Eleven spot bitcoin ETFs surged out of the gate

TGIF!

Eleven spot bitcoin ETFs surged out of the gate as they hit the market Thursday morning. Total trading volumes for BlackRock, Fidelity and Grayscale products exceeded $1 billion in the first 30 minutes of trade, according to market data crunched by Blockworks.

Meanwhile, JP Morgan CEO and longtime Bitcoin critic Jamie Dimon again came out against the number one digital currency, reiterating his stance that it is a tool for criminals and tax evasion.

“The actual use cases are sex trafficking, tax avoidance, anti-money laundering, terrorism financing,” Dimon said. “I’ve always said Bitcoin doesn’t have value.”

Despite Dimon’s long-time campaign against Bitcoin, global investment giant BlackRock named JP Morgan as an active participant in its pending ETF filing with the SEC, according to a report by Bloomberg.

I guess time will tell...

A quick reminder about Papaya’s upcoming webinar on January 17th at 4:30 PM BST | 11:30 AM EST. I understand how overwhelming it can be to handle payroll manually each month, but there's a better way, and there's still time to join this webinar and discover it.

Register now for an exclusive demo of Papaya Workforce OS - the world's first embedded payroll and payments solution. Learn how to streamline your operations, save time and money, and transform your payroll into a strategic asset.

Have a great weekend and I’ll be back on Monday!

Cheers,

Marcel

SPONSORED CONTENT

POST OF THE DAY

🇬🇧 HSBC has launched Zing, a new multicurrency and money transfers product in the UK market that is designed to rival the likes of Wise and Revolut. But how does Zing’s offering compare to the wider market?

FEATURED NEWS

Mastercard announces development of inclusive AI tool to provide personalized, real-time assistance to small business community.

INSIGHTS

🇧🇷 Brazil's Nubank trades above IPO price for first time in nearly 2 years. The lender, backed by Warren Buffett's Berkshire Hathaway, priced its New York Stock Exchange IPO in December2021 at $9.00 per share, marking a closing all-time high of $11.85 the following day.

Take a look at The Revolut Business Model explained by The Business Model Analyst in the following Business Model Canvas and SWOT analysis. Click here to access the full article.

FINTECH NEWS

🇿🇦 MTN and Ericsson to facilitate mobile financial services in Africa. By leveraging MTN's Mobile Money (MoMo) service on the Ericsson Wallet Platform, the partnership seeks to increase financial inclusion by serving several customers, including high-end business applications and new users.

🇺🇸 Ramp has surpassed Brex in Total Payment Volume. Hitting $30B annualized (209% YoY growth) at the end of 2023 off the growth of Ramp's second product, Bill Pay. Link here

PAYMENTS NEWS

ACI Worldwide takes over Payment stack of UK retailer Co-op. As a strategic technology partner of ACI Worldwide, Co-op uses the full range of solutions offered by ACI Payments Orchestration Platform, including in-store, online and mobile payment processing and end-to-end payments and fraud management.

DIGITAL BANKING NEWS

Revolut plans "bank branches in every country in Europe and eventually every country in the world", says Andrius Bičeika, deputy CEO and partner at Revolut, who also reflects on the evolving landscape of the startup world, shares insights for fellow startups, and explores why personal AI bankers could potentially outperform their human counterparts.

🇲🇽 Ualá México emerges as the fastest-growing Fintech in the country, adding over 140k new clients in December 2023. Ualá has demonstrated a commitment to the local market by offering financial solutions tailored to current needs, and anticipates continuing its positive trajectory and reaffirming its presence in the Mexican financial sector.

🇲🇽 Bineo, the digital bank of Banorte, has entered the competitive market of digital banking in Mexico, commencing operations with savings accounts and loan services. The Bineo app is available for both iOS and Android versions. It can be downloaded for free, and transactions can be conducted directly from its platform.

🇨🇦 EQ Bank challenges Canadians to expect more of chequing accounts as "Second Chance" campaign launches. The bank is helping Canadians re-define their chequing account expectations after its new survey revealed a significant disconnect in awareness about fees paid and interest earned. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Spot bitcoin ETFs surpass $1B in trade volumes after first 30 minutes. BlackRock’s iShares Bitcoin Trust (IBIT) led trading volumes with roughly 10 million shares traded in the first 15 minutes after the bell, according to Yahoo Finance data. Investors had traded about 13.5 million of IBIT by 10 am ET.

🇺🇸 ‘Bitcoin has no value’: JP Morgan’s Jamie Dimon says as market awaits ETF. Despite his bank being a participant in a Bitcoin ETF, Dimon asserts Bitcoin is primarily used for illegal activities. The executive cautioned that the anticipated Bitcoin ETFs could flop once launched.

🇺🇸 Circle confidentially files for US IPO. In a press release, Circle said the IPO is “expected to take place after the Securities and Exchange Commission completes its review process, subject to market and other conditions.” The firm previously sought to go public through a special purpose acquisitions company.

