Evolve Bank Hit by Major Ransomware Attack: Customer Data Exposed

Hey FinTech Fanatic!

Evolve Bank & Trust has been hit by a significant cyberattack, with the Russia-linked LockBit ransomware group releasing stolen customer data on the dark web. This breach follows LockBit's claim of hacking the US Federal Reserve, though no proof has been provided for the latter.

Evolve confirmed the attack, acknowledging that "bad actors" had posted unauthorized data online. LockBit published files across 21 dark web links after Evolve did not meet ransom demands. This attack coincides with regulatory scrutiny on Evolve to improve risk management and oversight of FinTech partnerships.

The timing is particularly troubling as Evolve recently received a "cease and desist" order from the Federal Reserve and is involved in a bankruptcy case with the collapsed FinTech platform Synapse.

This incident is part of a larger trend of increasing cyber threats to financial institutions. Recent ransomware attacks have also targeted Santander and the UK National Health Service, disrupting services due to security misconfigurations.

These attacks highlight the vulnerabilities of smaller financial institutions, which often lack the robust security infrastructure of larger corporations. The myth of "bank-grade" security is increasingly questioned, with smaller banks at greater risk.

Ransomware proceeds frequently link to state actors like Russia, fueling a cyber cold war. This attack on Evolve underscores the urgent need for enhanced cybersecurity measures in the financial sector.

Make sure you follow Jason Mikula for the latest updates on this subject.

Have a great weekend and I'll be back in your inbox on Monday!

