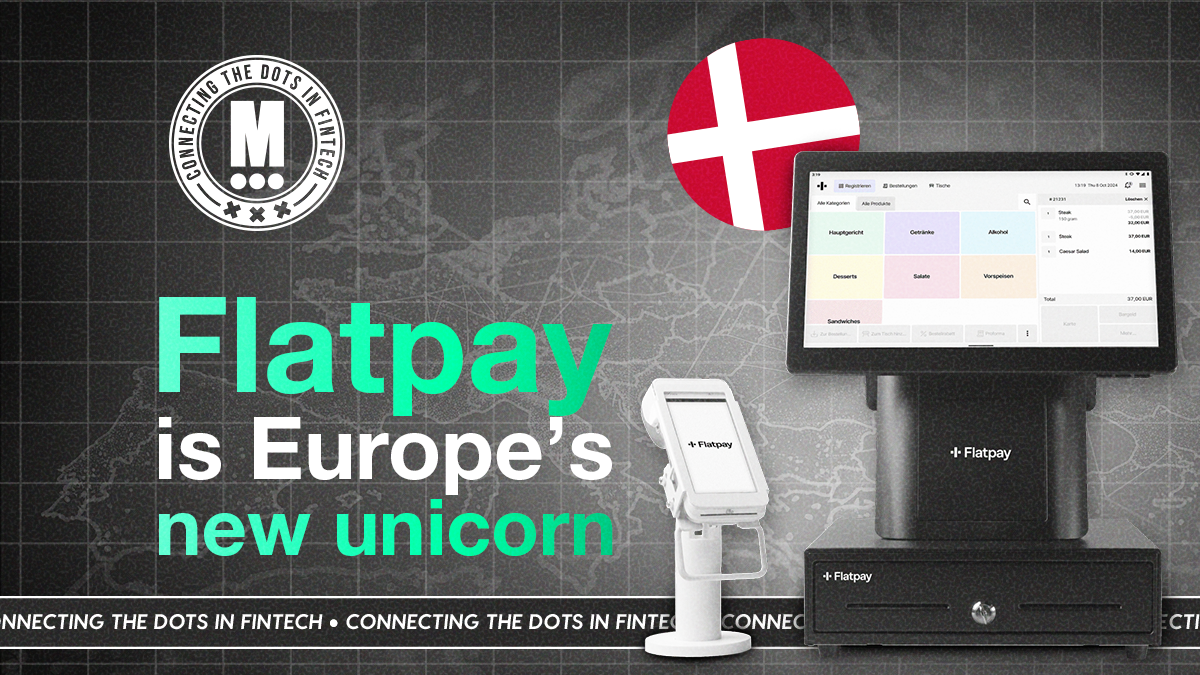

Danish Startup Flatpay Joins the European FinTech Unicorn Club

Hey FinTech Fanatic!

Flatpay has reached a valuation of €1.5 billion, becoming one of Europe’s newest FinTech unicorns.

The Danish startup focuses on small merchants and has grown to around 60,000 customers, up from 7,000 in April 2024.

The company says it crossed €100 million in ARR in October and expects that number to increase by nearly €1 million a day. Its plan for 2026 is to grow ARR to between €400 and €500 million.

To fuel this expansion, Flatpay raised €145 million in fresh funding backed by AVP Growth, Smash Capital, and Dawn Capital. The company also plans to move into one or two new markets next year, with job postings suggesting that the Netherlands could be next.

Flatpay employs 1,500 people and expects to double its headcount by the end of next year. They continue to bet on in-person onboarding as its key differentiator, arguing that hands-on support helps win over SMBs that want simplicity.

The company is also exploring a deeper move into FinTech with a future banking suite and is testing voice AI agents, though it sees these additions as part of a gradual adoption process for merchants.

Scroll down for more FinTech stories shaping the week, and I'll be back in your inbox tomorrow!

