SEC Ethereum investigation & €450 Million Bet: Revolut's Race to 50M Customers

Hey FinTech Fanatic,

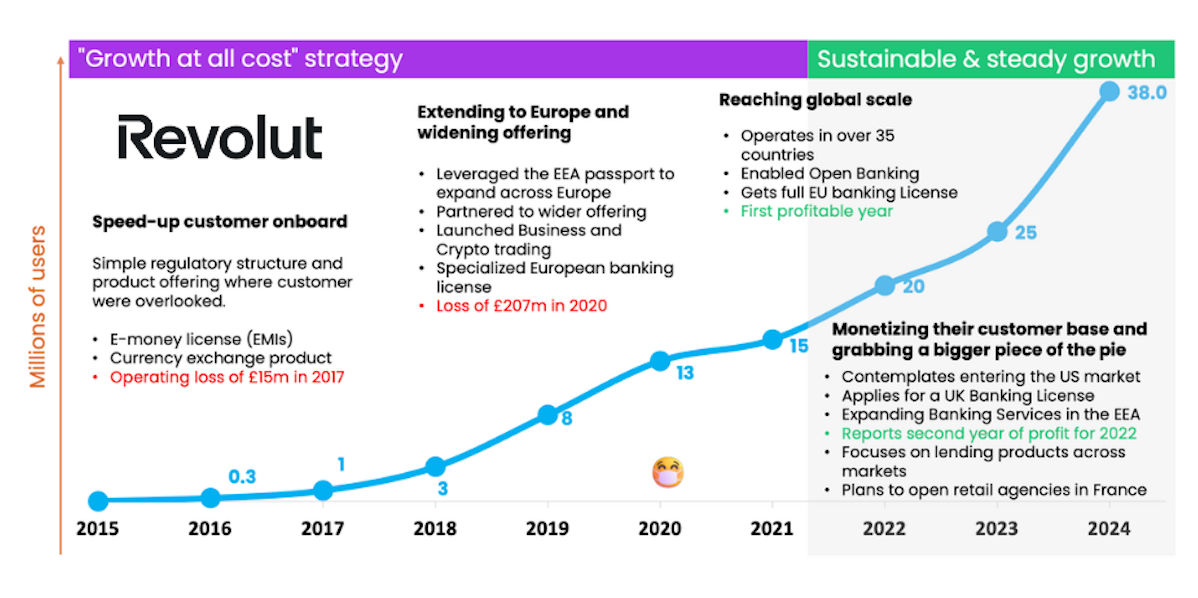

Revolut is embarking on an ambitious journey, setting aside a whopping €450 million for marketing and sales efforts across Europe. Their goal? To captivate a global audience of 50 million customers by the end of 2024, targeting a staggering 40% yearly growth.

While this may seem like a bold ambition, Revolut's current trajectory suggests they are on the right path to achieving it.

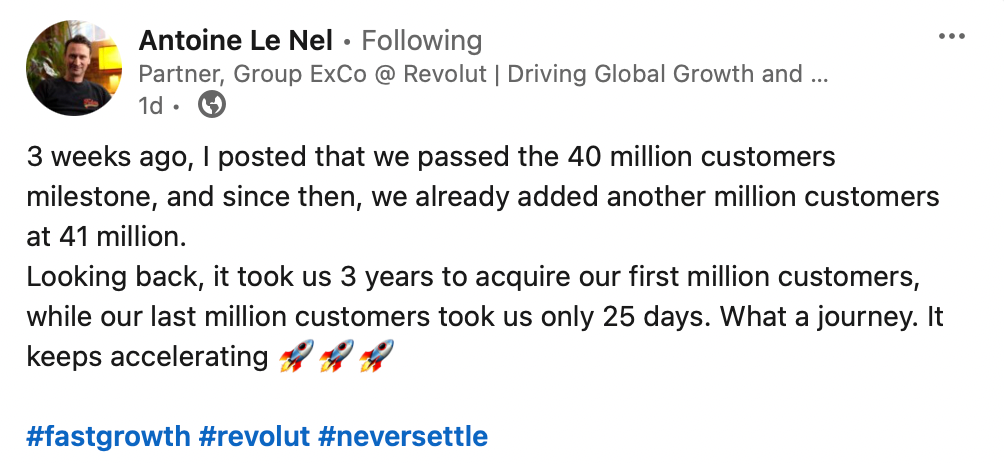

Antoine Le Nel, sharing insights on LinkedIn, revealed an impressive milestone:

Revolut's pace of acquiring new users is astounding, averaging 40,000 sign-ups daily. At this rate, they are poised to surpass the 50 million customer mark by year-end. This rapid growth parallels that of Nubank, which boasts around 90 million users, predominantly in Brazil.

