European Central Bank (ECB) has called for changes to tech firm Apple’s payments system

Hey FinTech Fanatic!

Piero Cipollone, a member of the executive board of the European Central Bank (ECB), has urged for alterations to be made to the payment system of tech giant Apple.

Cipollone conveyed this message in a letter addressed to Thierry Breton, the European Commissioner for the internal market, on April 19.

He cautioned that Apple's existing approach might not align with facilitating offline payments should a European central bank digital currency be introduced in the future.

The saga continues...

More developments in Pay by Bank, where Stripe launched "Link Payments" last week, and now also Plaid announced the latest updates to 'Plaid Payments' in their Spring 2024 update:

Stripe Payments 'pay by bank' update

Also, Paysafe launched Pay by Bank for iGaming, a new solution allowing U.S. online bettors to instantly and securely fund deposits at operators’ cashiers directly from their online bank account as well as cash-out winnings seamlessly.

Is 2024 really going to be the break through year for Pay by Bank Payments?

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

POST OF THE DAY

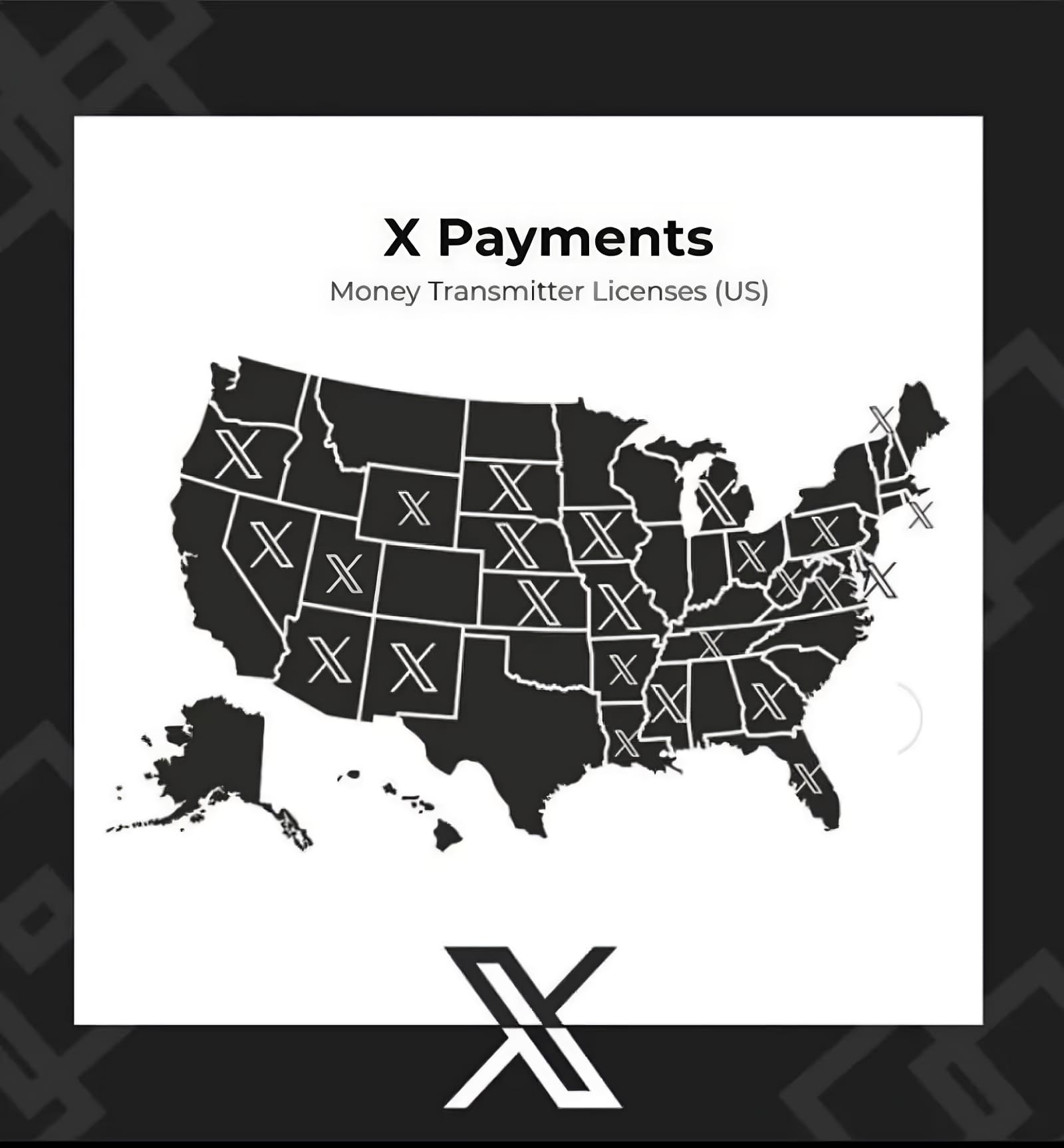

🇺🇸 Elon Musk’s X now has a Money Transmitter License in 25 States.

According to Christopher Stanley, the Head of Payments at X, the platform's payment capabilities will extend far beyond simple tipping.

PODCAST

They’ll explore Swan.io's groundbreaking approach to embedded finance, transforming banking into a seamless experience like…hailing a ride with Uber.

#FINTECHREPORT

📊 "The Embedded Lending Opportunity FinTech report by Visa," explores the state of play for embedded lending and related consumer preferences about financing options.

FINTECH NEWS

🇿🇦 Telecommunication operator MTN South Africa has entered a collaboration with Investec and Electrum to provide PayShap on its MTN Mobile Money (MoMo) platform, which at the time of the announcement, is one of the first non-banking participants to provide PayShap.

