EU Parliament Accelerates Banking: Instant Transfers Now a Reality

TGIF!

We end the week in FinTech with interesting Payments news from Europe: The European Parliament has passed a regulation mandating that funds must be transferred to EU retail and business bank accounts within ten seconds.

This move, part of an update to the Single Euro Payments Area (Sepa) rules agreed last November, aims to speed up transactions for retail clients and SMEs, ensuring immediacy and enhanced security.

Banks and payment service providers (PSPs) are required to process credit transfers promptly and at reasonable costs.

The regulation applies at any time, with a transition period for non-euro member states, although exceptions outside business hours are considered for liquidity concerns.

To combat fraud, PSPs must implement advanced fraud detection systems and offer identity verification services without extra fees. They should also enable clients to set limits on instant transactions to prevent fraud, with compensation available for failures in fraud prevention.

Additionally, PSPs must screen clients for sanctions related to money laundering and terrorism financing. Fees for instant transfers cannot exceed those for standard transfers.

The legislation was overwhelmingly approved and will be implemented within 12 months after its publication, signifying a major step towards faster and safer financial transactions in the EU.

Read more global FinTech industry updates below, and I'll be back in your inbox on Monday!

Cheers,

#FINTECHREPORT

2023 saw 786 BankTech implementations across 356 vendors in 92 countries. Explore key insights from Cedar Capital & Cedar-IBSi FinTech Lab's annual research here.

INSIGHTS

Adyen delivered a period of profitable growth as the company finished its accelerated investment phase of growing its global team.

Let’s dive into Adyen’s H2 2023 Key Figures:

FINTECH NEWS

According to Twimbit research, Lazada, Grab, Gojek, Shopee and AirAsia are the top 5 Superapps across SEA. Among the top 5, Grab, and Gojek have diversified their service offerings and prioritised an exceptional user experience with integrated payment solutions.

🇬🇧 Vanguard set to launch app for UK investors. The app – currently in development – will allow its customers to invest in the passive giant’s ETFs and other products. While a launch date is yet to be set, the app is expected to provide investors with easy access to the firm’s platform.

🇧🇭 Zain Bahrain has launched a new fintech company, the Bede app, as part of its development strategy in the Middle East and Africa. The launch is expected to represent an important part of the company’s plan to develop across its country markets and the kingdom’s overall digital landscape.

🇺🇸 Plug and Play opens fintech startup accelerator in Texas. This program will offer startups the opportunity to work closely with mentors, access corporate partners, and participate in industry-specific events and workshops. Read more

🇺🇸 Revenued, a leading fintech that helps small businesses simplify the process of managing business finances, announced the company's first neobank partnership with Found, a fintech company on a mission to make self-employment easier. The new partnership signifies a transformative step towards democratizing financial services for small businesses.

🇺🇸 Aeropay partners with Cross River, UBank on gaming payouts. Both banks serve similar purposes for Aeropay, with some key differences: UBank lends Aeropay its same-day Automated Clearing House, deposit and withdrawal capabilities, while Cross River lends its connection to the Real Time Payments network and FedNow.

PAYMENTS NEWS

Mastercard on why biometrics is the future of secure payments. Today it’s a finger tap, tomorrow you may only need your face to pay, says Mastercard’s Karthik Ramanathan. Read the complete article to learn more.

🇨🇦 Nuvei launches omnichannel payments tech. Nuvei’s unified commerce offering, which is now available to customers operating outside of North America for the first time, is enabling businesses to develop new customer payments experiences with greater control and unified analytics effortlessly.

Ebury opens Brazil real to China yuan payments corridor. The new solution will facilitate and expedite trade between Brazil and China, which in 2023 alone totaled exports and imports of over US$145 billion, according to Brazilian Government data.

‘Buy now pay later’ firms like Affirm, Afterpay, Klarna shift from loyalty rewards to paid subscriptions. 43% of people using buy now pay later (BNPL) cards say they'd delay a purchase or buy cheaper product if BNPL wasn't available. Now these firms are adding subscriber fees.

🇨🇴 Tapi and Littio have entered into a strategic partnership to provide a simpler and faster payment experience for users in Colombia. This collaboration will enable over 200,000 Littio users to pay for more than 15,000 different services directly from the platform without the need to switch applications.

Fast money: European Parliament greenlights ‘instant payment’ law. The European Parliament has formally approved legislation that will force banks and other payment service providers to offer EU citizens and businesses the option of performing virtually instantaneous credit transfers.

