Coinbase Secures EU-Wide MiCA License, Taps Luxembourg as European Hub

Hey FinTech Fanatic!

Coinbase has become the first U.S. crypto exchange to obtain a MiCA license under the EU’s new crypto regulation framework, selecting Luxembourg as its new central hub for the region.

Granted by the Commission de Surveillance du Secteur Financier (CSSF), the license allows Coinbase to legally offer crypto services across all 27 EU member states, a major milestone under the Markets in Crypto-Assets (MiCA) regime that took full effect in late 2024.

“MiCA has set the standard, and Luxembourg is leading the way,” said CEO Brian Armstrong, adding that Coinbase is “all in on Europe.”

While Coinbase originally positioned Ireland as its EU base in 2023, the company has now pivoted to Luxembourg due to its pro-business climate and clear crypto-specific laws.

Daniel Seifert, Coinbase’s EMEA VP, said the move wasn’t a knock on Ireland but rather a recognition of Luxembourg’s regulatory edge.

Coinbase still plans to expand its Dublin office and add ~50 new roles there, maintaining Ireland as a key operational hub in the region.

Coinbase joins firms like Bybit, OKX, and BitGo in securing MiCA licenses, but stands out as the first U.S.-headquartered exchange to fully comply. Rival Gemini is also expected to receive a MiCA license soon, choosing Malta as its EU base.

With the license, Coinbase gains the right to:

- Passport crypto services across the EU

- Serve both retail and institutional clients under a single compliance framework

- Operate with regulatory clarity at a time when global crypto rules are still fragmented

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

🇪🇸 The 2025 payments landscape in Spain and Portugal by Getnet. The adoption rates of real-time payments illustrate that the message is clear: consumers want real-time payments. Success will depend on merchants’ having the right technology to meet the needs of consumers without compromising on customer experience.

INSIGHTS

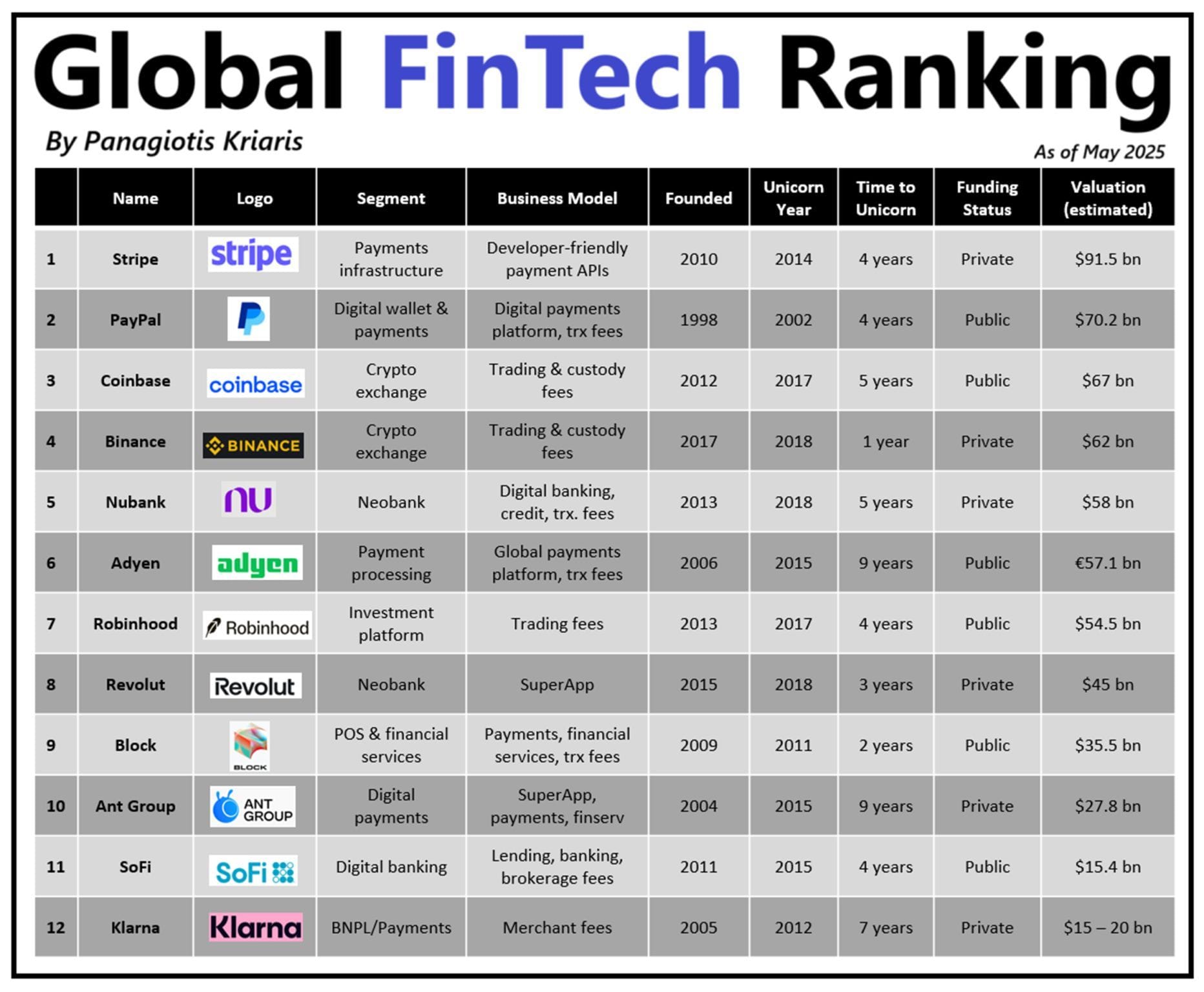

💰 Ever wondered about the biggest FinTechs globally?

