💸 Deel Hits $17.3B & Upgrade Climbs to $7.3B

Hey FinTech Fanatic!

Two big rounds, two huge valuations.

Upgrade just raised $165 million at a $7.3 billion valuation.

The online lender, founded by LendingClub’s Renaud Laplanche, hasn’t raised since 2021 and has been profitable for three years. With annualized revenue now above $1 billion, Upgrade says it’s 12–18 months away from an IPO.

Deel meanwhile announced a $300 million Series E at a $17.3 billion valuation 🤯

The global payroll platform brought in Ribbit Capital alongside long-time investors a16z and Coatue, and has now crossed $1 billion ARR with three consecutive years of profitability.

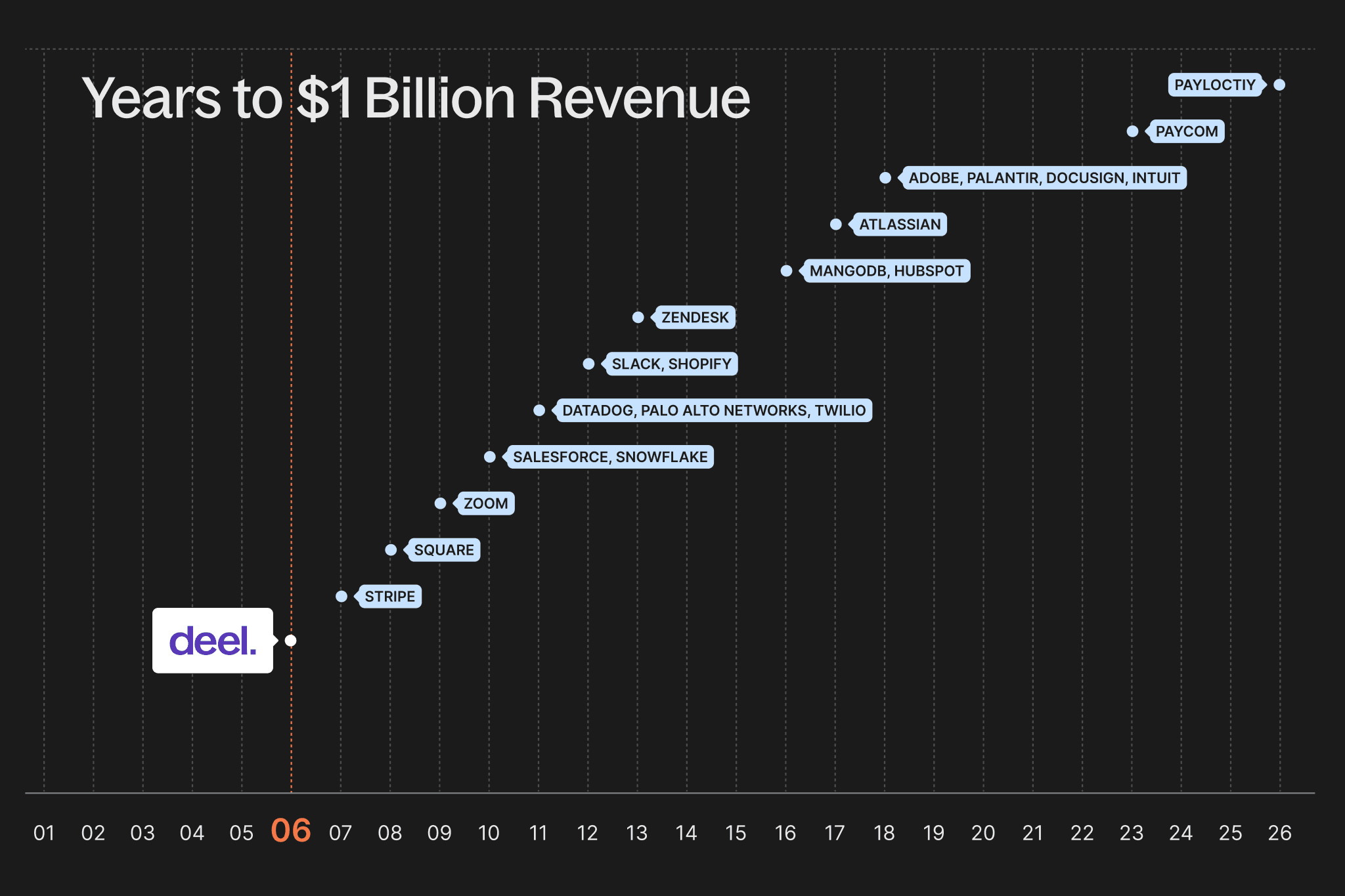

👉 Fun fact: Deel hit the $1B revenue mark faster than most high-growth tech peers — thanks to an organic growth engine that scaled at lightning speed (see chart below).

Two FinTechs, both scaling fast, and setting the bar high for the rest of the industry.

Enjoy your weekend, but before you do, scroll down for the latest FinTech updates!

