Coinbase Eyes SEC Green Light for Tokenized Stock Trading on Blockchain

Hey FinTech Fanatic!

Coinbase is actively seeking approval from the U.S. SEC to offer tokenized equities, which would allow users to trade blockchain-based versions of stocks, placing it in direct competition with Robinhood and Charles Schwab.

“It’s a huge priority,” said Paul Grewal, Coinbase’s Chief Legal Officer.

Tokenized equities would let investors hold digital tokens representing traditional shares, enabling 24/7 trading, lower fees, and faster settlement. But to legally offer them in the U.S., Coinbase needs a no-action letter or exemptive relief from the SEC, especially since the company is not a registered broker-dealer.

The concept is gaining traction: Kraken recently announced “xStocks” (tokenized U.S. equities) for select markets abroad. Coinbase’s entry could legitimize the space domestically, if the SEC plays ball.

The timing aligns with a pro-crypto pivot under the Trump administration, which has dropped previous lawsuits against Coinbase, Binance, and Kraken, and launched a task force to design new crypto rules. Bitcoin has soared amid the regulatory thaw.

“What’s been missing is confidence,” Grewal noted. “That’s what a no-action letter could finally bring to this space.”

If approved, tokenized stock trading could become Coinbase’s next billion-dollar business line and reshape how U.S. retail investors interact with equities.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

ARTICLE OF THE DAY

🇧🇷 How do consumers pay in Brazil?

FEATURED NEWS

🌎 Powering the Future of E-commerce across the Globe with Roberto Kafati, CEO of DEUNA. In this episode, the discussion explores the company’s mission to simplify online payments, the unique challenges of operating in the regional market, and the innovative ways DEUNA is transforming the digital consumer experience.

Powering the Future of E-commerce in LATAM with DEUNA

FINTECH NEWS

🇬🇧 Solidgate launches Treasury. Solidgate Treasury is a new solution for digital businesses to send, receive, and manage money without limits, allowing them to operate like a global business from day one. Treasury is built to scale with the customer's needs, streamlining payouts and global money movement worldwide.

🇬🇧 UK FinTech Paddle pays $5M fine following allegation it abused US credit card system. The regulator stated that the London–based FinTech facilitated schemes that allegedly utilized fake virus alerts and pop-up messages to impersonate familiar brands, such as Microsoft or McAfee.

🇺🇸 Robinhood launches new tools to woo traders. The financial services company with meme-stock origins is introducing two new features that will bring more sophisticated trading capabilities to its mobile app, including a tool that lets users preview simulated returns before they place an options trade.

🇬🇧 Revolut will soon launch its AI financial assistant, according to UK CEO Francesca Carlesi, who noted that fierce competition was boosting the FinTech industry, while leading to convergence between new players and established banks. “FinTech is not just about new small startups starting to attempt to do something,” she said.

PAYMENTS NEWS

🇻🇳 Visa rolls out Flex Credential in Vietnam for flexible payment options, allowing cardholders to choose between debit, credit, and other payment options using a single card. Beyond debit and credit, it can also support loyalty point redemption and, in some markets, access to multiple currency accounts through a single card.

🇨🇳 Alipay embeds payments into AR glasses. Alipay has integrated QR code payments into augmented reality glasses from Chinese outfit Rockid to enable users to pay for products in-store by looking at the label. Keep reading

🇳🇿 Worldline NZ has officially launched Direct Pay, a revolutionary in-person account-to-account payment method built on open banking technology. It is the leading in-person payment solution in New Zealand to leverage open banking APIs from all four major NZ banks and is now available for merchants to use.

🇺🇸 JPMorgan Chase unveils new Sapphire Reserve card perks and $795 annual fee. Users will now get more than $2,700 in annual benefits when the updated card launches. That includes most of its previous benefits, along with new ones tied to how customers earn and spend points on travel and dining.

🌍 Unzer rolls out with Wero from EPI. With the collaboration, Unzer aims to support the launch of Wero, a new European digital payment method. Wero is a mobile wallet offering instant A2A payments, aiming to deliver a secure and sovereign way for people to pay and shop across Europe.

🇫🇷 Stripe rolls out 15 new features to boost France’s digital economy. The new offerings focus on simplifying online payments, expanding financial services, and integrating advanced technologies such as AI and stablecoins. Continue reading

REGTECH NEWS

🇰🇼 Kuwait Central Bank tightens rules on e-payment providers to boost oversight. The circular mandates strict compliance with regulations governing the use of the Electronic Payment Services Gateway System, as part of the Central Bank’s ongoing efforts to enhance governance, operational oversight, and risk mitigation in the digital payments sector.

