Coinbase Closes $2.9B Deribit Deal

Hey FinTech Fanatic!

Coinbase has acquired crypto derivatives platform Deribit for $2.9 billion, becoming the world’s largest crypto derivatives exchange. The deal, advised by FT Partners, combines Coinbase’s U.S. reach with Deribit’s offshore dominance, bringing $59B in open interest and $1T+ in annual trading volume onto one platform.

And speaking of knowing your FinTech moves… last week’s FinTech Quiz was a blast! We even hit the response limit 😅

Huge thanks to everyone who played, and a special shoutout to Joseph Lim, the only one who nailed every single question! Looks like we found our first round’s ultimate expert.

Now it’s time for a brand-new round:

- 11 FinTech questions based on last week's news

- Score a perfect 11/11 and secure your spot on the Leaderboard of Legends

- So see where you stand, defend your spot, and prove your FinTech knowledge

- Compare your score with colleagues, share in the comments, and tag me on LinkedIn... I'm watching

Stick around, there is a reward for top performers over a period of time. 😉

Stay tuned for: What's next, who gets the highest score, and more...

This round closes on August 21st at 12:30 PM CEST.

Let the games begin!

Don't forget to read the latest FinTech developments 👇 Some will show up in next week's Quiz 👀

Cheers,

FEATURED NEWS

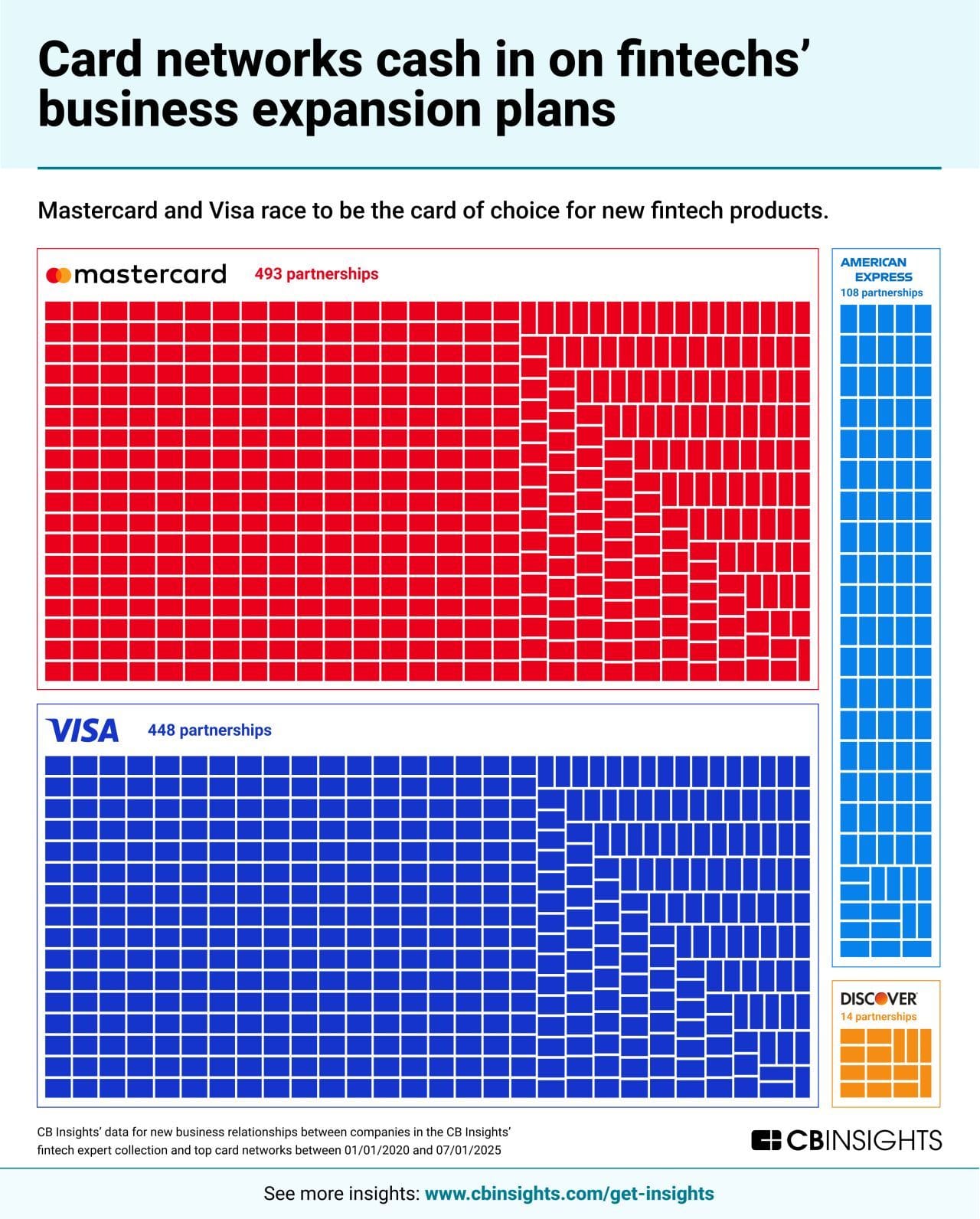

📊 Mastercard and Visa race to be the card of choice for new FinTech products.

FINTECH NEWS

🇬🇧 Ecommpay helps merchants get Disability Confident. The Disability Confident Scheme aims to encourage employers to recruit, retain, and develop disabled people and those with long-term health conditions. The sessions will help businesses build a truly inclusive culture, highlighting that disability inclusion isn’t just the right thing.

🇺🇸 SoftBank’s PayPay submits filing to the US SEC for listing of ADRs. The exact schedule, size, and price for the public listing of PayPay’s American depositary shares are yet to be decided. The feasibility of a listing is subject to market and other conditions and is contingent on the completion of the SEC’s review, SoftBank said in a statement.

🇺🇸 Lendflow launches new AI automation suite for embedded lending. By combining automation with advanced AI, Lendflow Automate provides partners with an always-on, digital workforce to streamline operations, lower costs, and accelerate decision-making, helping them “do more with less.”

🇬🇧 Swiipr launches welfare 'eco-card' for travelers. Swiipr’s Mastercard welfare cards enable airline ground staff to instantly distribute food and beverage payments when flights are delayed, offering instant, secure, and compliant payouts that have universal retail compatibility.

