Circle Files $6.71B IPO, Dismisses Sale Rumors

Hey FinTech Fanatic!

After months of quiet, shifting timelines, and whispers of a possible sale... Circle has officially launched its IPO. The USDC issuer is targeting a valuation of up to $6.71 billion, with shares priced between $24-$26. If successful, they’ll begin trading on the New York Stock Exchange under the ticker “CRCL.”

Circle has been waiting a long time for this moment. A SPAC deal in 2022, which valued Circle at $9 billion, collapsed before reaching the finish line. Then came a SEC filing this April, followed almost immediately by reports of delays tied to market uncertainty. Meanwhile, rumors swirled of potential acquisition talks with Coinbase and Ripple, rumors Circle promptly dismissed, reaffirming its path toward the public markets.

The IPO includes 24 million shares, with 9.6 million offered by Circle itself and 14.4 million coming from existing shareholders. J.P. Morgan, Citi, and Goldman Sachs are leading the effort, with a full bench of global banks supporting the launch.

Since the Trump administration entered the White House with a more permissive stance on digital assets, only eToro has made it through just 2 weeks ago. Now, others like Kraken, Gemini, and more are watching closely as Circle moves forward.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

Start your Money20/20 Europe on the move with Checkout.com! Join our Pick Up the Pace Run on June 4th, 7:00 AM from RAI Amsterdam. Meet industry peers, get energized & claim exclusive swag for the first 50 sign-ups. Spaces are limited — register now!

