Checkout.com to Power Spotify Payments Across 180+ Markets

Hey FinTech Fanatic!

Big distribution move in global giants today, with focus on scale, stability, and leadership as the market matures...

Checkout.com just landed a strategic partnership with Spotify to power payments across 180+ countries.

This puts Checkout at the center of subscriptions for 700M+ monthly users and 280M+ paying subscribers.

Spotify plugs into Checkout’s Intelligent Acceptance, network tokens, and authentication stack to keep recurring payments running quietly in the background.

This is about scale and reliability. Local acquiring. AI-driven optimization. Fewer failed payments. Smoother renewals.

Guillaume Pousaz, Founder & CEO at Checkout.com, summed it up clearly. Payments are critical to the digital experience. At this scale, even small gains matter.

And there’s movement at PayPal, too

PayPal named Enrique Lores as its next CEO, effective March 1. A board-level reset, with David Dorman stepping in as independent chair.

This follows a review that concluded progress wasn’t moving fast enough.

New leadership at PayPal. New chapter. Execution back in focus.

Curious what else is moving in FinTech right now? Scroll down 👇 More tomorrow.

Cheers,

FINTECH NEWS

🌍 If you are in East Asia, Europe, or LATAM, we always have a running option for you! 🏃➡️ Check our runs in Dubai, Berlin, and Panamá City next!

🇺🇸 Plus500 introduces its US prediction markets platform. Through this new offering, Plus500’s B2C customers in the US can now access a broad range of regulated prediction markets covering economic indicators, financial events, geopolitical developments, and other measurable real-world outcomes.

🇬🇧 Bank of England names first FinTech cohort for scale-up regulator. Backed by the Treasury and jointly run by the FCA and PRA, the unit is intended to help innovative FinTechs scale more quickly in the UK, with industry leaders welcoming it as a step toward strengthening the country’s competitiveness as a global financial services hub.

🌍 London FinTech Teya launches in Spain and Italy amid European expansion. According to Teya, the growing SME economies of Spain and Italy present a significant opportunity for FinTech to be a financial ally to small businesses. Teya’s expansion follows the launch of product innovations for its 75,000-strong European customer base.

🇺🇸 Superform expands to the U.S. with mobile app launch for a user-owned neobank. The app is designed for users who want a simpler way to grow their money without the stress of managing wallets, understanding protocols, or navigating multiple chains. Users can create an account, onramp with fiat, and start earning in minutes.

PAYMENTS NEWS

🇬🇧 Checkout.com announces strategic partnership with Spotify to power efficient, scalable payments globally. The partnership will enable Checkout.com to provide global acquiring services for Spotify to deliver a smooth, secure, and reliable payments experience for its global audience of more than 700 million monthly active users and more than 280 million paying subscribers.

🇩🇪 Airwallex expands to Germany. Airwallex aims to differentiate itself by enabling faster international payments and local accounts across markets, with the goal of quickly attracting several thousand active customers in Germany. Keep reading

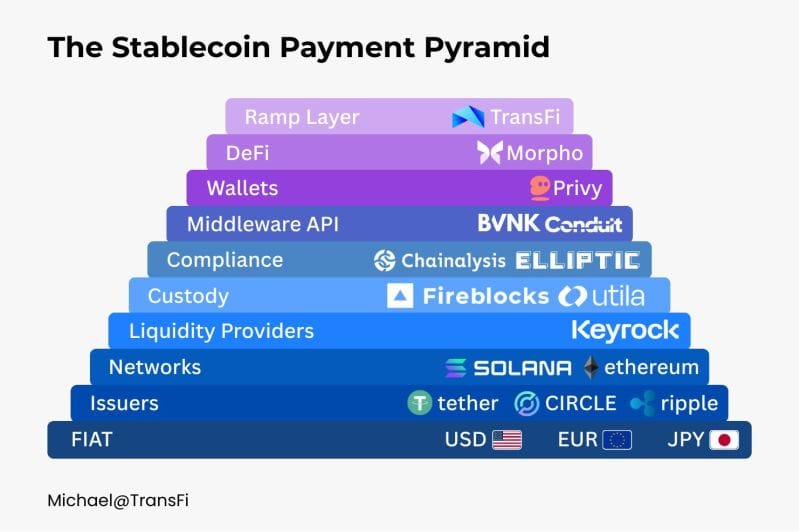

➡️ The 𝗦𝘁𝗮𝗯𝗹𝗲𝗰𝗼𝗶𝗻 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗣𝘆𝗿𝗮𝗺𝗶𝗱

Every real-world stablecoin payment runs through all of these layers:

🇺🇸 Samsung Electronics plans to expand the scope of Samsung Wallet's global payment American Express cards. The existing Samsung Wallet has supported Mastercard and Visa payments overseas, and Amex card users can now use overseas payments through Samsung Wallet without a physical card.

🇬🇧 Clear Junction launches onChain stablecoin pay-in service. onChain Stablecoin Pay-In is designed for banks, electronic money institutions, and money service businesses. Through their own apps or online banking environments, clients can offer their customers stablecoin-based prefunding while maintaining a fiat-first operational experience.

🇵🇭 Coins.ph joins Circle payments network to enable Philippine Peso payouts. The move is designed to reduce the friction often associated with traditional international transfers, offering potentially lower fees and faster access to funds for recipients.

🇺🇸 Intuit partners with Affirm to provide a pay-over-time offering for QuickBooks Online. Through the partnership, many businesses will have the ability to offer Affirm’s flexible payment options to their customers, while enabling businesses to attract new customers, boost conversion rates, maximize sales, and improve cash flow.

