Emerging Trends and Shifts in the Indian🇮🇳 Fintech Landscape

As the ebb and flow of FinTech funding in India paint a dynamic canvas, a close examination of the trends and their underlying currents becomes paramount to comprehend the evolving narrative.

Despite a seeming dip post the fervent funding high tide of 2021, the Indian FinTech Ecosystem has showcased remarkable resilience and adaptability, sowing seeds for a future rich in innovation and growth.

The regulatory environment has undergone significant alterations, with notable developments such as the 2023 KYC amendment, IT outsourcing guidelines, amendments in FLDG within DLG guidelines, and progress with the Personal Data Protection Bill, all playing a crucial role in molding the future landscape of FinTech in the country.

Diverse Focus and Funding Realities

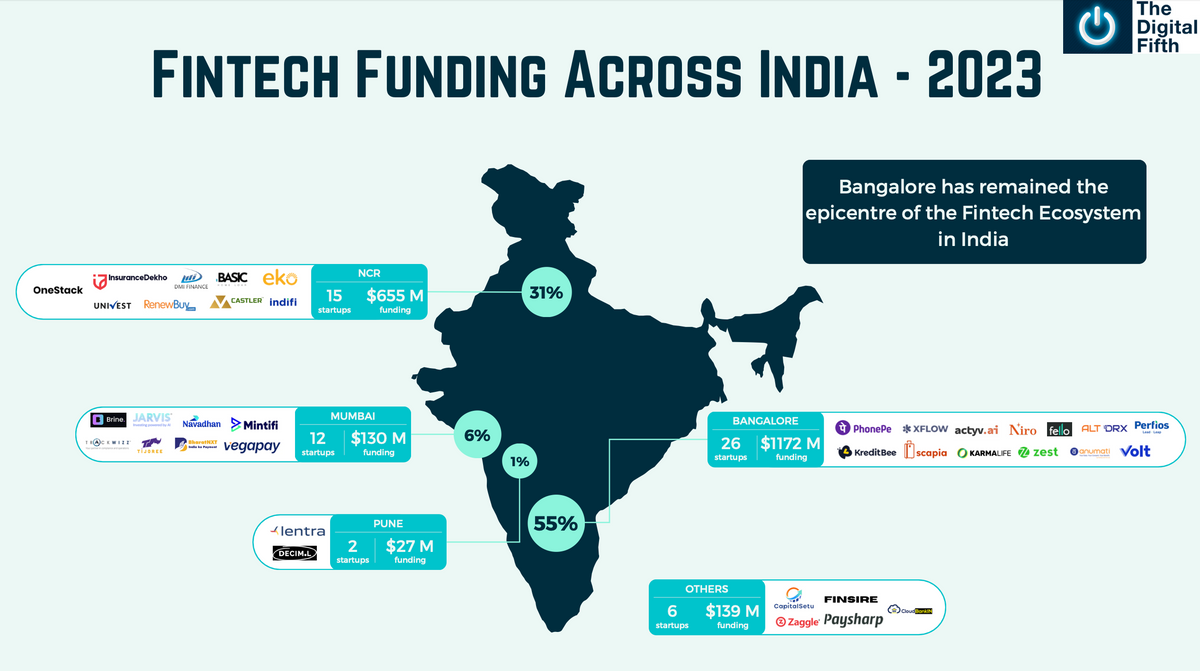

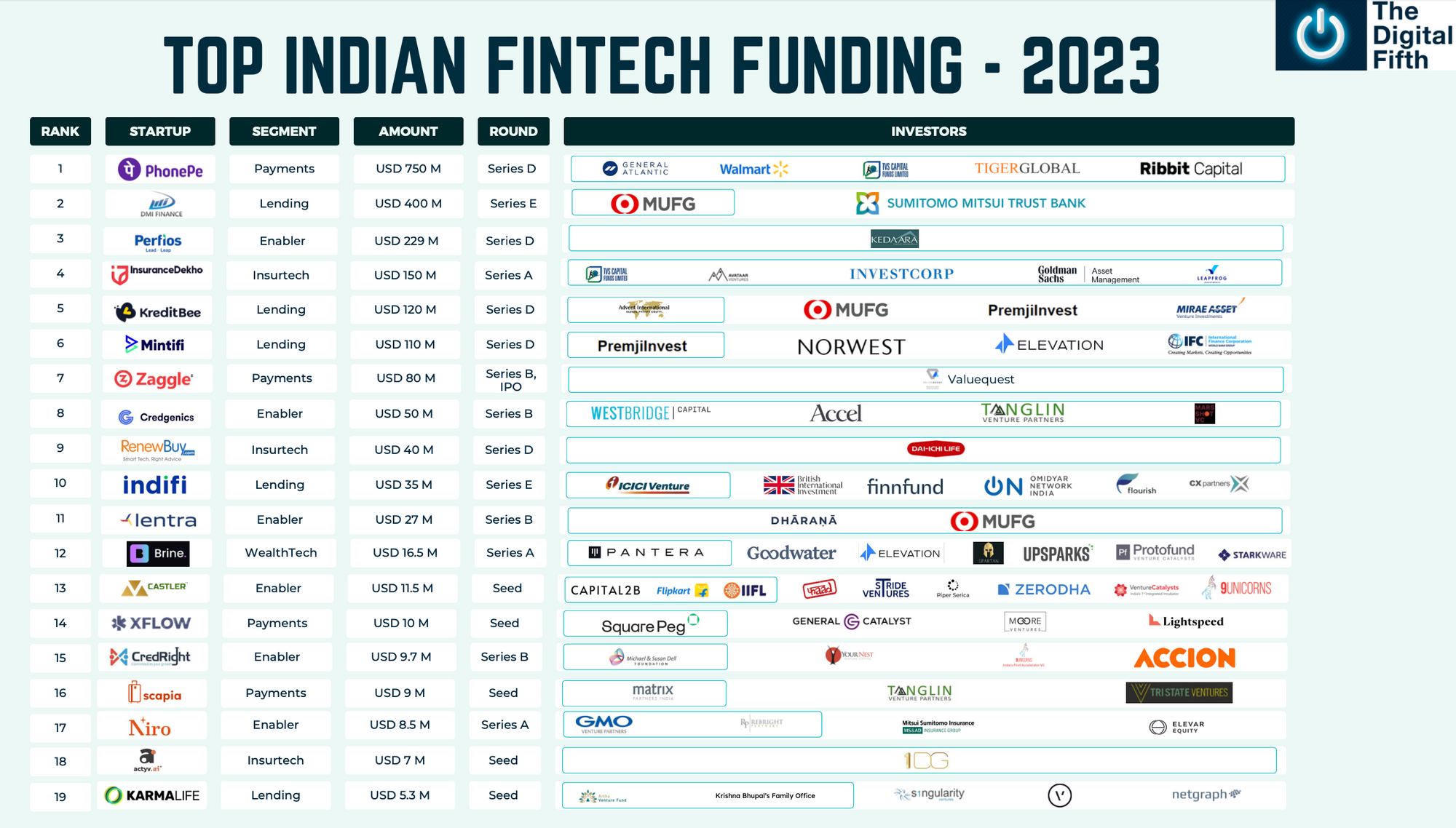

The funding scenario unveils a tapestry of varied focus and investor confidence across different fintech segments. A cumulative funding of USD 2 B until September, with USD 449 M in Q2 alone, reflects the sustained investor interest. While staple segments like Payments and Lending continue to attract capital, emerging sub-segments like LaaS, cross-border and Escrow payments, and Account Aggregators are becoming focal points of investment.

The data elucidates a notable tilt towards early-stage startups, with Pre-series funding witnessing growth, while Series D+ funding has diminished at a CAGR of -45%. This divergence possibly suggests burgeoning investor confidence in newer startups, indicative of a rich future innovation pipeline.

Segment-specific Narratives

- BankingTech: Standing tall as the top-funded segment, driven by an upward trajectory in open banking and a shift towards microservices-based architecture, thereby enabling agility and scalability.

- LendingTech: Scooping up the second-highest funding, propelled by regulatory initiatives like DLG and FLDG guidelines and the RBI’s CFSS mandate. The substantial adoption of ONDC and an uptick in MSME credit further signify imminent expansion.

- Payments: Attracting a whopping USD 846 M in funding, although predominantly funneled towards established players. Initiatives like UPI lite and credit card-based UPI payments spell future growth.

- WealthTech: The segment, albeit securing a modest USD 11 M, pinpoints a shift with a focus on Fixed Income Instruments and Discount broking, and integration with NSDL & CDSL data.