What do you think? Can Revolut achieve its ambitious target of 50 million customers by the end of 2024?

Cheers,

POST OF THE DAY

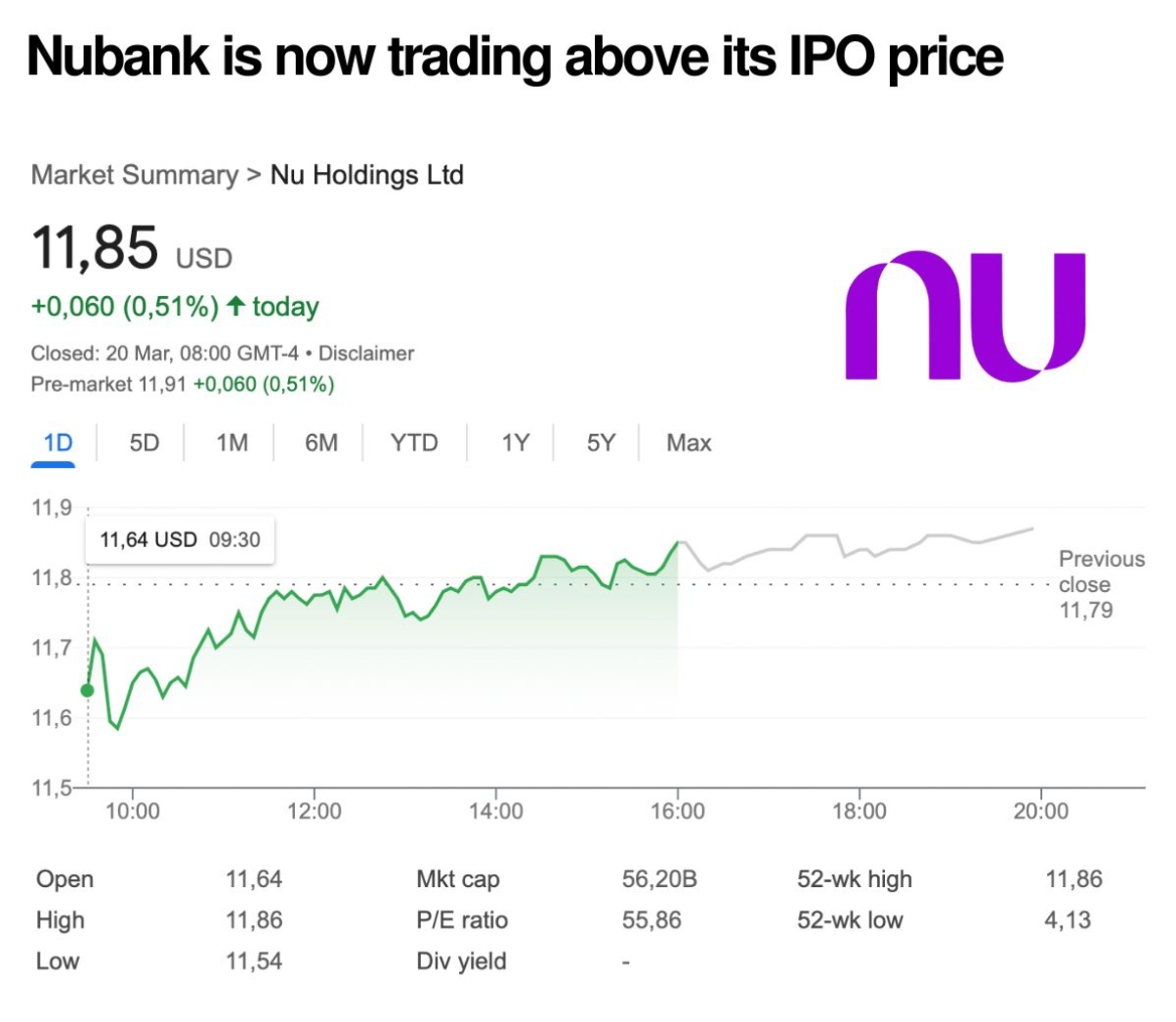

On December 9, 2021, Nubank began trading on the NYSE at $11.25 a share and closed the trading session at $10.33.