INSIGHTS

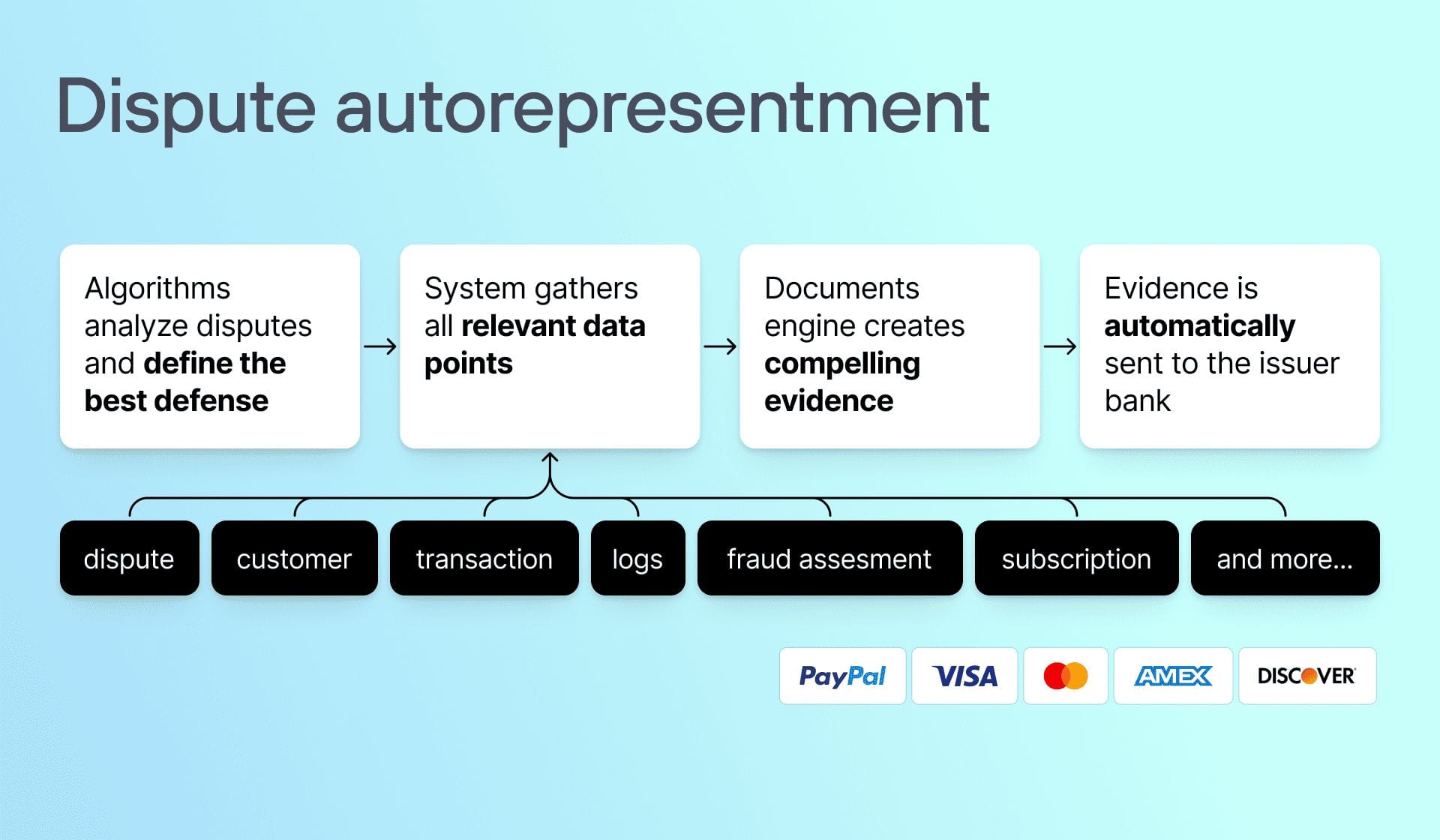

🇬🇧 Automated dispute representment: More revenue, less work, better win rates by Solidgate. It eliminates these challenges for PayPal and card chargebacks. Autorepresentment acts as an always-on dispute analyst and attorney, fighting disputes immediately, intelligently, and effectively. Read the full article

FINTECH NEWS

🇬🇧 Ecommpay grows processing volume by 25% in 2024. Driven by a clear focus on financial inclusivity, the company has achieved a 19% YoY increase in transaction volume and an impressive 25% rise in processing volume. During the same period, merchants leveraging Ecommpay’s seamless global payments infrastructure experienced an 8% improvement in acceptance rates.

🇬🇧 UK FinTech hiring surges. Risk and compliance hiring is projected to rise by 29% in 2025, marking the third consecutive year of growth. Within that, demand for financial crime professionals is set to jump by 50%, while fraud-related roles are expected to double.

🇮🇳 Flipkart to hire 5,000 employees in 2025 amid push into quick commerce, AI, and FinTech. The hiring push comes as Flipkart targets rapid scale-up across these verticals while also preparing for a potential IPO and a shift of its legal domicile from Singapore to India.

🇺🇸 Plaid's CEO Zach Perret said the company made a risky gamble in its early days. He revealed that the company scraped data from 12,000 banks, acknowledging the complexity of doing so at scale. Despite the challenges, Perret emphasized that Plaid’s overarching goal was always to partner with banks.

🇹🇷 13 arrested as Turkish FinTech Papara faces money laundering probe. The company is reportedly under investigation for alleged money laundering activities. The probe centers on the company's founder and CEO, Ahmed Faruk Karslı, who has faced scrutiny over regulatory compliance and governance practices.

🇺🇸 Global Payments’ Worldpay offers stablecoin payouts using Circle. Infrastructure provider BVNK will enable the new stablecoin offering, and crypto firm Fireblocks’ integration services will help facilitate the connection to Worldpay. Worldpay’s payout platform currently supports 135 traditional currencies.

PAYMENTS NEWS

🇬🇧 ACI Worldwide redefines payments with ACI Connetic. ACI Connetic brings together account-to-account (A2A), card payments, and AI-driven fraud prevention on a unified cloud-native platform, making it simpler, faster, and more cost-effective for banks and financial institutions to modernize their payments infrastructures.

🇳🇱 PayU rolls out MCP server to integrate AI assistants and payment systems. The company said early use cases include generating payment links, emailing invoices to customers, fetching payment status using invoice IDs, and checking transaction or refund statuses.

