Coinbase Gains UK VASP Registration, Expanding Its Global Crypto Footprint

Hey FinTech Fanatic!

Coinbase has secured VASP registration from the Financial Conduct Authority (FCA) in the UK, enabling the company to provide crypto and fiat services. The registration establishes Coinbase as the largest registered digital assets player in the UK market.

Keith Grose, UK CEO at Coinbase, stated: "This is a critical registration to cement our strong position in the UK and unlock our ambitious expansion plans." The UK remains Coinbase's largest international market as the company pursues its goal of onboarding 1 billion people into crypto.

The regulatory approval enhances Coinbase's ability to operate within the UK's regulatory framework while maintaining security and compliance standards. The company will continue offering services through its FCA-registered platform.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

FEATURED NEWS

🇩🇪 All the details and figures on the Solaris rescue. Research by Payment & Banking reveals which investors would profit from a Solaris exit and why employees are likely to walk away empty-handed.

The rescue of Solaris has been one of Germany’s most dramatic FinTech stories. The Berlin-based startup fought for survival, cutting a third of its workforce, yet regulatory troubles and foreign asset write-offs pushed it to the brink. By December 2024, its very existence was in jeopardy, with investors even considering shutting it down.

A last-minute lifeline arrived just before Christmas—a multi-million-euro capital injection from Japanese investor SBI. For employees, it provided a moment of relief. But for SBI, it was a strategic move, securing a dominant stake and positioning itself for significant future gains.

INSIGHTS

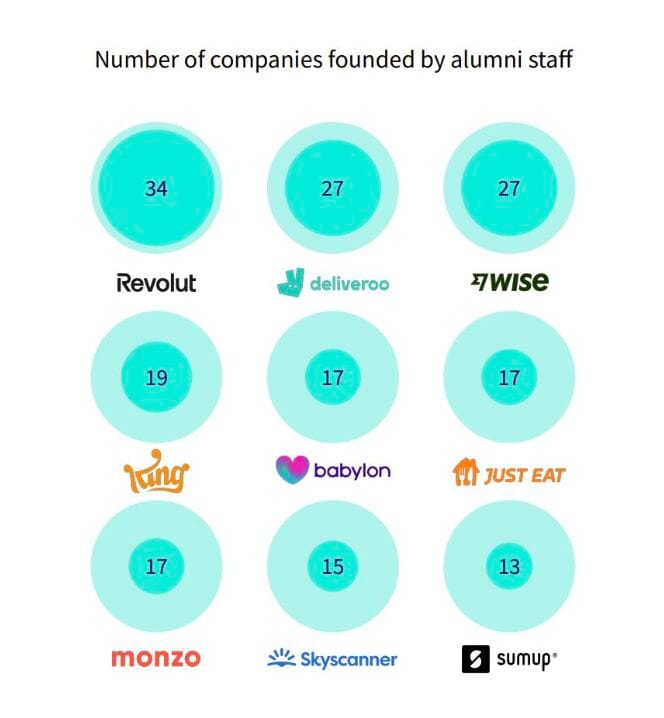

📊 A new report shows that Revolut is the UK's top founder factory.

This new report produced by Dealroom.co and HSBC Innovation Banking shows which UK startups have spawned the most other startups via their alumni👇

FINTECH NEWS

🇬🇧 Payments FinTech GoCardless shrinks losses after cutting jobs. The London-headquartered FinTech posted a pretax loss of £35 million ($43.8 million) for the 12 months through June 2024, compared to a £78 million loss a year earlier. Revenue grew 41% year-on-year to £132 million.

🇺🇸 Payroll services provider DailyPay prepares for 2025 US IPO. The New York-based company is in talks to hire investment bankers for its planned initial public offering that could value the company between $3 billion and $4 billion. Continue reading

🇺🇸 Robinhood launches Super Bowl event contracts for retail traders. The contracts will be available to eligible customers in all 50 states through the derivatives exchange Kalshi Inc. With an emerging asset class like event contracts, “we recognize an opportunity to better serve our customers as their interests converge across the markets, news, sports and entertainment,” the company said.

🇺🇸 Dub: the copy trading app that has teens talking. Social media changed everything from news consumption to shopping. The company thinks it can do the same for investing through an influencer-driven marketplace where users can follow the trades of top investors with a few taps. Think of it as TikTok meets Wall Street.

PAYMENTS NEWS

🌍 Volt.io partners with Pay.com to enhance open banking offering. The partnership between Volt's real-time payment capabilities and Pay.com's advanced payment orchestration creates a streamlined global payments and open banking solution that simplifies payment processing for merchants and customers alike.

🌍 Adyen chooses Yapily to provide data services. The partnership will enable Adyen to deliver a streamlined onboarding experience for customers while strengthening their account verification processes. Merchants that use Adyen’s services can now welcome faster, more seamless, and highly secure onboarding experiences.

🇺🇸 Musk team given access to sensitive federal payment system. The Trump administration has given Elon Musk's deputies access to the federal payments system that controls the flow of trillions of dollars in government funds every year. Read more

🇨🇦 Payments Canada shares details on real-time rail development. Since their update in Q4 2024, Payments Canada and their delivery partners, CGI, IBM, and Interac, claim to have made progress on the Real-Time Rail (RTR) and are reported: “more than halfway through the technical build of the RTR”.

🇺🇸 RTP Network surpasses one billion payments. The network’s recent rapid growth underscores the expanding acceleration of instant payments adoption. This extraordinary increase reflects the growing demand for faster, more transparent, and always-available payment solutions from consumers, businesses, and the financial community.

🇬🇧 TransferGo launches multi-currency accounts. Companies often face high fees, complicated currency exchange processes, slow delivery times, and friction when moving money globally. TransferGo aims to remove these barriers by providing a trusted platform with competitive rates and a seamless international payment experience.

