🇨🇼 Curacao based Girasol Payment Solutions has acquired Colombian FinTech FinZi

Hey FinTech Fanatic!

From the chilly climes of NYC, it's a pleasure to share some FinTech news from sunny Curacao, a place I fondly regard as my second home.

Curacao based Girasol Payment Solutions has acquired Colombian FinTech company FinZi to enter the Colombian and South American markets. This strategic move leverages FinZi's infrastructure and market presence to expand Girasol's services in the region. FinZi, known for its digital wallet catering to over 250,000 users, primarily targets the youth segment and offers a variety of financial products.

Marwan Rozier, CEO and Founder of Girasol Payment Solutions, stated that Colombia has always been a key market for Girasol, and entering it with FinZi is an exciting prospect.

The acquisition aligns with Girasol's vision to become a leading digital payment provider in the Caribbean and Latin America. FinZi will continue focusing on its digital wallet services, while Girasol plans to implement its technological solutions and expand into the B2B segment.

The partnership aims to strengthen FinZi's market presence and introduce new products and services, with a goal to reach 1 million users by the end of 2024.

I wish them all the best and I hope to hear more FinTech updates from the Caribbean in the future!

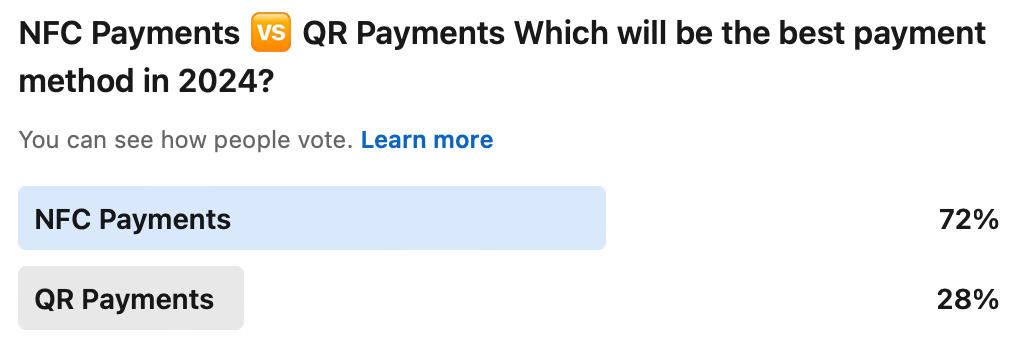

Furthermore, the results from my payments poll last week seem pretty clear:

Enjoy more global FinTech updates below👇 and I'll be back with big PayPal news that will "shock the world" 😉 So stay tuned!

