Crypto Exchange Bithumb Restructures Ahead of Potential IPO

Hey FinTech Fanatic!

Bithumb, South Korea’s second-largest exchange, is quietly setting the groundwork that could redefine its trajectory. On July 31, it will carve out its non-exchange operations into a separate entity, temporarily named “Bithumb A.”

The structure may seem complex, but the purpose is straightforward: to shield its core trading business from risks tied to other ventures and streamline operations ahead of a potential IPO.

The numbers tell their own story. After a relatively quiet stretch, Bithumb posted $110 million in net profit for 2024—a 5x increase YoY. While still behind Upbit’s figures, the rebound marks a notable shift and sets the stage for a possible listing on the Korean Exchange—or, as hinted last year, the Nasdaq.

Samsung Securities is set to lead the underwriting. Still, uncertainties remain—beyond valuation and listing venue, regulatory scrutiny looms large. The exchange has recently come under fire for KYC shortcomings and service disruptions during periods of political unrest.

Yet, the strategy seems deliberate. With compliance under the spotlight and investor expectations rising, Bithumb’s restructuring looks less like an internal reshuffle and more like a calculated step toward global relevance—one foot in Seoul, the other eyeing Wall Street.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 Airline Retailing: The Case for Fraud Prevention. In an industry facing tight margins and rising expectations, fraud is still draining profits. This eBook, by CellPoint Digital, explores how smart payment routing, modern fraud detection, and orchestration can transform airline retailing from reactive to proactive. Download and read here

FINTECH NEWS

🇬🇧 TradingView adds Interactive IL to list of partner brokers. This addition brings new trading opportunities in stocks, options, bonds, ETFs, and futures from your favorite charts. Using Interactive Israel on TradingView, traders can invest in various financial instruments.

🇭🇷 Robocash achieved the milestone of 40,000 investors. The platform strengthened its presence in Germany, Spain, and France. The majority of investors come from the IT and technology sectors, indicating a clear interest in digital financial solutions.

🇺🇸 FINRA fines J.P. Morgan Securities for alleged rule violations. The firm did not conduct reasonable reviews of notifications to determine whether the information provided was accurate, instead relying solely on automated features of the firm’s deal management system to help prevent inaccuracies from being input into the firm’s system.

🇺🇸 Discover Bank hit with $1.2 billion restitution order over interchange fees. In imposing the penalty, the FDIC says that for approximately 17 years, the bank misclassified millions of consumer credit cards as commercial, resulting in higher interchange fees for transactions processed on the Discover network.

🇺🇸 Affirm expands credit reporting with TransUnion to all pay-over-time products. New reporting will not impact scores in the near term, but it advances efforts to help consumers build credit histories and support positive credit outcomes. Keep reading

PAYMENTS NEWS

🌍 Adyen was hit by multiple DDoS attacks. The first attack occurred on Monday 21 around 7.00 pm, and affected customers in Europe. The issues were initially resolved, but a second DDoS attack was reported by the company at 8:35 p.m. Most functionalities were restored.

🇧🇷 Adyen bets on AI and new Pix features to boost online sales. It launched a frictionless payment solution via Open Finance, letting users pay without redirection. It will also pilot "Pix Automático" for recurring payments. These innovations aim to boost conversion rates, lower costs, and offer more payment options, especially for those without credit cards.

🇯🇵 Stripe launches new features for businesses in Japan, including PayPay integration. Businesses in the country can accept PayPay for online purchases. They can also get paid out faster for PayPay transactions now in as few as four business days instead of waiting until the end of the month.

🌍 Thunes launches new global business payments service. Thunes Business Payments is a new service aimed at helping enterprises, merchants, banks, and mobile wallet providers streamline international business transactions. The new solution provides access to local Automated Clearing House (ACH) systems in over 50 countries.

🇨🇱 Klap launches Visa and Mastercard acquiring services in collaboration with BPC. The move marks a step in Klap’s technological evolution, enabling it to offer modernised and secure payment processing services while improving operational scalability.

🇧🇪 Swift launches Case Management for cross-border payment investigations. The solution aims to help the community improve efficiency, time, and costs, offering a better experience for the customers. Case Management delivers data quality and accuracy through orchestration capabilities.

🇮🇹 Sale of Italian payments company PagoPA to mint and Poste hits valuation snag. The prospect of PagoPA changing hands, even though it would remain under state-controlled entities, has alarmed Italy's crowded banking sector, which is grappling with increasing competition in the digital payment business.

