EXCLUSIVE: Klarna Breaks Silence on Dutch Debt Collection Registry

Hey FinTech Fanatic!

Dutch Minister says Klarna is not registered in the national debt collection registry and may be in breach of regulations.

New parliamentary responses in the Netherlands are raising questions around debt collection practices linked to Buy Now, Pay Later providers, following reporting by Follow the Money NL.

According to the minister, Klarna falls under the Dutch Debt Collection Quality Act, meaning it is required to register in the national debt collection registry.

The discussion touches a broader nerve. Consumer protection. Regulatory consistency. And how BNPL should be supervised, especially given its scale and popularity among younger consumers.

The debate now moves toward potential supervisory action and how rules should apply across the industry to ensure equal standards, effective consumer protection, and responsible BNPL business models...

Exclusive statement from Klarna:

“We support the Wki and its goal of fair and transparent debt collection. As Klarna doesn't work directly with debt collection, we needed time to properly understand how the law applies to us...

But we recognise this has taken too long and we should have moved faster. Our application for the Wki register is now ready, and we're committed to finalising this promptly,” a Klarna spokesperson said.

What do you think? Should BNPL providers be treated the same as traditional debt collectors when it comes to registration and oversight?

I’ll be watching closely how this moves forward... and thanks for sharing this news earlier, Don Ceder.

More stories and what this could mean for BNPL regulation ahead 👇 I'll be back soon with what's shaking up the FinTech industry. Stay tuned!

Cheers,

FINTECH NEWS

🇺🇸 Crypto.com launches "OG", a new prediction market experience. OG provides sports fans access to the most comprehensive range of CFTC-regulated sports event contracts as well as additional event contracts across financial, political, cultural, and entertainment events.

🇨🇴 Yape enables direct transfers from Peru to Nequi in Colombia to expand its regional reach. This new feature allows users to send funds between the two platforms with crediting in a matter of minutes, simplifying a common process for thousands of users who send money abroad.

🇨🇱 Global66 reports historic growth in 2025. During 2025, the platform facilitated the transfer of US$3.7 billion from Chile abroad, representing an explosive growth of 157% compared to the previous year. Continue reading

🇬🇭 Onafriq partners with PAPSS to pilot instant cross-border payments from Nigeria to Ghana. The pilot enables instant cross-border payments fully denominated in Naira, eliminating the need for hard currency conversion. Delivered in partnership with banks and mobile money operators, the service has received regulatory approval from the CBN.

PAYMENTS NEWS

🌏 Mastercard launches portfolio of fleet solutions in Asia Pacific. The solutions are strategically engineered to support different market maturities and customer segments, from SMEs with small fleets to large logistics operators. Mastercard Fleet: Next Gen unifies payments data, turning transactions into actionable insights embedded across fleet management workflows.

🇳🇱 Dutch Minister states Klarna is not registered in the debt collection registry and may be in breach of regulations. Parliamentary responses suggest Klarna falls under the Dutch Debt Collection Quality Act, which would require such registration, prompting questions about whether its activities legally qualify as debt collection.

🇦🇺 Revolut unveils unified payments platform for Australia. The company said Australian businesses can accept payments, settle funds, and manage payment operations through a single platform alongside their business account. Additionally, Revolut Business enters Singapore’s merchant payments market, allowing businesses to accept online and in-person payments from a single platform. The launch brings merchant acquiring into the Revolut Business account, combining account-to-account, online, and in-store payments.

🇺🇸 Visa acceptance platform now supports tap to pay on iPhone, boosting contactless acceptance for merchants. Merchants can accept all forms of contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets, wherever they do business, and the solution supports Visa and other major card networks.

🇦🇺 Finance platform LemFi launches remittance services in Australia as global expansion continues. As an independent remittance platform, LemFi can now directly provide its remittance services to Australian residents, offering competitive exchange rates, fast transfers, and low-cost fees.

🇬🇧 PayPal-backed Modulr banks its first full-year profit. Myles Stephenson, CEO and co-founder, heralded the achievement as an important milestone. He said: “It gives us control over our destiny: the ability to invest in products for our customers, expand globally, and pursue strategic opportunities.”

🇨🇳 China starts paying interest on digital yuan in latest bid to extend its reach, aiming to encourage use as an alternative to the dollar for cross-border transactions. China is focusing on using the digital yuan to expand cross-border transactions by businesses.