🇸🇦 PayTabs Group achieves FinTech dominance with its AI-powered payment platform. This transformative orchestration layer delivers unified control over the payment ecosystem through plug-and-play APIs and secure local hosting, ensuring unmatched efficiency, visibility, and compliance for the financial sector and other vital industries that drive the region’s economy.

🌍 Apple brings Tap to Pay on iPhone to eight more European countries. It was introduced in Belgium, Croatia, Cyprus, Denmark, Greece, Iceland, Luxembourg, and Malta, enabling millions of merchants to use an iPhone to seamlessly and securely accept in-person contactless payments.

🇺🇸 TransFi launches BizPay, a cross-border payment platform created to facilitate simpler transactions for businesses and individuals in over 100 countries. The platform is designed to improve sending and receiving money and managing payouts and pay-ins globally.

🇳🇱 Mambu launches latest product offering, Mambu Payments, extending composable banking beyond core. This means Mambu is poised to help financial institutions modernise core infrastructure and accelerate innovation across the entire banking stack, spanning lending, deposits, and payments.

🇺🇸 Block’s bitcoin checkout goes live in Vegas, a significant step in making it ‘everyday money’. Block says the initiative is part of a broader strategy to offer small businesses more payment options and position bitcoin as the internet’s native currency.

REGTECH NEWS

🇮🇳 RBI tightens default loss guarantee rule. The Reserve Bank of India has instructed finance companies to exclude default loss guarantees from FinTech firms when provisioning for stressed loans, impacting digital lending service providers. NBFCs must now make full provisions on these loans, diminishing their appeal for new business.

🇺🇸 CFPB to ditch open banking rule. The Financial Technology Association (FTA) has hit out at US regulators over plans to rescind open banking rules, calling the move a handout to Wall Street banks. Read more

🇮🇳 Worldline gets RBI nod to facilitate cross-border online transactions. According to a statement from its parent firm, Worldline India, this authorisation enables Worldline ePayments India to facilitate cross-border online transactions for the import and export of goods and services.

DIGITAL BANKING NEWS

🇬🇧 LHV Bank makes UK retail banking entrance with new current account offering. LHV Bank says it is aiming to challenge the "market norm of low and 0% interest current accounts" by introducing a current account paying 3.25% AER on balances up to £1 million.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Bitstamp launches regulated Staking for UK customers. Dubbed “Bitstamp Earn Staking”, the service allows UK-based crypto enthusiasts the ability to participate in staking through a reputable and regulated exchange, offering a trustworthy avenue to earn additional income on digital assets.

🇬🇧 Blockchain.com seeks Africa expansion as crypto rules emerge. The company is looking to grow in countries including Ghana, Kenya, and South Africa, and this quarter is planning a physical office in Nigeria, which is the firm’s fastest-growing market in West Africa.

🇺🇸 Circle launches Initial Public Offering. The IPO price is currently expected to be between $24.00 and $26.00 per share. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

🇺🇸 Moomoo expands into digital assets, launching Moomoo Crypto. The new US Crypto’s plan to launch over 30 coins is an exciting option for Moomoo investors to trade on its all-in-one trading platform. Keep reading

🇬🇧 Revolut seeks Gibraltar presence with new crypto role. The position that is currently open requires potential candidates to be based in Gibraltar or within a commutable distance. “We’re looking for someone to help us solve the toughest problems in our new entity,” Revolut’s job posting said.

PARTNERSHIPS

🇬🇧 Solidgate partners with Tipalti to change the payment game for platforms and marketplaces. This collaboration brings Solidgate’s expertise in Pay-In infrastructure and Tipalti’s advanced Pay-Out and financial automation tools to create a seamless, end-to-end payment ecosystem.

🇸🇬 Malaysia and Singapore boost digital trade connectivity. The collaboration aims to catalyse the transition from paper-based to digital trade flows, including the use of verifiable electronic records, aligned with the region's push for trade facilitation and supply chain resilience.

