Did Nubank Create the Best FinTech Ad Ever?

Hey FinTech Fanatic!

Time flies, and next week I'll find myself back in the US once again. Of course I'll be attending FinTech Meetup, and on March 4th, my dear friends from Financial Revolutionist are hosting what promises to be the highlight happy hour of the event—you'll surely find me there.

I encourage you to request an invite as well so we can have the opportunity to meet in person!

Before we delve into the latest industry news and reports, I'd like to share with you an outstanding short film that was recently released. If you are a fan of the hit serie The Office, this won't disappoint. It's possibly the best FinTech advertisement ever produced:

Planos no Papel | Filme Completo | Nubank & Leslie David Baker

Nubank truly nailed it with this one. What are your thoughts? What's your favorite FinTech ad of all time? I'd love to hear your opinions in the comments below.

Enjoy more news updates below, and I'll be back in your inbox tomorrow!

Cheers,

POST OF THE DAY

“Every company will be a #FinTech company” - Angela Strange

FEATURED NEWS

🇨🇭 Temenos responds to Hindenburg's report: Capital Markets Day 2024. Read more about Temenos's response here.

#FINTECHREPORT

Binance uncovers the top crypto industry dynamics of 2023 and discuss key trends as we head further into 2024. Check out the full report here

INSIGHTS

🇺🇸 Sequoia Capital has retracted its request to remove Michael Moritz as chairman of Klarna’s board, according to emails reviewed by The Information. Sequoia partner Matthew Miller, the director who in recent days had asked Klarna shareholders to remove Moritz, is instead leaving the Klarna board.

🇺🇸 Democrats blast ‘dangerous’ Capital One-Discover merger. “With a merger this size, the regulators need to ensure our financial system remains strong and competitive, so that consumers continue to have access to safe, affordable financial products and services,” said Senate Banking Committee Chair Sherrod Brown (D-Ohio).

FINTECH NEWS

🇬🇧 Yonder launches free membership in latest move to reshape market. The London-based rewards credit card startup with backing from investors including GoCardless’ Matt Robinson, Cred’s Kunal Shah and Rio Ferdinand, has launched a free membership in the latest move on its mission to rebuild young consumers’ relationships with credit.

🇬🇧 BVNK goes live as an e-money institution in Europe, bolstering B2B payment services. BVNK is excited to announce that its EMI licence in Europe is live, following an acquisition in 2023. BVNK now holds 8 licences and regulatory approvals globally across fiat payments and digital assets.

PAYMENTS NEWS

🇨🇴 Nuvei launches direct local acquiring in Colombia, becoming the first global payments company to offer this service in the country. This enables local and international partners to accept card payments from their customers without relying on intermediaries or third-party payment processors.

🇮🇳 US-based online payments gateway service provider PayPal has registered with the Financial Intelligence Unit – India under Anti-Money Laundering law. The company has finalised the formal procedure, which was designated as a reporting entity under the Prevention of Money Laundering Act (PMLA).

The Payment Orchestration Platform Market is set to grow from its current market value of more than $848.6 million to over $4.83 Billion by 2032. The surge in digital payments and e-commerce transactions necessitates sophisticated payment processing solutions to manage diverse payment methods efficiently.

🇶🇦 Qatar Central Bank (QCB) to launch Instant Payment Service 'Fawran' in March. The service is within the QCB's pioneering and innovative initiatives in the fields of payment and digital transformation in Qatar, enabling instant, low-cost money transfers between citizens and residents, 24/7.

🇩🇪 Impressive numbers published by Visa Germany for financial year 2023. The payment volume increased by 25 percent, the number of debit cards increases by 33% (to now around 16 million). Learn more by clicking on this link.

OPEN BANKING NEWS

🇨🇴 SoyYo has integrated with Redeban to enhance transactional security and facilitate payments in Colombia, creating a digital identity and fraud prevention ecosystem that supports user interaction through Open Finance. This alliance drives innovation and financial inclusion, empowering users with more digital identity control.

🇦🇪 Data intelligence platform Bud Financial (Bud) is joining forces with FinTech Galaxy to strengthen the Open Banking scene in the MENA region and transform how financial institutions (FIs), FinTechs, and businesses integrate and leverage customer data.

REGTECH NEWS

🇺🇸 Hummingbird, a compliance and risk platform, announces the launch of Automations, a powerful new product for boosting compliance productivity, reducing risk, and lowering costs. This offers compliance teams visual automation tools to streamline manual tasks, saving time and effort while enhancing oversight.

DIGITAL BANKING NEWS

🇬🇧 Revolut launches Robo-Advisor in EEA to automate investing. The new product is advantageous for those who don't have the time to actively invest, or have limited or no trading experience. It assigns a portfolio taking into account customers’ personal circumstances like risk tolerance and financial goals.

