Coinbase Rolls Out New Token Sale Platform

Hey Fin Tech Fanatic!

Coinbase kicked off the week with a new release.

This time, they are debuting a platform that lets blockchain projects sell digital tokens directly via Coinbase's infrastructure.

Monad, a blockchain startup, will be the first to utilize this platform for its token sale.

According to The Wall Street Journal, individual investors will be able to purchase tokens before they're listed on the exchange.

The platform will feature about one token sale per month, using an algorithm to allocate tokens among investors who submit purchase requests during a designated one-week window.

By automating allocation and enforcing post-sale restrictions, Coinbase’s new model may represent a reset for public token sales.

See you tomorrow!

Cheers,

INSIGHTS

📈 How FinTech is accelerating the global money movement. According to ACI Worldwide, global RTP transactions reached 266.2 billion in 2023, up 42% year-over-year, underscoring the massive demand for speed and efficiency. Real-time payments are now setting the new standard for businesses and consumers worldwide.

FINTECH NEWS

🇺🇸 FIS launches Innovative Asset Servicing Management Suite. The suite combines the traditionally separate critical functions of corporate actions processing to revolutionize asset servicing, creating a seamless experience that helps capital investment work more efficiently and underscores FIS's commitment to unlocking financial technology for the world.

🇸🇬 Ant International open-sources Falcon AI model for forecasting. Ant International has made the Falcon TST model available as open source on GitHub and Hugging Face. The company said the model can be used for various time-series forecasting tasks, including weather prediction, financial market trends, and cross-border traffic data.

🇰🇪 Irish FinTech Umba hits profitability in Kenya and eyes next growth phase with stablecoin launch. Tiernan Kennedy, the company’s Chief Executive, said it is eying further success on the back of a move into stablecoins and the rollout of an AI bot. Umba is a digital financial services provider offering innovative banking solutions primarily by smartphone.

PAYMENTS NEWS

🇦🇷 Agentic Payments: the new trend in digital shopping with AI by Pomelo. In this article, Pomelo describes how agentic payments work, how artificial intelligence is involved in their development, some application examples, and how to prepare to incorporate them into your business.

🇺🇸 ACI Worldwide Thomas Warsop, CEO and President, rangs the Nasdaq stock market closing bell. The company provides real-time, intelligent payments orchestration software that enables banks, billers, and merchants to grow and modernize their payment systems securely and efficiently.

🇦🇺 Afterpay Ads integrates Square to unlock Australia’s complete shopping journey. The integration aims to unlock audience intelligence across industries and demographics. The result is an omnichannel advertising platform powered by payment data, predicting purchase intent through pre-transaction financial behaviours.

🇬🇧 Bank of England launches consultation on regulating systemic stablecoins. Such stablecoins are a new type of digital money designed to maintain a stable value and could be used for retail payments and wholesale settlement in the future. Keep reading

🇮🇹 Italy's banks back digital euro, want costs spread over time. Italian banks support the European Central Bank's digital euro project, but want investments required by them to implement it to be staggered over time because the costs are high, a top official of the Italian Banking Association said.

🇨🇦 PayPal brings a no-fee buy now pay later offering to Canada. PayPal is promoting its Pay in 4 installment option, offering consumers a way to split purchases into predictable payments without late fees, sign-up costs, or hidden charges. Covered by PayPal’s Purchase Protection, the service ensures secure and worry-free online shopping.

🇦🇪 Uzbekistan’s FinTech, OSON, ecosystem eyes the UAE market through DIFC licence. In the MENA region, OSON will focus on cross-border payments, regional wallet services, and collaborations with local banks and payment institutions, aligning with the region’s broader drive toward digital-economy transformation.

🇧🇷 PicPay announces a global account with the Visa brand and a partnership with AstroPay. Brazil’s PicPay has launched a Global Account in U.S. dollars and euros, enabling users to make international purchases and transfers directly from its app. Developed with AstroPay, the Visa-branded service offers competitive exchange rates, up to 4% annual returns.

REGTECH NEWS

🇯🇵 Japan approves major stablecoin project backed by top banks. Banks will start issuing payment stablecoins pegged to the yen, designed to streamline business-to-business transactions and improve overall productivity in Japan’s financial ecosystem. According to the FSA, the project will include user-protection measures and full transparency around the systems used.

🇮🇹 UniCredit set to appeal ruling over Italy’s demands for BPM deal. The bank’s board is considering an appeal as a way to clarify the regulatory framework for future consolidation moves. It is also intended to protect the bank against any future complaints from investors.