Cheers,

POST OF THE DAY

➡️ Everything you need to know about Network Tokenization in Payments.

Here's a beginner-friendly step-by-step guide👇

FINTECH NEWS

🇺🇸 Brex announces partnership with Oracle as the first FinTech global issuer to power B2B payments in Oracle Fusion Cloud ERP. Leveraging Oracle’s integration with Mastercard, Brex will power Oracle’s global, embedded B2B payments solution in Oracle Cloud ERP, enabling customers to select Brex virtual cards directly from within payables workflows.

PODCAST

🎤 Episode 111 - Understanding Digital Money by Dashdevs. In this episode of the FinTech Garden podcast, hosted by Igor Tomych, presents an insightful conversation with Jonny Fry, Head of Digital Assets Strategy at ClearBank. The episode focuses on the evolving landscape of digital currencies, examining their potential impact on the future of payments and financial systems.

Understanding Digital Money by Dashdevs

PAYMENTS NEWS

🇬🇧 Solidgate has launched Routing 2.0 in Beta, a major upgrade to its payment orchestration engine, designed to give merchants greater control and flexibility over their payment flows. Accessible through the Solidgate HUB, this intuitive interface lets payment teams adjust, test, and optimize routing logic in real time, without needing developer support.

🇬🇧 Klarna has launched Klarna Balance and the Klarna Card in the UK, expanding into everyday banking. Balance lets users hold e-money and earn rewards, while the Card offers debit payments with optional credit. Following FCA approval and global success, Klarna continues to grow its presence in retail banking.

🇺🇸 B2B FinTech Yaspa on using its homegrown rebrand to break America. The B2B open banking payments provider, which works primarily within the iGaming (online gambling) sector, is launching into the US with a refreshed brand and visual identity.

🇮🇳 Razorpay revenue jumps 65% in FY25. The company’s audited figures show revenue rising to Rs 3,783 crore from Rs 2,296 crore a year earlier, while gross profit climbed 41% to Rs 1,277 crore. Despite the top-line growth, Razorpay posted a post-ESOP loss of Rs 1,209 crore, which it attributed to restructuring costs and tax payments tied to its redomiciling to India.

🇺🇸 Plaid has introduced LendScore, a new credit risk score that uses real-time cash flow data and insights from nearly 1 million daily connections across the Plaid Network. Designed to address gaps in traditional credit assessments, LendScore offers lenders a more accurate, up-to-date view of borrower risk.

🇺🇸 FIS introduces Smart Basket, transforming the shopping experience through real-time purchase intelligence. Smart Basket aims to reshape the future of intelligent commerce, using real-time intelligence to analyze purchase transactions and deliver targeted promotions, bringing greater value and convenience for today’s consumers.

🇫🇷 Mastercard invests €250 million in three new data centres in France. With over a dozen existing data centres across the region, Mastercard aims to ensure always-on payment capabilities, minimize disruptions from natural or geopolitical events, and maintain the high level of security and trust consumers expect every time they use their card.

🇺🇸 Dash Solutions launches dashClinical, strengthening leadership in clinical trial payments. The launch includes technological updates and strategic senior hires to better support the company’s global customer base of sponsors, site networks, clinical research organizations, and CTMS platforms, now spanning 80 countries and continuing to expand.

FINTECH RUNNING CLUB

🏃➡️ The FRC family keeps growing! 🌍 We’re thrilled to welcome Tobi John, our new London host. Read more about his journey below and join him for his debut run!

REGTECH NEWS

🇺🇸 Tech, Crypto-focused bank founded by billionaire Trump supporter, Erebor, wins US approval. A new US bank that aims to serve emerging tech firms in sectors such as crypto and artificial intelligence has received conditional approval to operate from the Office of the Comptroller of the Currency.

🇻🇳 Police seize $34m from NextTech founder in crypto fraud case. Hanoi police have seized assets valued at US$34 million from Nguyen Hoa Binh, a well-known investor on Shark Tank Vietnam and chairman of tech company NextTech, following his arrest for alleged cryptocurrency fraud.

DIGITAL BANKING NEWS

🇺🇸 FinTech giant SoFi expanding Utah operations. As part of the agreement, SoFi, a digital finance company with FDIC-insured online banking, is planning to add 410 new, high-paying jobs and invest $3 million in the Beehive State over the next decade. Keep reading

🇧🇷 Nu Holdings ranked #4 on Fortune’s 100 Fastest-Growing Companies List. The high ranking is a clear testament to the efficacy of Nu’s business model and its relentless focus on customer-centric technology and operational efficiency. Nu’s position at #4 underscores its ability to scale profitably in the highly competitive financial services sector.

🇩🇪 Trade Republic launches Bond ETFs after distributing €2.5 billion in interest. The digital bank said customers can now buy bond exchange-traded funds with defined maturity dates, earning yields that run 1 to 3 percentage points above typical instant-access savings accounts.

