Cegid Acquires Shine to Become Europe’s Next Financial Copilot

Hey FinTech Fanatic!

Cegid has entered a definitive agreement to acquire Shine.

Together, they aim to build a unified, cloud-native financial hub for more than one million SMBs and 15,000 accountants across Europe. The platform will bring together e-invoicing, accounting, payroll, payments, tax… all under one roof.

Shine brings more than 400,000 SMB customers, a strong brand, and a scalable tech stack. Its co-founders, Rico Andersen and Martin Hegelund, have been building toward this moment for years.

Cegid, backed by Silver Lake and led on this deal by Christian Lucas, sees Shine as a cornerstone in its next phase of European expansion.

Jean-Michel Aulas, Cegid’s founder, also highlighted that the combination strengthens Cegid’s long-standing commitment to supporting SMBs and their accountants.

And there’s another important angle here: the deal was advised by FT Partners, led by founder and CEO Steve McLaughlin, continuing their strong momentum in major European and CFO-stack transactions this year.

Want to dive deeper into this story?

👉 Check it out here.

Keep scrolling down for more FinTech stories from today, and I’ll be back in your inbox next week!

Cheers,

#FINTECHREPORT

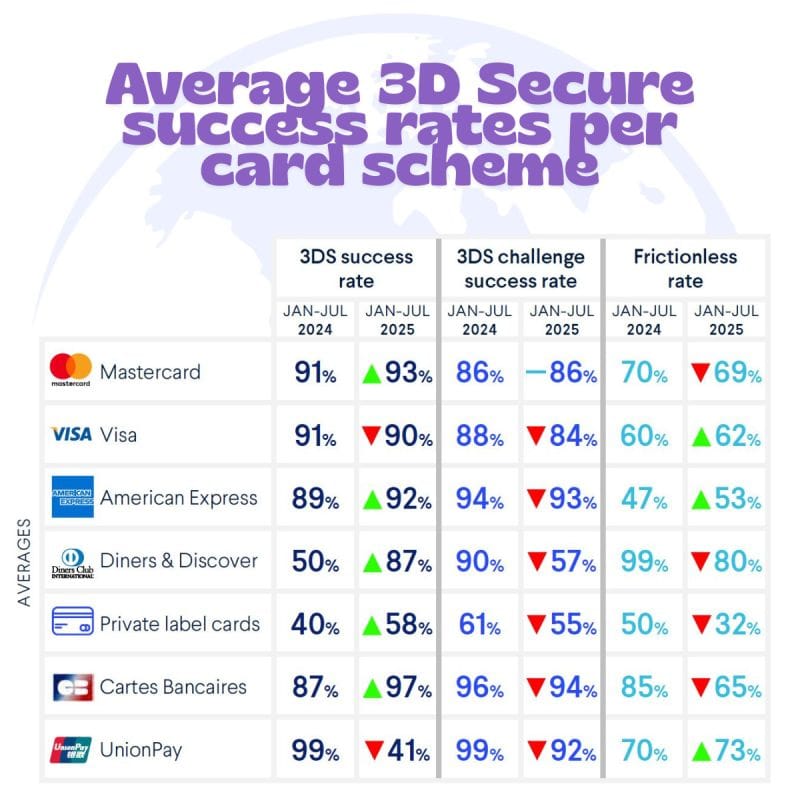

📊 Average 3D Secure success rates per card scheme.

Let’s dive into Ravelin Technology’s latest report👇

PAYMENTS NEWS

🇮🇳 Paytm rolls out Gold Coins, allowing users to earn digital gold with every payment made. The initiative is designed to fold wealth-building into everyday transactions and tap India’s deep-rooted trust in gold as a store of value. Read more

🇵🇹 InvoiceXpress launches free plan to support entrepreneurs and the national economy by removing barriers to issuing tax-certified invoices, allowing them to focus on growing their businesses. Rui Pedro Alves, Founder and Managing Director, added that the free plan aims to spur entrepreneurship, create jobs, and generate broader economic value for society.

🇹🇿 Vodacom Tanzania launches M-Pesa Global Payment to enable cross-border transactions. The initiative aims to cut costs, simplify trade, and boost financial inclusion, positioning M-Pesa as one of Africa’s most advanced digital payment platforms.

PODCAST RECOMMENDATION

🎤 Organizing Life Through FinTech: Fraser Stewart on Building Lyfeguard by DashDevs. In Episode 126 of The FinTech Garden, Igor Tomych speaks with Fraser Stewart, founder of Lyfeguard. The conversation covers the company’s shift from B2C to B2B2C, the importance of privacy and encryption, plans to introduce AI agents for automated data management, and lessons learned from building FinTech around sensitive life planning. Watch the full episode

Organizing Life Through FinTech: Fraser Stewart on Building Lyfeguard by DashDevs

REGTECH NEWS

🇪🇺 EU agrees on new rules for online fraud protection. The new set of rules would make payment service providers liable for covering customers' losses if they fail to implement appropriate fraud prevention mechanisms, and would force them to freeze suspicious transactions.

🇬🇧 The UK has opened a dedicated stablecoin cohort within its Regulatory Sandbox, inviting prospective issuers to test products, receive support, and help inform future rules as the country develops its stablecoin regime. The program offers a controlled testing environment, guidance from innovation officers, policy-shaping input, and public visibility for accepted participants.