Cheers,

Marcel

SPONSORED CONTENT

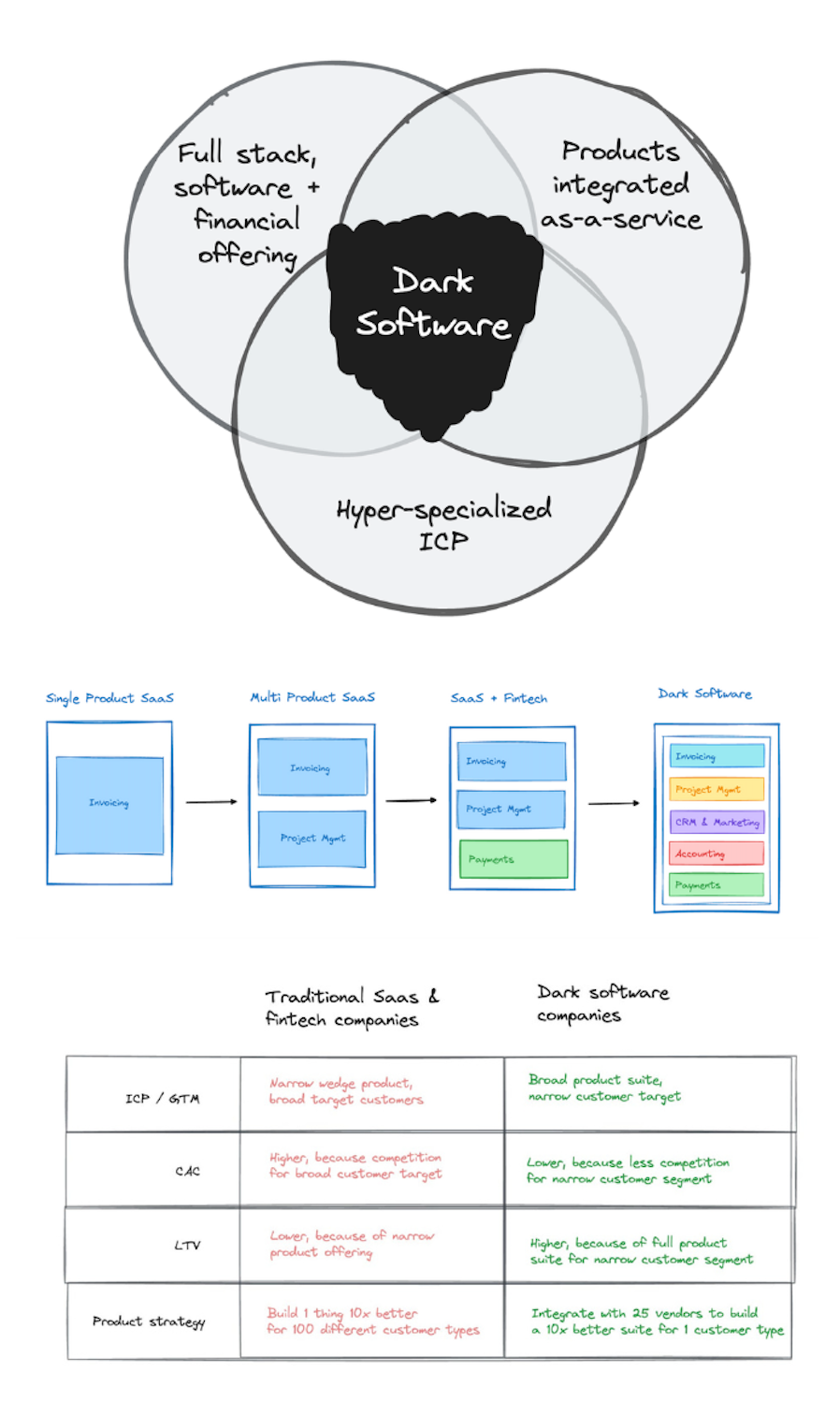

POST OF THE DAY

Dark software: a new model for SaaS and FinTech?

#FINTECHREPORT

What is FinTech? Check out this FinTech report by McKinsey & Company and gain valuable insights into the evolving landscape of financial technology. Link here

INSIGHTS

🇺🇸 Venmo, Cash App, PayPal, Zelle and other payment apps may be convenient ways to send cash with a few taps of your smartphone, but they’re a breeding ground for theft, Manhattan District Attorney Alvin Bragg tells CNN. The issue has gotten so out of hand in New York that Bragg has sent a letter to the popular apps demanding that they put in more security measures.

FINTECH NEWS

Uncapped launches its new product, Line of Credit, tailored for high-growth brands and retailers. This new product provides sellers with a pre-agreed, committed credit facility, ensuring funding certainty that can be accessed within 48 hours. Read more

PayPal has now enabled the withdrawal of funds to local bank partners in Costa Rica, El Salvador, and Panama. This functionality is already available in other countries where PayPal operates, and with the addition of these countries, it expands further in LatAm, including Argentina, Colombia, Peru, and the Dominican Republic.

🇬🇧 BNP Paribas launches UK fintech incubator. The lab is inviting applications from SMEs - rather than traditional fintechs - for an incubator programme focused on harnessing external data and insights to boost engagement with financial services customers.