🇩🇪 BlackRock-backed Scalable Capital eyes European listing after securing banking licence. An initial public offering in Europe would be the “ideal scenario” for Munich-based wealthtech Scalable Capital, co-CEO Erik Podzuweit said, as it weighs up potential exit options after securing a €1.5bn valuation this summer.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Paxos mistakenly issues $300 trillion of PayPal stablecoin. Paxos immediately identified the error and burned the excess PYUSD, with the company stating there is no security breach and customer funds are safe. The erroneous transaction was visible on Etherscan and was quietly reversed within minutes.

🇸🇬 MAS launches BLOOM to settle tokenized Liabilities and Stablecoins. The project will deal with operational and financial risks. BLOOM will be dealing with G10 and major Asian currencies. The project aims at home and international settlements. It will also enhance efficiency in the process of corporate and institutional transactions.

PARTNERSHIPS

🇺🇸 ACI Worldwide and BitPay partner to power crypto and stablecoin payments for global merchants and payment service providers. By integrating BitPay, ACI further differentiates its Payments Orchestration Platform, enabling seamless acceptance and management of digital currencies, including stablecoins, as a strategic complement to traditional payment rails.

🇿🇦 Ripple and Absa Bank launch secure digital asset custody in South Africa. Absa Bank will integrate Ripple’s institutional-grade digital asset custody solution into its offerings. This allows Absa to provide regulated, secure, and scalable custody of tokenized assets such as cryptocurrencies for its clients.

🇺🇸 Quidkey has chosen TransferMate to significantly reduce credit card transaction fees for both domestic and international payments. Through this embedded solution, both companies will harness Open Banking technology to replace costly card rails with a faster, more efficient model of payments.

🇺🇸 Galileo and SoFi’s Tech Platform join the AWS partner network to deliver scalable payments worldwide. “By joining the AWS Partner Network, we’re meeting businesses where they already are, making it faster and easier for them to access our financial technology and bring new financial products to their customers,” said Sandy Weil, Chief Revenue Officer at Galileo.

🌍 OKX is expanding its partnership with Standard Chartered into the EEA, bringing its innovative collateral mirroring program. This service allows clients to securely hold assets with a Global Systemically Important Bank (G-SIB) while mirroring balances on OKX for trading, reducing counterparty risk, and enhancing asset security.

DONEDEAL FUNDING NEWS

🇺🇸 Deel has raised $300m at a $17.3b valuation. With this Series E, Deel will double down on expanding its infrastructure, advancing AI-powered payroll and HR products, and laying the foundation to serve 100 million employees worldwide. Keep reading

🇺🇸 FinTech startup Upgrade is valued at $7.3 billion in a new funding round. LendingClub founder Renaud Laplanche mentioned that Upgrade is looking to IPO but wanted additional capital for its balance sheet in the meantime. He said the company is also establishing a new valuation as it begins to offer employee liquidity.

🇬🇧 Hyperlayer lands £30m to help legacy lenders take on FinTechs. The firm’s tech is designed to work alongside existing banking infrastructure, which it says allows the legacy businesses to launch new products without complexity. Read more

🇩🇪 Bees & Bears raises €5M to scale embedded finance platform. The seed funding will support rapid scaling to meet demand, expansion into commercial and industrial segments, and entry into nearby European markets. Bees & Bears also plans to triple its headcount and further strengthen its market position.

🌍 YZi Labs leads $50m financing round in Better Payment Network to power global stablecoin payments. The newly raised funds will primarily be used to establish initial on-chain liquidity pools for stablecoin-to-stablecoin corridors and to develop an early market-making ecosystem.

🇮🇪 Irish FinTech lender Teybridge Capital Europe secures €50 million funding line to expand working-capital solutions. The funding expands the reach of the BRIDGE platform and strengthens Teybridge’s offering, while maintaining its agility and focus on reliable access to working capital.

🇺🇸 FinTech Glow raises $65 million. The funding values Glow at $325 million and will be used to expand into new markets and develop new products. Glow works with mobile operators and handset sellers to offer loans at the point of sale for customers to buy phones, helping carriers offload costs associated with financing those sales.

M&A

🇺🇸 Kraken expands US derivatives business in $100 million IG Deal. The acquisition gives Kraken a license to operate as a designated contract market in the US, paving the way for it to offer its own derivative products, such as perpetual futures and round-the-clock trading, in the market instead of routing them via other venues.

🇰🇷 Binance completes acquisition of South Korea’s Gopax crypto exchange. Gopax, a licensed local exchange that offers verified accounts with real names, will now integrate Binance’s advanced trading tools, worldwide liquidity, and operational assistance.

MOVERS AND SHAKERS

🇬🇧 GoCardless appoints Borja Valiente as its new Managing Director for EMEA. In his new role, he will lead the company's revenue growth strategy and customer acquisition in key markets. In addition to the change, the company has appointed Hamish Wood as Vice President of Customer Success for the region, with the mission of promoting a customer-centric culture.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()