Here's a Global FinTech Ranking with 12 FinTech Giants ranked by estimated valuation👇

FINTECH NEWS

🇬🇧 Neobank Revolut is actively exploring launching its stablecoin. The development comes amid a growing list of non-crypto companies now considering issuing their stablecoins as the regulatory environment shifts in the United States and around the world.

PAYMENTS NEWS

🇦🇷 How Bybit expanded its presence in the region through a partnership with Pomelo. Through Pomelo’s card issuance and processing technology, Bybit users can now use their digital assets for payments at any merchant that accepts Mastercard.

🇰🇷 Card payments remain the top choice of South Koreans. According to a survey of 3,500 adults conducted by the Bank of Korea, credit cards accounted for 46.2% of all transactions, while debit cards accounted for 16.4%. For international transactions, 89.2% of respondents who made overseas payments in the past reported using a credit card.

🇬🇧 Ebury launches Ebury Connect for integrated and cross-border solutions. By leveraging Ebury’s API and other connectivity options, corporates can integrate Ebury’s financial features and manage complex cross-border payments automatically.

🇪🇬 Swypex launches Egypt’s first approval-based corporate card. The Approval-Based Limits Card allows finance teams to assign dynamic spending limits that remain locked until individual transactions are reviewed and approved. Swypex is licensed by the Central Bank of Egypt and backed by a $4 million seed round led by Accel.

🇬🇧 payabl. announces PrestaShop integration to support 250,000+ online merchants. It is designed to simplify and enhance e-commerce transactions. The solution aims to provide online merchants with a seamless checkout experience, boosting conversion rates and operational efficiency.

REGTECH NEWS

🇦🇪 FinTech firm DLocal secures licenses in the UAE, Turkey, and the Philippines. These new licenses contribute to dLocal's expanding portfolio, which includes over 30 licenses and registrations worldwide. Keep reading

DIGITAL BANKING NEWS

🇦🇪 First Abu Dhabi Bank becomes the First MENA Bank to join CIPS as a direct participant. FAB’s direct participation in CIPS enhances its ability to provide clients with faster, more secure, and efficient cross-border RMB payment solutions, reinforcing its leadership in cash management and clearing across the MENA region.

🇭🇺 Revolut crackdown possible: government to tighten regulations on neobanks with new tax. The legislation would tighten the rules for paying the transaction fee and eliminate the loophole that neobanks have been able to rely on so far. According to the new definition, any operation that reduces the user's account balance may be subject to the fee, even if it is just an internal transfer.

BLOCKCHAIN/CRYPTO NEWS

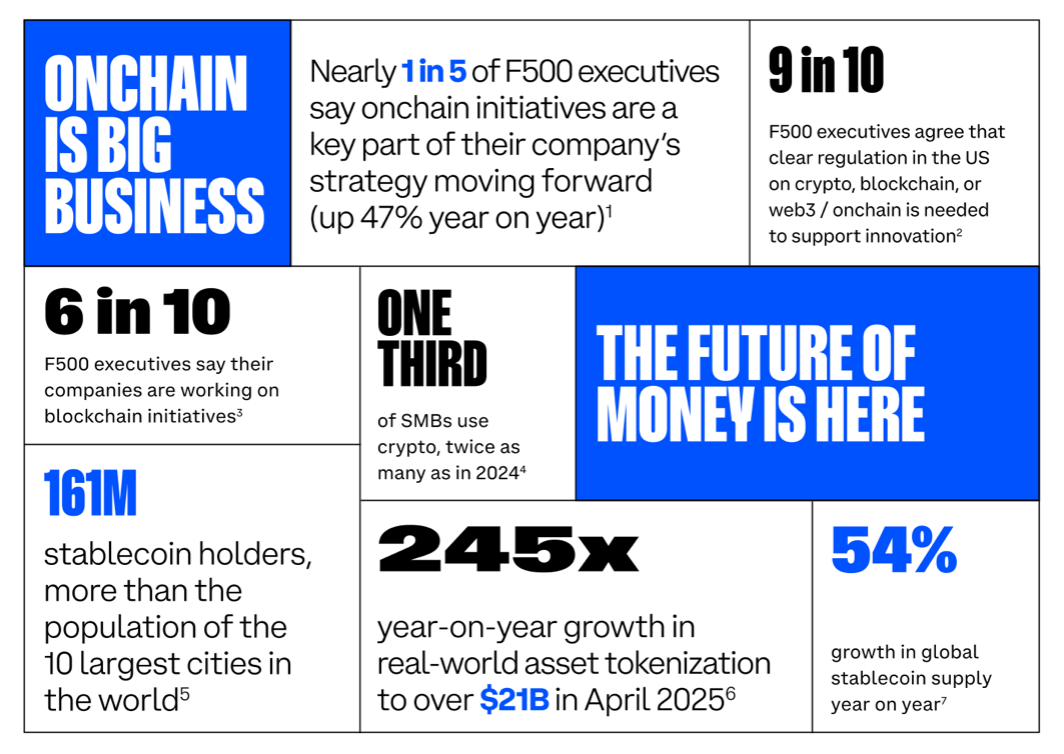

📈 Stablecoins are bigger than PayPal.