DIGITAL BANKING NEWS

🇺🇸 Virginia Community Bank announces its exit from BaaS. "The timeline for the expected return on invested capital extended beyond the Company's plan, and we decided to devote our energy to the core bank," CEO Jeff Dick said in a press release. Read more

🇬🇧 10x Banking announces new AI capabilities to accelerate core banking transformation. AI capabilities are being integrated into 10x Banking’s meta core to accelerate banking transformation, improve operational efficiency, and enhance decision-making for banks.

🇹🇭 Bank of Thailand approves three consortia to develop virtual banks. By approving this move led by Krungthai Bank, SCBX, and Ascend Money, the Bank of Thailand aims to support branchless banking and scale financial inclusion in the region.

🌍 SBS improves microfinance to expand financial access across Africa. Through the initiative, SBS plans to improve small-scale transactions, this is intended to ensure compliance with local regulations and support the growth aspirations of financial institutions using the SBP Core Amplitude solution.

🇬🇧 GB Bank breaks £2 billion balance sheet milestone, months after hitting profitability. The figures demonstrate the bank’s continued success as it looks to become the go-to funding partner of choice for UK SMEs, which are the engine room for growth in our economy.

🌎 Nubank and UOL Group company seek professionals who know cryptocurrency technology. Nubank is offering a hybrid IT Risk Analyst role that requires knowledge of crypto tech. The bank also launched new features like crypto price alerts and wallet transfers to enhance its crypto services.

🇮🇳 Tide launches formalisation tools to help MSMEs access government benefits. The collaboration introduces three new services on the Tide platform: GST Registration, Udyam Registration, and Scheme Discovery Reports, designed to accelerate formalisation and improve access to credit, subsidies, and incentives.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Oregon AG Rayfield files lawsuit against Coinbase for promoting high-risk cryptocurrencies. The complaint states that Coinbase has generated substantial revenues from transaction fees while Oregonians have faced severe losses from investments deemed risky and difficult to navigate.

🇰🇷 Bithumb to split into 2 as crypto exchange inches toward South Korean IPO. Bithumb Korea will be the entity seeking a public listing, local media reported, citing the country’s corporate registry. The other unit, Bithumb A, will oversee venture investments, asset management, and new business initiatives.

🇺🇸 Deutsche Bank and Standard Chartered eye U.S. crypto expansion. The timing of this move coincides with the significant policy shift under President Donald Trump’s renewed administration. Keep reading

🇬🇧 Paydify launches to enable businesses worldwide to accept crypto payments. Built to simplify fragmented blockchain infrastructure, Paydify turns complex crypto payments into a smooth checkout experience, with real-time stablecoin settlement and zero transaction fees.

🇺🇸 Fireblocks Network supports Circle's new USDC-based payment system. The company provides digital asset infrastructure, helping organisations of all sizes operate on the blockchain. It offers a secure and scalable platform for custody, tokenization, payments, settlements, and trading across a vast ecosystem.

PARTNERSHIPS

🇬🇧 FICO Platform helps Lloyds Banking Group say yes to more customers. By leveraging real-time data ingestion and advanced analytics, the platform has helped to drive a 2.5% credit card approval uplift, double new-to-bank consumer loan customers, and resolve over 50 system limitations, delivering faster, smarter, and more efficient lending decisions across products.

🇬🇧 Fiserv supports Vanquis Banking Group's digital transformation. Vanquis will become the first bank to select Fiserv’s next-generation processing platform, Vision NextTM, an end-to-end solution that delivers global processing economies of scale plus fully integrated adjacent services that span the issuing lifecycle.

