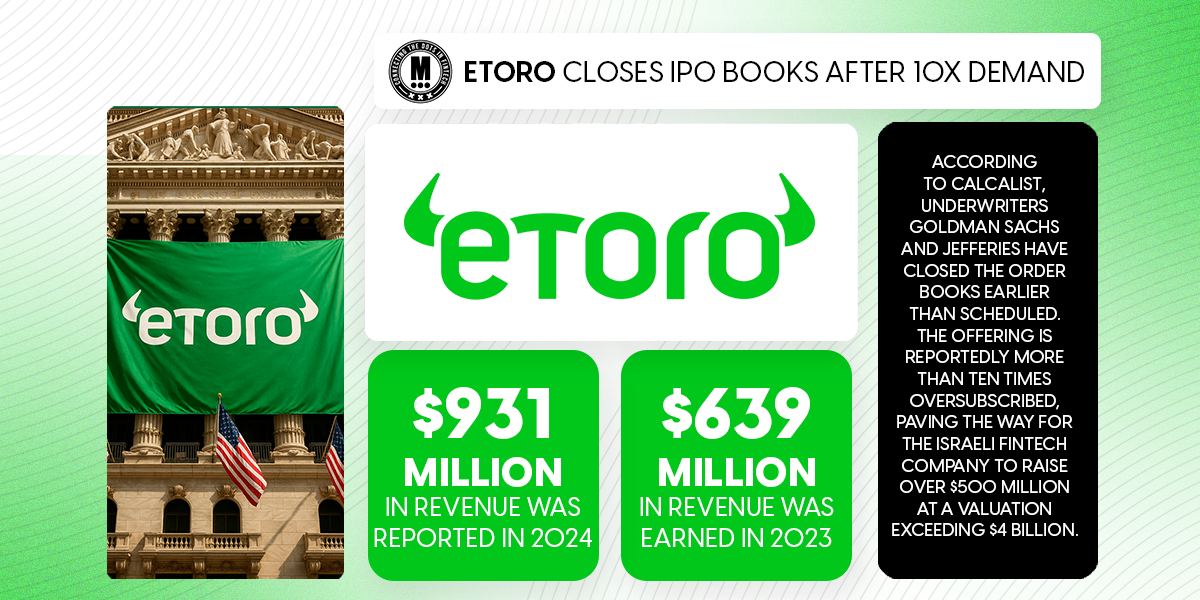

eToro Closes IPO Books After 10x Demand

Hey FinTech Fanatic!

Some stories arrive all at once, like a tide waiting offshore. After shelving its public debut in 2021, eToro has found its moment, and the response has been swift.

According to Calcalist, underwriters Goldman Sachs and Jefferies have closed the order books earlier than scheduled. The offering is reportedly more than ten times oversubscribed, paving the way for the Israeli FinTech company to raise over $500 million at a valuation exceeding $4 billion.

Founded in Israel, eToro operates a platform for stocks, ETFs, and crypto assets. A rebound in crypto trading volumes has reshaped its trajectory. From a net loss of $21 million in 2022, followed by a modest profit of $15.3 million in 2023, the company reported a $192 million profit last year. Revenue rose from $639 million in 2023 to $931 million in 2024, while EBITDA nearly tripled to $304 million over the same period.

There is, however, a shift in the short term. Higher marketing investments are forecasted to weigh on profits. For Q1 2025, eToro projects net income between $56 million and $60 million, compared to $64 million in the same quarter last year.

A missed chance in 2021, a re-entry in 2024, and now an IPO met with remarkable demand. That’s where eToro stands today.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 External payments for app developers: Upgrade your app monetization strategy with Solidgate. The app monetization landscape is evolving fast, and so should your payments. This whitepaper reveals how to capitalize on the latest app market shifts, drive better unit economics, and painlessly move from in-app billing to external payments. Download here

FINTECH NEWS

🌍 IPO, buyback hurdles hit Airtel Africa. Its mobile money IPO is delayed to H1 2026, raising concerns despite strong Q4FY25 earnings driven by tariff adjustments and easing currency headwinds. The company reported a net profit of $80 million, a significant swing from the previous year's loss.

🇮🇳 Stockify taps rising demand for pre-IPO shares among global investors. Founded in 2022, the startup has emerged as a notable player in the FinTech ecosystem by tapping into a sector long dominated by brokers and opaque practices.

🇮🇱 Payoneer suspends 2025 guidance and taps advisors, citing a “rapidly evolving and uncertain global macro and trade environment.” The company had previously projected strong growth in revenue from small- and medium-sized businesses (SMBs) and marketplace sellers, but is now opting for caution.

🇺🇸 Monzo lines up bankers to steer blockbuster IPO. According to reports, Monzo was in the process of hiring senior bankers from Wall Street stalwart Morgan Stanley to help steer the float, which is expected to value the company at over £6bn. Read more

🇬🇧 Zilch surpasses 4.5 million customers and £600 million in consumer savings. This milestone customer announcement marks a significant achievement. Zilch is now in the wallets of nearly 15% of the UK’s 34 million working adult population.