🇺🇸 FinTech CEOs call on Trump to block banks from imposing 'account access' fees. In the letter to Trump, the open banking CEOs say: "Large banks are taking aggressive action to preserve their market position by imposing exorbitant new 'account access' fees that would prevent consumers from connecting their accounts to better financial products of their choice.

🇺🇸 FIS launches Investor Services Suite to Transform Investor Servicing Lifecycle. The solution helps optimize end-to-end processing for swift customer onboarding and enhanced investor screening, making it possible to automate the investor lifecycle and improve operational efficiency, thereby supporting clients in meeting their regulatory obligations.

PAYMENTS NEWS

🇺🇸 Jack Henry's Initial launch of Tap2Local will empower financial institutions and their SMB customers with fast, seamless digital payments. Developed in collaboration with Moov, a modern digital payments processor, the cloud-native Tap2Local solution offers merchants many distinguishing features.

OPEN BANKING NEWS

🇺🇸 eBay Seller Capital integrates Open Banking to make financing easier and more accessible for sellers. With this integration, eBay aims to build on the hundreds of millions of dollars of working capital already delivered to thousands of sellers to help grow and expand their businesses.

REGTECH NEWS

🇺🇸 Don’t just detect fraud, predict and prevent it to build member trust. This article highlights that fraud events have surged by 25% year‑over‑year, and that total losses are expected to reach record levels in the coming years, according to data from both the Federal Trade Commission and ACI Worldwide.

🇮🇳 UPI 'collect requests' to end in October. The ‘collect request’ feature allows UPI users to send a payment request to another person, say, to split a dinner bill or remind a friend to return borrowed money. The recipient can accept or decline the request.

🇨🇳 Sunrate secures license to operate in China. This acquisition represents a strategic step in SUNRATE’s ongoing commitment to enhancing its global licensing framework and ensuring compliant operations in all jurisdictions, whether through direct licensing or strategic partnerships.

DIGITAL BANKING NEWS

🇧🇷 Brazilian digital lender Nubank posts 42% profit boost. The firm, which has nearly 123 million clients across Brazil, its main market, Colombia, and Mexico, posted a $637 million second-quarter net profit for the April to June period. Revenue stood at $3.7 billion, up 40% year-on-year.

