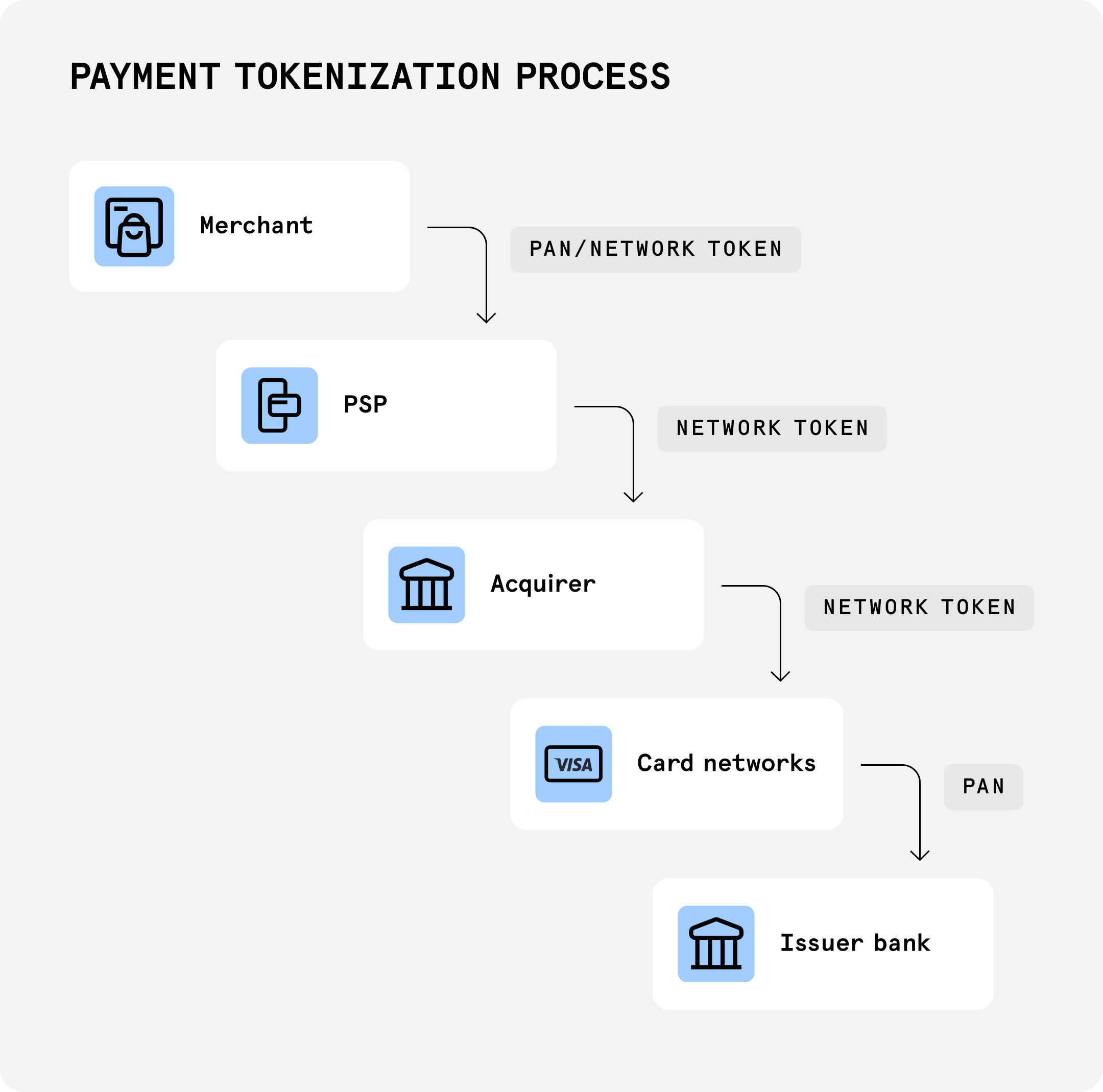

➡️ How does 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 work?