👊Nubank is now trading above its IPO price:

BREAKING NEWS

🇺🇸 SEC probing crypto companies in Ethereum investigation as hopes for ETF dim. The Securities and Exchange Commission is waging an energetic legal campaign to classify Ethereum, the second-most popular cryptocurrency, as a security, according to U.S. companies that have received subpoenas related to an investigation. Read more

#FINTECHREPORT

Over 10,000 banks across more than 50 countries are being impacted by Open Banking APIs. Read all about it in this FinTech report by ndgit. Click here to learn more

FINTECH NEWS

🇪🇹 M-PESA Safaricom has signed an International Money Transfer Agreement with Onafriq, Africa’s largest digital payments network, operating in 40 African countries, to help streamline remittance flows to Ethiopia. Through the agreement, individuals within Ethiopia are able to receive remittances from different parts of the world through M-PESA.

🇬🇧 Railsr's parent company, Embedded Finance, has written to London-listed payments firm Equals Group to propose a potential merger of the two companies, Sky News learns. Equals Group confirmed that they have received a non-binding proposal from Embedded Finance and TowerBrook Capital Partners to combine shared capital, but no action has been taken.

PAYMENTS NEWS

🇦🇷 PayRetailers Arg S.R.L. recognized as a PSP Aggregator by BCRA. This significant milestone marks a pivotal moment in the company's journey, allowing it to expand and enhance its local operations in alignment with BCRA regulations, reinforcing its unwavering commitment to transparency and trustworthiness.

🇬🇧 Lloyds set to become main payments processor for Paypoint as bank expands small business footprint. Lloyds Bank and Paypoint have announced they are expanding their existing partnership, with the lender set to become the main processor of card payments for Paypoint’s 60,000-strong network of small businesses and retailers.

REGTECH NEWS

🇮🇱 BioCatch and Google Cloud team up to bring fraud detection and financial-crime-prevention solutions to emerging markets. Through its partnership with Google Cloud, BioCatch will provide the solutions needed for financial institutions in the region to recognize and combat these fraud attacks in real-time, protecting their customers from nefarious actors.

DIGITAL BANKING NEWS

🇬🇧 Revolut plans to invest €450 million in Europe for marketing and sales to target 50 million global customers by 2024, aiming for 40% annual growth. This sounds wild, but they seem to be well on track to achieve this. Keep reading for additional insights

🇦🇺 Volt co-founder buys banks remnants. The new business of Luke Bunbury, one of the co-founders of Volt Bank, has emerged as the buyer of all remaining assets of the failed bank. Via his latest venture, We Are Embedded, Bunbury has announced that “we have acquired the assets of Volt/BAAS technology.”

🇺🇸 Chime Financial, Inc. was ordered to pay a $2.5 million penalty to settle claims concerning its mishandling of complaints involving customer transactions. The California Department of Financial Protection and Innovation cited the company for unfair acts, as defined by the California Consumer Financial Protection Law.

🇿🇦 Digital bank Discovery Bank has reached its monthly operational break-even ahead of the group’s target date. This was revealed after Discovery Bank announced its financial results for the six months ended December 31, 2023. The break-even milestone comes after Discovery Bank had been making losses since going live to take on the traditional banks.

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 Crypto firm Ledger to launch iPod-inspired crypto wallet in May, after months of delays. The product, Ledger Stax, is roughly the same size as a credit card and lets users track their crypto holdings on an E-ink display, similar to technology used by Amazon in its Kindle line of e-book readers.

🇺🇸 BlackRock creates fund with Securitize, a big player in real-world asset tokenization. BlackRock CEO Larry Fink said in an interview earlier that the company's filings for spot bitcoin and ether ETFs were "stepping stones towards tokenization." More on that here

🇺🇸 Genesis to pay $21m SEC fine. The firm has agreed to pay the penalty to the Securities and Exchange Commission (SEC) for the unregistered offer and sale of securities. The SEC charged Gemini and Genesis’ crypto asset lending program, Gemini Earn, in January 2023.