🇺🇸 SoFi stock falls after Second-Quarter outlook disappoints. SoFi exceeded revenue and income expectations last quarter, driven by its financial-services and technology platform segments. However, its shares dropped over 10% as the digital financial-services provider issued a Q2 forecast below analysts' expectations.

🇲🇬 Madagascar FinTech MVola bolsters super app, Mvola Fô, to increase its reach among the Malagasy population. Regardless of the mobile network they use, citizens can now open an account through the super app MVola thanks to this new option.

🇶🇦 The Qatar Central Bank (QCB) has taken a significant stride in promoting financial innovation by approving the first cohort of ‘Buy Now Pay Later‘ (BNPL) companies for its regulatory sandbox, a pivotal part of the Third Financial Sector Strategy and the FinTech Strategy.

🇺🇸 Apex FinTech files for IPO: What it means for the evolving FinTech industry. Apex is a key player in the "FinTech for FinTechs" space and its proposed IPO has sparked a lot of interest. Wil Hamory examines the potential implications of the IPO and how it might influence the broader FinTech landscape.

PAYMENTS NEWS

🇺🇸 Is 2024 going to be the break through year for Pay by Bank? First, Stripe announced "Pay Links" for Pay by Bank payments. Now, also Shaffer Bond from Plaid presents the latest updates to 'Plaid Payments.' Click here to learn more

HSBC and PayPal are among the founding members of a new working group investigating the adoption of quantum-safe cryptography in the payments industry. Experts predict that over the next decade cryptographically relevant quantum computers will start posing cybersecurity risks.

🇹🇭 Cross-border QR payments with India set to begin in Q3. The Bank of Thailand is gearing up to launch QR code cross-border payments between Thailand and India by the third quarter of this year, with plans to extend the system to become a multinational payment network spanning Asia.

