Cleo Considers IPO as Revenue Soars Toward $500M ARR

Hey FinTech Fanatic!

Cleo posted $136M in 2024 revenue and says it’s just passed $250M ARR. 🤯

In a LinkedIn post, CEO Barney Hussey Yeo said the company is now profitable and weighing an IPO: “$500M ARR is around the corner. So, London or NYC for the IPO?” he wrote.

Will the London Stock Exchange miss out on another FinTech IPO?

There’s more on Cleo, scroll down for the full story and the latest in FinTech 👇

Cheers,

Follow me on Threads for daily scoops!

INSIGHTS

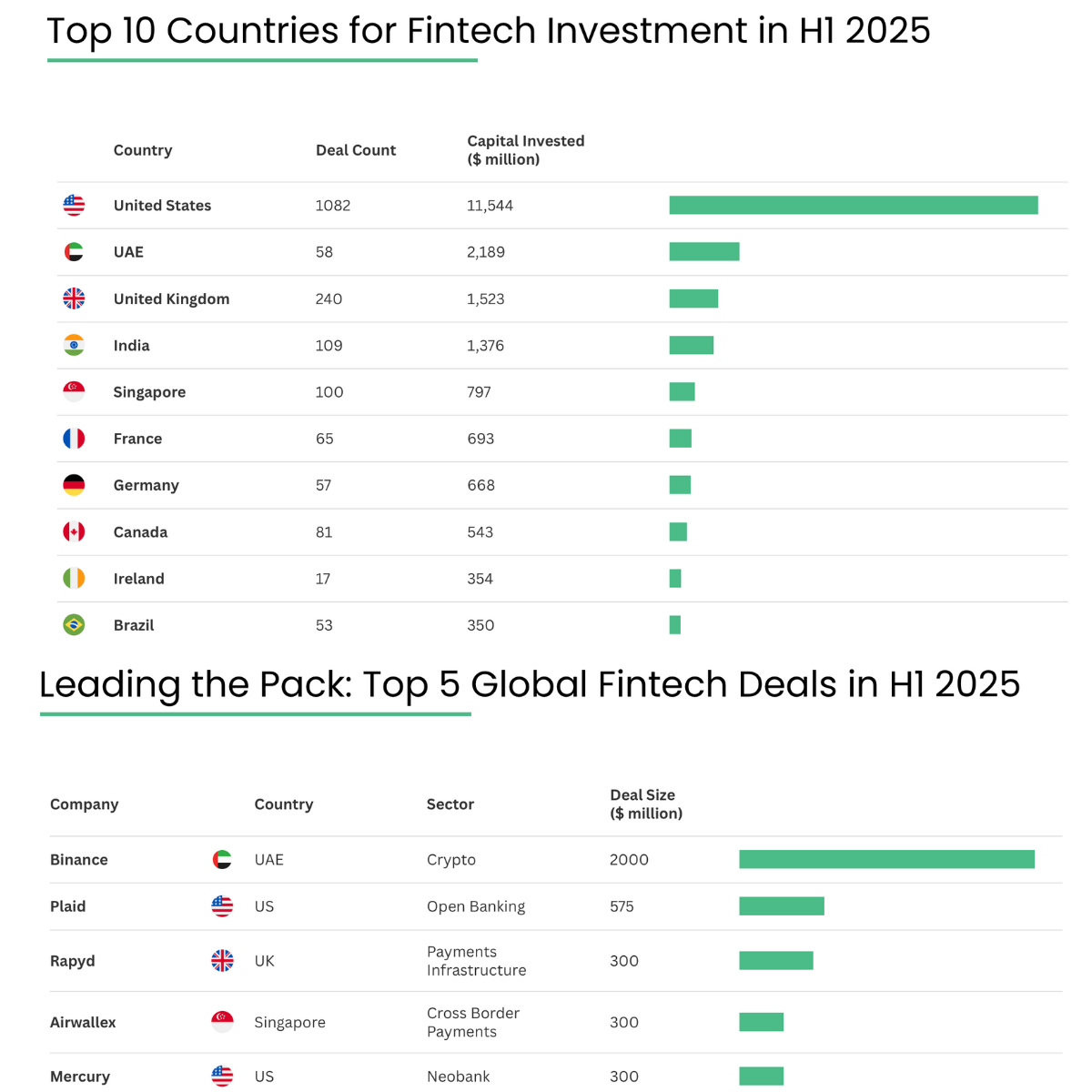

📊 FinTech funding lags deeptech, health, and B2B SaaS in H1 2025. According to Sifted data, FinTech funding in Europe during the first half of 2025 decreased by 20% year-over-year, from €4.6 billion in H1 2024 to €3.7 billion in H1 2025. Read more

FINTECH NEWS

🇬🇧 Square launches data-driven cash advances in the UK. Businesses can access simple funding to grow their business and keep operations running smoothly. Whether a restaurant owner, retail merchant, or beauty salon, fast and easy access to funds helps sellers manage daily expenses without delay and with no interest.

