Equifax UK Launches Digital Tool for Faster Social Tariffs

Hey FinTech Fanatic!

Equifax UK launched a transformative tool to support financially vulnerable consumers. Tariff Connect is designed to streamline eligibility assessments for social tariffs, giving utility and telecoms providers a smarter, faster way to help customers access essential discounts and special pricing plans.

By harnessing the power of Open Banking, Tariff Connect automates the once-manual, document-heavy process. It’s about making life easier for consumers and bringing operational efficiency to firms. For those facing financial hardship, this tool ensures that support is just a few clicks away, with eligibility reassessed regularly to adapt to changing consumer circumstances.

Craig Tebbutt, Equifax UK’s Chief Strategy and Innovation Officer, shared his thoughts on the launch: “The economic backdrop may have improved, but beneath the surface, cost-of-living pressures remain high, especially around domestic bills. With nearly 6.4 million people in the UK relying on Universal Credit, the need for accessible social tariffs is greater than ever. The launch of Tariff Connect simplifies access to social tariff rates for those facing financial difficulty and reflects our commitment to leveraging technology to drive positive social impact.”

This announcement follows growing pressure from regulators and policymakers to support financially vulnerable households as they grapple with high energy costs and inflation.

Good news to finish the week! Keep scrolling if you’re interested in reading a bit about what’s been happening in FinTech, I'll be back on Monday!

Cheers,

SPONSORED CONTENT

Discover how Mangopay enabled the fast migration of 800 sellers without disrupting sales on the Maisons du Monde platform, and learn about the benefits of our PSP-agnostic infrastructure.

#FINTECHREPORT

📊 Explore Worldpay's "Global Payments Report - How Consumer Choice is Changing Commerce" to see how consumer preferences are evolving into trends and what these trends mean for the future of businesses. Get the full report here

FINTECH NEWS

🇺🇸 US-focused AI FinTech Cleo hits $150m ARR and eyes return to the UK. CEO Barney Hussey-Yeo says the company is eyeing a fundraise early next year to fuel its expansion plans, especially its anticipated return to the UK. Click here to learn more

🇬🇧 Additiv expands UK presence with new London office, appoints Pierre Dufauret as UK Market Head. These strategic moves underscore additiv’s commitment to strengthening its presence in the UK market and supporting its growth ambitions in the region.

🇳🇬 Currenzo, the Nigerian subsidiary of cross-border remittance provider Africhange, has received the CBN International Money Transfer Operator (IMTO) license. Africhange’s license enables faster, more affordable remittances directly into Nigeria for Nigerians at home and abroad.

🇦🇷 MercadoLibre misses third-quarter profit expectations on logistics, credit costs. MercadoLibre reported a 35% rise in Q3 revenue to $5.3 billion, in line with forecasts, but its net profit rose only 11%, missing estimates due to increased logistics and credit costs.

🇨🇾 Capital.com set to double technology team amid strong growth. The company announced total client trading volumes reached over $450 billion in Q3 2024, a 20% increase from Q2 2024, affirming the company's steady growth trajectory.

🇺🇸 MoneyLion’s customer growth surges 54% on ecosystem upgrades. The firm’s 3Q results highlighted double-digit growth in customers and revenues, as more individuals engaged with its “digital ecosystem” for personal finance, with the app and marketplace serving as key components.

PAYMENTS NEWS

🇦🇺 GoCardless expands partnership with Big Red Cloud for payment solutions. Big Red Cloud is integrating GoCardless' payment solutions into its platform, enabling users to collect and reconcile recurring payments via Direct Debit, simplifying the process for accountants and SMEs.

🇸🇬 Ant International drives AI in cross-border payments to boost global expansion. The firm’s AI model predicts currency exchange rates on an hourly basis, helping businesses reduce transaction costs. Continue reading

🇳🇱 Adyen shares slide as payments giant’s transaction volume growth slows. Adyen reported third-quarter net revenue of €498.3 million, marking a 21% YoY increase. Despite strong sales, shares dropped over 6% Thursday off the back of a slowdown in transaction volume growth.

🇸🇬 OCBC now offers instant transfers to WeChat Pay and Alipay in China. This makes OCBC the first bank in Asia Pacific to offer this service, enabling peer-to-peer transfers via the OCBC mobile app using Visa Direct. Transfers now take seconds instead of the traditional 2-5 days.