DIGITAL BANKING NEWS

🇬🇧 Finastra launches cloud-native tool for commercial lending. The platform is aimed at helping lenders replace manual workflows with a more scalable and integrated cloud-based approach. The solution uses modular deployment and licensing, allowing it to be deployed on its own or alongside other components within the LaserPro Lending Platform.

🇩🇴 Qik launches remittances to receive money from abroad. With this feature, the bank said that funds sent from abroad are credited in less than 30 minutes. This benefit applies to remittances from the United States and other countries whose remittance companies operate with Visa Direct.

🇮🇩 KakaoBank gains 93.3 billion won from Superbank listing in Indonesia. The gain, which represents more than 20% of KakaoBank’s 2024 net income on a pre-tax basis, underscores the bank’s strategy of enhancing corporate value through overseas expansion and continued cooperation with Superbank.

BLOCKCHAIN/CRYPTO NEWS

🇿🇦 South Africa’s first institutional rand stablecoin, ZARU, launches. ZARU is designed to modernise payment and financial infrastructure, enabling both retail and institutional users to transact at the speed of the internet while bolstering the local financial system.

PARTNERSHIPS

🇱🇺 Wero is now available at Banking Circle. The initiative is designed to simplify cross-border payments and scale adoption across Europe, aligning with Banking Circle’s role as a modern-infrastructure bank supporting payment service providers as new schemes and volumes emerge.

🇺🇸 Sumsub brings travel rule compliance to the Fireblocks platform. Under the partnership, Sumsub’s Travel Rule solution is embedded directly into the Fireblocks platform. This enables financial institutions and virtual asset service providers to manage regulatory requirements within existing workflows.

🇫🇷 Sumeria partners with Mistral AI. The company has launched a simplified bank transfer feature that uses Mistral AI’s latest OCR models to allow users to initiate payments directly from documents without manual data entry. Read more

🌎 Paysafe enables FuturePay’s Latin American expansion with a local payments suite. To support its Latin American market entry, FuturePay has integrated Paysafe’s SafetyPay solution to enable merchants to offer customers in the region bank transfers, online cash, and other local payment methods, including Pix for Brazil.

🇺🇸 Lydian enables crypto acceptance for Fiserv Clover merchants. The app will allow merchants to accept payments from more than 300 digital assets, including USDT, Bitcoin, and Ethereum, directly at the point of sale or online, while continuing to receive settlement in their local currency.

🇦🇪 botim money expands global remittances through TerraPay’s Partnership. This partnership enables botim money users to send funds through direct bank transfers and instant mobile wallet payouts, supported by TerraPay’s global payments network.

🌎 Adyen and Fresha surpass $5.5 million in capital issued. The offering is now live in the US, UK, Australia, Canada, Netherlands, Finland, and Sweden, with over $5.5 million in loans issued to date. This launch strengthens Fresha's financial product ecosystem, enabling small and medium businesses across the platform to access working capital quickly and seamlessly to fund their growth.

🇰🇷 Upbit partner KBank files stablecoin wallet trademarks ahead of IPO. In its IPO registration statement, the bank said it plans to use proceeds from the offering to accelerate its digital asset business, among other initiatives. Continue reading

🇨🇳 Visa Direct and UnionPay International will extend the global money movement network to billions of cards in the Chinese mainland. By connecting Visa Direct’s global money movement network to UPI’s MoneyExpress platform, Visa will provide a more seamless, secure, and transparent way for consumers and businesses worldwide to send money into Chinese Mainland, one of the world’s largest remittance destinations.

🇬🇧 YouLend and Intuit team up to bring embedded capital to QuickBooks UK customers. The new capital solution is designed to address the hurdles many small businesses face when looking to secure financing. Keep reading

🇺🇸 Merchant Rentals partners with FreedomPay to deliver flexible financing solutions for merchants. By collaborating with Merchant Rentals, FreedomPay can now offer merchants access to tailored leasing and financing options for POS technology, meeting growing demand for flexibility and affordability in the retail and hospitality sectors.

DONEDEAL FUNDING NEWS

🌎 alfred raises $15m in Series A funding. The company intends to use the funds to strengthen its technological, regulatory, and operational infrastructure across Latin America and extend its support to companies operating regional cross-border payments at scale.

🇨🇦 Neo Financial secures $68.5m in oversubscribed Canadian-led round. Neo said the capital will be used to launch its inaugural securitization program. By securitizing its credit assets, Neo is adopting a capital-efficient funding model long used by large banks, allowing it to scale its lending portfolio without relying exclusively on equity-funded growth.

MOVERS AND SHAKERS

🇫🇷 Josy Soussan leaves Klarna's public affairs for Mastercard. Josy Soussan, Head of Public Affairs at the Swedish company Klarna, announced that he has joined Mastercard in the same role. The new position allows him to reconnect with long-standing interests in financial inclusion and the use of technology to support businesses, consumers, and wider economic growth.

🇺🇸 PayPal appoints Enrique Lores as Chief Executive Officer and David W. Dorman as Independent Board Chair. The appointment follows a detailed evaluation conducted by the Board of Directors on the current position of the company relative to its competition and the broader industry landscape.

🇺🇸 United FinTech Americas head Mark Lawrence departs. Lawrence played a key role in United FinTech’s early growth and expansion in the Americas, describing his departure as the end of a successful start-up chapter. He said he plans to take time off with family before pursuing his next professional opportunity.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()