🇺🇸 BNPL firm Sezzle turns to gamification to encourage timely payments. Called Payment Streaks, the new feature promises to reward consumers for consistent and timely payments. By hitting streaks, users move up loyalty tiers that secure benefits such as entry into monthly giveaways and bonuses for referring friends.

🇺🇸 Mastercard: Tokenized transactions grow 50% Year Over Year. Mastercard said in its most recent earnings report on Wednesday (May 1) that the shift to digital payments from cash is gaining strength, and contactless and tokenized transactions are proving to be strong tailwinds.

🇮🇹 Nexi to integrate self-checkout technology with shopreme. The move underscores Nexi and shopreme’s shared commitment to reshaping the in-store payments landscape, leading to an era of convenience, efficiency and innovation for European consumers and retailers.

🇨🇭 Icon Solutions announced that it has developed and launched a new SIC5 scheme pack for its Icon Payments Framework (IPF) – the payments solution putting global banks in control – to accelerate support for domestic instant payments in Switzerland.

🇺🇸 Orum launches No Code Verify tech for FedNow payments. Orum’s Verify solution offers 100% coverage of all US-based consumer and business bank accounts — a meaningful step forward in an industry still plagued by invalid credentials, friction, and fraud.

🇺🇸 Payments processor BlueSnap reaches $10m settlement with FTC. The payments company, ex-CEO Ralph Dangelmaier and SVP Terry Monteith agreed to turn over $10 million for consumers and to stop processing payments for certain high-risk clients.

🇺🇸 Fitbit warns you have 3 months before mobile payments switch to Google Wallet. Users must prepare for the shutdown of Fitbit Pay and switch to Google Wallet before July 29. The change provides access to more cards and faster checkouts with Google Pay, ensuring a smooth transition.

🇳🇦 NPCI on Thursday said its overseas arm has signed a pact with the Bank of Namibia for developing a Unified Payment Interface-like instant payment system for Namibia. By leveraging technology and experiences from India's UPI, the partnership seeks to help Namibia modernize its financial ecosystem.

OPEN BANKING NEWS

🇬🇧 TransferGo has partnered with Tink to add Pay by Bank to its payments offering. Pay by Bank is an embedded payment method powered by open banking, and is now live for TransferGo’s customers in the UK, introducing a new way to more securely and quickly send money internationally.

🇸🇦 Mastercard collaborates with SingleView to empower businesses across the region with greater access to corporate and commercial solutions powered by SingleView technology. The agreement will see both partners work together to enable enterprises in the Kingdom to unlock the value of data safely and securely.

DIGITAL BANKING NEWS

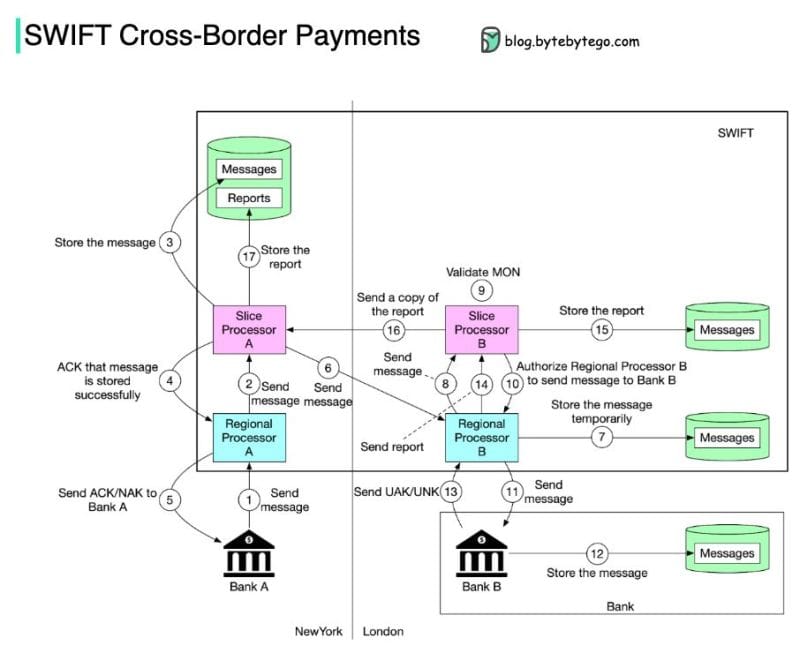

📲 How does 𝐒𝐖𝐈𝐅𝐓 wire transfer work in 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬? Let’s dive in, step by step:

🇩🇪 Tide set to launch business accounts in Germany with Adyen. Following its announcement of strategic entry into the German market in March, Tide will soon offer cost-effective and efficient business accounts to small businesses lacking a finance function.

