Circle Gains a Rival as Paxos Launches USDG in EU

Hey FinTech Fanatic!

There’s a new USD-based stablecoin in town. Paxos has launched Global Dollar (USDG) across the EU, following approval under the region’s new MiCA framework.

Backed by Robinhood, Kraken, and Mastercard, USDG enters a market opening up to regulated dollar tokens. With oversight from Finland’s FIN-FSA and Singapore’s MAS, Paxos is positioning itself early in this regulated space.

For users in the EU, USDG adds another MiCA-compliant option alongside Circle’s USDC, which has so far dominated this segment.

“USDG is a fully regulated global USD-stablecoin that is compliant with MiCA and now available in the EU,” said Walter Hessert, head of strategy at Paxos, “a testament to our commitment to offering global digital assets that are supervised by prudential regulators and also meet the highest standards of consumer protection.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FEATURED NEWS

💰 How much does it cost to advertise through Connecting the Dots in FinTech…? That’s not something I’d just share publicly, but now I’ve decided to just share it all: our full media kit, including pricing and ad formats.

#FINTECHREPORT

🇬🇧 Sustainability & Social Impact in Ecommerce by Ecommpay and IMRG, consumer trends in charitable giving, and environmental expectations. With consumers increasingly looking beyond product and price, and seeking brands that reflect their values, findings from the survey of 1,000 UK consumers provide valuable insights for the e-commerce landscape. Download the complete report here

FINTECH NEWS

🇺🇸 Circle applies for US trust bank license after bumper IPO. If the charter is granted by the U.S. Office of the Comptroller of the Currency, it would enable Circle to act as a custodian for its reserves and hold crypto assets on behalf of institutional clients.

🇺🇸 Mercurity FinTech joins the Russell 2000 Index. This inclusion marks a significant milestone for the company, enhancing its market visibility and access to a broader base of institutional investors. Keep reading

🇮🇱 eToro unveils changes to crypto services. The company is introducing a new pricing structure where traders will be able to better understand their investment performance and the cost of every trade, with full transparency and no embedded fees.

🌍 Robinhood, Kraken-Backed Global Dollar (USDG) comes to Europe. “USDG is a fully regulated global USD-stablecoin that is compliant with MiCA and now available in the EU, a testament to our commitment to offering global digital assets that are supervised by prudential regulators and also meet the highest standards of consumer protection,” said Walter Hessert, head of strategy at Paxos.

🇺🇸 Peter Thiel-backed Valar Ventures FinTech sells $70 million stake in Wise. The price was a less-than-1% discount to Wise’s closing price. Wise shares fell in early trading in London before erasing losses and trading up about 0.6% at £10.46. Continue reading

💰 Visa and Mastercard race to capture a $253 billion crypto threat. Tech firms and crypto start-ups are challenging Visa and Mastercard's dominance in digital payments with stablecoins, promising lower fees, faster settlement, and bypassing traditional card networks.

🇬🇧 Regulation is slowing down FinTech. The Regulatory Innovation Office (RIO) is set to partner with the Digital Regulation Cooperation Forum to develop tools for FinTech businesses to navigate financial regulations. Tools will include a “unified digital library”, providing access to all digital policy and regulation.

PAYMENTS NEWS

🇬🇧 DEUNA’s CEO Unveils Athia at Payments Leaders' Summit. Roberto E. Kafati, Co-Founder and CEO of DEUNA, delivered a keynote presentation addressing key gaps in global payment infrastructures. He introduced Athia, designed to convert raw payments and commerce data into strategic, context-aware actions that align with business objectives

🇪🇸 Mollie has officially launched Tap to Pay on iPhone in Spain, enabling businesses to accept in-person, contactless payments directly through their iPhone using the Mollie app, no additional hardware required. It also opens up new possibilities for innovative in-store setups.