Cheers,

FINTECH NEWS

🇩🇰 Danish startup FlatPay joins the club of European FinTech unicorns to track. Flatpay’s own valuation has grown at a similarly fast pace. Now valued at €1.5 billion ($1.75 billion), the Danish startup reached unicorn status in only three years. However, while CEO and co-founder Sander Janca-Jensen is proud of this accomplishment, he has his sights set on another metric: annual recurring revenue.

🇬🇧 Santander’s Ebury weighs stake sale after London IPO delay. Prospective investors have been discussing the possibility of acquiring a minority stake in the group. Discussions are at an early stage, and the structure of a potential deal hasn’t been finalized, with an IPO remaining an option at a later stage.

🇺🇸 eToro enables 24/5 trading for all S&P 500 and Nasdaq 100 stocks. Online broker eToro announced it has expanded its 24/5 trading offering to cover all stocks in the S&P 500 and Nasdaq 100, allowing users to trade the most followed US equities around the clock, 5 days a week.

🇬🇧 Nearly half of UK FinTech founders consider shifting business overseas. According to a FinTech Founders report, more than a third rated the Treasury’s approach as “poor” and 13% as “awful,” while three-quarters said the UK is not positioned as a global FinTech leader. Concerns are mounting that a proposed exit tax in the upcoming Budget could further undermine investment and push founders overseas.