🇺🇸 Klarna is launching a monthly subscription plan in the U.S. called "Klarna Plus" to lock in its heaviest users ahead of an initial public offering this year, the company told CNBC. Subscribers to this plan, enjoy waived service fees, double rewards points, and exclusive discounts from partners.

🇺🇸 Brex is cutting 20% of its workforce and shaking up senior management ranks in a new effort to slash its cash burn, as the fintech firm grapples with slower revenue growth. The company told employees in an email that COO Michael Tannenbaum and CTO Cosmin Nicolaescu are both giving up their positions.

🇧🇷 Digital Credit Fintech Creditas, helmed by CEO Sergio Furio, announced that it does not plan to go public in 2024, as its current priority is to balance the books and ensure the company can sustain itself independently.

🇬🇧 10x Banking founder Antony Jenkins says banking tech startup “on track” to triple client roster by 2025. 2024 has started sure-footed for 10x Banking after securing a multi-million-pound funding round and Jenkins is upbeat about the year ahead, pointing to a new 10x Banking product going live in the market, and big-ticket deals close to being signed around the world.

Fiserv’s uChoose lets BP and Amoco customers pay at the pump. Through an integration with the Engage People loyalty network and fuel rewards technology provider Velocity Logic, uChoose Rewards members can redeem points for fuel purchases at the pump, saving 50 cents per gallon, up to 20 gallons.

PAYMENTS NEWS

PayFacs drive 47% more digital wallet payments than in retail. According to a recent study, PayFacs processed 38% of all payment transactions via digital wallets in the last 12 months — the second-highest share across four industry segments, with retail processing only 26% of payments via digital wallet.

🇫🇷 Ingenico builds smartPOS device on Cybersource fraud management platform. This collaboration delivers an efficient, ready-to-use commerce solution to authorize in-store card transaction processes across geographies, all on one platform. Read more

🇨🇭 Worldline and Commerzbank expand partnership to include instant payments in Switzerland. This extension enables Commerzbank to offer its customers in Austria, France, Italy, the Netherlands, Spain and the United Kingdom the sending and receiving of real-time transfers in euros.

🇺🇸 Mastercard and The Clearing House extend partnership on real-time payments. The partnership continues Mastercard’s role as the exclusive instant payments software provider for TCH’s RTP network, enabling both companies to integrate new instant payment use cases across a range of payment flows.

REGTECH NEWS

🇪🇺 EU agrees on stricter Anti-Money Laundering rules. The new rules aim to close regulatory loopholes and ensure illicit money from criminal activities and terrorism cannot be laundered through Europe's financial system. Read on

DIGITAL BANKING NEWS

🇩🇪 Vivid Money has launched Vivid Business, a financial platform designed for small and medium-sized enterprises (SMEs). This new service extends beyond private individuals and the self-employed, allowing companies with team members to manage their finances effectively.

🇲🇽 Nubank’s growth rate in Mexico surpassed that of Brazil on many occasions, with a portfolio that includes credit card, savings account, debit card, and personal loans, serving over 5.5 million customers in January 2024. More on that here

🇬🇧 Colombian tycoon Gilinski joins daughter on Metro Bank board. Metro Bank has appointed Colombian billionaire Jaime Gilinski Bacal, who owns almost a 53% stake in the lender, as a non-executive director. He will officially join the board once regulatory approvals and other formalities are completed.

🇲🇽 Santander Mexico to launch digital bank 'soon,' executive says. The bank’s digital product, known as Openbank, received its license to operate in the country in July. Openbank's launch "will be this year, soon," said Matias Nunez, Santander Mexico's head of digital and innovation.

🇨🇱 Banco Itaú Chile has launched "itu," a new digital checking account aimed at transforming the financial lives of young Chileans. This new banking product has a digital onboarding process directly through the “itu” app, which is available on Google Play and the App Store. Read more

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Digital assets startup Elwood receives FCA regulatory approval as a service company. This authorization applies to Elwood's execution management system ("EMS") in relation to security tokens and derivatives. The EMS platform allows clients to connect to global crypto exchanges and OTC venues.