🇦🇪 Ripple’s RLUSD Stablecoin wins key regulatory green light in UAE. The designation means licensed firms can use the dollar-pegged token for regulated activities, placing it into a small group of tokens permitted by the ADGM’s ring-fenced financial system.

FINTECH RUNNING CLUB

💥 Welcome aboard, Rodrigo! Join our newest Madrid co-host’s first FRC run on Dec 11th!

DIGITAL BANKING NEWS

🇧🇬 Revolut is outlining its phased transition from BGN to EUR in Bulgaria. BGN accounts and pockets will close on December 17, with balances automatically converted at the fixed EU rate. Outgoing BGN transfers ended on November 27 and incoming ones on December 10; after this date, any returns will be credited in EUR.

🇧🇷 PicPay enters the high-income segment with the Epic brand. The portfolio includes a Black card with up to 4% cashback and the option to split international purchases into up to three interest-free installments. In a statement, the bank reported that more than 2 million customers already fit the high-income profile.

🇧🇷 Nubank hires talent from Dex Labs and reinforces its data and AI strategy. The hiring of the Dex Labs team reinforces Nubank's ongoing investment in data and AI capabilities, aiming to continue advancing the global disruption of financial services, enabled by advancements in artificial intelligence.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 Binance launches 'Binance Prestige' bespoke service for private wealth and asset allocators. Encompassing onboarding, fiat services, financing, and more, Binance Prestige addresses the specific needs of family offices, private funds, and other asset allocators seeking a high-touch, professional approach to digital asset management.

🇦🇪 eToro expands UAE crypto deposits. The company now allows UAE-based users to deposit cryptoassets directly from external wallets, exchanges, or brokers. This feature is critical because it eliminates the regulatory and logistical friction of moving cryptoassets into the brokerage ecosystem.

🇰🇷 Upbit sees $38 million unauthorized withdrawal of Solana-based assets. Upbit confirmed that multiple tokens were affected, including DeFi and meme tokens. The exchange assured that it will fully compensate users from its own reserves.

🇺🇸 Do Kwon, co-founder of Terraform Labs, is asking a US court for a sentence of no more than five years for his role in the $40 billion TerraUSD collapse. He has agreed to forfeit over $19 million and property. His lawyers argue the 12-year cap in his plea deal is excessive, noting he also faces a separate trial in South Korea, where prosecutors are seeking a 40-year sentence.

🇦🇪 New UAE sweeping banking decree looks to cement country’s global crypto position. New regulations include faster licensing decisions, risk-based capital rules, and enhanced Shari’ah governance, promoting innovation and compliance in the digital asset space.

🇰🇬 Kyrgyzstan launches $50M gold-backed USDKG stablecoin to modernize cross-border payments. The Kyrgyz initiative underscores a broader trend toward responsible digital-asset innovation in emerging markets. The government’s focus on regulatory discipline, transparency, and tangible reserves signals a pragmatic approach to blockchain-based modernization.

PARTNERSHIPS

🇬🇧 Zodia Custody expands partnership with Deribit by Coinbase. Deribit users leveraging Zodia Custody will now have trades settled in net batches, intraday, with balances automatically reflected in users’ nominated wallets after each settlement cycle.

🇦🇪 Visa partners with Aquanow to enable faster settlement using stablecoins. The integration of Aquanow’s digital asset infrastructure with Visa’s world-class technology stack will enable Visa’s network of issuers and acquirers to settle transactions using approved stablecoins such as USDC, reducing costs, operational friction, and settlement times.

🇨🇭 Swiss Bank AMINA trials Google Cloud's Ledger for instant payments. The pilot aimed to showcase the potential of distributed ledger technology to support traditional financial infrastructure without new digital currencies or regulatory changes.

🌍 Klarna set to take off with Lufthansa Group, bringing flexible payments to travellers across Europe and the U.S. Lufthansa Group customers will be able to choose Klarna’s flexible payment options at checkout when booking travel experiences by offering the choice to pay in full, pay later, or spread the cost of their journey over time.

🇺🇸 Stakk expands the scope of deliverables with T-Mobile USA. The expanded scope is expected to drive increased transaction-based activity across the Stakk platform and, therefore, materially enhance the anticipated revenue trajectory of the relationship.

🇰🇷 MOIN expands strategic partnership with Nium. The expanded partnership will enhance global payout and collection capabilities, delivering faster, more affordable, and more transparent international money transfer services for Korean consumers and businesses.

DONEDEAL FUNDING NEWS

🇮🇳 Square Yards secures $35M funding, eyes unicorn status ahead of 2026 IPO. With strong revenue growth and a significant contribution from its FinTech segment, SquareYards is preparing for a potential $100 million funding round and an IPO in 2026, aiming to achieve unicorn status.

🇸🇦 erad secures $125 million facility led by Jefferies to power SME financing in the Middle East. Salem Abu-Hammour, co-founder of erad, said the partnership with Jefferies marks a major step for SME financing in the region, enabling embedded working-capital solutions within supplier and platform relationships to make access to funding as simple as a payment.

🇺🇿 Uzum raises 300 billion soums from U.S. VR Capital to expand FinTech operations. The company stated that the funding will accelerate the development of its core FinTech areas, including digital banking, payment infrastructure, and consumer lending.

M&A

🇫🇷 Cegid acquires Shine to accelerate the path to becoming Europe's leading financial copilot for SMBs and accountants. Both companies share a clear vision: empowering entrepreneurs by removing the complexity of running a business. Cegid and Shine will enable small business owners to spend significantly less time on administration and more time focused on their craft.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()