PAYMENTS NEWS

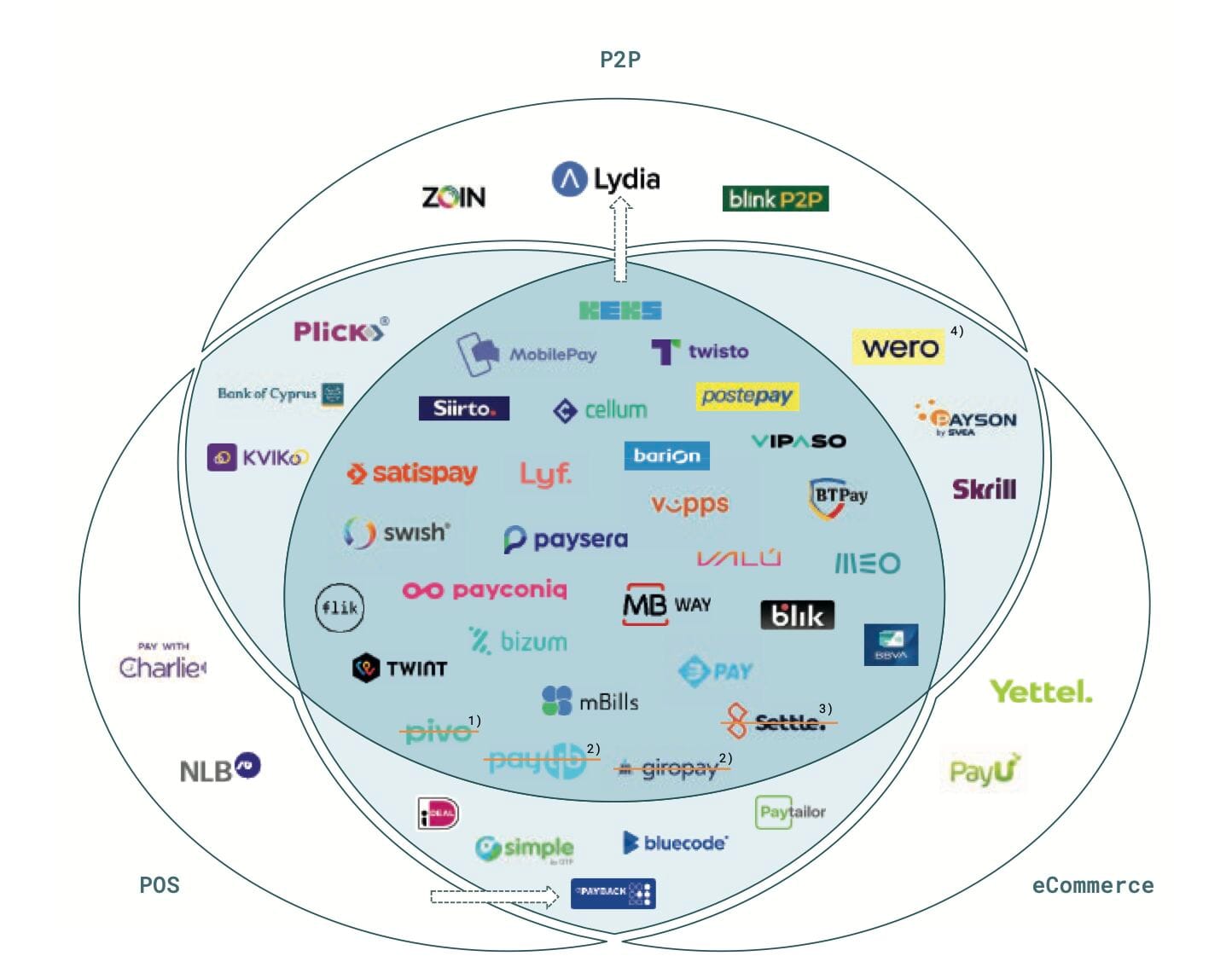

🌍 Europe’s local payment systems are gaining ground, and EPI Company’s Wero is helping reshape the landscape as domestic mobile solutions begin to outpace cards👇

🌏 Visa leans into AI-enabled payments and stablecoins to stay ahead of the game in Asia. Visa introduced AI-enabled payments that let consumers use AI agents to shop and complete secure, tokenized transactions. Additionally, a stablecoin settlement pilot is allowing select partners to make payments using stablecoins across supported blockchains.

🇧🇷 Pix celebrated its fifth anniversary as the country’s main payment method. According to the Central Bank, Pix transactions reached BRL 28 trillion through October. Originally designed for instant transfers between individuals, Pix has grown to include features like Pix cobrança and Pix automático, and is now used by 170 million adults and over 20 million companies.

🇦🇪 SIB launches digital payments and card tokenization platform, SIB Pay. One of the key features of SIB Pay is card tokenization, which replaces a user’s debit or credit card information with a randomly-generated token usable only with specific merchants.

🇬🇧 Revolut expands travel footprint by launching a new payments partnership with online travel platform Booking.com. Expanding Revolut’s innovative travel offering for customers, millions of Booking. com customers can now pay via Revolut Pay, Revolut’s streamlined one-click checkout solution, and benefit from a range of currencies.

🇮🇳 PayU secures RBI approval to run online, offline & global payments. The approval covers both inward and outward cross-border flows, positioning PayU to deliver a unified, compliant, and seamless suite of payment acceptance, settlement, and international transaction capabilities to merchants across all touchpoints.

🌍 PayPal and KKR renew agreement for European pay-later receivables. New agreement enables KKR to purchase up to €65 billion of eligible current and future PayPal buy now, pay later loans originated in Europe through March 2028. PayPal will continue to remain responsible for all customer-facing activities, including underwriting and servicing, associated with its European BNPL products.

🌍JP Morgan builds a unified payments backbone for digital and FinTech platforms worldwide. APAC’s payments landscape is shaped by fast-evolving digital adoption and significant market diversity. JP Morgan’s architectural response has been to redesign its infrastructure around interoperability. Additionally, J.P. Morgan is to cut 33 jobs as its Luxembourg payments unit shuts. The US banking group has decided to cease operations of J.P. Morgan Mobility Payments Solutions. It cited the company’s “performance and profitability” as reasons for the closure.

🇺🇸 Finzly brings agentic AI to back-end payments processing. The payments FinTech's agents, built on AWS cloud infrastructure, are designed to assist banks and credit unions with some of the manual steps involved in back-end payments processing and operations.

🇦🇺 Australian payments firm Vault becomes Mastercard Principal Issuer to boost innovation and security. This new collaboration unlocks faster innovation, greater agility, and enhanced security for its clients and cardholders alike. Keep reading

OPEN BANKING NEWS

🇺🇸 JPMorgan secures deals with FinTech aggregators over fees to access data. The deals aim to make open banking “safer and more sustainable,” while still allowing consumers secure access to FinTech services. The move follows the CFPB’s new open banking rule, which sets standards for data sharing between banks and FinTechs.