Citi and the Brazilian Development Bank join Hyperledger Foundation. The Hyperledger Besu Financial Service Working Group collaborates with enterprise users and code contributors to define new features and enhancements, aligning organizations adopting the technology with the development process. Read on

DONEDEAL FUNDING NEWS

🇳🇬 Brass, the Nigerian business banking startup that has been receiving criticism from customers for failing to process withdrawals on time, has received a capital injection from a group of investors, four people with knowledge of the deal told TechCabal. The deal, a mix of debt and equity, was concluded last week, those people said, while declining to share the exact funding amount.

Marco, the trade finance platform catering to the needs of SME exporters in Latin America, has announced the successful closure of a $12 million Series A funding round. This fundraise marks a significant milestone in Marco's journey, further strengthening its commitment to ESG efforts within the LatAm region.

🇳🇬 Uber leads $100M investment in African mobility FinTech Moove as valuation hits $750M. The funding is critical for Moove as it prepares to push into new markets. Moove says it plans to use the new capital to expand its revenue-based vehicle financing platform to 16 markets by the end of 2025. Read full piece here

🇺🇸 Ascent secures venture funding to modernize underwriting infrastructure and deliver financial portability. Ascent Platform Corporation announced that it has successfully raised $5.3 million in venture funding. The round was led by Foundation Capital, TruStage Ventures Discovery Fund, Alloy Labs, Reseda Group, and other investors.

🇩🇪 Bezahl.de (NX Technologies GmbH), the Cologne-based company behind the Payment platform Bezahl .de, has raised €22 million in funding from investors including PayPal Ventures. This marks a continuation of the positive trend in venture capital for German FinTechs, which collected €162.9 million in January and February, up 8.8% from the previous year.

🇮🇳 DBS Bank India announces USD 250 million lending support for start-ups. The initiative is part of the bank's emphasis on fostering innovation and entrepreneurship within the country's thriving startup ecosystem. DBS Bank focuses on enterprises that are set to redefine industry standards with innovative solutions.

🇿🇦 Float secures $11 million in funding. Standard Bank has provided an $11 million facility to FinTech Float, which will facilitate the rollout of its card-linked instalment platform, supporting its accelerated growth plans over the next four years. Float is a new payment method that encourages responsible credit card usage and, at the same time, helps merchants to grow their sales.

🇨🇴 Addi, a Colombian FinTech company specializing in Buy Now, Pay Later (BNPL) payments, has successfully raised $86 million. This new capital injection is aimed at financing another round of expansion, focusing on the local Colombian market following the shelving of plans to expand into Brazil and Mexico.

MOVERS & SHAKERS

🇬🇧 Paynetics appoints Hana Rolles as UK CEO. After serving as Chief Revenue Officer since September 2023, Hana, who has played a crucial role in driving revenue and cultivating strategic partnerships, will now spearhead the business as it enters its next growth phase.

🇫🇷 Crédit Agricole and Worldline announce the launch of their joint-venture and at the first Board meeting, held on 19 March 2024, Laurent Bennet, Chief Executive Officer of Crédit Agricole des Savoie, was elected Chairman of the Board of Directors and Meriem Echcherfi was appointed Chief Executive Officer. Read more

🇩🇪 Digital bank N26 announced the appointment of Mayur Kamat as its new Chief Product Officer. Mayur has a proven track record leading product teams and building new solutions at some of the world’s biggest technology companies. Click here to learn more

🇺🇸 Varo Bank welcomes Allen Parker as Chief Financial Officer, promotes Raktim Mitra to Chief Lending Officer. In his new role at Varo Bank, Parker will leverage his expertise in financial and tech leadership to oversee various functions. Raktim Mitra's promotion will see him taking on additional responsibilities in overseeing the development of borrowing and lending products.

🇵🇭 Tonik Digital Bank appoints Ex- BAP Head Cesar Virtusio to key role in the Philippines. As the Managing Director of the BAP, Mr. Virtusio was instrumental in “shaping policies and strategies that bolstered the Philippine banking industry, marking him as a visionary leader and a respected authority in banking and finance.”

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()