Pioneering Players and Collaborations

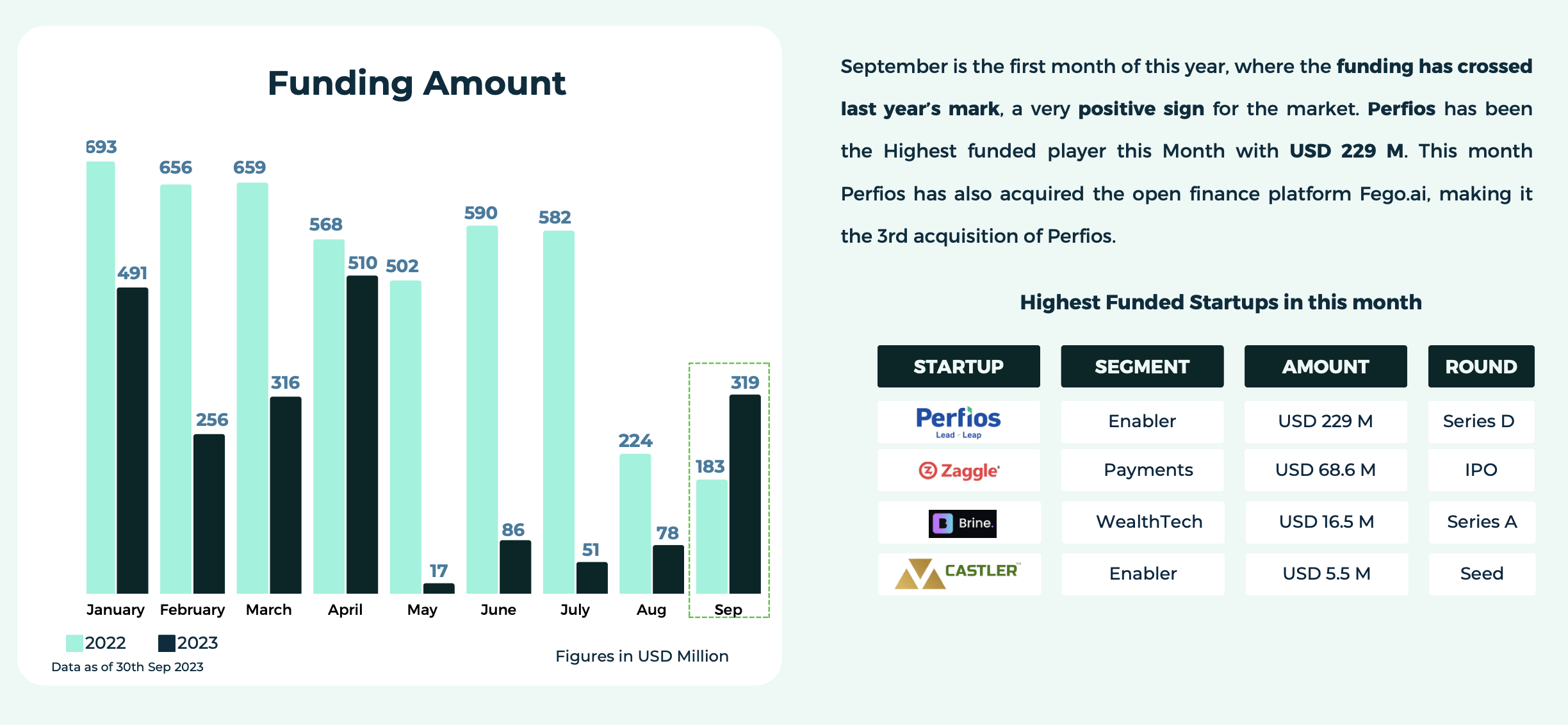

Perfios has emerged as a key player, procuring the highest funding in September with USD 229 M and marking its third acquisition with open finance platform Fego.ai.

This confluence of funding and strategic acquisitions underscore a holistic growth strategy, aiming for both financial and technological augmentation.

Conclusion

While September registered a funding surge, surpassing the previous year’s analogous mark, the overall perspective emanates positivity amidst the nuanced fluctuations across different fintech segments. The blending of regulatory changes, innovative developments, and strategic investments and acquisitions are conjuring a fertile ground, where the seeds of today’s endeavours can potentially sprout into a bountiful harvest of fintech innovations and growth in the foreseeable future.

In essence, the meticulous cultivation of these sown seeds, through adaptive strategies and navigational acumen amidst the dynamic trends, will determine the magnitude and quality of the eventual harvest in India's fintech ecosystem.

Source: The Digital Fifth

Comments ()