REGTECH NEWS

🇧🇷 The Central Bank of Brazil fined PayPal R$5 million for failing to comply with specific rules of the national instant payment system, Pix. The fine was imposed because PayPal did not meet the regulatory requirements for participation in the Pix ecosystem.

🇺🇸 New iDenfy solution brings instant license checks to KYC workflows. Combined with other KYC tools, companies will now have a new workflow option that instantly verifies any U.S. citizen's driver’s license faster. This will help ensure a higher level of accuracy while verifying new users in the market during the digital onboarding process.

DIGITAL BANKING NEWS

🇮🇪 Revolut’s Irish mortgage launch set to drift into 2026. Revolut’s more than three million customers in Ireland will present a significant opportunity to market its mortgage offering and challenge the three Irish banks that accounted for 92% of the €12.6 billion mortgages issued last year.

🇧🇷 Nubank says that the use of AI is already helping to expand credit limits for customers in Brazil. CFO Guilherme Lago said that the use of technology is in a phase of gradual adoption, having improved credit analysis and impacted growth. Read more

🇺🇸 Walmart, crypto firms, and FinTechs chase bank charters to offer full‑service financial access. Walmart, Amazon, and major crypto firms are pursuing national trust charters as regulators show new openness to nonbank financial players. Companies like Ripple, Coinbase, and Wise aim to safeguard assets and issue stablecoins, drawing resistance from traditional banks.

🇧🇷 The Central Bank will apply the same risk assessment and control rules to banks and non-banking institutions. This shift is part of the evolution of the supervisory process. It occurs at a time when the regulator has 1,800 authorized institutions. In addition, there will possibly be "100 to 150" applications related to virtual assets.

🇬🇧 LemFi rolls out savings accounts for UK immigrants. LemFi is moving to expand beyond remittances with new UK savings accounts offering 3.92% interest rates, targeting immigrants who face barriers accessing traditional financial services despite strong financial backgrounds.

🇺🇸 First digital asset bank in the U.S. approved for Norfolk. Governor Jim Pillen said the move signals Nebraska’s intent to lead in digital payments innovation, declaring the state “open for business” to the digital asset industry. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Blockchain.com plans to go Public in 2026 and adds Lane Kasselman as a co-CEO to lead the charge. The company is considering both a traditional IPO and a SPAC, with Citi advising, and has selected Dallas as its new U.S. headquarters. Its IPO ambitions come as several other crypto firms explore listings amid improving market and regulatory conditions.

🇦🇷 Banks are prepared to offer crypto services in Argentina. Gabriel Campa, Head of Digital Assets at Towerbank, believes that some companies will develop their crypto solutions directly, while others will seek to form alliances with third parties for this purpose.

PARTNERSHIPS

🇸🇬 UBS has entered a strategic partnership with Ant International. UBS Digital Cash will support Ant International’s global treasury operations with blockchain-based payments, enabling greater efficiency, transparency, and security. Meanwhile, UBS applies this expertise to enhance cross-border payment solutions for its clients.

