Coinbase Debuts Credit Card, Teams with Shopify, and Unveils Business Tools

Hey FinTech Fanatic!

The Fintech spotlight turned to Coinbase, which just unveiled a trio of moves that signal a deepening presence across consumer finance, retail, and business operations. Let's dive into it 👇

First, Coinbase is entering the credit card space in the U.S. through a partnership with American Express. The Coinbase One Card, issued by First Electronic Bank and powered by Cardless, will reward users with up to 4% back in Bitcoin.

It’s exclusively available to Coinbase One members. Will Stredwick of AmEx described the partnership as “an excellent mix of what customers are looking for right now.”

Alongside that, Coinbase is working with Shopify to enable USDC payments on Base, its Layer 2 network. Early access merchants can already accept crypto at checkout, and U.S. shoppers will soon receive 1% cash back when paying in USDC. There won't be any extra fees for merchants, something Shopify plans to expand globally later this year.

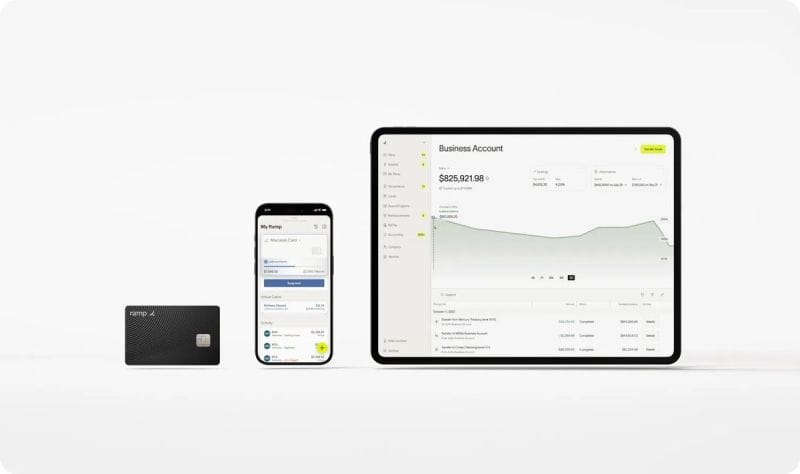

Coinbase also revealed its new product for businesses. Coinbase Business is designed to serve startups and SMBs with crypto-first financial tools. From treasury management to crypto payouts and passive USDC earnings, it brings key operations under one platform. The onboarding process is self-serve, fee-free, and promises fast approvals within 2 days.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FINTECH NEWS

🇺🇸 New Coinbase One Card to launch on the American Express Network. The card will offer up to 4% Bitcoin back on every purchase, provided by Coinbase and Cardless, and issued by First Electronic Bank. The card will be exclusively available to U.S. members. Meanwhile, Coinbase partners with Shopify to bring USDC payments to merchants. Coinbase’s Jesse Pollak discusses the company’s new partnership. Watch the complete interview

🇮🇳 Groww triples FY25 profit to Rs 1,819 crore; closes fresh funding at $7 billion valuation. Bengaluru-based FinTech closes $200 million funding round led by Singapore’s GIC ahead of IPO. The fundraiser also drew participation from existing investors, including Iconiq Capital.

🇬🇧 Crypto FinTech Tap Global to list on London’s AIM. The firm, which aims to establish itself as a bridge between traditional assets and the crypto market, said it expects its admission onto AIM to become effective and that dealings in ordinary shares will commence on 27 June.

🇺🇸 Walmart and Amazon are exploring the issuance of their stablecoins. Stablecoins could enable merchants to bypass traditional payment rails, which incur billions of dollars in fees annually, including the interchange fee they pay when customers make purchases using their cards.

🇩🇪 Bafin imposes a 500,000 Euro fine on FinTech Solaris. According to the statement, Solaris exceeded the large exposure limit on multiple occasions between January 2022 and March 2024, thereby violating the requirements of the European Capital Requirements Regulation (CRR).

PAYMENTS NEWS

🇪🇸 FinTech company Silbo Money is opening its WhatsApp payments platform to the public, aiming to reach 30,000 users this year. The Seville-based firm, backed by former BBVA CEO Ángel Cano, completes its testing phase and announces its launch to challenge Bizum.

DIGITAL BANKING NEWS

🇬🇧 Peymo launches AI-powered digital finance platform that integrates fiat banking, cryptocurrency wallets, tokenized assets, and embedded finance. With this platform, which the company dubbed an “AI-powered multi-hybrid bank,” users can manage British pounds, euros, crypto assets, and branded debit cards

🇧🇷 Nubank launches automatic Pix, accompanied by intelligent account search. Recurring bill payments can be set up automatically through the app, which will be available to the financial institution's customers starting next Monday (16/6). The new feature comes with a smart search feature.