DIGITAL BANKING NEWS

🇬🇧 Monzo makes changes to buy now, pay later for millions of customers. The digital bank is simplifying the use of its service by allowing customers to select the "pay later" option at checkout and extend their repayment period to six or twelve months, albeit with interest.

🇻🇳 VPBank transitions to cloud-native core banking with Temenos and Red Hat. The upgraded system enables the bank to launch products more quickly, integrate easily with partners, and deliver richer, more reliable digital services to its customers, leading to improved performance.

🇬🇧 Snap Finance UK redefines lending with an instant-access virtual card. The new proposition makes point-of-sale finance more accessible and manageable, offering customers instant loan access with more flexibility on how they spend and pay, and full visibility through the Snap Wallet mobile app.

🇸🇬 DBS rolls out a gen AI-powered chatbot to all corporate clients. The virtual agent automatically connects users to a customer service specialist, who is in turn equipped with a digital co-pilot that helps them provide more tailored support to clients. Users can access the service via the bank’s digital banking platform, IDEAL.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase launches platform for digital token offerings. Blockchain startup Monad will be the first project to sell its token on the new platform. The system will allow participation from individual investors, including those in the US. Coinbase will not charge fees for users, while issuers will pay a percentage of the USDC raised.

🇸🇮 Slovenian brokerage Ilirika taps Boerse Stuttgart Digital for crypto trading and custody. Through the integration, clients of Illirika gain reliable and regulated access to cryptocurrencies. Boerse Stuttgart Digital will be fully embedded within Ilirika’s platform, enabling seamless trading and secure custody for its clients.

🇧🇷 Brazilian Central Bank regulates the use of virtual assets and creates a new type of institution. The set of rules seeks to balance incentives for innovation and security in cryptocurrency transactions. The rules will come into effect on February 2nd, 2026. Companies will now be authorized by the Central Bank, subject to the entire supervisory process.

PARTNERSHIPS

🇲🇽 Bitso seeks to connect digital currency to the payments infrastructure, relying on Nvio. The project aims to enable companies, FinTech firms, and international operators to make and receive local currency transfers through a regulated and technologically advanced structure.

🇬🇧 Revolut and Scandinavian Airlines partner to turn everyday spending into rewards. Through this partnership, Revolut users can transfer their RevPoints into EuroBonus points at a 1:1 ratio, with no minimum transfer amount, making it easier than ever to turn daily spending into unforgettable experiences.

🇩🇪 TransferMate connects with SAP. TransferMate acts as a non-bank payments provider with an integration to SAP Multi-Bank Connectivity. The partnership helps empower businesses using SAP solutions to execute cross-border payments effortlessly within their SAP Cloud ERP or SAP S/4HANA Cloud environments, eliminating the need for external payment platforms.

🇲🇽 Invex, from Mexico, joins forces with Walmart and strengthens its financial ecosystem. With this new partnership, the entity seeks to expand access to formal credit, especially among the less banked sectors, through secure, digital products adapted to daily consumption.

