Crown Raises $13.5M Series A and Hits a $90M Valuation

Hey FinTech Fanatics!

Crown just raised a $13.5M Series A. The round brought in Paradigm, marking the firm’s first investment in a Brazilian company.

The raise puts Crown at a $90M valuation. BRLV has already passed R$360M in subscriptions, making it the largest stablecoin in emerging markets.

BRLV is designed for enterprises, FinTechs, and Web3 applications. A different model from retail-focused tokens. Fully backed by Brazilian government bonds and built to bridge Pix, banking rails, and offshore markets with on-chain liquidity.

Crown says its structure gives holders legal protection over the reserves that back the token. A setup built for institutional demand and bank-grade requirements.

The architecture targets financial institutions, exchanges, and tokenization platforms looking for compliant infrastructure at scale.

If you're tracking the next big FinTech moves, take a look at the updates below 👇

Cheers,

#FINTECHREPORT

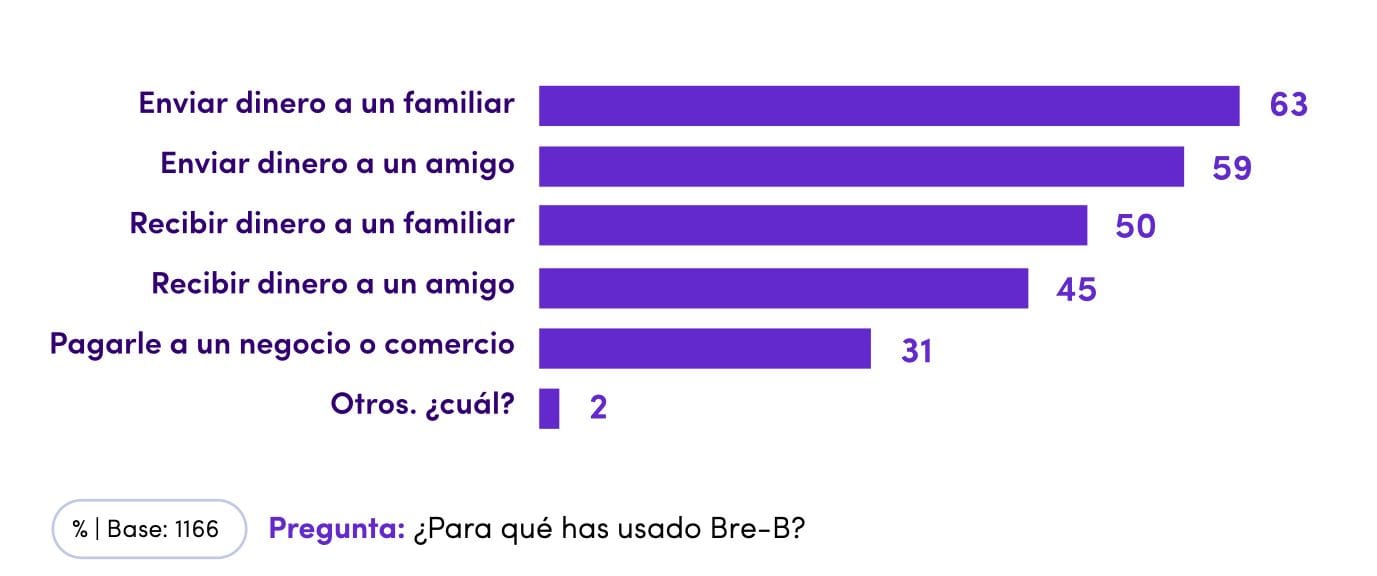

🇨🇴 Bre-B's first adoption study: The use of instant payments in Colombia. In this study, Pragma breaks down the key factors for understanding consumer behaviour regarding Bre-B, allowing customers to adjust their business model to capitalise on this technological transformation from day one. Download the report here