🇺🇸 BlackRock spot ether ETF decision delayed by SEC. This delay was largely expected, with the SEC also delaying decisions on Fidelity’s proposed fund on Jan. 18. The decision comes just weeks after the SEC approved nearly a dozen spot bitcoin ETFs.

DONEDEAL FUNDING NEWS

🇩🇰 Danish fintech Safty raises €11.3 million. Safty currently collaborates with financial institutions such as Lunar and Sønderjysk Forsikring and will use the funding for further predictive product development and extension to other Nordic countries.

🇺🇸 ModernFi raises $18.7M series A to power deposit growth at community and regional banks. ModernFi helps banks thrive in an increasingly competitive banking landscape, and attract and retain clients that might otherwise go to the largest banking institutions or leave the banking sector entirely.

🇬🇧 WealthKernel secures £6 Million in series A extension funding. “The new funding will help fuel our commitment to strengthening our market presence and continue to bring innovative solutions to the wealth management industry,” said the company CEO.

🇺🇸 BillingPlatform secures $90 Million growth equity investment from FTV Capital. The new funding will accelerate innovation, product development and go-to-market expansion for the leading enterprise revenue lifecycle management platform. Read more

🇺🇸 Bilt nabs $3.1 billion valuation, Ken Chenault joins as Chairman. The startup raised equity in a transaction that more than doubles the startup’s valuation to $3.1 billion as consumers continue to flock to its loyalty program, which converts rental payments to points that can be used for air miles and other rewards.

M&As

🇦🇺 Prospa snaps up Zip SME loan business for $15.6m. Zip Co continues to wind down the operations of its Zip Business Capital ANZ subsidiary after reaching a deal to sell its loans business to Prospa for $15.6 million. Prospa will pay for the acquisition from existing warehouse funding arrangements and expects to settle this week.

Curacao based Girasol Payment Solutions has acquired Colombian FinTech company FinZi to enter the Colombian and South American markets. The acquisition occurred as Girasol saw a significant opportunity to enter the Colombian market through FinZi, utilizing its infrastructure, local team, brand, and market presence.

Allianz Direct set to buy Accel-backed Luko for €5m, according to a person with direct knowledge of the matter. The deal still needs to be green-lighted by the French commercial court in charge of the case and a final ruling is expected today.

🇫🇷 Societe Generale mulls putting digital Bank Shine up for sale, newspaper Les Echos reported on Wednesday, citing unnamed sources. The report said the lender was in the process of approaching potential buyers of the business, citing several unnamed sources.

MOVERS & SHAKERS

🇬🇧 DNA Payments Group appoints Adyen’s Jan-Pieter Lips as CEO. JP will be responsible for DNA Payments’ next period of growth as the company continues to develop and provide simple, unified payments into fast growing vertical market sectors such as restaurants and specialist retail.

🇺🇸 Bread Financial names Allegra Driscoll executive vice president and CTO. Ms. Driscoll's proven track record as an innovative and visionary leader combined with her deep understanding of financial services will be invaluable as the firm continues its tech innovation and modernization.

🇺🇸 US fintech DailyPay creates 293 in Belfast jobs as part of a £24 million investment in Northern Ireland. The positions will have an average salary of £42,500 a year, adding £12 million annually to the local economy, according to Invest NI, which helped secure the move.

🇭🇺 Seon welcomes Björn Heckel as CTO. Heckel brings an impressive track record in software development management, large-scale engineering operations and proven strength in building and motivating teams through periods of high growth.

🇬🇧 IFX Payments hires Graham Ridley from Barclays as strategy director. Graham will operate as a vital resource across the business, promoting scalable solutions to optimize performance throughout IFX Payments as each division grows. More here

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()