🇩🇪 N26 faces new trouble with financial regulators. BaFin has targeted the Berlin-based digital bank's risk management and apparently sees problems with its Dutch mortgage subsidiary, Neo. The irritation comes at an inopportune time for N26 CEO Valentin Stalf, who is currently seeking new investors.

🇺🇸 Chime shares set to open 48% above offer price in Nasdaq debut. The stock was indicated to open at $40, compared with the IPO price of $27. The company, along with some of its investors, sold 32 million shares to raise $864 million. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Trident Digital to create XRP treasury of up to $500M. The reserve will be funded through stock issuance and other financial instruments. Through this initiative, Trident aims to demonstrate how public companies can thoughtfully and responsibly participate in the ongoing development of decentralized finance.

🇺🇸 Coinbase introduces Coinbase Business. It is a secure, compliant platform for startups and small businesses to send and receive payments, manage crypto assets, and automate financial workflows in one place. It offers a no-fee, self-serve application with approvals for businesses in as little as two days.

PARTNERSHIPS

🇦🇺 Mortgage Choice taps NextGen to bring open banking to brokers. Mortgage Choice is set to make open banking part of its loan application process through a new partnership with technology provider NextGen, allowing its network of brokers to access real-time financial data using the Frollo Financial Passport.

🇬🇧 Trusek partners with tell.money to deliver seamless PSD2 compliance for its clients. This strategic partnership delivers seamless, scalable, and regulation-ready open banking access, ensuring Trusek’s clients can meet compliance demands effortlessly while accelerating their go-to-market strategies.

🇺🇸 U.S. Bank and Fiserv unite to boost digital card solutions. The primary goal of the partnership is to integrate Elan’s credit card issuing capabilities into Fiserv’s Credit Choice platform, creating a more unified and user-friendly digital experience. This will enable financial institutions to offer both debit and credit card information in a single, seamless interface for consumer and small business customers.

🌍 Greece joins EuroPA through IRIS Payments. Through the IRIS Payments partnership, DIAS will further simplify instant mobile payments within Europe for its active users, contributing to the formation of a unified network expected to serve citizens across 10 European countries.

🇩🇪 Raisin to integrate with FIBT's BaaS platform. The integration will expand on FIBT’s existing partnership with the German-based FinTech company, which already included serving as the holder of Raisin customers’ cash accounts. Keep reading

🇧🇷 InDrive partners with Belvo to facilitate Pix via open finance on its platform. Customers will be able to pay seamlessly with Pix when utilising inDrive’s ride-hailing and delivery services. Working with Belvo, the new feature enables fast, secure, and intuitive Pix transactions, fully embedded within the inDrive app.

DONEDEAL FUNDING NEWS

🇺🇸 Ramp hits $16 billion following a $200 million valuation in a new funding round. The deal represents significant growth for Ramp. The company was valued at $13 billion in a secondary share sale earlier this year. The company offers corporate cards and other financial tools to businesses.

🇬🇧 Crypto software company OneBalance raises $20 million from Cyber Fund and Blockchain Capital. The company will use the money raised in this round to expand the capabilities of its flagship product by integrating functionality for additional blockchains.

🇺🇸 GrailPay raises $6.7 million for remedial ACH platform. The company will use the funds to grow its product and engineering teams, expand go-to-market efforts, and bring new capabilities to its risk models. Read more

🇮🇳 FinTech startup Zype secures debt. The proceeds of this debt funding will be used to augment the long-term working capital needs of the company, the filing added. The FinTech platform last raised funds in December 2022, securing Rs 146 crore (approximately $17.7 million) from its existing investor, Xponentia Capital.

M&A

🇵🇹 BPCE to buy Lone Star’s Novo Banco in €6.4 billion deal. The transaction is expected to close during the first half of 2026. “The decision by the majority shareholder to pursue a direct sale to BPCE represents a clear strategic opportunity, positioning Novo Banco to join one of Europe’s strongest financial groups,” the Portuguese lender said.

🇦🇺 ASX sells out of Digital Asset Holdings for $57m. ASX announced it had completed the sale of its shareholding in Digital Asset Holdings, which will be recognised in its FY25 financial results. The sale represents a pre-tax gain of about $42 million. The gain will be recognised in the asset revaluation reserve in equity.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()