REGTECH NEWS

🇬🇧 UK’s Banking Watchdog probes Barclays over iT outage. After such incidents the Bank of England expects firms to identify causes and share their internal processes for dealing with what happened. Banks must also identify lessons and implement appropriate measures as a result.

🇬🇧 Uphold relaunches staking following regulatory clarity. This allows registered crypto-asset service providers to offer staking services. The move follows a UK Treasury amendment to the Financial Services and Markets Act 2000 removing previous barriers to staking for UK investors.

🇬🇧 UK MPs return to attack on the FCA. Members of Parliament have hit back at the Financial Conduct Authority (FCA) for its seeming failure to adequately address an earlier report that branded the watchdog as 'incompetent at best, dishonest at worst', amid calls for far-reaching reforms.

🇮🇳 India reviewing crypto position due to global changes. The review, which follows crypto-friendly policy announcements by U.S. President Donald Trump, could further delay publication of a discussion paper on cryptocurrencies that was due for release in September 2024.

DIGITAL BANKING NEWS

🇶🇦 BKN301 names Qatar as MENA hub in digital banking push. The move comes as Qatar's digital investment sector is poised to reach a transaction value of $477 million in 2025. The Qatar office will serve as the central point for delivering BKN301's BaaS Orchestrator platform across the MENA region.

🇿🇦 Investec Bank launches new electronic trading platforme ZebrA-X . This innovative platform is designed to create a distinct and high value offering in the market and meet the evolving needs of clients seeking rapid and efficient execution in the rapidly evolving electronic trading landscape.

🇺🇸 Jack Henry and Moov to implement Visa Direct. The addition facilitates the delivery of funds directly to eligible cards, bank accounts, and wallets around the world, is part of Jack Henry's alliance with Moov to enable community and regional financial institutions to offer robust and comprehensive digital payment services.

🇪🇺 N26 completes transformation into a European Company. The transition offers N26 the opportunity to operate under a single set of rules applicable across the EU. This enables greater operational efficiency, and enhanced flexibility to better serve N26’s expanding customer base throughout European markets.

🇺🇸 Zing missed user targets before shutdown. Zing struggled to acquire new customers before it was shut down. Zing was HSBC’s attempt at keeping up with the next generation of payment platforms which have sought to poach consumers and B2B customers from the legacy banks amid rapid expansion.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Brava launches stablecoin management system. Brava plans to expand into stablecoins tied to other currencies in other geographies throughout the year, including newly pegged stablecoins from major firms such as PayPal and Deutsche Bank.

🇬🇧 Coinbase has officially obtained a VASP registration from the FCA. Crypto exchange Coinbase is now the largest registered digital assets player in the UK, and can offer both crypto and fiat services. Crypto adoption in the UK is growing, with 𝟴.𝟴 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 adults now owning crypto.

PARTNERSHIPS

🇺🇸 Yaspa and Playbook Engineering join forces to transform iGaming payments. This collaboration will enable players to enjoy seamless, fast, and secure payment journeys using Pay by Bank for deposits and withdrawals. Playbook strategically selected Yaspa as their exclusive real-time payment provider.

🌍 Binance Pay partners xMoney to enhance payment convenience. The collaboration allows direct payments from Binance accounts to merchants, reducing processing times and streamlining checkout procedures across industries.

🌍 PRECISION and FinMont partner to Drive Innovation and Solve Fraud Challenges. This collaboration addresses these challenges by integrating PRECISION’s proven fraud prevention technology into FinMont’s platform, creating a next-generation payment ecosystem tailored to address the unique complexities of travel payments.

🇶🇦 Fingular and TESS Payments announce partnership With Bank Al Rayan. The partnership aims to address pressing financial needs, offering accessible, customer-centric, and technology-driven solutions while contributing to Qatar’s National Vision 2030.

🇺🇸 Bluevine announces partnership with Xero. The integration will provide seamless data sync and greater collaboration opportunities for small business owners and accountants in the US. Read More

DONEDEAL FUNDING NEWS

🇩🇪 Solaris clinches €140 million funding round. "This fresh capital will not only support our operations until we reach profitability but will also accelerate our ability to seize market opportunities and build a strong core capital base," said Solaris CEO.

🇦🇪 Myne raises $2 million in pre-Seed funding. This funding will be deployed to scale operations, deepen Myne’s technology infrastructure, accelerate user acquisition, support its innovation pipeline and roadmap for regional expansion. In its first year, Myne aims to establish a strong foothold in the UAE.

M&A

🇺🇸 Paytm subsidiary acquires 25% stake in US FinTech for $1m. This development follows Paytm’s recent announcement of plans to establish three new subsidiaries in the UAE, Saudi Arabia, and Singapore through PCTL to expand its tech-enabled payments and financial services globally.

MOVERS AND SHAKERS

🇺🇸 Brex CFO Ben Gammell succeeds Karandeep Anand as president. Former Microsoft director Anand, who has served as CPO and president of Brex since 2023, is now moving into the role of advisor. While assuming the role of president, Gammell will continue to serve the role of CFO, as he has done since 2022.

🇺🇸 Carolyn Weinberg joins BNY as CSIO. "Fostering BNY's culture of innovation and curiosity is essential, and Carolyn's breadth of experience in product innovation, development and commercialization will enhance our ability to quickly grasp and cater to the biggest trends in capital markets," said CEO.

🇩🇪 Broadridge names new head of international buy-side sales. Stephen Wilkes senior vice president, head of international buy-side sales, will lead Broadridge’s sales efforts across the EMEA and APAC regions, with a focus on asset managers and fund administrators.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()