🇻🇳 JCB rolls out Apple Pay for Vietcombank, MBBank, and VPBank Cardholders. The rollout supports the growth of digital payments in the country, offering a more convenient way to pay in stores, within apps, and online. Keep reading

🇬🇧 Yonder launches debit cards. The new Mastercard debit cards offer the same perks as Yonder's credit card: points earning, zero foreign exchange fees, curated local rewards, and travel-friendly benefits. The Yonder Free Debit earns one point per £1 spent with no monthly fee.

🇯🇵 Soft Space and Hokkoku enable stablecoin payments on SoftPOS in Japan. The solution will allow merchants in the country to accept both contactless cards and stablecoin payments using only an NFC-enabled Android smartphone or tablet. It is scheduled for launch in Q4 2025.

🇬🇧 Landmark ruling finds Visa and Mastercard breach interchange fees law. In a decisive legal blow to the global card giants, the UK’s Competition Appeal Tribunal (CAT) has ruled that Visa and Mastercard’s default multilateral interchange fees (MIFs) breach European competition law.

🇪🇸 Viva.com rolls out Tap to Pay on iPhone in Spain, empowering local merchants with a fast, simple, and secure way to accept contactless payments using just an iPhone and Viva.com’s Terminal app, no additional hardware or payment terminal needed.

🇺🇸 Thredd expands global footprint with New Office in the U.S. The new office will serve as a central and strategic hub to support Thredd’s operations across the Americas, enabling deeper support for the company’s growing network of clients and partners throughout the region.

🇺🇸 Nearpay becomes the first Saudi payments FinTech to expand into the U.S. By entering the US, it joins a competitive field that includes Square and SoftPOS providers like Stripe Terminal and Fiserv’s Clover. Management says the company will target small retailers and service businesses looking to cut hardware costs.

REGTECH NEWS

🇮🇳 SEBI allows intermediaries to use NPCI’s ‘e-KYC Setu System’ for digital KYCs. NPCI, along with UIDAI, has developed and implemented a system known as the ‘e-KYC Setu System’ to enable the digitization of the customer onboarding. Registered intermediaries may use the facility of the ‘e-KYC Setu System’ to perform digital KYC.

DIGITAL BANKING NEWS

🇪🇸 Trade Republic launches the first Spanish payroll account with Bizum and 2% interest on unlimited cash balances. The new payroll account, which includes Bizum functionalities, completes Trade Republic’s bank offering in Spain, which enables customers to have a fully localised banking experience.

🇳🇱 Finom validates trust and information security standards with ISO/IEC 27001:2022 Certification across 100+ security requirements. This certification validates Finom’s comprehensive Information Security Management System (ISMS) and demonstrates the company’s commitment to meeting rigorous information security standards expected by financial regulators across Europe.

🇪🇸 Revolut follows CaixaBank and launches a new service in Spain. Revolut confirmed that its Pro or Business customers will be able to accept contactless payments using only an iPhone and the Revolut app. Read more

🇫🇷 Qonto is likely to apply for a banking licence within the year. “Getting a banking licence would, in the same way, enable us to do more internally, to own more of the value chain and not be dependent on some banking partner’s speed,” Alexandre Prot, CEO and co-founder, said.

🇩🇪 Deutsche Bank aims to launch a crypto custody service in 2026. It has enlisted crypto exchange Bitpanda’s technology unit to help build the offering. Its custody project comes as large financial institutions increasingly focus on digital assets, encouraged by new regulations in Europe and a favorable environment in the US.