🇺🇸 ACH Network Volume hits record highs amid surge in faster payments. B2B payment volume rose nearly 10% in 2025, reaching 8.1 billion payments. Health care claim payments from insurers to medical and dental providers also saw a 7.3% increase, nearing 548 million transactions.

🇮🇪 Bank of Ireland contactless payments reached record levels in Q4. Contactless card transactions, including digital wallets (Apple Pay/Google Pay), increased by 10% when compared to Q4 2024, whilst contactless ‘tap and go’ payment levels rose by 4%.

DIGITAL BANKING NEWS

🇬🇧 Revolut ramps up legal hiring amid expansion drive. Revolut is planning to grow its legal team by 15% in a bid to keep up with rapid expansion at the digital bank. The London-based FinTech is hiring for 29 legal roles globally, including in the UK, Europe, the Middle East, North America, and Asia, according to job postings.

🇬🇧 Starling supercharges savings offering with new Cash ISA and revamped easy saver. This move allows users to effortlessly segment their tax-efficient savings for different life goals, a key differentiator in the crowded market. Starling’s top investor withdraws support for London IPO. Harald McPike, who invested $70m in Starling in 2016 and still holds around a third of the bank, is said to believe the company is increasingly open to a US listing despite his earlier opposition.

🇬🇧 Chase enters the UK insurance market. The new product is a bundle of worldwide travel insurance, mobile phone insurance, and AA UK breakdown cover, available for a fixed monthly rate of £12.50. Customers can purchase and manage their cover and submit any claims via the Chase app.

🇮🇹 Hype launches SplitHype. The new feature is designed to simplify group expense management and reduce friction, billing, and arguments among friends, families, or roommates. It is integrated directly into the app and is available to all Hype customers, regardless of their plan.