🇦🇺 Stripe’s Australian lead steers clear of Tyro takeover talks. Stripe’s Australian Chief says there is nothing to reveal about its reported interest in homegrown merchant terminal business Tyro, despite growing intrigue around each company’s next move.

🇳🇱 Mambu's product update Q1. The focus was on delivering key enhancements aimed at improving operational agility and streamlining account management. These updates empower institutions to better handle real-world banking scenarios, automate complex processes, and remain aligned with regulations.

🇮🇹 Investing is now available on Satispay. Users can access a "Salvadanaio Remunerato" (Remunerated Piggy Bank), which allows them to invest in a money market fund managed by Amundi Asset Management. This fund offers an annualized return of 2.24% and is designed for low-risk, short-term investments.

🇮🇪 Revolut extends RevPoints rewards programme to credit card users. Customers will be able to earn rewards on their transactions, such as airline miles, gift cards, and discounts on hotel stays and other experiences. All paid plan users will receive a greater earn rate of up to 2x versus their debit card.

🌎 MercadoLibre and Nubank get more aggressive in the LatAm digital banking race. Both companies are always making strong pushes in the same markets: “difficult” Mexico, the more tech-savvy Brazil, and Colombia, which Bloomberg described as “less-developed but potentially interesting.”

🇬🇧 Trading platform iForex eyes London IPO. It plans to pursue a public listing on the London Stock Exchange (LSE), seeking to enhance its brand visibility and secure funding for technology advancements. The platform currently serves over 4.6 million users.

PAYMENTS NEWS

🇨🇦 Square launches new unified point of sale app in Canada. The newly released Square Point of Sale app consolidates these features into one interface, enabling Canadian sellers to personalize tools for their unique needs, whether they run a quick-service café, full-service salon, or multi-location retail operation.

🇱🇹 Lithuania prepares an offline card payment system for national emergencies. The card payment system is to ensure people can still make purchases in the event of an emergency internet outage, an official from the country’s national bank has said.

DIGITAL BANKING NEWS

🇸🇬 DBS introduces Mobile Wallet Toggle to help prevent phishing-linked fraud. The added step is intended to create a deliberate pause, giving users time to verify their actions and reduce the risk of unauthorised transactions. Continue reading

🇧🇷 Nubank innovates by allowing card limits to become account balances. The new feature allows customers to convert part of their credit card limit into available balance in their checking account. This functionality aims to provide greater financial flexibility, especially in situations where a merchant doesn't accept credit card payments.

🇧🇷 Banco Neon enters 'third phase': doubling in size in two years through new products and expanding potential customers. Neon plans to broaden its product offerings to attract a wider range of customers. This includes introducing new financial products and services to cater to the diverse needs of its clientele.

🇬🇧 Chetwood Bank reports £4 billion in customer savings deposits. The bank says the milestone reflects its rapid growth and commitment to savers in the UK. The company wants to be the leading challenger bank in the UK. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Former FTX EU customers can now recover their funds. Customers may now complete the two-step process to claim their Euro funds via Backpack EU: get verified and withdraw funds. Explore more

🇰🇷 Bank of Korea pushes for control over won-based stablecoins. Koh Kyung-chul, head of the BOK’s Electronic Finance Team, said, “Stablecoins have a significant impact on central bank policy implementation, including monetary policy, financial stability, and payment and settlement.”

🇰🇷 RedotPay enters South Korea with crypto-powered payment cards. The company’s crypto debit cards, both physical and virtual, are now accepted at all Korean merchants that support Visa. The move marks RedotPay’s latest step in global expansion.

🇪🇺 BitGo secures MiCA license to expand digital asset services across the EU. This approval enables BitGo Europe GmbH to offer regulated digital asset services across all 27 European Union member states. Continue reading

🇨🇦 Crypto.com obtains restricted dealer registration in Canada. The registration allows Crypto.com Canada to continue offering crypto asset products and services to Canadians while it seeks registration as an investment dealer in Canada and membership with the Canadian Investment Regulatory Organization (CIRO).

PARTNERSHIPS

🇧🇭 ila Bank partners with Mastercard to launch innovative solutions and expand into new markets. ila Bank will leverage Mastercard’s expertise to introduce a loyalty program that supports cardholders’ lifestyle, providing added value across a wide range of areas, including dining, luxury shopping, travel, and priceless experiences.

🇱🇰 Mastercard & LankaPay join forces, launch co-branded card and secure QR payments in Sri Lanka. This move supports financial inclusion, better tourist experiences, and safer digital transactions across the country. Read more

🌍 BBVA expands its agreement with OpenAI to 11,000 ChatGPT licences, as part of its plan to extend generative AI capabilities across the entire organisation. Employees report that automating routine tasks with this tool allows them to save an average of nearly three hours of work per week.

🇮🇹 UniCredit partners with Google Cloud to accelerate digital transformation across 13 markets. This is an investment in its cloud infrastructure, delivering on one of the key pillars of the bank's digital strategy, which involves migrating large sections of the bank's application landscape to Google Cloud's scalable and secure platform.