INSIGHTS

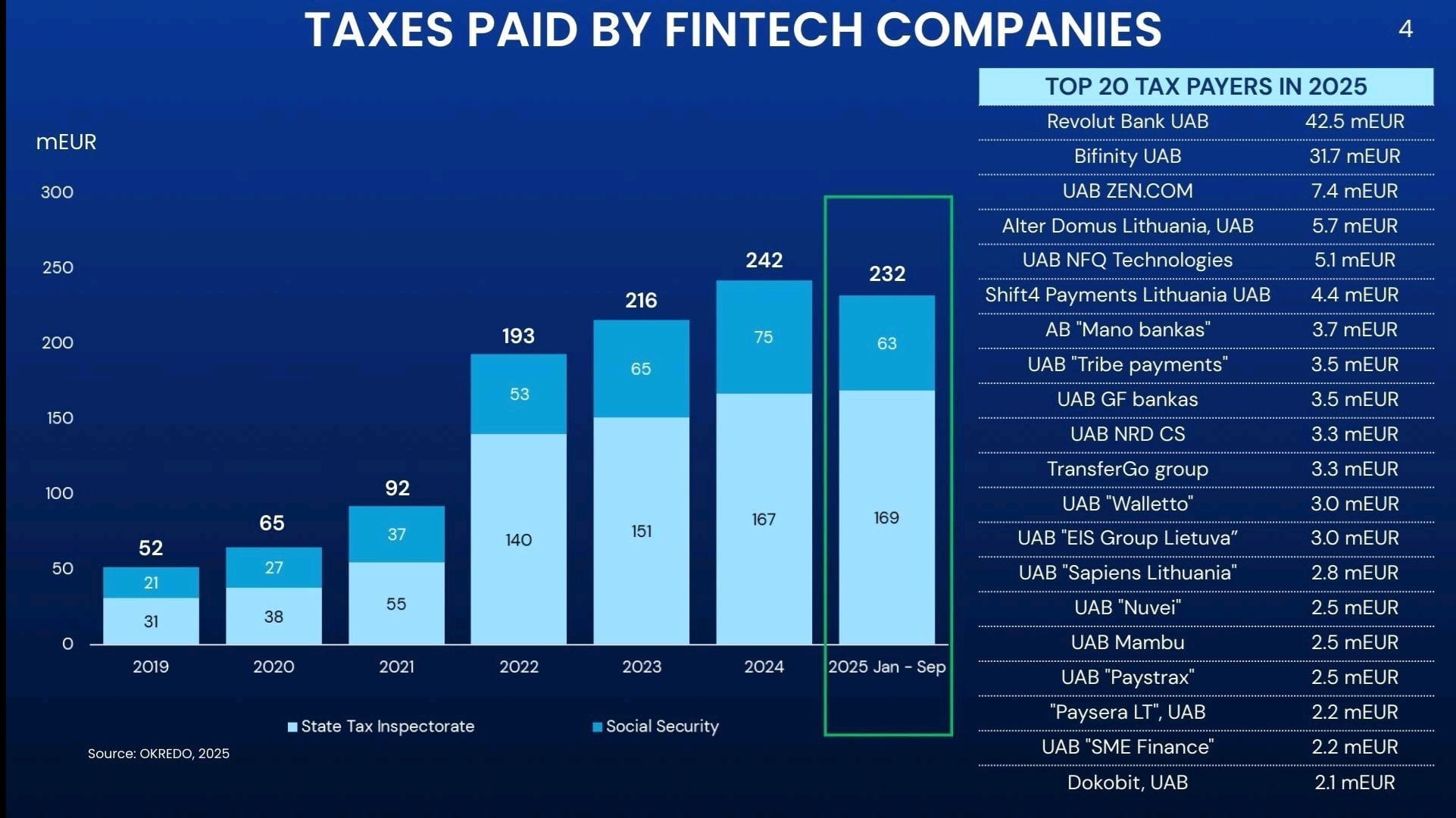

🇱🇹 The top 20 FinTech companies by taxes paid in Lithuania this year👇

FINTECH NEWS

🗓️ 2026 Runs Are Loading! New runs for 2026 are being planned, and you won’t want to miss them.🎉👉 Sign up to our Luma calendar to get notified the moment new runs drop!