DIGITAL BANKING NEWS

🇬🇧 Monzo partners with BlackRock to offer 11 ETFs designed to attract more investors. The new ETF offering will be rolled out to new customers from today and will be available to existing customers in the coming weeks. Read more

🇦🇷 Traditional banks in Argentina don't fear a 'Nubank case' with Mercado Pago. While Mercado Pago has applied for a banking license, established banks in the country are open to fair competition. They see the move as an opportunity to enhance financial services and foster innovation.

🇲🇽 Openbank welcomes over 100,000 customers in Mexico. According to Matías Núñez Castro, CEO of Openbank Mexico, “Reaching this milestone of 110,000 customers in under four months confirms the great potential of our 100% digital banking model in the Mexican market. This is the first step of a clear strategy: to make Openbank the most empathetic, efficient, and approachable digital banking model in Mexico.”

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase seeking US SEC approval to offer blockchain-based stocks. If granted, the move would allow Coinbase to effectively offer stock trading via blockchain technology, placing it in direct competition with retail brokerages such as Robinhood and Charles Schwab, and could open a new business segment for Coinbase.

🇬🇧 Revolut adds Solana to boost crypto access. By integrating Solana, Revolut is giving users access to a network built for speed, low fees, and smart contract functionality, the tools that power decentralized apps and digital finance. Keep reading

🇺🇸 Celsius Bankruptcy Twist: Alexander Mashinsky’s Crypto Assets now go to creditors. The court ordered that all crypto assets, cash, and Miningco shares held by Mashinsky and the involved entities must be released for redistribution. This decision clears the way for a wider distribution of remaining assets, bringing some relief to the thousands of creditors still waiting for their payouts.

🇻🇳 Bitget Wallet becomes the first crypto wallet to support national Vietnam QR payment, allowing users in the region to scan the VietQR code and directly pay in crypto. The integration makes Bitget Wallet the first self-custodial wallet to natively integrate itself into a country’s national QR code payment system.

🇩🇪 OKX opens crypto exchanges in Germany and Poland. The launches bring deep liquidity, low fees, and access to over 270 cryptocurrencies, including more than 60 crypto-Euro pairs, to users in both countries, all within a secure, compliant, and user-centric framework.

🇺🇸 JPMorgan to pilot deposit Token JPMD on Coinbase-linked Blockchain. JPMorgan will move a fixed amount of JPMD from the bank’s digital wallet to the biggest US crypto exchange, Coinbase, Naveen Mallela, global co-head of the bank’s blockchain division Kinexys by JPMorgan, said in an interview.

PARTNERSHIPS

🇦🇪 Stake Transforms Payout Experience with Checkout.com Pay to Card Integration. The new solution enables investors to receive their dividends and returns directly to their bank cards, often in just minutes, marking a major step forward in delivering faster, frictionless investing experiences.

🇪🇬 EGBANK partners with Mastercard to expand digital payment services, to improve financial accessibility, promote the use of digital payments, and extend its card portfolio to include new customer segments. Mastercard will assist EGBANK in developing its range of debit, credit, and commercial cards, providing customised financial solutions with additional benefits.

🇬🇧 Experian welcomes Monzo to the support hub. As part of Experian Support Hub, more than 12 million Monzo UK customers will now be able to share their access and support needs with them and multiple businesses in an accessible, simple, and standardised way.

🇬🇧 OpenPayd and Circle partner to deliver global fiat-stablecoin infrastructure at scale. Leveraging Circle Wallet's infrastructure, this partnership will enable OpenPayd’s enterprise clients to move and manage money globally across both traditional banking rails and blockchain-based networks, at scale and in real time.

🇲🇾 Bank Muamalat taps Backbase for AI-driven Islamic banking. By harnessing Backbase’s AI-powered Banking Platform, ATLAS delivers a faith-aligned digital experience with seamless onboarding, DuitNow integration, Shariah-compliant financing, and personalised servicing, setting a new benchmark for Islamic financial services in the region.

🇺🇸 Alpaca integrates Kraken Embed to expand crypto access for its partner network. By integrating Kraken, Alpaca expanded its crypto infrastructure with a fully managed backend into its Broker API. This enables Alpaca’s B2B clients to seamlessly integrate crypto access into their products, using the existing Alpaca infrastructure they already rely on.