BLOCKCHAIN/CRYPTO NEWS

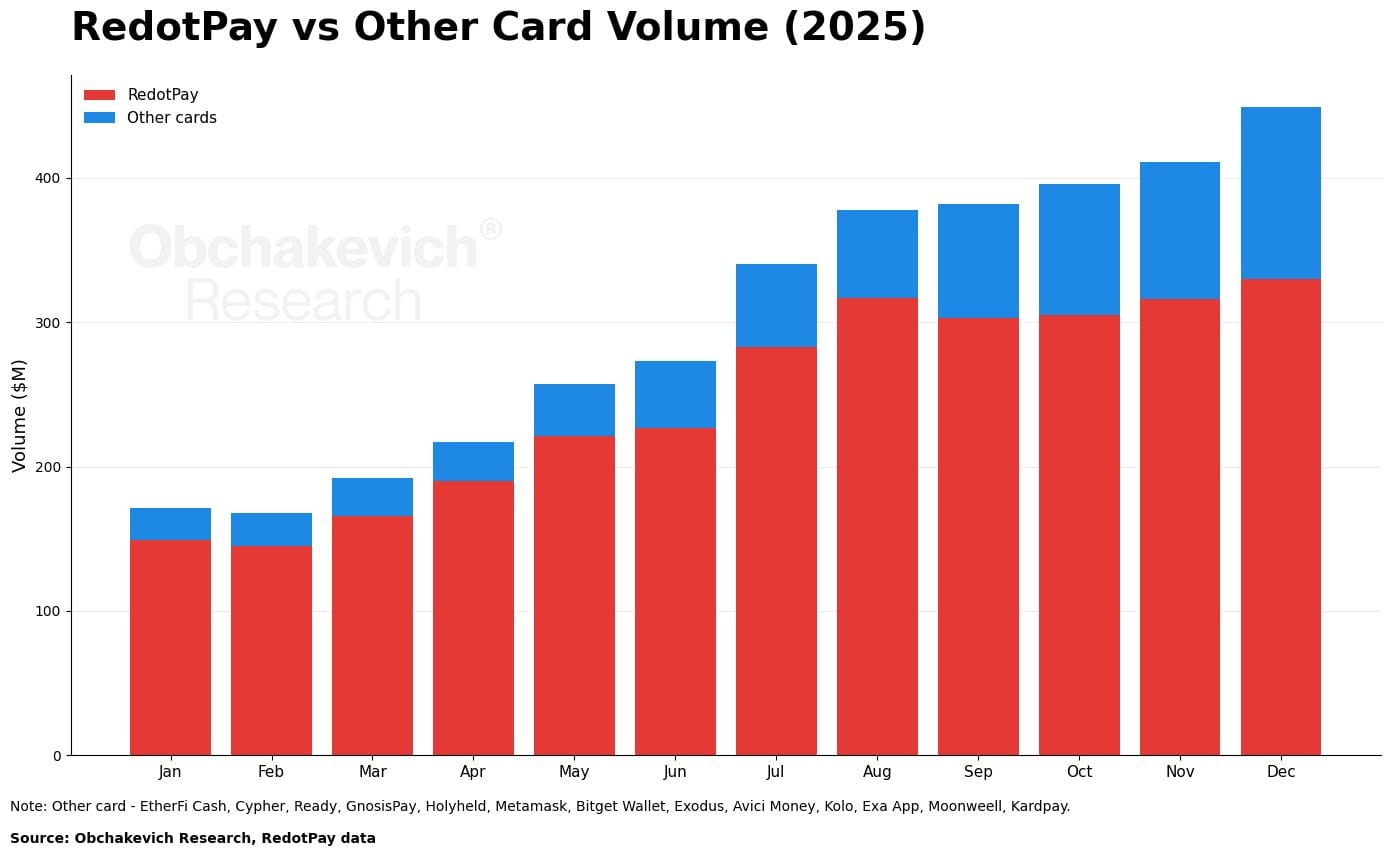

📊 RedotPay processed 4 times more card volume than the other 13 crypto cards combined 🤯

🇬🇧 Chimera Wallet, in partnership with Wirex, is launching the Chimera Card, a Bitcoin-funded debit card designed for everyday spending while keeping users in control through self-custody. The card can be funded directly from a Bitcoin wallet via on-chain or Lightning payments and used at over 80 million merchants worldwide, converting Bitcoin to fiat at checkout with transparent pricing.

🇺🇸 Blockchain.com & Ondo Finance launch on-chain tokenised U.S. stocks across Europe. Eligible users across Europe can now gain direct access to regulated, tokenised U.S. stocks and ETFs seamlessly within the Blockchain.com DeFi wallet.

🌍 BBVA joins banking consortium to issue European stablecoin. The aim is to enable faster and cheaper payments, as well as the settlement of digital assets within a regulated environment backed by all the safeguards that a European bank can offer.

🇨🇭 UBS considers expanding cryptocurrency access for individual clients. If UBS proceeds, this decision could reshape how everyday investors interact with crypto markets. It would also place pressure on rival banks to accelerate similar offerings.

🇺🇸 Coinbase has confirmed it experienced an insider breach when a contractor accessed data on roughly 30 customers, without proper authorisation. The company explained that the contractor was fired, and the affected individuals were notified and offered free identity theft protection services, as well as reporting the incident to the regulators.

PARTNERSHIPS

🇨🇳 The European Travel Commission and Mastercard launch a new European travel co-branded card for Chinese visitors. The new card is designed to support seamless and secure payment experiences for Chinese travellers visiting Europe, as demand for long‑haul travel and premium cultural experiences continues to recover.

🇬🇧 Noah and Sumsub partner to deliver the fastest, most scalable compliance and verification engine for modern money. Through the partnership, any client using Noah’s high-speed rails and accounts can now onboard users in seconds, with greater accuracy, fraud protection, and success rates, thanks to Sumsub’s automated verification.

🇭🇰 PhotonPay scales global footprint with Stripe to deliver next-gen online payment solutions. By integrating Stripe's robust infrastructure, PhotonPay is elevating its online acquiring capabilities, ensuring merchants can scale seamlessly across multiple regions with unmatched efficiency and reliability.

🇦🇪 Equiti Group partners with Checkout.com to expand worldwide payments. Equiti Clients will experience faster funding, smoother withdrawals, and a wider range of payment options, as well as improved transaction speed and reliability for high-value, time-sensitive domestic and cross-border transactions.

🇺🇸 Bolt expands its SuperApp with embedded investing through Atomic. Through the partnership, Bolt will offer consumers the ability to open brokerage accounts, trade stocks and ETFs and invest through automated managed portfolios directly within the Bolt experience.

🇦🇺 Vault selects Thredd as strategic issuer processing partner for Australia and UK expansion. The partnership enables Vault to run a diverse portfolio of card programmes leveraging Thredd’s full-stack issuing and processing capabilities, including virtual and physical cards, tokenization fraud monitoring, 3DS, digital wallet integrations and transaction controls.

🇱🇹 SME Bank selects Flagright for real‑time transaction monitoring and watchlist screening. The partnership aims to strengthen SME Bank’s financial crime controls while maintaining fast, scalable operations. SME Bank provides digital banking and lending services to small and medium-sized enterprises as it expands across the region.