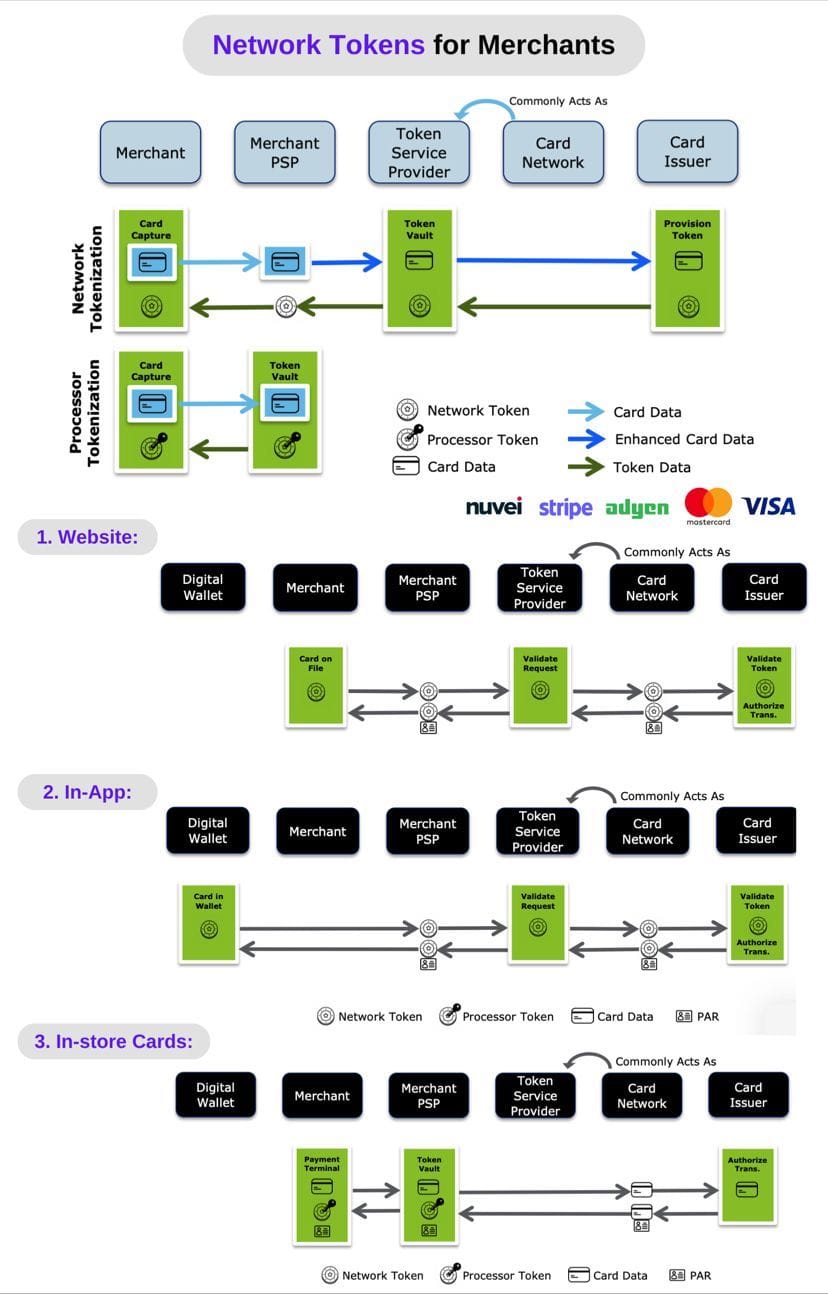

🇫🇷 Mastercard and Prestashop join forces to revolutionize online payments with click to pay. Merchants based in France, Spain, Italy, and the UK who utilize the PrestaShop platform will be the first to have access to integrate Click to Pay. This partnership marks a pivotal moment for the future of online payments in Europe.

🇺🇸 Paysafe launched Pay by Bank for iGaming, a new solution allowing U.S. online bettors to instantly and securely fund deposits at operators’ cashiers directly from their online bank account as well as cash-out winnings seamlessly. Read more

🇫🇷 1POINT6, formerly Panto, announces that it has obtained payment agent status and signed its first customer less than 6 months after its co-creation by BNP Paribas and Studio 321 (October 2023). The FinTech offers an avant-garde payment platform for marketplaces.

🇸🇪 Brite delivers open banking instant payments to Shopware merchants. Brite Instant Payments allow businesses to tackle operational inefficiencies while alleviating pain points associated with legacy payment methods.

DIGITAL BANKING NEWS

🇧🇷 Combined Brazilian Banking App downloads almost reach 𝟭𝗯𝗻 (❗️) from 2017 - March 2024 🤯

🇬🇧 Starling Bank's SaaS business can be bigger than the bank, says its boss, who has no ambitions to be a future Starling CEO. Sam Everington, the CEO of SaaS business Engine, talks the future of Engine and its growth plans and how it could be bigger than Starling Bank.