BLOCKCHAIN/CRYPTO NEWS

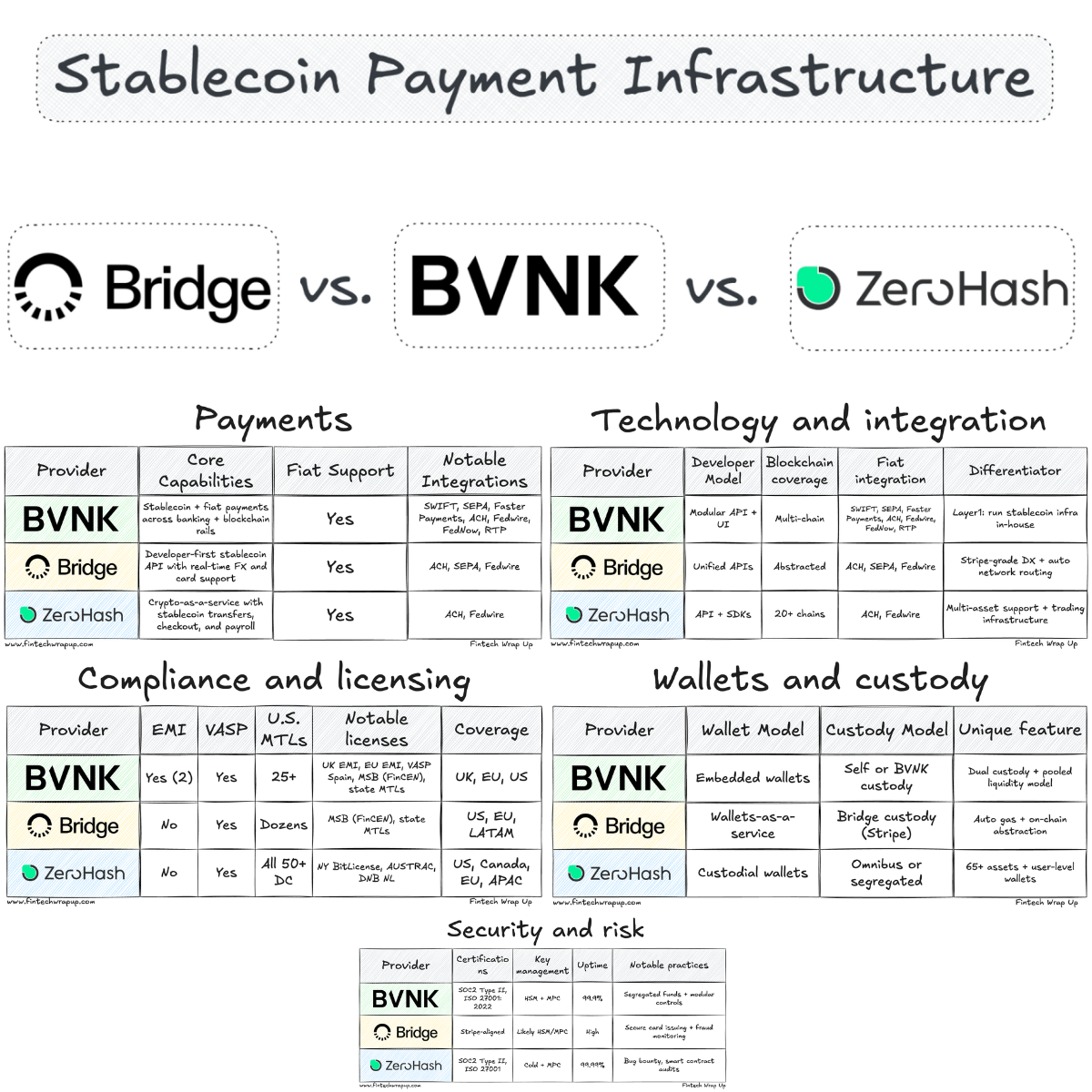

📊 Stablecoin Payment Infrastructure. BVNK 🆚 Bridge 🆚 zerohash.