🇬🇧 Monzo top UK bank for SME current account switch gains in 2024. Monzo experienced the highest net current account switch gains for SMEs and charities last year, according to the latest data from the Current Account Switch Service (CASS). Continue reading

BLOCKCHAIN/CRYPTO NEWS

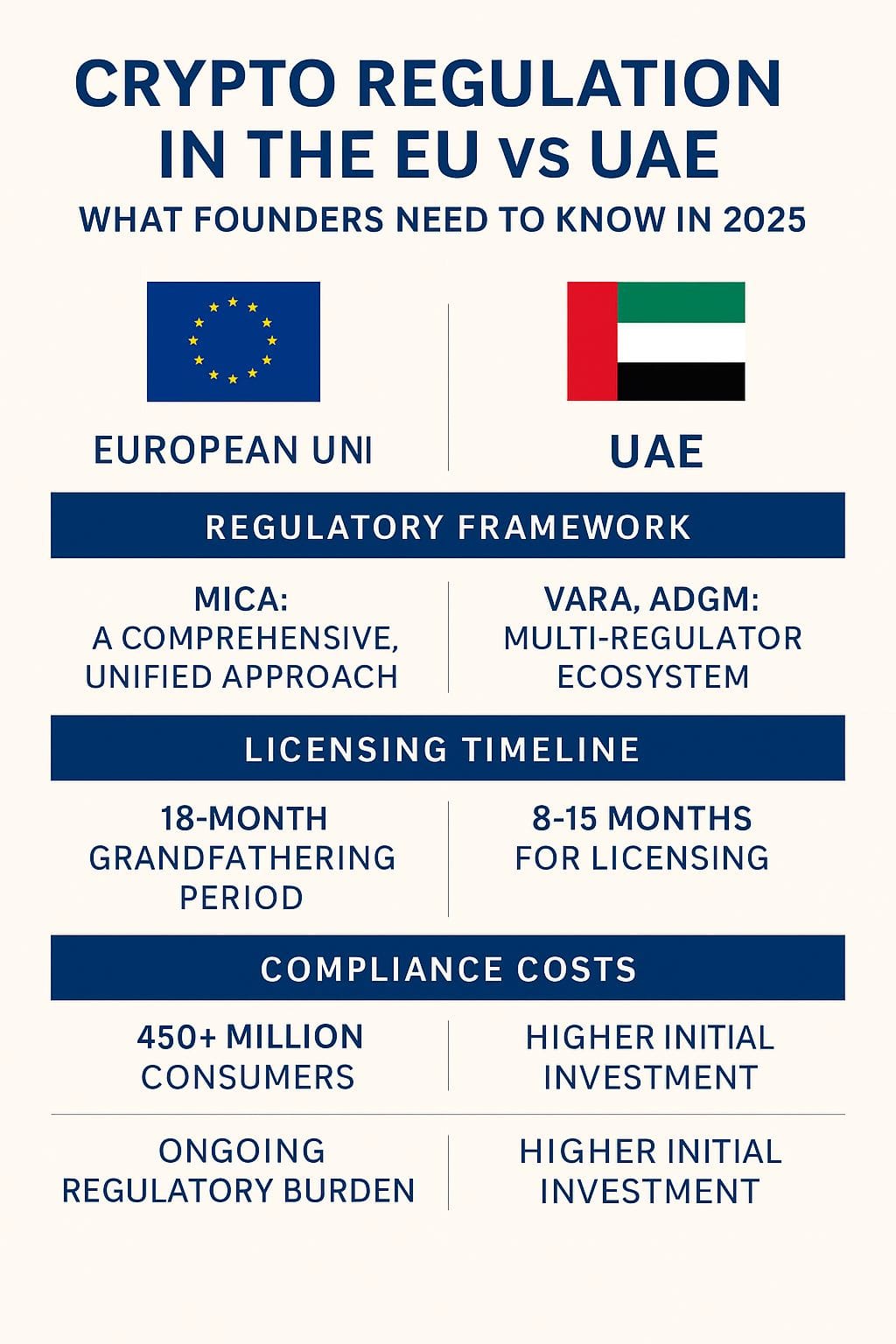

➡️EU 🆚 UAE

The Crypto Regulation Face-Off Every Founder Needs to Know About👇

🇺🇸 Coinbase CEO Brian Armstrong confirms launch of Concierge for high-value clients. This new service provides dedicated human advisors for clients needing faster, more personalized assistance. Users receive tailored support that surpasses the platform’s usual chat and phone help options.