DONEDEAL FUNDING NEWS

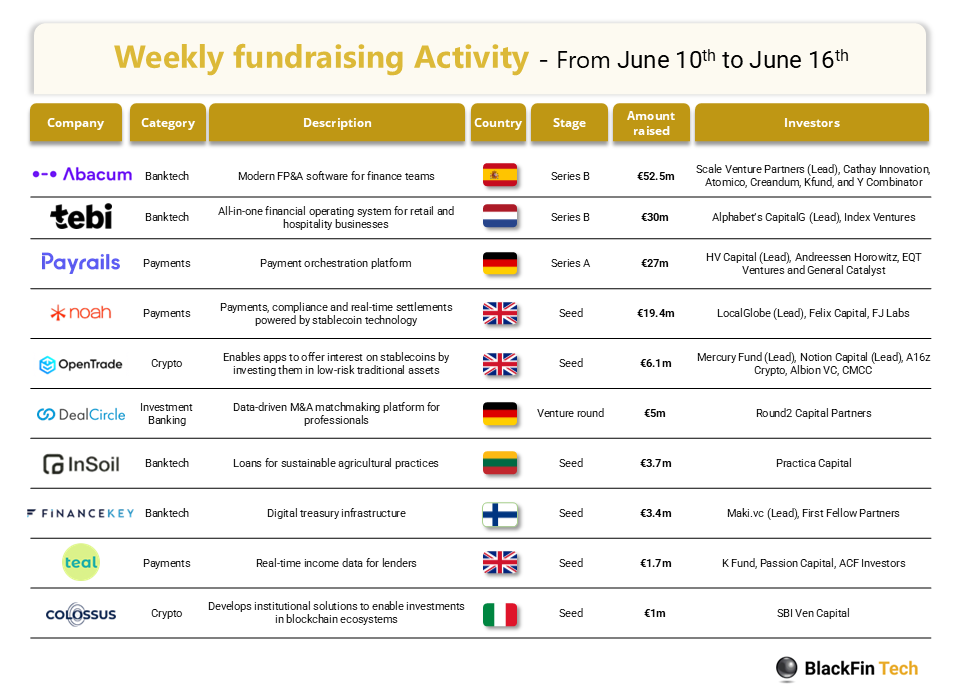

💰 Over the last week, there were 10 FinTech deals in Europe, raising a total of €150 million: three deals in the UK, two in Germany, and one deal each in Spain, Finland, Italy, Lithuania, and the Netherlands.

🇦🇪 SaturnX raises $3m to bring stablecoin-based payment infrastructure to global remittance markets. The capital will be used to accelerate SaturnX's expansion into new payment corridors in Southeast Asia, including the Philippines, Bangladesh, Indonesia, Pakistan, strengthen regulatory infrastructure, and continue building its end-to-end API platform for enterprise-grade stablecoin payments.

🇮🇳 Saswat nets $2.6 mn for financial offerings to micro enterprises. The startup plans to use the capital to strengthen its tech stack, introduce new financial products, and scale operations. Read more

🇮🇳 Razorpay picks up majority stake in Pop for $30 million. Pop will use the funding to strengthen product innovation, enhance the value proposition for consumers via Popcoins-led rewards, and build deeper merchant partnerships across D2C and lifestyle categories.

🌏 Octane secures $5.2 million to transform fleet payments across MENA. The new capital will accelerate the expansion of Octane’s acceptance network, deepen its technology stack, and support the company’s growth across Egypt and the wider Middle East and North Africa (MENA) region.

🇵🇭 Philippine FinTech startup Salmon has secured $88 million in a funding round. The funds will primarily be used to expand Salmon’s loan portfolio, which includes revolving credit lines, product loans, and cash loans, aiming to enhance financial inclusion in the region.

🇺🇸 Thiel-Backed fund invests in Ex-Citi Banker’s stablecoin startup. Ubyx is building a clearing system for connecting stablecoin issuers with banks and FinTechs, aiming to reduce friction for users seeking to use the crypto tokens for payments. Read more

🇺🇸 Payabli lands $28M Series B to accelerate payments infrastructure innovation for software companies. The new funding will accelerate Payabli's product development, with a targeted focus on AI-driven features designed to deliver personalized experiences for customers.

M&A

🇳🇱 Centric takes majority stake in Dutch FinTech Twelve. This strategic move marks a significant milestone for both organizations, combining deep market expertise and a shared vision for the future of retail technology. Centric will support founder and newly appointed CEO Willem van Kralingen in strengthening Twelve’s service offering and accelerating its European growth strategy.

🇮🇱 FinTech unicorn Tipalti acquires Statement for $35-45M to expand real-time cash flow management. The all-Israeli deal, signed amid the war with Iran, aims to enhance Tipalti’s capabilities in the financial management space. Keep reading

MOVERS AND SHAKERS

🇪🇸 Bizum appoints Fernando Rodríguez as its new Deputy General Manager of International Expansion, strengthening its organizational structure for the company's ongoing European interconnection process. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()