🇺🇸 Stablecoins face last-mile trouble. Phil Bruno, Chief Strategy and Growth Officer at ACI Worldwide, explains that although recent legislation like the GENIUS Act, signed into law by President Trump, is raising the profile of stablecoins through enhanced consumer protections, reserve requirements, and federal oversight, translating that into real-world, frictionless adoption remains a challenge.

🇺🇸 Coinbase loses $300,000 in MEV exploit after token approval error. Coinbase Chief Security Officer Philip Martin confirmed the loss, describing it as “an isolated issue” tied to a change in a corporate DEX wallet. He stressed that no customer funds were affected.

🇺🇸 Citigroup weighs crypto custody as ETFs and stablecoins gain momentum. Wall Street giant Citigroup is weighing plans to offer cryptocurrency custody and payment services, aiming to capitalize on a market bolstered by Trump-era regulatory approvals and pro-industry legislation.

🇺🇸 Block unveils Proto Rig and Proto Fleet, marking a new era in Bitcoin mining. Proto Rig is designed to be infrastructure, a paradigm shift that solves many existing pain points for miners and signals the company’s long-term commitment to the industry.

PARTNERSHIPS

🇺🇸 FalconX and Copper partner to extend ClearLoop off-exchange settlement protections. This partnership underscores the commitment to security, transparency, and efficiency of Copper’s innovative ClearLoop off-exchange settlement functionality, which provides robust protections against exchange insolvency and compromise.

🇿🇦 Network International expands portfolio with Absa Bank. Through this collaboration, services will include card management for fleet cards and commercial prepaid cards, transaction switching and authorisation, integration with fleet management software, and direct connectivity to Absa Bank systems.

🇺🇸 Worldpay and Trulioo collaborate on safeguards for agentic AI commerce. This collaboration aims to bring trust, consent, and accountability to the rapidly evolving landscape of digital payments driven by artificial intelligence. Read more

🇬🇧 VivoPower partners with Crypto.com for XRP treasury custody strategy. Its Crypto.com Custody offering will provide institutional-grade custody services. It makes sure that VivoPower’s digital assets, especially its XRP reserves, are safe and available all over the world.

🇨🇳 RayNeo and Ant Group partner to advance AR glasses innovations in payments. Beginning with in-store payment scenarios, the augmented reality pioneer will collaborate with Ant Group to explore AR glasses solutions for a diverse range of applications, including everyday services and cross-border payments.

🇺🇸 Growfin partners with Zuora to transform accounts receivable for the enterprise. The collaboration will help enterprise companies tap into the power of AI to transform their quote-to-cash operations to support modern monetization strategies.

🇬🇧 TerraPay and Whish Money partner on cross-border payments. The partnership leverages TerraPay’s expansive global market access to enable both sending and receiving of cross-border payments, offering Whish users an end-to-end remittance experience that is reliable, secure, and faster than traditional channels.

🇺🇸 Routable teams up with FedNow for expanded instant payments coverage. According to the Co-Founder and CEO of Routable, the integration of FedNow significantly enhances the company’s coverage for instant payments, allowing it to better support its customers.

🇺🇸 GPN partners with Tampa Bay Lightning for arena transactions. This collaboration is part of GPN’s expanding portfolio of stadiums and venues, now facilitating transactions in more than 160 locations around the globe, covering every major U.S. sports league and some of the most famous international stadiums.

DONEDEAL FUNDING NEWS

🇿🇦 Street Wallet secures $350K to bring cashless payments to South Africa’s informal economy. The fresh capital will be leveraged to deepen market penetration, fuel higher sales growth, and expand the company’s footprint across South Africa. Read more

🇺🇸 Drivepoint adds $9M from Top Tech and Consumer Investors. The company will utilize the new funding to intensify its AI product development in forecasting, variance analysis, and decision intelligence, and to expand its go-to-market efforts as demand from mid-market and enterprise brands accelerates.

M&A

🇺🇸 Coinbase closes $2.9 billion Deribit deal and becomes top crypto derivatives exchange. The deal combines Coinbase’s U.S. dominance with Deribit’s offshore market leadership, bringing $59 billion in open interest and more than $1 trillion in annual trading volume onto one platform.

🇨🇦 Royal Bank of Canada and Bank of Montreal explore $2bn sale of Moneris payments business. RBC and BMO have brought in advisors to explore a potential sale of the business, which generates approximately $700 million in annual revenues. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()