🇵🇭 Tala announced its partnership with Maya Bank, the digital bank leader in the Philippines, marking a significant milestone towards bridging the financial gap for millions of Filipinos. This collaboration is a groundbreaking initiative in the Philippines and the wider Southeast Asian market, channeling an unprecedented $48.5 million through independent digital platforms to expand access to credit for millions more Filipinos.

🇳🇬 Kuda Bank, Moniepoint, OPay and Palmpay have paused account opening for new customers following a directive from the Central Bank of Nigeria after the EFCC blocked 1,146 bank accounts involved in unauthorised forex dealings on Wednesday.

🇮🇩 Grab-backed Superbank introduces auto-savings product in Indonesia. The new savings feature called Celengan, is accessible through its app, and lets users automatically save a set amount of money every day.

🇯🇲 TerraPay and VM Money Transfer Services have partnered to expand the Remittance Market for Jamaicans. With this new agreement, VMTS now gains access to TerraPay's robust online platform, enabling hassle-free cross-border transfers for customers sending and receiving money across approximately 31 markets globally.

🇳🇬 Aella Credit, Africa’s first lending FinTech to enter Y Combinator, becomes a micro-finance Bank. The FinTech company serves over 2 million users in Nigeria. In 2020, as reported by BitKE, Aella raised $10 million in order to expand across Africa and build its blockchain-based lending market, CreditCoin.

🇮🇳 Bengaluru-based neobank Fi, has become the latest FinTech startup to secure a non-banking financial company (NBFC) licence from the Reserve Bank of India (RBI). This comes at a time when FinTech startups have been making a beeline to get a NBFC licence from India’s banking regulator.

🇧🇷 Nubank has announced the launch of a payroll loan portability option in Brazil. The company estimates that approximately 5 million people from its customer base are pensioners and federal public servants, so they can benefit from this feature.

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 Australia to approve first spot bitcoin ETFs before the end of 2024 according to Bloomberg. 2 Bitcoin ETF applications have been submitted, with a 3rd application in progress. Self-managed pension assets could flow into the new products.

🇷🇺 Russia prepares for total crypto ban as geopolitical tensions rise. Russia will enforce a strict ban on the general circulation of crypto assets such as Bitcoin, allowing only digital financial assets issued within its jurisdiction.