🇬🇧 Cleo CEO teases IPO after AI FinTech doubles revenue. The company’s annual results reveal a previously undisclosed fundraising from existing investors. Announcing the results, the CEO and founder claimed Cleo will soon reach $500m annual recurring revenue while floating the idea of a London or NYC public listing.

PAYMENTS NEWS

🇩🇪 PayPal dominates web store payments in Germany, but Apple Pay reigns in the UK. A new report from the direct-to-consumer payment platform Appcharge reveals regional differences in payment preferences. Keep reading

🇯🇲 JN Bank releases a new digital pay wallet. JN Pay Wallet allows users, whether they have a bank account or not, to access the Central Bank Digital Currency, JAM-DEX, to transfer funds, pay bills, buy mobile credit, and make deposits and withdrawals from a JN Bank account and JN Bank Smart ATM.

🇮🇳 New UPI Rules from August 1: Big changes coming to GPay, PhonePe, Paytm, and others, which will improve the ecosystem, making it smoother and more efficient by overcoming problems such as server downtimes and delays in payments through 7 new changes made by NPCI.

🇺🇸 Nuvei adds PINless debit and least cost routing to boost approval rates in North America. PINless debit and least cost routing are available now in the U.S., enabling eligible transactions to bypass traditional card rails in favor of lower-cost local debit networks.

🇮🇳 RBI has flagged concerns over the zero-charge model. While the government supports free digital payments, the RBI has underscored the need for a revenue mechanism to keep the system running efficiently in the long run. Continue reading

🇺🇸 Wise turned to the US as some investors pushed back on dual shares. Wise's plan to shift its primary listing out of London gathered momentum after some existing shareholders rebuffed a proposal that would have allowed Chief Executive Officer Kristo Käärmann to keep his so-called golden shares for many more years.

🇦🇺 Zip has announced a new integration with Xero via Stripe in Australia, enabling small businesses using both platforms to offer Zip’s flexible payment options directly on their invoices. This integration allows businesses to get paid upfront while giving customers greater flexibility in how they pay.

🇨🇭 Levl onboards with BCB for a cross-border solution. Levl’s BCB accounts, operated out of the UK and Switzerland, are key to its business expansion, allowing remittances in global leading currencies often favoured by consumers and businesses in emerging economies.

OPEN BANKING NEWS

🇺🇸 FinTech, Crypto, and Main Street Business trades urge President Trump to uphold open banking rules amid anti-competitive moves from the nation’s largest banks. The open banking rule affirms consumers’ ability to securely control and share their financial data to access the services of their choice, a foundational right in today’s digital age.

REGTECH NEWS

🇮🇳 Federal Bank, in collaboration with FinTech partners M2P and MinkasuPay, launches biometric authentication for E-com card transactions. Customers can now authenticate online purchases using just a touch or a look, their fingerprint, or face ID.

🇦🇪 UAE banks to cancel OTPs and switch to app verification. The change will apply to all types of local and international financial transfers and online transactions. Instead of OTPs, banks will shift to authentication via mobile banking apps, using in-app confirmation features.

DIGITAL BANKING NEWS

🇵🇰 Zindigi launches Visa Virtual Debit Card. The virtual card prioritizes convenience and security. Users can generate it with one click, use it immediately for online purchases or global services, and benefit from 3D secure authorization for fraud protection.

🇬🇷 Greece cracks down on bank fees with new legislation. The Greek Finance Ministry has introduced sweeping changes to bank transaction policies that will eliminate charges for cash withdrawals from ATMs starting August 11, in a move aimed at protecting consumers and promoting digital banking services.

🇦🇺 Australians embrace digital banking as digital wallet use surges. According to the ABA, more than four billion payments were made via mobile wallets in the last year, which is 11 times more than the 353 million ATM cash withdrawals, which were valued at A$106bn.

🇨🇴 Lulo Bank will compete head-to-head with Nubank, Bancolombia, Davivienda, and others with a coveted product. The Gilinski Group's neobank surprised the financial sector with a product designed to compete head-to-head with the country's leading banks.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 US crypto legislation drives $4B surge in stablecoin supply. Regulatory clarity is opening the door for banks, asset managers, and crypto firms to roll out new stablecoin products. With regulatory clarity comes new capital, new players, and intensified competition.