Just take a moment to process that👇

🇦🇺 AUDC launches the Australian Digital Dollar AUDD stablecoin on the Hedera Network. AUDD can now be held, sent, and received by anyone using a Hedera-enabled digital wallet, offering seamless, real-time access to Australian dollar stablecoin payments.

🇺🇸 Binance introduces Locked Addresses and Concentration Indicator features, designed to give its clients greater visibility into token supply dynamics and potential volatility risks. Users can now verify whether a portion of a project’s token supply is indeed locked, track how much is involved, and factor that into their trading decisions.

🇱🇺 Coinbase secures MiCA License from Luxembourg’s financial regulator, the CSSF. This permit would enable the U.S.-based exchange to operate across all 27 EU countries under the new EU regulatory framework. This is a pivotal moment for Coinbase, Luxembourg, and Europe’s growing crypto ecosystem.

🇺🇸 Kraken moves HQ to Wyoming, cites regulatory environment. Kraken said it was “recognition of the pro-crypto policymakers and constructive regulations” that contributed to its move to Wyoming. Read more

🇨🇦 Canadian crypto firms struggle to create first local stablecoin. The CEO of Coinbase Canada, Lucas Matheson, stated that the industry has been seeking a champion in the federal government for stablecoin legislation, as the country typically relies on financial regulators in each of the 13 provinces rather than a single national agency.

PARTNERSHIPS

🇺🇸 Sunbit selects Checkout.com to bolster acceptance rates and reduce processing costs. Through its relationship with Checkout.com, Sunbit has already experienced a six per cent increase in payment acceptance rates, which has enabled it to lower costs while creating a more positive consumer experience.

🇨🇱 Hites partners with Getnet to improve the customer payment experience across Chile. The partnership aims to provide a smooth, fast, and secure payment experience for customers while also improving operational efficiency for Hites’ internal teams. Getnet emphasizes that technology should serve both people and businesses.

🌍 Mastercard teams up with enza to support FinTech advancement in Africa. Through this partnership, FinTech companies are set to be able to develop propositions on the enza platform that provide consumers and businesses with embedded Mastercard payment solutions capabilities.

🌏 dtcpay partners with Mastercard Move to upgrade global payments. The companies aim to deliver a cost-effective and transparent way to move money across borders, ensuring that recipients and senders get more value in every transaction.

🇬🇭 Onafriq and PAPSS to launch cross-border payments from Ghana. The partnership will empower small and mid-sized enterprises (SMEs) and individuals who traditionally face barriers in cross-border transactions by providing them with easier access to formal payment services.

🇺🇸 Experian accelerates migration to AWS to drive innovation with Generative AI. By leveraging AWS’s advanced cloud capabilities, Experian can provide faster, more scalable solutions that empower clients with deeper insights and more secure data services.

DONEDEAL FUNDING NEWS

🇺🇸 Crypto startup Nook raises $2.5 million. The company will use the money raised in this round to fine-tune its technology and market, and distribute its product. It seeks to make it easier for non-crypto native users to increase the amount of their crypto holdings, which lets users lend their crypto to borrowers in exchange for interest.

🌏 FinVolution to raise $130m to grow its global business. The offering will be made to qualified institutional investors and is subject to market conditions and standard closing procedures. Keep reading

M&A

🇨🇭 NetGuardians and Intix merge to create transaction intelligence firm Vyntra. Vyntra integrates NetGuardians' financial crime prevention capabilities with Intix's transaction data visibility and analytics tech. The combined entity now serves over 130 financial institutions across more than 60 countries

🇬🇧 CUBE acquires Acin to launch integrated risk and compliance solution. The acquisition enhances CUBE’s technology stack and market positioning, introducing new capabilities such as automated control-to-regulation mapping, full traceability, and anonymised industry-wide benchmarking.

MOVERS AND SHAKERS

🇷🇴 Salt Bank Appoints Vikram Tikoo as Chief Technology Officer. Vikram's main objective is to strengthen Salt Bank's strategic direction to enable rapid growth. In his new role, he will oversee the integration of advanced technologies to ensure the platform’s scalability and security while supporting the expansion of its product and service offerings.

🌍 Visa appoints Tareq Muhmood as Regional President for Central and Eastern Europe, the Middle East, and Africa. In his new role, the established Visa leader will be responsible for leading operations across more than 86 innovative and fast-growing markets.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()