PARTNERSHIPS

🇸🇦 ACI Worldwide and iNet extend partnership to bolster FinTech growth in Saudi Arabia. iNet will deploy and manage a Point of Sale (POS) infrastructure using ACI Postilion, an acquiring platform that enables banks, FinTechs, and merchants to deliver fast and seamless omnichannel transaction processing while staying compliant with evolving regulatory standards.

🇺🇦 Solidgate has teamed up with Monobank. This collaboration opens powerful new opportunities for international businesses. Solidgate is now making it easier than ever to succeed in the Ukrainian market with seamless, tech-driven card payments powered by Monobank’s innovative platform.

🇦🇺 Coinbase integrates PayPal as a payment method in Australia. By linking their PayPal account, users have a simple and speedy way to buy crypto on Coinbase. This will allow users to more seamlessly access Coinbase Australia’s suite of products: simple and advanced trading, stablecoin rewards, and staking.

🇬🇧 multifi partners with GoCardless to streamline payments for small businesses. Through this collaboration, GoCardless’s Direct Debit feature will be integrated directly into the multifi platform. This will create a seamless repayment process, making it easier for businesses to manage their cash flow and focus on growth.

🇳🇿 Westpac and POLi partner to deliver secure open banking payments. With this new integration, POLi transitions to secure, bank-approved open banking APIs, allowing Westpac customers to authenticate and authorise payments directly within Westpac’s secure digital banking environment.

🇦🇺 Fonto partners with Mastercard on Open Banking solutions. The deal creates opportunities to expand Fonto’s data and research products in Australia and supports its ambitions for international expansion by accelerating its entry into new markets.

DONEDEAL FUNDING NEWS

🇮🇩 Indonesian AI spend management platform Monit nets $2.5M. Monit plans to use the new funds to improve its product capabilities, particularly in AI and machine learning. The company also aims to expand its leadership and sales teams. Keep reading

🇮🇳 Zango bags $4.8M to boost AI-native compliance tools. The AI-based SaaS platform plans to deploy the fresh proceeds to expand its teams in Bengaluru and London, and build product modules for an AI-native governance, risk, and compliance.

M&A

🇸🇪 Länsförsäkringar Bank announces agreement to acquire SAVR in Landmark FinTech Deal. The transaction marks a significant step in the evolution of the Swedish financial market, where an established bank strengthens its digital position by acquiring the technology and innovation capabilities built by a FinTech from the ground up.

MOVERS AND SHAKERS

🇩🇪 N26 appoints Jochen Klöpper as CRO and Managing Director. Effective 1 December 2025, Klöpper will be appointed Managing Director and assume responsibility for risk management and compliance functions. He replaces Carina Kozole, who will leave the company effective 31 July 2025 to take on a new professional challenge.

🇬🇷 Kostas Xiradakis joins Snappi as Chief Commercial Officer. In this role, Kostas will lead Snappi’s marketing, sales, and customer experience efforts as the company accelerates its growth and sharpens its focus on customer-first innovation. Read more

🌎 Mastercard to expand crypto team with two senior hires to drive blockchain initiatives. The first role will oversee strategic partnerships across the digital asset sector, working with issuers, infrastructure providers, and startups to scale solutions. The second role will focus on collaborating with financial institutions to develop blockchain uses.

🇬🇧 Barclays appoints new Chief Operating Officers. Craig Bright, Chief Information Officer, and former Goldman Sachs banker Anne Marie Darling would assume the role of group Co-Chief Operating Officers. Keep reading

🇯🇵 Citigroup hires ex-Nomura Executive Akira Kiyota for Japan Investment Banking. The move is part of a trend of global banks bolstering their dealmaking ranks in Japan, where companies are considering acquisitions, asset sales, and privatizations to improve profitability and shareholder value.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()