🇬🇧 Revolut offers ex-staff 30% discounted exit after $75 billion valuation. Revolut has offered former employees the chance to sell their shares back to the company at a price that implies a valuation of about $52.5 billion, roughly 30% below the $75 billion level set in its latest funding round completed in November.

PAYMENTS NEWS

🇺🇸 Stripe and Paradigm open Tempo Blockchain to the public, adding Kalshi and UBS as Partners. Tempo seeks to apply a tried-and-true playbook to the world of crypto. The blockchain is designed to facilitate straightforward acceptance of stablecoin payments by such platforms.

🇮🇱 Payoneer cuts 6% of workforce as profitability pressures mount. Payoneer said: As part of our multi-year transformation to become a product-oriented company, we are making structural changes to our product and technology teams. The changes will affect a small percentage of our team in Israel.

🇺🇸 Fiserv faces security issue lawsuit. A lawsuit filed by a credit union last week alleges that payments processor Fiserv deceived its clients about its security protocols. Self-Help stated that Fiserv “represented” it was using two-factor authentication when, in fact, it was not.

🌍 Klarna is now available on Apple Pay to customers in France and Italy. With this launch, consumers across eight major markets can now choose to shop with Klarna through Apple Pay’s simple and secure experience, and consumers have more choice and flexibility in how they can pay.

🇺🇸 Tether-backed payments startup Oobit expands into the US. The tap-to-pay solution integrates with non-custodial wallets, enabling users to make purchases from their iOS and Android devices. Merchants receive instant fiat payouts through existing Visa rails.

🌍 UPI accounts for nearly half of global instant payments. The IMF has recognised India’s UPI as the world’s largest retail fast-payment system, now responsible for nearly half of global instant transactions, underscoring its scale, interoperability, and rapid expansion into smaller towns and rural markets.

DIGITAL BANKING NEWS

🇧🇷 Nubank CEO David Vélez told CNN Money that the company will pursue a Brazilian banking license to meet regulatory requirements, while also advancing expansion in Mexico, Colombia, and the U.S., where he sees major market potential.

🇲🇽 Nu Mexico 'doubles down' on the national market and will invest $2.5 billion in the remainder of the decade. Nu Mexico is preparing to consolidate its transformation with new leadership and various plans aimed at achieving its goal of becoming the largest banking institution in the country. Additionally, Nubank launches a subscription manager to control recurring payments. The financial institution's goal is to help clients control their spending across various sources.

🇺🇸 Revolut has launched Revolut BillPay, an AI-powered accounts payable automation tool that positions the company to compete in the $20B+ global AP automation and B2B payments market alongside firms. The product is expanding to Australia, Singapore, and the US.

🇲🇽 Revolut Bank arrives in Mexico, aiming to reach a minimum of 5.5M customers in its first 5 years and 40M customers in 10 years. In an interview, Juan Guerra, CEO of Revolut Bank in Mexico, emphasised that the firm's strategy is not subject to economic fluctuations, but to a fundamental value: offering better prices and more value for customers' money.

🇰🇼 National Bank of Kuwait launches enhanced mobile banking app to elevate customer experience. The banking app aims to facilitate customer experience, provide better control, and ensure flexibility and convenience as they manage their finances digitally.

BLOCKCHAIN/CRYPTO NEWS

🇭🇺 Revolut withdraws from Hungary with its crypto services, citing the need to comply with local regulations; despite securing MiCA licensing through its Cyprus entity, the company says regulatory conditions in Hungary require a full shutdown, and customers must now close or withdraw their crypto holdings before access ends.

🇬🇧 The UK government wants to treat crypto as property. Investors need convincing. The UK government has said that crypto tokens such as bitcoin and ether can be recognised as personal property, but investors still need more clarity to enter the emerging market, according to industry experts.

🇦🇪 Circle gets Abu Dhabi greenlight amid UAE stablecoin and crypto push. The license enables it to operate as a licensed Money Services Provider as the UAE accelerates its rollout of crypto regulations. This allows the stablecoin issuer to operate as a Money Services Provider in the IFC.

🇦🇪 Binance fires staff over insider information for 'personal gain'. Binance has laid off one of its employees after confirming they used insider information to promote a newly launched memecoin on the platform’s official X account. Binance emphasised its “zero tolerance” stance toward internal misconduct and pledged to strengthen oversight to prevent future breaches.