🇭🇺 Revolut reboots crypto services after legal freeze. It is now allowing users to access depositing, releasing, and staking rewards through its app. This comes after a full suspension of crypto features in early July, following restrictive legal changes passed in June by parliament.

🇧🇷 BitGo establishes official presence in Brazil to offer crypto custody and digital treasury services to financial institutions. By establishing a local presence, BitGo aims to ensure compliance, security, and sovereignty in providing services to financial institutions such as banks, brokerages, and asset managers.

🇧🇷 Tourists in Rio may soon pay with crypto as Bybit and Tether expand. The partnership comes amid growing interest in digital assets. The Central Bank Director stated that about 90% of Brazil’s crypto transactions involve stablecoins. He noted most transactions are linked to cross-border payments, which raise challenges for taxation and regulation.

PARTNERSHIPS

🇺🇸 Circle’s USYC is now supported as yield‑bearing off‑exchange collateral for Binance’s institutional clients. This partnership comes amid surging demand in the broader market for tokenized interests in US Treasuries, which has nearly doubled since the start of 2025.

🇺🇸 Greenlight announces integration with Q2's digital banking platform. Greenlight’s integration with the Q2 Digital Banking Platform allows financial institutions to deliver a valuable financial education and personal finance experience directly within their digital banking apps.

🇺🇸 FinTech Platform Alpaca enters new partnerships to expand financial access and enhance trading by collaborating with innovative FinTech companies like Composer, ZAD, and Manzil. These partnerships highlight Alpaca’s commitment to democratizing finance and fostering inclusive, accessible investment opportunities.

DONEDEAL FUNDING NEWS

🌍 H1 2025 FinTech Investment Landscape. This report provides a detailed look at investment activity across regions, highlighting emerging trends, standout deals, and perspectives from Innovate Finance members and the wider venture ecosystem. Continue reading

🇨🇳 Digital assets firm OSL raises $300 million to expand crypto business worldwide. The funding will accelerate OSL Group’s global buildout, particularly in regulated stablecoin infrastructure and compliant payment rails, said Ivan Wong, Chief Financial Officer of the Hong Kong-listed company, in a statement.

🇳🇴 Blockchain startup Bitzero raises $25M. The funds will be used to drive immediate revenue growth and further its mission of setting a new global standard for clean, community-centered mining operations. Keep reading

🇺🇸 21-year-old MIT dropouts, Delve, raise $32M at $300M valuation led by Insight. Delve, which automates regulatory compliance with AI agents, ended up fielding multiple term sheets, eventually closing a $32 million Series A at a $300 million valuation.

🇺🇸 Ramp is in talks to raise at a $21 billion valuation, up 30% from June financing. The six-year-old corporate card and expense management startup is in discussions with investors to raise $350 million at a valuation of about $21 billion, with the investment, according to three people with direct knowledge of the fundraising, just a month after raising at a $16 billion valuation.

M&A

🇺🇸 Trovata acquires ATOM, unlocking full treasury management capabilities to redefine corporate treasury. This move marks a bold step forward in Trovata's mission to modernize and democratize treasury technology, unlocking the full capabilities required to serve large global enterprises.

🇬🇧 Marex to acquire Winterflood Securities for £103.9M. The acquisition is expected to enhance Marex’s existing UK cash equities business, consistent with its strategy to bring new clients and new capabilities onto its platform and diversify earnings.

MOVERS AND SHAKERS

🇺🇸 Ji Hun Kim appointed as CEO of Crypto Advocacy Group. The CCI is one of many crypto advocacy organizations that periodically write to US lawmakers and regulators on digital asset policy. Before Kim, Sheila Warren headed the council as CEO, departing just a month before the Trump administration took office.

🇮🇳 Setu strengthens the top deck with Senior Execs from Razorpay, PhonePe, and Wibmo. This follows the appointment of Anand Raisinghani as its new CEO. Prashanth Nimmagadda joined as CTO. Ramkumar Thirumurthi has come on board as CRO, and Santosh Subramanian has joined as Head of Finance.

🇦🇷 Ualá adds Alexia Quesada as its new Chief People Officer. Quesada will be responsible for leading Ualá's management, culture, and talent development strategy at a key moment for the company, which is actively seeking talent, especially in areas related to technology.

🇺🇸 Fulton Bank appoints Kevin Gremer as Chief Tech and Ops Officer. He will be responsible for leading a team of information technology and operations professionals. He is charged with leveraging leading technology to provide the best digital customer experience at Fulton Bank.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()