DONEDEAL FUNDING NEWS

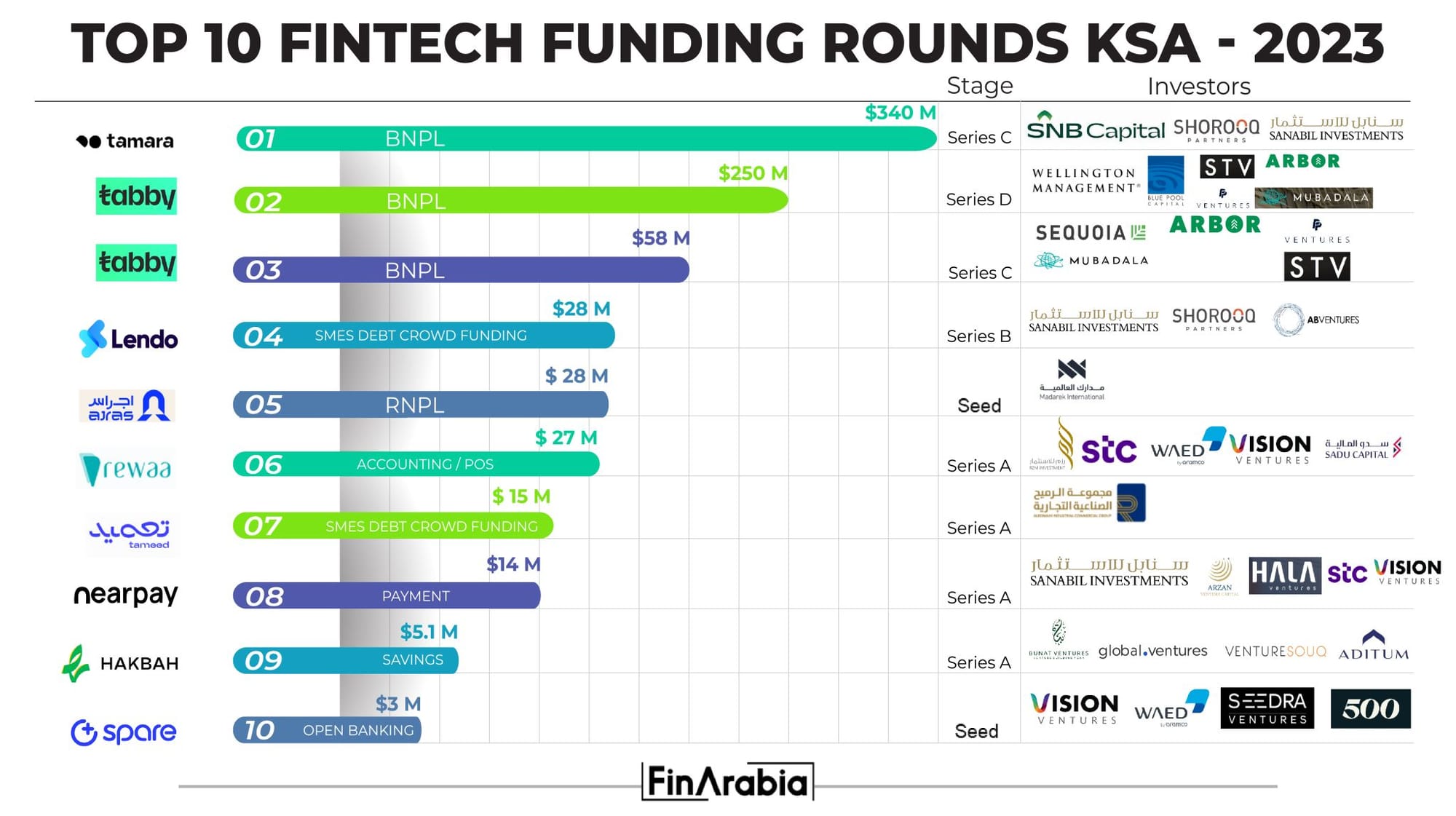

Top 10 FinTech investment rounds in Saudi Arabia for 2023 by Finarabia.

🇨🇭 Swiss payments fintech Rivero raises $7 million to step into new markets and boost its product development and workforce. Rivero's Saas product suite fills a gap in the market for fraud recovery, dispute management and payment scheme compliance, with a particular focus on issuing banks.

🇺🇸 Karma Wallet goes live with $2 million capital injection. Accompanied by the funding injection from socially conscious investors, including the innovative Tweener Fund, this launch heralds a new era of impact-driven, conscious consumerism. Read more

🇬🇧 hyperexponential raises $73M in series B funding. The firm plans to use the funds to expand into the US, open a NY office this year, invest in new product capabilities for growing client demand in adjacent insurance markets, including SME insurance, and aims to double its global team to over 200 within the next year.

M&A

Trustly completes SlimPay merger, reinforcing its commitment to providing a comprehensive Open Banking-enabled, pan-European recurring payments service.This will allow consumers to experience faster and more convenient payments, as Trustly’s presence at checkouts means no more manual detail entry.

Thomson Reuters launches $626 Million offer for Pagero. The firm will begin a public tender offer to acquire all of Pagero’s shares. Access the complete article here

🇺🇸 US-based lender Downpayments has launched its services in Florida backed by $31.8 million in initial debt funding. Making its debut at a time when mortgage rates are topping nearly 8%, the start-up seeks to provide property investors with interest-free down payments on their next home purchase by enabling them to leverage their existing equity.

MOVERS & SHAKERS

🇧🇷 PayRetailers, a Spanish payment processing company focusing on LatAm, is gearing up for aggressive expansion in Brazil in 2024. As part of its strategy, the startup has announced the hiring of Joel Fernandes Bueno as the new Head of Compliance and Márcio Franklin as the Head of Products in Brazil.

🇬🇧 Scotland reports 24% fintech employment growth. Fintech SMEs now employ more than 10,500 people across 226 enterprises, and more than 38% of fintech enterprises have reached scale-up stage creating more employment opportunities. Learn more

🇳🇱 Adyen’s CTO Alexander Matthey to depart at the end of 2024. Matthey, with a decade at Adyen, faces the challenge of balancing family life in Berlin with Adyen's HQ in Amsterdam. Adyen will begin the search for a successor covering both internal and external candidates, ahead of the CTO’s departure in December 2024.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()