🇺🇸 PNC becomes the first major U.S. bank to offer direct Bitcoin trading to clients via Coinbase. The new service allows qualified private banking clients to buy, hold, and sell bitcoin without using an external cryptocurrency exchange. Keep reading

PARTNERSHIPS

🇺🇸 Ovanti partners with Mastercard’s Finicity as US BNPL strategy takes shape. Finicity enables Ovanti to lend to the 150 million underbanked Americans overlooked by credit score–driven players; with added credibility from Mastercard, merchant reach via Shift4, and cheaper funding from BNPLPay, Ovanti now has the data, distribution, and capital needed to expand in the U.S. market.

🇺🇸 Circle stablecoin for ‘banking-level privacy’ to launch on Aleo blockchain. The launch of USDCx comes amid a broader push from the crypto industry to persuade big banks and institutions to use blockchain technology. Read more

🇺🇸 Stakk secures Peter Thiel-backed neobank Panacea Financial as a key client. Under the terms of the agreement, Stakk will deliver Panacea Financial a solution encompassing its mobile image capture, PDF, and scanner imaging capabilities, image authentication, OCR, and document/data orchestration capabilities.

🇬🇧 ClearBank partners with Finseta to power its multicurrency and cross-border payments services. Under this partnership, Finseta will leverage ClearBank’s virtual IBAN technology to provide GBP and MCCY wallets for its UK customers, allowing Finseta’s customers to move money faster and more efficiently.

🇺🇸 Fifth Third signs a deal, making FinTech firm Brex the provider of its commercial cards. The program will run on Brex’s embedded payments platform, which lets banks issue corporate cards and automate expense reporting using artificial intelligence tools, the companies said in a release.

🇺🇸 Visa partnership boosts OwlPay cash in the US remittance and blockchain payments market. The new application enables users in the United States to send money directly from their mobile devices to bank accounts in multiple international regions.

🇺🇸 Jopari collaborates with J.P. Morgan to enhance electronic claim payments. The collaboration also leverages J.P. Morgan's Commercial Banking relationship with Jopari, along with its account and entity validations services, to enhance payment accuracy, strengthen security, and streamline disbursements through Jopari’s integrated platform.

DONEDEAL FUNDING NEWS

🇧🇷 Crown is valued at US$90 million after raising US$13.5 million in an investment round that attracted a crypto industry giant. Crown's architecture was designed to meet the needs of financial institutions, exchanges, and tokenization platforms with bank-level rigor.

🇮🇳 FinTech lender Fibe raises $35M from World Bank's IFC. The capital will be used to strengthen the company’s balance sheet and support long-term portfolio expansion. Continue reading

🇺🇸 FinTech Startup BON Credit secures $3.5 million in funding. The capital infusion will accelerate BON Credit's product and service development offerings as it seeks to become the clubhouse leader of next-generation credit management tools. The funding supports the initial rollout of BON Credit's new app and establishes a foundation for long-term growth.

🇳🇿 FinTech Hnry raises $30m to boost market presence in Australia and the UK. "The new investment will primarily accelerate Hnry’s growth in Australia and the UK, markets that together represent more than five million sole traders," CEO and co-founder James Fuller said.

M&A

🇿🇦 Capitec buys Walletdoc in R400m deal to boost digital payments. Capitec noted that the acquisition is a strategic step in its ongoing commitment to lowering the cost of payments, broadening access to digital financial services, and promoting financial inclusion in South Africa.

🇧🇷 Mastercard and Mubadala work on a deal for embattled Brazilian FinTech. Mubadala is negotiating a deal that would see the sovereign-wealth fund acquire control of Will Bank and inject capital into the FinTech firm. Will Bank also pays a fee to Mastercard for its services.

MOVERS AND SHAKERS

🇬🇧 Mangopay names Andy Wiggan Chief Product Officer. The company said Wiggan will lead its global product strategy. His remit covers existing wallet infrastructure, embedded financial services, and future product development for multi-party payment flows.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()