DONEDEAL FUNDING NEWS

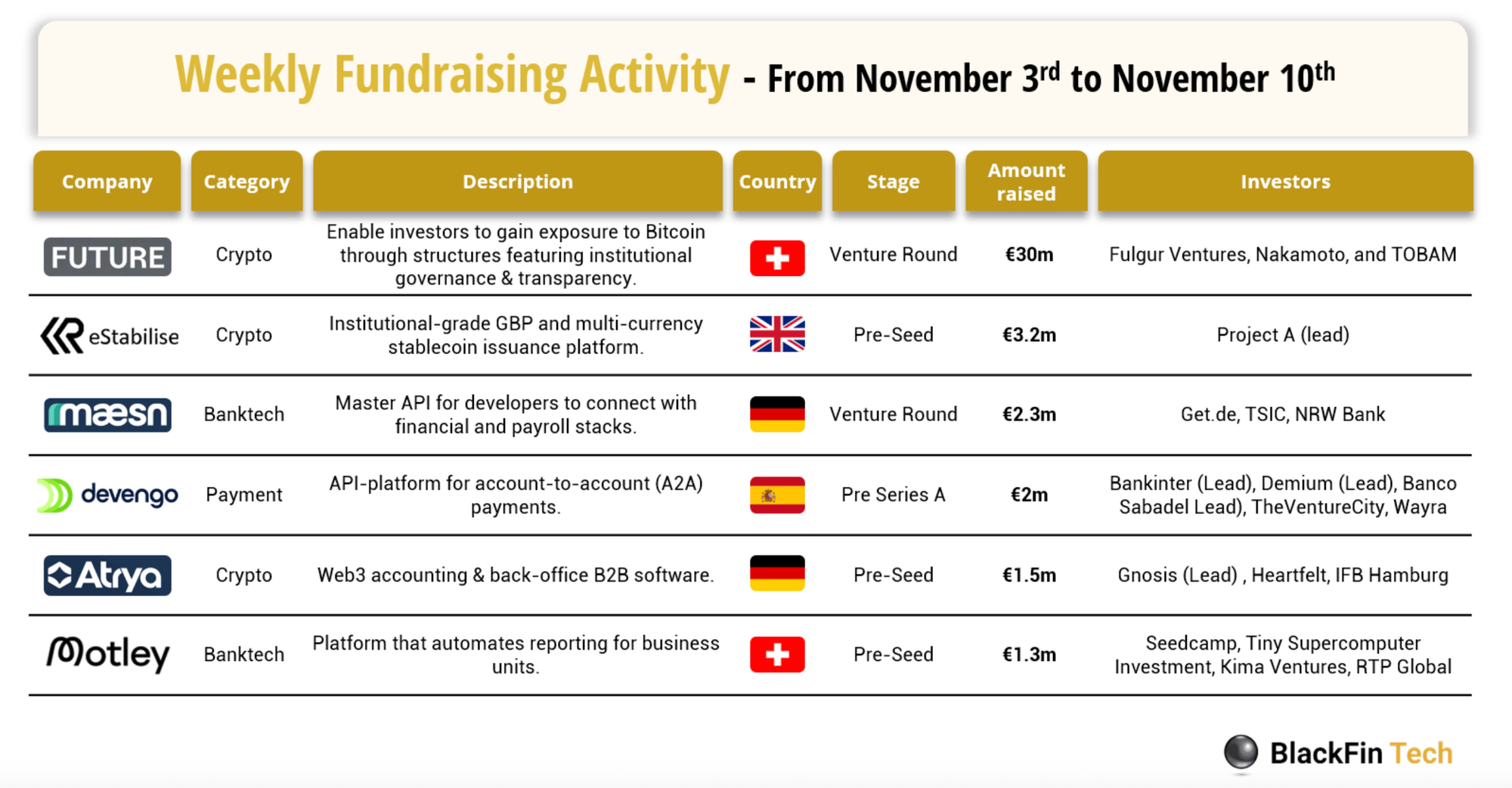

💰 Over the last week, there were six FinTech deals in Europe, raising a total of €40 million, including two transactions in Germany, two in Switzerland, one in Spain, and one in the United Kingdom.

🇺🇸 Arx Research raises $6.1 million seed round to launch ‘Burner Terminal’ stablecoin and fiat point-of-sale device. The terminal accepts stablecoins and both contactless and chip-and-PIN cards, with EMV certification for security, compliance, and compatibility with existing payment systems.

M&A

🇺🇸 Paystand acquires Bitwage to make stablecoins enterprise-grade for global B2B finance. The deal positions Paystand to deliver enterprise‑grade stablecoin settlement and FX across its network, which has processed more than $20 billion in payment volume for 1,000+ enterprises and more than one million businesses worldwide.

🇳🇱 Bird boosts its stake to 5.39% as CM.com rejects €165.8M ‘unsolicited’ takeover bid. CM. com’s board dismissed the proposal, saying it undervalued the company and didn’t align with its long-term growth plans, while Bird’s growing stake signals continued interest and potential for renewed takeover attempts.

MOVERS AND SHAKERS

🇨🇭 Alpian names Miren Rubio Zuluaga as Chief Product Officer. In her new role, she is expected to lead the bank’s product strategy and innovation roadmap, focusing on scaling the platform and enhancing client experience. Zuluaga has been with the firm for over five and a half years.

🇮🇳 Razorpay hires Google veteran Prabu Rambadran to lead engineering, AI innovation. His appointment comes as Razorpay accelerates its vision to build AI-first, globally adaptable platforms. These will power the future of digital payments and business banking across India and Southeast Asia, driving the company’s next wave of innovation and product diversification.

🇱🇺 Bitget appoints Ignacio Aguirre Franco as Chief Marketing Officer to drive a universal exchange vision. Franco will spearhead Bitget’s global marketing operations and strengthen its Universal Exchange strategy, which aims to merge centralized, decentralized, and traditional financial systems into one accessible ecosystem.

🇺🇸 Fortis appoints Brent Coles as CFO and Sharat Shankar as CROO to drive the next growth phase in payments technology. The strategic hires position Fortis to accelerate its embedded payments capabilities and deepen relationships across its software platform and enterprise resource planning (ERP) partner network.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()