DONEDEAL FUNDING NEWS

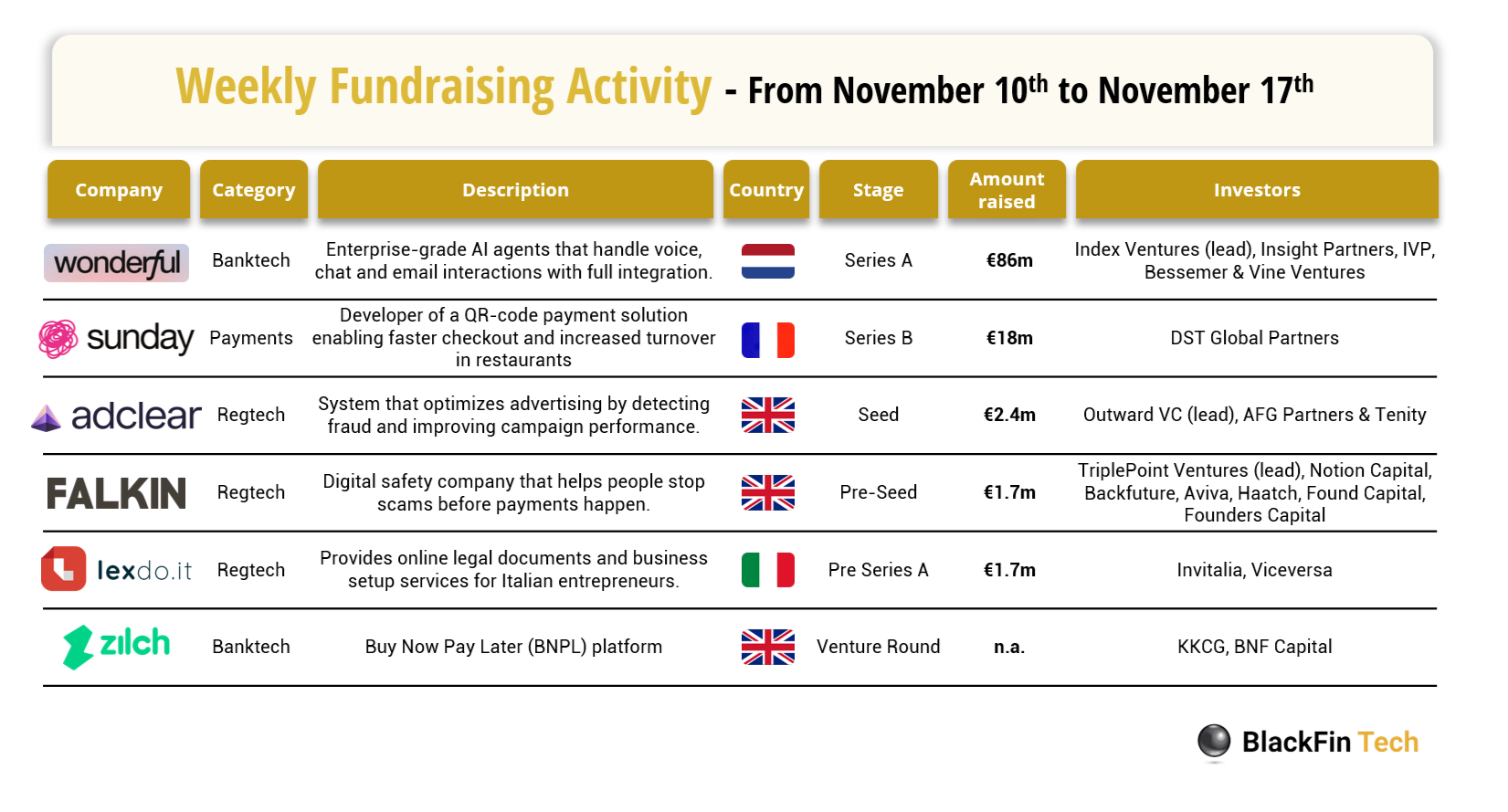

💰 Over the last week, there were six FinTech deals in Europe, raising a total of €110 million, including three transactions in the United Kingdom, one in France, one in the Netherlands, and one in Italy.

M&A

🇬🇧 Iwoca reportedly exploring sale options worth over £1bn, with banks and payments companies identified as potential acquirers. The London-based FinTech, whose backers include Citi and Barclays, has been consulting with advisers about a sale process that could commence early next year.

🇨🇱 Monnet Payments strengthens its presence in Chile after acquiring ETpay. With this move, the company expects to reach 70 million transactions in Chile and process USD 5 billion by the end of 2025. The acquisition adds 90 to 100 new Chilean clients and around 20 global clients from Mexico to Monnet’s portfolio.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()