OPEN BANKING NEWS

🇨🇴 Colombia has taken a significant step towards financial inclusion by becoming the third country in LatAm to regulate open finance, following Brazil and Chile. The Colombian Financial Superintendence issued Circular No. 004 of 2024, outlining standards for open finance, which aims to create a more transparent, competitive, and inclusive ecosystem by providing clear operational frameworks for financial entities.

🇺🇸 Trustly adds context to merchant data with MX, which has announced MX’s data enhancement services will be leveraged as part of Trustly‘s Open Banking product suite. With Pay with Bank, consumers enjoy fast, safe payments, while merchants benefit from an efficient payment solution.

DIGITAL BANKING NEWS

🇧🇷 Brazil digital bank Inter&Co beats profit forecasts in fourth quarter. Brazilian digital bank Inter&Co reported a better-than-expected five-fold increase in fourth-quarter net profit as it cut costs and focused its lending portfolio on more profitable categories.

🇺🇸 Fiserv CEO details special bank charter pursuit. The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano recently said. Read on

Latin America Embraces Banking-as-a-Service: Projects 14% Annual Growth through 2027. BaaS is growing in popularity among businesses as a strategy to improve client engagement and retention. BaaS in LatAm will grow at a compound annual growth rate of 14.27% between 2022 and 2027. The market's size is anticipated to expand to USD 2,430.08 million.

🇨🇴 RapiCredit, an online short-term loan platform, has achieved a significant milestone by granting over three million loans in its nearly ten years of operation, impacting more than 590,000 clients across Colombia. Future plans include consolidating quick loans, not only through the website but also via their Android app.