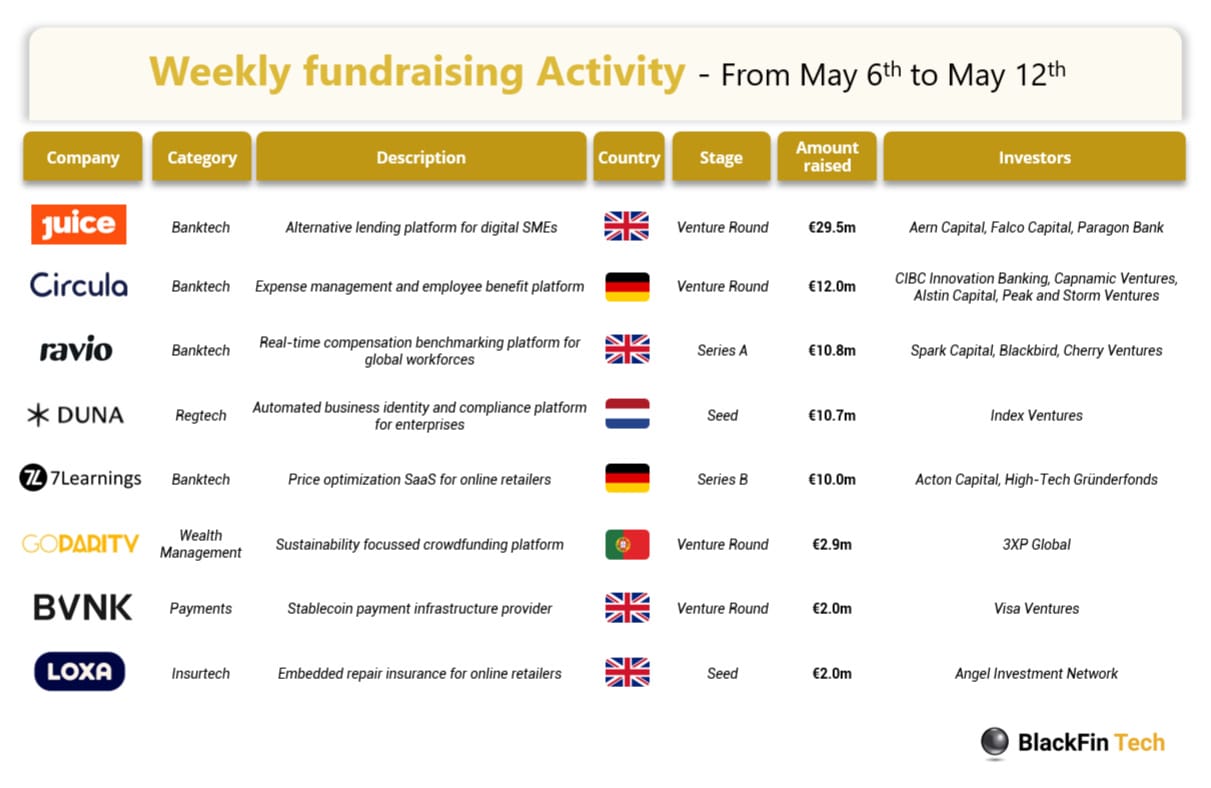

DONEDEAL FUNDING NEWS

💰Over the last week, there were 8 FinTech deals in Europe, raising a total of €80.0 million in equity: four deals in the UK, two deals in Germany, and one deal in each of Portugal and the Netherlands.

🇺🇸 eToro IPO 10x oversubscribed; expected to raise over $500M at $4B+ valuation. The underwriters of the IPO, led by Goldman Sachs and Jefferies, notified participants in the Israeli FinTech company's roadshow that they will no longer be accepting new orders.

🇬🇧 RetailBook investment platform wins funds to survive downturn. A platform enabling retail investors to take part in share issues normally reserved for institutional investors has raised fresh capital to tide it over until more favourable conditions return to the moribund stock market.

🇺🇸 Stash raises $146M in series H funding. The company intends to use the funds to accelerate product innovation, drive subscriber growth, and further develop AI capabilities. The round was led by Goodwater Capital. Continue reading

MOVERS AND SHAKERS

🇬🇧 Irina Chuchkina joins ‘Wallet in Telegram’ as Chief Growth Officer. "Telegram is the ideal platform for launching accessible financial tools because investing and managing money should be a right, not a privilege. Anyone should be able to invest in their future, send money as easily as a message," she stated.

🇬🇧 Moneybox appoints Melissa Birge as Independent Non-Executive Director to support the next phase of growth. Melissa brings a wealth of experience from executive and non-executive roles across high-growth, consumer-facing, and digital-first businesses.

🇳🇱 BUX CEO Yorick Naeff to be appointed Head of Innovation at ABN AMRO. Following ABN AMRO’s acquisition of BUX, Yorick has played a key role in guiding the integration process between the two companies. He will continue to serve as CEO of BUX during the transition period.

🌎 Wise appoints Ricardo Amaral as the new Head of Banking for Latin America and Country Manager for Brazil. He will be responsible for delivering the PIX integration and driving a highly localized growth strategy across all customer segments to further Wise's contributions to a faster, more convenient, and efficient international payment experience for Brazilians.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()