DONEDEAL FUNDING NEWS

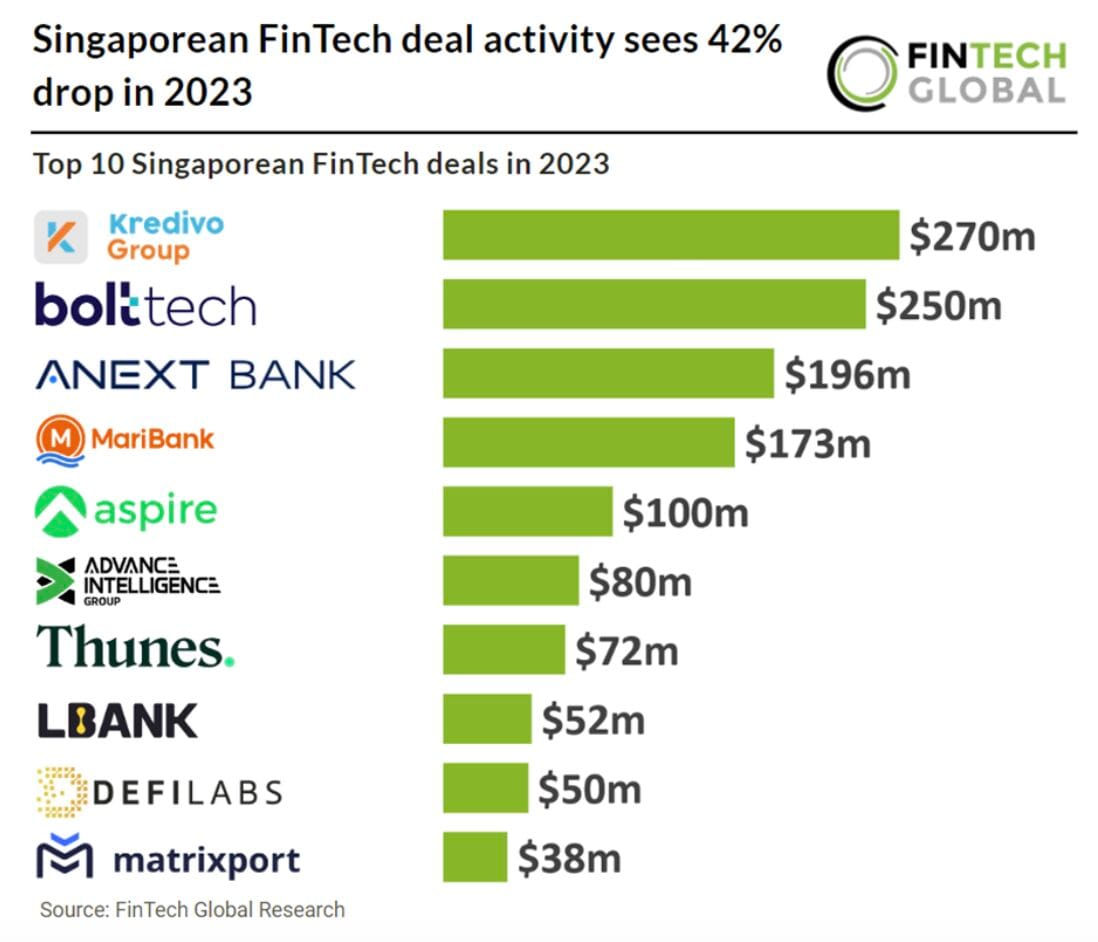

🇸🇬 Singaporean FinTech deal activity sees 42% drop in 2023. Take a look at the key Singaporean FinTech investment stats in 2023. Click here to learn more.

Last week we saw 2 official FinTech deals in Europe for a total amount of €51.3m raised with one deal in the Netherlands and one in Sweden. Read the complete Blackfin Tech article here

🇺🇸 Ex-PayPal and Venmo vets launch Meso to connect crypto wallets with bank accounts, announce $9.5M seed round. The on-ramp product integrates bank accounts and cards within crypto applications, allowing the latter to onboard users without first sending them off to a centralized exchange to fund their wallets.

MOVERS & SHAKERS

🇺🇸 BNY Mellon names Julie Gerdeman global head, data and analytics. Gerdeman joins BNY Mellon from Everstream Analytics, where as CEO she led the supply-chain transformation of global organizations through the application of artificial intelligence and predictive analytics, and before that CEO of HealthPay24.

🏴 FinTech Wales announces Sarah Kocianski as new CEO. A FinTech and insurtech strategist with over a decade of industry experience, Sarah has worked with global organisations, scaleups and startups from across the financial services industry and beyond, including major banks and insurers, healthtechs and retailers.

🇰🇷 Toss Bank taps ex-DGB CFO, Rhee Eun-mi, as new CEO. The bank’s CEO recommendation committee picked Rhee as the sole candidate for the next top leadership position in recognition of her deep understanding of the banking industry and excellence in making strategic decisions.

🇬🇧 Ozone API, a FinTech in the open banking sector, announces the appointment of former Virgin Money CEO, Dame Jayne-Anne Gadhia as the Chair of its Board. Dame Jayne-Anne has enjoyed a distinguished career spanning over three decades in financial services and technology. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()