🇬🇷 Microsmart and Begini join forces to enhance microfinance access for Greek MSMEs. With MSMEs comprising 99% of Greek enterprises, this collaboration is a vital step toward bridging the credit gap for underserved entrepreneurs. Continue reading

🇬🇧 JCB expands in-store card acceptance with PayXpert. This partnership ensures broader JCB Card acceptance, making it easier than ever for JCB Cardmembers to use their preferred payment method while traveling and spending in Europe and in the UK.

🇬🇧 Tradu chooses Salt Edge for PSD2 compliance and payment initiation across the UK and EU. The partnership with Salt Edge enables Tradu to address critical challenges in the financial sector, including regulatory compliance, fraud prevention, and user authentication, particularly in light of PSD2 regulations.

🇦🇷 Santander joins Argentinian FSIs to launch fraud intelligence-sharing network. The network, called BioCatch Trust, aims to help prevent different types of scams, including investment, business email account compromise, where a criminal manipulates the victim outside of a digital banking session.

🇱🇹 Genome partners with Sepagon to optimise the Open Banking market. Through this collaboration, Sepagon incorporates Genome’s secure incoming payment APIs and real-time webhook notifications to offer optimal and transparent C2B payments for businesses and their customers.

🇷🇴 Revolut Business and Danubius join forces to boost in-person payments in retail networks. The partnership aims to increase the flexibility of the merchants and retail networks by offering Revolut Reader to their customers across Romania. Keep reading

DONEDEAL FUNDING NEWS

🇮🇳 GyanDhan nears USD 6 mn funding round led by Pravega Ventures and Classplus. The company has emerged as a leading marketplace in the education-finance space, connecting students with over 15 banks and NBFCs. It also operates its own NBFC and provides a SaaS platform tailored for overseas education consultants.

🇱🇺 Luxembourg-based FinTech Financial Navigator secures €1.1 million in funding. The funding will play a key role in accelerating Financial Navigator’s mission to modernize treasury and finance operations for mid-sized enterprises and the fund industry.

🇧🇪 FinTech startup Husk secures €1m to scale payment solutions for Europe’s startups. The newly raised capital will be used to scale operations and accelerate the company’s geographical expansion. It will also support product development as Husk looks to refine and extend its platform’s capabilities.

🇸🇬 Cred to raise $75 million from existing investors. The company's plans to raise fresh funds augurs with its plans to focus on the development and adoption of its new product offerings. Read more

🇺🇸 FinTech FUTR secures $1.25m to accelerate AI and payment innovations. FUTR’s platform aims to optimise financial outcomes for consumers by harnessing AI agents and automated cash management. The core objective is to help users monetise their data.

MOVERS AND SHAKERS

🇨🇭 Christopher Giancarlo, known as “Crypto Dad,” joins Swiss Bank Sygnum to boost global crypto growth. He will help guide the bank’s global regulatory strategies and build partnerships with institutions. Keep reading

🌍 Visa names Antony Cahill CEO of its European operations. Mr. Cahill will replace Charlotte Hogg, who is leaving Visa after eight years to pursue a new external opportunity. Mr. Cahill will be based in London and is expected to transition to his new role in early June.

🇬🇧 Lloyds Banking Group appoints Aritra Chakravarty as head of agentic AI. Chakravarty will oversee the bank's plans to launch a prototype agentic AI system later this year. Continue reading

🌍 payabl. appoints Christia Evagorou as Deputy Group CEO. In her expanded role, she will work closely with Group CEO Ugne Buraciene and the Board to support the company’s continued growth across Europe and beyond. Christia brings over 15 years of experience in corporate governance, tax, and legal structuring.

🇬🇧 Starling strengthens leadership team with four new appointments. Catarina Abrantes-Steinberg has been appointed Group CPO, Ian Cox joins as Starling’s new Group Head of Internal Audit, Monica Risam has been appointed Group General Counsel, and Bernadette Smith has been promoted to CCO. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()