🇩🇰 Lunar founder has "confidence" appeal against court decision will be successful. The Danish challenger is appealing a court ruling related to the failed takeover of Norwegian Instabank. The deal fell through due to a dispute over capital requirements needed for its completion.

BLOCKCHAIN/CRYPTO NEWS

🇳🇬 Binance exec nears 100 days in Nigerian custody without a bail ruling as trial looms. On Thursday, Justice Emeka Nwite postponed Gambaryan’s money laundering trial to May 17. Gambaryan has endured numerous delays and reversals ever since he was swept up in Binance’s worsening legal crisis in Africa’s most populous nation.

DONEDEAL FUNDING NEWS

🇺🇸 Baselayer snaps $6.5M to use AI to combat fraud and optimise business onboarding. With the funding, Baselayer plans to double down on investing and scaling its platform as well as refining and building out new features in its GenAI model.

🇬🇧 Manchester-based FinTech Firenze secures 750K to make Lombard loans accessible to all. The investment will be used to accelerate its mission to democratise access to Lombard lending. It will allow Firenze to continue its team growth and start onboarding the first wealth managers and platforms.

🇩🇰 Pleo secured €40M in debt financing from HSBC Innovation Banking to level up credit offering. Pleo's Overdraft feature is already available across Sweden, Germany, the UK, and Denmark (and it’ll soon be in the hands of businesses in the Netherlands very soon).

🇳🇬 Norrsken22 invests $205 million in Africa’s growing FinTech sector. The fund targets expansion in digital payments and neobanks, especially in Francophone West Africa. In the first quarter of this year alone, substantial investments were made due to stronger performance metrics compared to other markets.

🇨🇿 Prague-based Birdwingo secures €1.2 million for their financial education and investment platform. Birdwingo’s app is unique in the EU, allowing underage teenagers to invest in popular stocks and ETFs, such as Apple, Nvidia, and the S&P 500, among over 12,000 additional options.

🇮🇳 FinTech startup Dexif raises $4 million led by RTP Global. The funds will be utilised to expand the business operations, scale technology and increase recruitment. Click here to read the full piece

🇺🇸 Altruist raises $169M series E to set a new standard in wealth management. The new round of funding values the financial technology company north of $1.5B, on the heels of 550% YoY revenue growth and tripling AUM for a second consecutive year.

M&A

🇧🇷 Israeli FinTech Nayax has acquired Brazilian paytech VMtecnologia specialising in self-service retail, in a deal that could be worth approximately $27 million. For Nayax, the acquisition and intended integration of VMtecnologia and its technology is set to fuel its expansion into Latin America.

MOVERS & SHAKERS

🇺🇸 Uplinq adds former Visa Small Business leader Matt Baker as Strategic Advisor, strengthening business development efforts. As strategic advisor, Baker will advise Uplinq’s internal team on business development opportunities and go-to market strategy across the globe.

🇺🇸 Feedzai appoints David Larson CFO. Feedzai, the market leader in anti-fraud and financial crime software, has appointed corporate finance heavyweight David Larson as its new Chief Financial Officer as the firm enters its phase of growth and expansion.

🇬🇧 OneBanx welcomes former Vocalink CEO Gregor Dobbie to Board of Directors. This strategic move is poised to significantly enhance OneBanx’s industry footprint, leveraging Dobbie’s extensive experience in driving innovation and excellence in financial services.

🇺🇸 DailyPay appoints Brett Pitts to its Board of Directors. Pitts, an accomplished leader in the banking and payments industries, brings decades of experience to DailyPay from prominent financial institutions and financial services companies where he drove innovation as an executive leader and board member.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()