Cheers,

POST OF THE DAY

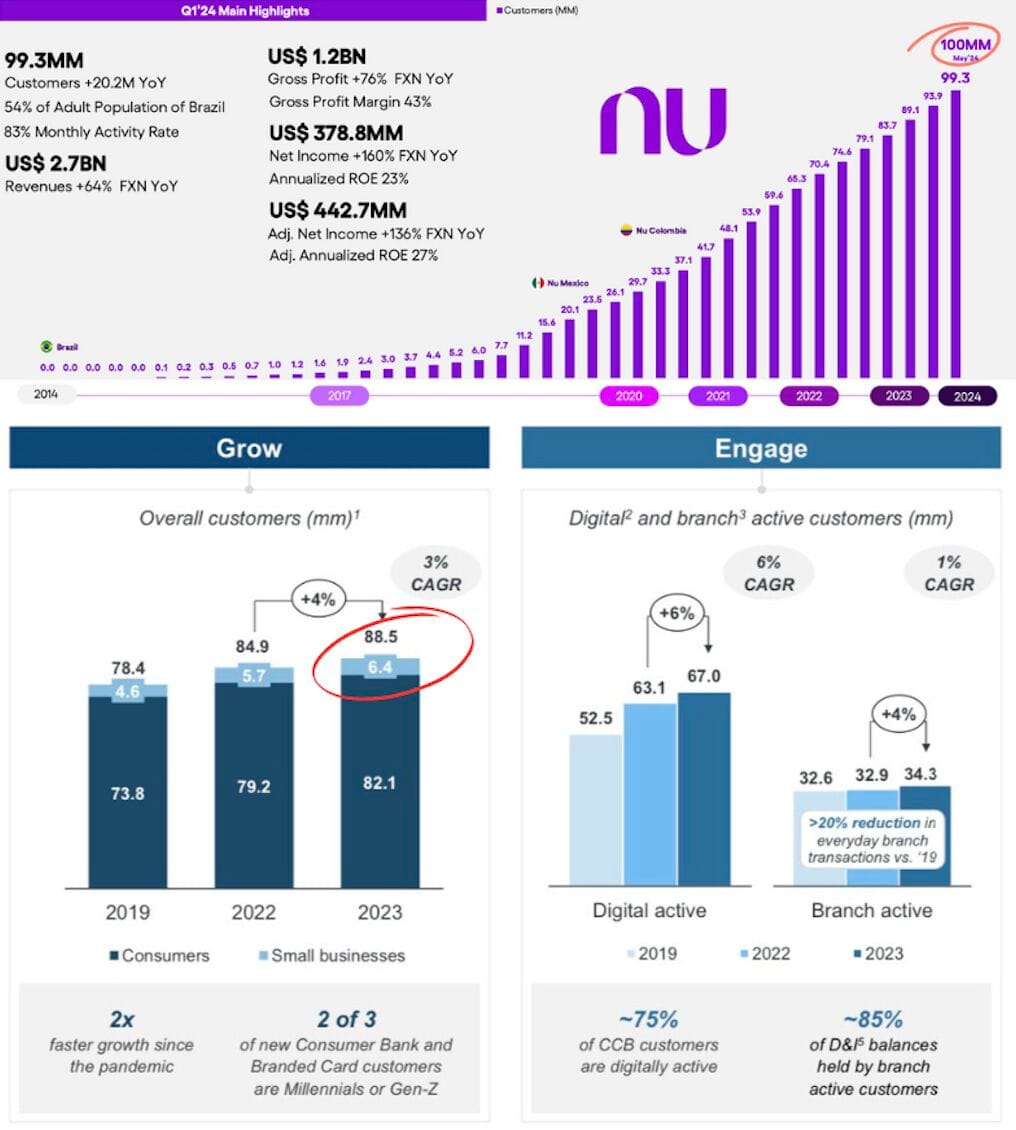

📈 Nubank serves more customers than JPMorgan 🤯

#FINTECHREPORT

📊 The Ultimate Guide to Sending Mass Payments Efficiently by Payquicker:

Efficient mass payments are essential for businesses. Mass payouts, which disburse funds to multiple recipients simultaneously, help manage payroll, commissions, and rebates, saving time and reducing administrative work.

I highly recommend reading the complete guide for more detailed information

FINTECH NEWS

🇬🇧 Driffle selects Mangopay to level-up digital gaming product platform. Mangopay will provide a customised end-to-end payment flow, including pay-in, e-wallet management, seller payout, and KYC/KYB to enable Driffle to offer a seamless, safe, and compliant experience for its users. Find out more

🇺🇸 Airwallex, a leading global payments and financial platform for modern businesses, announced an integration with QuickBooks, the leading financial technology software platform among businesses of all sizes. This integration enables Airwallex customers to eliminate repetitive manual inputs and better manage their time and cash flow.

🇮🇳 Flipkart Group launches payments app, Super.money, in FinTech push. The new app, now live in beta on Play Store, allows users to make mobile payments via UPI, an interoperable network that is the most popular way Indians transact online.

🇭🇰 Hong Kong targets DeFi, metaverse for FinTech expansion. Government-backed studies in Hong Kong have identified decentralized finance (DeFi) and metaverse technologies as new opportunities to enhance the region's dominance in the global FinTech landscape.

PAYMENTS NEWS

🇨🇦 Visa announces new collaboration with Amazon to provide Canadian consumers with more choice at checkout. When shopping online on Amazon.ca or on the Amazon app, eligible RBC and Scotiabank credit cardholders will now have the option to select Visa enabled Installments as their payment method for qualifying purchases.

🇳🇱 Amsterdam’s FinTech unicorn Mollie launches Mollie Invoicing to strengthen business services. This new solution allows users to send invoices directly from the Mollie Dashboard, addressing customer demand. The development of Mollie Invoicing is a step in enhancing services for B2B companies.

🇧🇷 Fingerprints supports Valid in roll out of biometric payment cards in Brazil. The cards, which feature Fingerprints’ proven biometric technology, will offer new levels of contactless security, convenience and hygiene. Learn more

🇿🇦 Paycorp expands into embedded business funding in South Africa and the UK. For the past year, Paycorp's Capital Express brand has provided business funding to ATM clients across South Africa in partnership with the country’s foremost specialist in merchant cash advance, Retail Capital, a division of Tyme Bank.

OPEN BANKING NEWS

🇬🇧 Open Banking Excellence (OBE) launches first of its kind open banking in a Box programme to drive UK ecosystem expansion abroad. The programme gives access to invaluable insights, expertise and practical advice honed from the UK’s experience in creating the blueprint for open banking.

🇬🇧 Leading payment orchestration provider, BR-DGE, has announced its partnership with open banking solution Trustly. The integration into BR-DGE’s platform will provide customers access to Trustly’s global open banking capabilities, which processed $58 billion in transactions in 2023.