🇪🇺 EU questions retailers in Visa and Mastercard fee controversy. The European Commission has reportedly launched a probe into whether Mastercard and Visa’s fees are harming merchants. Responses from questionnaires sent to retailers and PSPs could help build an antitrust case, potentially leading to fines of up to 10% of a company’s global revenue.

🇸🇬 Boxo and Nium launch customisable white-label remittance platform. This collaboration empowers mobile apps to seamlessly integrate international money transfer services into their existing platforms, allowing users to send money across borders effortlessly and at competitive rates.

🇸🇬 Liquid Group rolls out roamQR to Link E-Wallets and QR Networks. This initiative aims to streamline payments for both consumers and merchants by supporting e-money “push” transactions from e-wallets and card-linked “pull” QR payments from bank accounts.

🇲🇽 dLocal and Viva Aerobus expand payment options. The collaboration aims to simplify local payment processing for travelers across Mexico, the United States, Central, and South America, allowing customers to book flights using their preferred payment methods.

🇿🇦 FNB launches near real-time cross-border payments with BankservAfrica, making it the first bank in Southern Africa to facilitate real-time cross border payments across the Common Monetary Area of South Africa, Namibia, Lesotho and Eswatini.

🇳🇱 CAB Payments shares plunge after StoneX ditches bid talks. The firm’s shares dropped by 17.5% after U.S. rival StoneX confirmed it would not pursue an offer for the London-listed cross-border payments company.

OPEN BANKING NEWS

🇬🇧 Equifax unveils an open banking-based system to simplify utility and telecom social discounts. The solution, Tariff Connect uses a digital application form and Open Banking technology to automatically assess eligibility, removing the need for manual documentation and reducing processing time from weeks to minutes.

DIGITAL BANKING NEWS

🇹🇭 Nium and Kinexys partner to enhance cross-border payment accuracy. This partnership enables financial institutions to verify beneficiary account details before payments, reducing errors, misrouted transactions, and fraud. Read on

🇬🇧 Chase’s new UK credit card won’t offer rewards as bank aims for top five in Europe. JP Morgan Chase’s UK head has clarified reports of plans to launch a UK credit card, stating it would not be a rewards-based card, though stopped short of confirming the launch. Find out more