DONEDEAL FUNDING NEWS

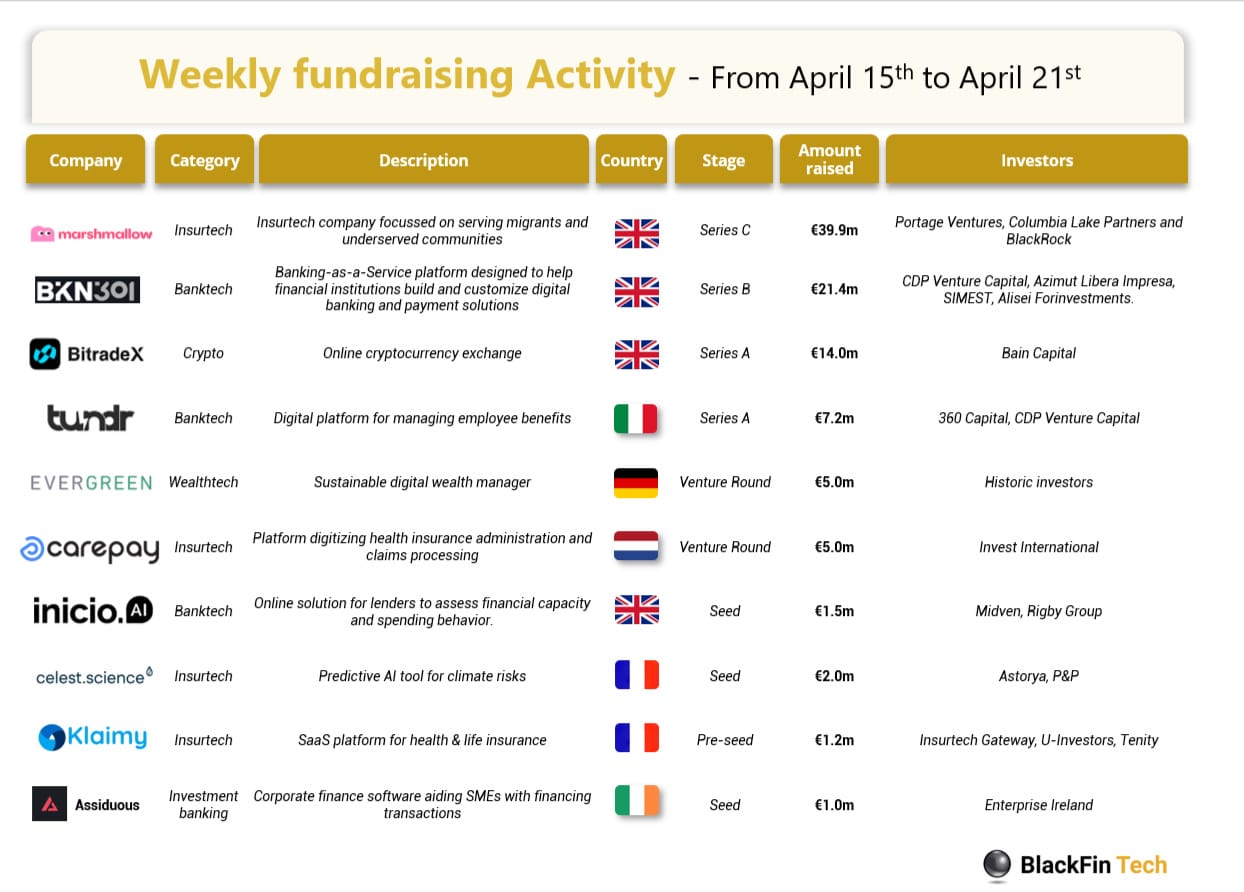

💰 Over the last week, there were 10 FinTech deals in Europe, raising a total of €93 million in equity, 4 deals in the UK, 2 deals in France, and one deal in each of Germany, Italy, the Netherlands, and Ireland.

M&A

🌍 Pointsharp acquires Vemendo to advance its growth strategy in Europe. Through this move, Pointsharp aims to improve its capabilities in the European IAM software market, as the synergy complements and strengthens the company’s offerings, further solidifying its position in the Nordics and beyond in Europe.

🇪🇺 Capgemini acquires Delta Capita. Through this acquisition, Capgemini is addressing the critical industry need for integrated risk management and regulatory compliance solutions. This transaction, finalised on April 16, marks Capgemini’s second acquisition in the FCC sector in the past 18 months.

🇺🇸 Clearwater Analytics finalizes $1.5 billion acquisition of Enfusion to deliver a unified cloud-native investment platform. This strategic combination positions Clearwater as the industry’s first single-instance, multi-tenant, cloud-native platform to unify front, middle, and back-office investment operations.

MOVERS AND SHAKERS

🇬🇧 Ecommpay strengthens leadership team for European growth with appointment of Roy Blokker. Roy will be particularly focused on engaging with large, complex, and globally focused merchants to build strategic partnerships. He will also lead the development of tailored solutions that deliver optimal payment performance.

🇬🇧 Finalto alum Neil Wilson joins Saxo Bank as UK Investor Strategist. Wilson had served as Chief Market Analyst at Retail FX and CFDs broker Markets.com since 2018, and was also B2B Chief Market Analyst at Markets. com’s parent company, Finalto, since 2022, before leaving the group at the end of last year.

🇺🇸 Coinbase vet Daniel Harrison joins Phantom as comms head. Harrison expressed strong confidence in the company's mission and product, stating that the more he learned, the more convinced he became that Phantom offers the best solution in one of the most critical categories in the crypto industry.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()