🇺🇸 Trovata, the global leader in corporate banking APIs, announces the launch of its new Multibank Connector which includes the most extensive library of direct-to-bank APIs to power financial services worldwide. Trovata's API platform provides a streamlined way to access balances, transactions, and payment rails.

DIGITAL BANKING NEWS

🇵🇹 Revolut launches digital personal loans up to 30,000 euros in Portugal. Despite not yet having an IBAN or branch, the FinTech is advancing the launch of new products in the country. Starting this Wednesday, some customers will have access to personal loans ranging from 1,000 to 30,000 euros.

🇺🇸 Visa announced its Digital Emergency Card Replacement, a new service that promptly delivers a digital card replacement on behalf of card issuers via text or email. Once received, cardholders can authenticate and add the new card into their digital wallet.

🇬🇧 Virgin Money’s AI-powered virtual assistant, Redi, is being expanded to more customers, having already supported over one million conversations since its launch in March 2023. The intuitive, easy-to-use chat function is now available 24/7 for personal banking customers who manage their current accounts via the app.

🇺🇸 Bluevine announced the general availability of the Bluevine Business Cashback Mastercard, which offers small business owners essential access to working capital along with an expansive menu of business tools, merchant discounts, and services to help boost productivity, better manage travel and expenses, and more.

🇰🇷 Shinhan Card, KakaoBank to team up for PLCC. The companies said on Wednesday that they signed a business agreement to develop and jointly market a private label credit card (PLCC) in the first half of next year. Click here for more info

🇦🇪 DBS and Mashreq, two leading financial institutions in Asia and MENA announced a collaboration that extends same-day and near-instant peer-to-peer cross-border payments to Mashreq’s retail customers, in selected markets across Asia Pacific, Europe and the Americas.

🇭🇰 Tencent-backed online lender WeBank gets green light to set up FinTech unit in Hong Kong. The Hong Kong subsidiary will manage WeBank’s overseas business, and offer services to countries and regions covered by the Belt and Road Initiative, the online lender said.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 BVNK launches Layer1, a self-custody infrastructure for stablecoin payments. This self-hosted, self-custody digital asset infrastructure helps businesses launch stablecoin payments quickly and securely, while keeping full control and privacy over their digital assets.

🇬🇧 SpacePay accelerates global crypto adoption, aiming to be the number one crypto payments provider. When it launches, SpacePay will be widely available on most existing point-of-sale card machines, allowing millions of crypto holders to finally be able to spend their crypto.