DONEDEAL FUNDING NEWS

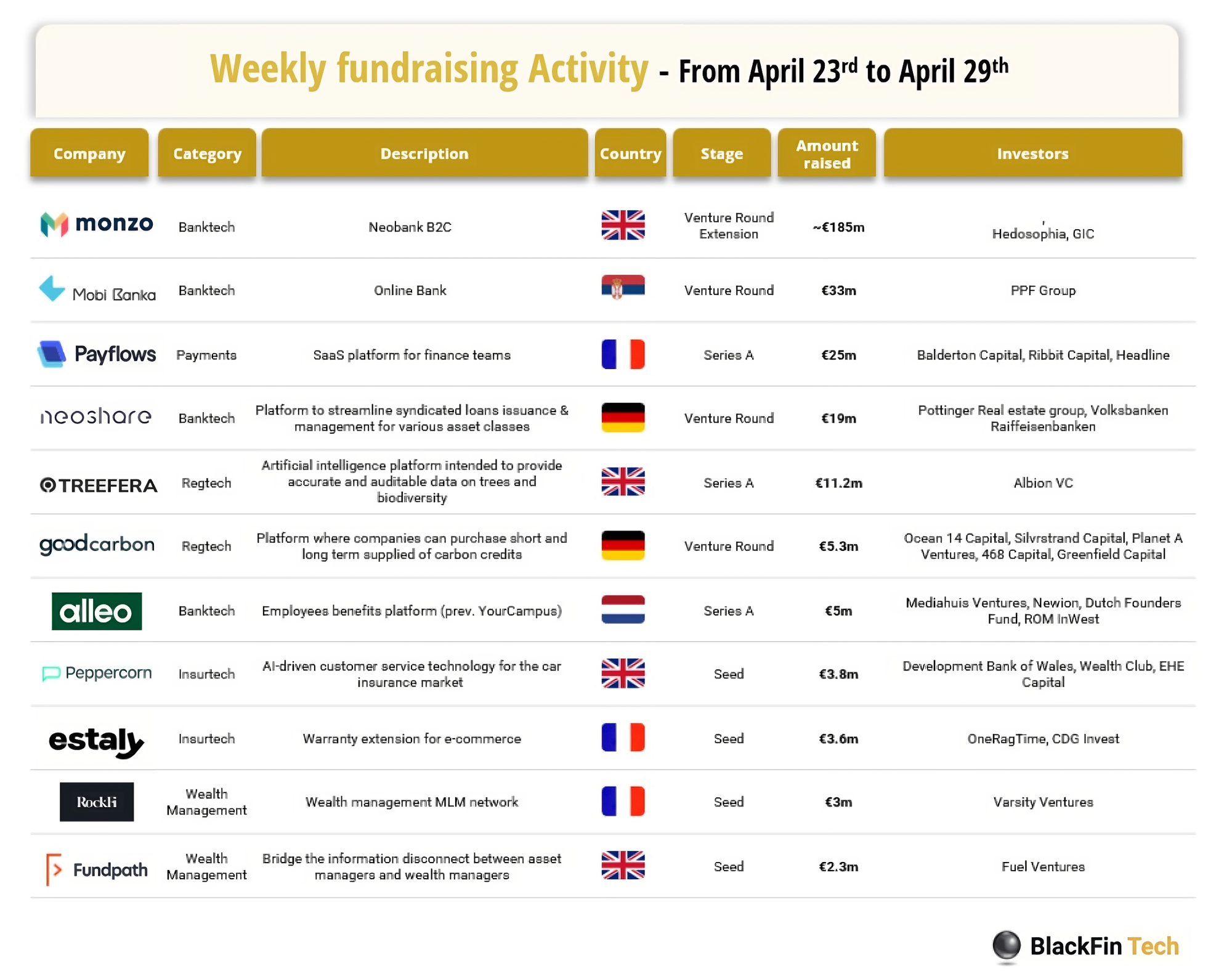

Last week we saw 11 official FinTech deals in Europe for a total amount approaching €296m raised, with 4 deals in the UK, 3 in France, 2 in Germany, 1 in The Netherlands, and 1 in Serbia. Check out the full BlackFin Tech article here

🇳🇬 The valuation of OPay, the Nigerian FinTech startup backed by Sequoia Capital and Softbank, has risen by over 30% since its Series C funding round in 2021, according to recent corporate filings by Opera, an early OPay investor. The valuation growth underscores how Nigeria’s digital payments boom is fueling the rise of a new crop of financial technology companies.

🇬🇧 Leading online SME lender Capify has secured a £100 million credit facility from Pollen Street Capital. The new facility will support the lender's ambitious growth plans and provide working capital to thousands of SMEs in the coming years.

🇬🇧 Female-founded Noggin HQ bags £710K to help users get access to credit. This funding will be used to accelerate the launch of their first product, a price comparison platform, where people can purchase products with fair and transparent credit terms.

🇮🇳 Mumbai-based BRISKPE announced that it has raised $5 million in a seed round from PayU, the payments and FinTech business of Prosus. This investment marks a crucial milestone in BRISKPE’s journey to empower Indian MSMEs and exporters by simplifying global payments.

🇺🇸 Backflip raises $15 million to help real estate investors flip houses. Backflip offers a service to real estate investors for securing short-term loans. Beyond helping users secure financing, Backflip’s tech also helps investors source, track, comp and evaluate potential investments.

M&A

🇦🇺 FinTech provider BidFin acquired by humm. BidFin employees will be transitioning to the new ownership and will continue to operate as a stand-alone business. Financial terms of the deal haven’t been disclosed.

MOVERS & SHAKERS

🇬🇧 British Business Bank names top civil servant Kristen McLeod CBE as new chief strategy officer. McLeod will oversee the bank’s economics, policy, and strategy teams, working to achieve its strategic objectives of “driving sustainable growth, backing innovation, unlocking potential, and working to build the modern, green economy.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()