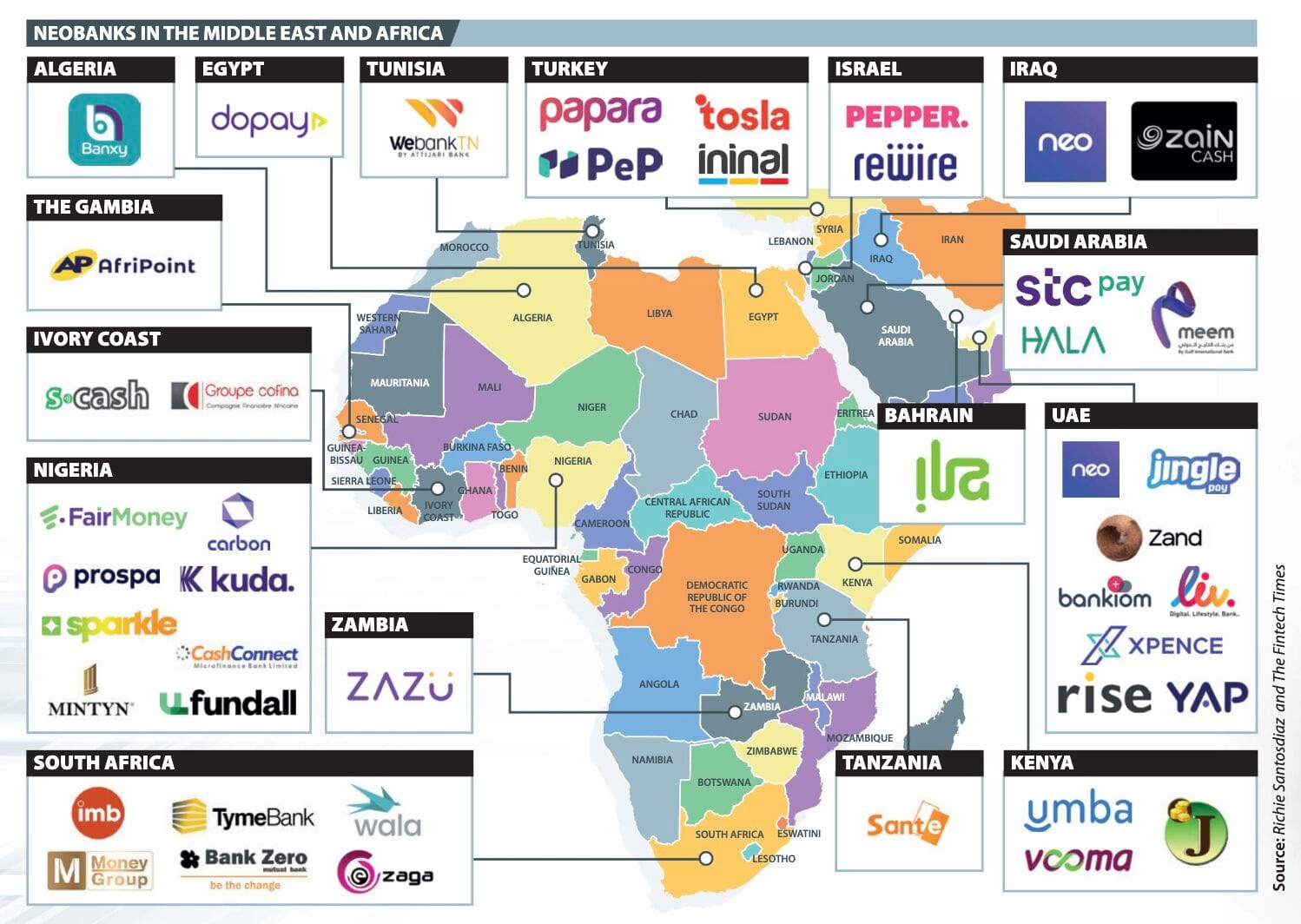

Neobanking Market poised to reach $3.3 trillion by 2032, with companies catering to various end-user segments. Neobanks have gained immense popularity owing to their customer-centric approach offering user-friendly interfaces and providing hassle-free financial services.

🇪🇬 Mastercard collaborates with the Egyptian Banks Company on digital payments. The collaboration marks a significant step towards fostering sustainable economic growth activities, further enhancing the digital payments landscape and driving inclusive economic development in Egypt.

🇬🇧 Revolut has announced its latest scam data for 2023, revealing that the majority of all its reported scam cases in the UK started on Meta platforms. Across its UK customer base in 2023, Revolut found that 60% of all of its reported UK scam cases originated from just three sources: Facebook, Instagram, and Whatsapp.

🇩🇪 Traditional German banks remain on top as banking app downloads increase 19% in 2023 with a combined downloads hitting 59.6m. Postbank, a retail bank, had the largest app download growth in 2023 from the previous year, almost doubling (96%) to a total of 2m downloads. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 TradeStation Crypto to pay $3M to settle SEC, state charges. The company will pay $1.5 million in a multi-state settlement, and it will also pay the SEC the same sum. “TradeStation Crypto does not comment on regulatory investigations and settlements,” a TradeStation spokesperson told Blockworks.

🇳🇱 Kraken secures VASP registration from Dutch Central Bank. Kraken obtained a VASP registration from the Dutch Central Bank (DNB), marking another milestone in its European growth strategy. The registration will allow Kraken to expand into an important European market and offer its industry leading products to Dutch clients.

DONEDEAL FUNDING NEWS

🇹🇷 Turan, which aims to build a financial bridge between the Turkic states, announced that it has received a follow-up investment of 1.2 Million USD under the leadership of United Payment, one of the first e-money companies in the country. The application facilitates many financial transactions for Turkish people living in Turkey.

🇫🇷 “We want to be predators, not prey”: French fintech Pennylane raises €40m for M&A. The accounting software sees its valuation double to €1bn with this latest round of funding. The funds will largely be used to finance acquisitions as the company looks to expand its technology and services portfolio.

🇫🇷 Ex-Société Générale’s exec launches new €150m European seed fund. Varsity VC, a brand-new seed investor founded by banking veteran and ex-Société Générale deputy CEO Didier Valet, has closed a first €75m for its first fund, targeting €150m. It will make seed investments in Europe across four verticals including fintech, healthtech, climate tech and enterprise software.

MOVERS & SHAKERS

🇫🇷 French payments giant Worldline is axing around 1400 jobs - eight per cent of its workforce - as part of a cost reduction programme. The Power24 plan will cost around €250 million but deliver a €200 million run-rate cash costs savings from 2025, says the firm.

Yuno, a prominent player in the fintech industry, has recently bolstered its executive team with significant new hires in North America and the Asia-Pacific region, underscoring the company's dedication to growth. Industry veterans Carol Grunberg and Jonathan Hall have joined Yuno, enhancing both its leadership strength and innovative capabilities within the international markets, especially in fintech.

MoneyGram announced four strategic appointments to its senior management team, responsible for the acceleration of the Company’s global digital strategy. MoneyGram Online (Edwina Johnson); MoneyGram Business (Arnoldo Reyes); Pricing Strategy (Vijay Raman); and Payments and Product Partnerships (Mike Tekulve).

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()