DONEDEAL FUNDING NEWS

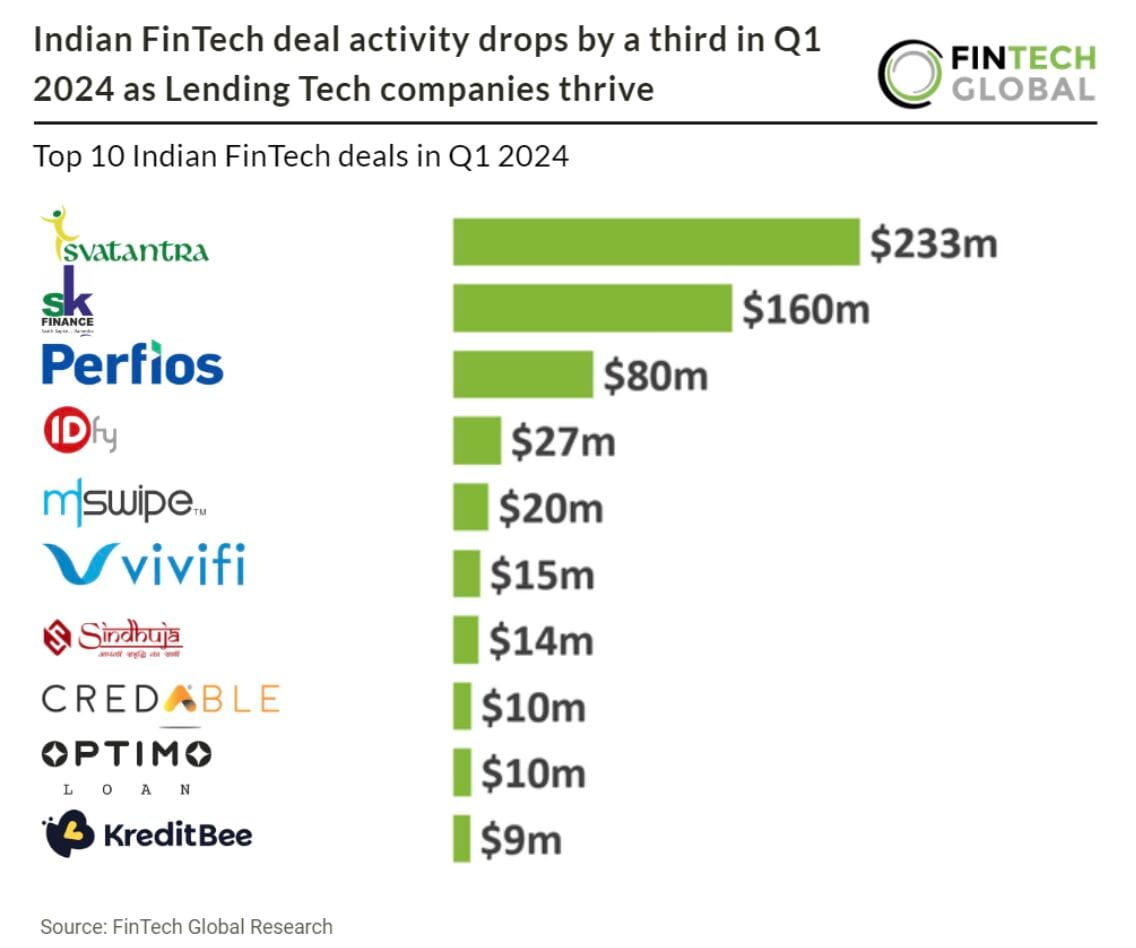

🇮🇳 Indian FinTech deal activity drops by a third in Q1 2024

🇺🇸 US RegTech Norm Ai raises $27 million. The company has developed a proprietary language to represent government regulations and corporate policies as decision trees that become executable computer programs through the use of large language models.

🇦🇪 UAE FinTech startup Comfi secures $5m debt facility to boost B2B payments. This strategic financial boost is aimed at enhancing Comfi’s operations within the B2B payments sector, specifically catering to manufacturers and suppliers, according to a report from Wamda.

M&A

🇺🇸 Chime to buy Salt Labs for as much as $173 million in push to expand ahead of possible IPO. The firms aim to unite everyday people to unlock their financial progress. The deal calls for Chime to provide an upfront payment of $14 million, according to people familiar with the deal.

MOVERS & SHAKERS

🇬🇧 Gareth Jones joins Atom bank as Chief Risk Officer. Jones replaces Chris Sparks, who will retire after nine years at the bank. In his new role, he will ensure that Atom bank maintains its risk-management culture.

🇬🇧 FNZ appoints Enrique Sacau as CEO. Within his role at FNZ, Enrique will focus on client relationships, new client acquisition, and strategic expansion, as FNZ continues to respond to growing client demand and accelerates its purpose of opening up wealth in the region.

🇳🇱 Finom appoints ex-Revolut Rob Allen as Head of Sales. Rob Allen's appointment adds to FINOM's increasingly diverse leadership group as well as wider talent pool. Rob will start at the company in July 2024. Read on

🇩🇪 Solaris hires Michael Bonacker to lead supervisory board. Bonacker brings a wealth of banking and transformational experience to Solaris, as the organization sets its sights on strengthening its market-leading position after proving resilient in adapting to new market conditions.

🇬🇧 Tribe Payments appoints Andrew Hocking as CEO. Andrew will leverage his exceptional commercial acumen and skills in identifying new business opportunities to guide Tribe in its next expansion phase.

🇨🇦 Payments Canada appoints Susan Hawkins President and CEO. For over five years, Hawkins was the Global Head of Enterprise Payments and Executive VP of US Payments at TD Bank Group, where she led the modernization and governance of payment infrastructure and payment products working with teams in the US and Canada.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()