BLOCKCHAIN/CRYPTO NEWS

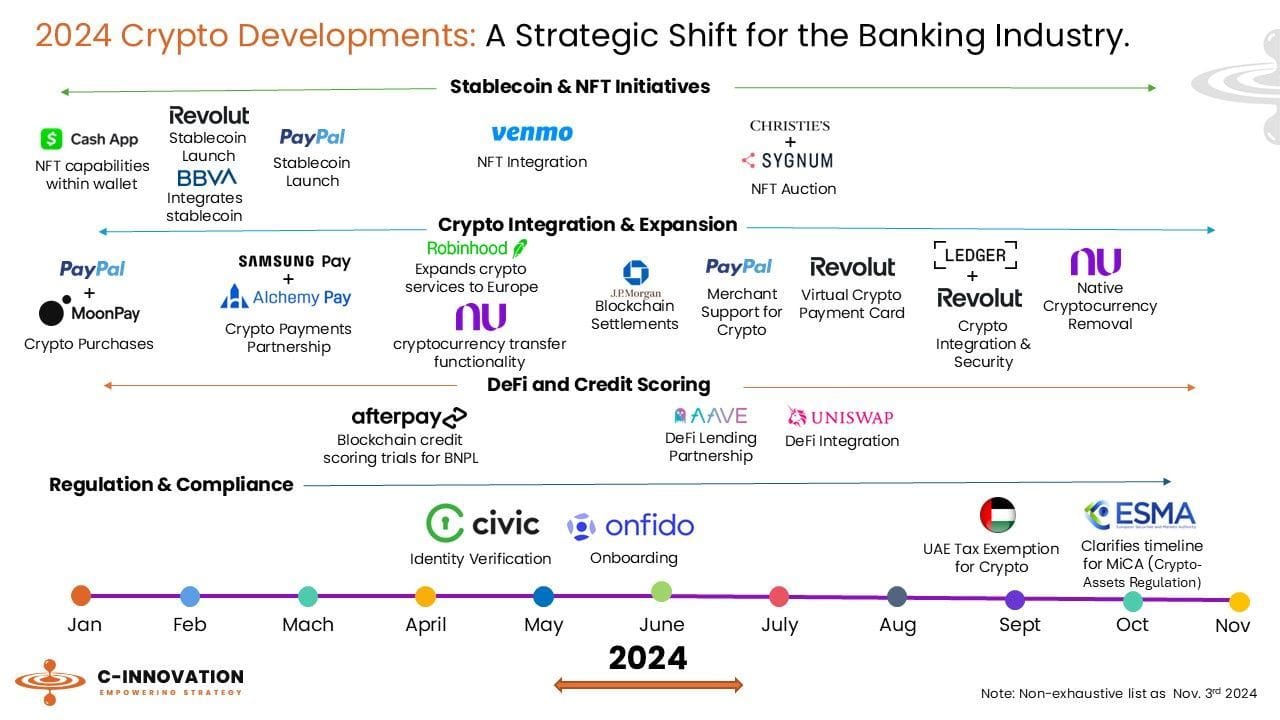

📈 As Bitcoin hits all time highs, digital banks and FinTech are leading the way in integrating crypto services, expanding access, and navigating regulatory changes.

Here are the big developments in the industry in 2024:

🇺🇸 FTX co-founder Wang seeks no prison time, citing limited knowledge of SBF fraud. Wang’s defense argued that he only discovered the extent of the fraud, including Alameda Research’s misuse of FTX customer funds, after it was “well underway.”

🇨🇭 UBS pilots blockchain-based payment system. UBS announced it has successfully piloted its blockchain-based UBS Digital Cash system to enhance cross-border transaction efficiency. The pilot involved transactions with multinational clients and banks, including domestic Swiss and cross-border payments in USD, CHF, EUR, and CNY.

PARTNERSHIPS

🇪🇺 Wolt partners with Revolut to bring Wolt+ membership to its Premium, Metal, and Ultra Paid Plan subscribers. Through this partnership, Revolut customers on a paid plan can now enjoy the convenience and savings of Wolt+ for free, making their everyday lives simpler and more affordable.

🇬🇧 Marygold & Co join forces with Griffin to promote financial wellness. This relationship allows Marygold & Co. to include savings accounts in its app, which will be released later this year and empower users in the UK with a variety of tailored wealth-building tools.

🇬🇧 Flexys partners with Moneyhub to ‘revolutionise’ collections industry. The partnership leverages Flexys' collections expertise and Moneyhub's Open Banking tech to create a more transparent, efficient, and customer-focused collections process.

🇰🇼 Ottu announces strategic partnership with Keyloop to enhance automotive dealers digital payments. The partnership with Keyloop will enhance Ottu's expertise in dealership payment management through an incorporated and secure payment gateway.

🇦🇪 Network International partners with Tamara to offer flexible payments at point of sale. This collaboration empowers merchants to offer flexible, Sharia compliant payment solutions at the point of sale (POS). Keep reading

🇫🇷 TheFork and Mastercard form partnership for ‘Booming Experience Economy’. The multiyear partnership, which will launch next year, will enable eligible cardholders worldwide to gain access to exclusive benefits, Mastercard said in a news release.

DONEDEAL FUNDING NEWS

🇧🇪 Belgian-Swiss startup Predikt raises €750K for AI-driven financial forecasting. The startup plans to use the funding mainly to develop the platform further and increase usability and marketing locally and abroad. Continue reading

🇪🇸 Marosa secures a €12 million investment from Aquiline. This funding represents Marosa's first external capital raise and will help accelerate its growth strategy, expand compliance software and e-invoicing offerings, and support its global expansion.

M&A

🇬🇧 Bumper acquires Telford-based AutoBI, a software firm serving car retailers and OEMs. This marks Bumper’s first acquisition and allows the firm to strengthen its digital payments platform with enhanced insights for dealer partners.

MOVERS & SHAKERS

🇬🇧 BR-DGE appoints Chun Ong as Chief Operating Officer. In his new role, Chun will support BR-DGE's growing demand by taking on a key leadership role focused on scaling operations and improving cross-functional collaboration. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()