🇻🇳 Tala enters Vietnam via a US$100 m digital credit partnership with CIMB. Tala said its technology enables automated credit scoring and decisioning, allowing loans to be approved and disbursed within minutes, while CIMB will provide the banking infrastructure and regulatory support for the product.

🇧🇷 dLocal partners with DHL Express Brazil to automate Pix payments and accelerate parcel release. The integration replaces manual payment checks with real-time confirmation, improving customer experience and operational efficiency across Brazil.

🇺🇸 United Financial Credit Union partners with Nuuvia to launch SmartStart Youth Banking Platform. Nuuvia's youth banking platform integrates seamlessly within United Financial Credit Union's existing digital banking infrastructure, providing a secure, modern mobile-first experience for children, teens, and their parents.

DONEDEAL FUNDING NEWS

🇶🇦 SkipCash raises $4m Series A to expand digital payments across GCC. The funding will be used to scale SkipCash’s payment infrastructure and broaden its footprint across GCC markets as demand for seamless digital transactions continues to rise.

🇲🇽 Tapi raises US$27 million to scale Mexican payment infrastructure. Tapi intends to use the new capital to expand its technical team, which constitutes more than 70% of the total structure of the organisation. Read more

🇿🇦 Lula secures over $21m to boost SME funding. The capital infusion will fuel Lula’s technology-driven lending platform, which specialises in providing working capital to businesses hampered by limited collateral, thin credit histories, or uneven cash flows.

🇺🇸 Tether retreats from $20bn funding ambitions after investor pushback. Tether CEO Paolo Ardoino has downplayed its planned funding round after investors pushed back on a $500bn valuation. Continue reading

🇬🇧 UK Crypto Neobank Plutus raises $2.3m on base with PlusMore. This move reinforces Plutus’ commitment to security, governance, and community-driven adoption, while ensuring that PlusMore users holding PLUS can enjoy both immediate and long-term benefits through its RaaS ecosystem.

🌍 Mobility FinTech GoCab raises $45m to scale electric mobility and financial inclusion across Africa. This funding will allow GoCab to scale operations in its core African markets, expand into new high-growth cities across and outside the continent, and deploy AI-driven solutions for credit scoring, fleet optimisation, and risk management.

M&A

🇺🇸 Bitwise to acquire crypto staking company Chorus One, extending its push into cryptocurrency yield services. The acquisition adds a major staking operation to the crypto asset manager’s platform as demand for on-chain yield products increases among both retail and institutional investors.

🇺🇸 Experian acquires Own Up to expand mortgage access and consumer home loans. The acquisition will strengthen the Experian Marketplace, adding expert homebuying guidance and proven loan capabilities to Experian’s existing ecosystem of credit cards, personal loans, and auto insurance offers.

🇳🇬 Nomba acquires licensed Canadian payments firm to power Africa–Canada trade. According to the company, the acquisition, completed in Q2 2025, provides Nomba with regulatory coverage in Canada, enabling it to move money locally within the country and connect Canadian dollar payment flows directly to African markets.

🇨🇴 Columbia Bank inks $597m merger with Northfield Bank. As part of the move, Columbia will undertake a second-step conversion to transition from its mutual holding company structure to a fully public stock holding company. This process involves the creation of a new holding company to serve as the parent of the combined banks.

🇺🇸 Santander agrees to buy US bank Webster in $12.2bn deal as UK weighs on profits. Banco Santander Executive Chair, Ana Botín, said the deal was 'strategically significant' for Santander's US business and offers 'meaningful, tangible value' for the group.

MOVERS AND SHAKERS

🇲🇾 Aeon Bank CEO Raja Teh Maimunah to step down on March 31. Raja Teh joined the bank three years ago and steered Aeon Bank through its inception as a digital bank. She said her tenure at the bank was a "profound honour and a once-in-a-lifetime privilege."

🇮🇱 Remitly cuts 110 jobs in Israel and closes R&D hub three years after $80 million Rewire acquisition. The company will retain only sales and business roles in the country, marking a sharp retreat from the engineering footprint it inherited through the acquisition.

🇺🇸 U.S. Bank adds industry veterans to its payments. Peter Geronimo has joined U.S. Bank to lead the company’s new PMI Sales Distribution team, and Raj Gazula has joined to lead strategy and serve as the Chief Administrative Officer for PMI. This new team will further enable U.S. Bank to deliver a holistic approach to clients.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()