Cash Plus Hits $550M Valuation in Casablanca’s First FinTech IPO

Hey FinTech Fanatic!

Hope you made it through the Black Friday buzz. As the week kicks off, one story directly from Morocco pulled me in, and I thought you’d want to see it too.

Cash Plus just became the first FinTech to list on the Casablanca Stock Exchange.

The IPO values Cash Plus at $550 million and raised $82.5 million in total, with the breakdown detailed in the announcement.

Private equity firm Mediterrania Capital Partners sold 1.8 million shares, while the founding Amar and Tazi families didn’t sell any and committed to a seven-year lock-up.

Post-IPO, the company now has a 15.5% public float, with MCP reduced to 14.3%. Local coverage also notes the offering drew 81,466 subscribers, showing strong retail demand.

It’s interesting how these market moves keep reshaping the landscape, isn’t it? Scroll down for more FinTech updates 👇, and I’ll be back in your inbox tomorrow!

Cheers,

ARTICLE OF THE DAY

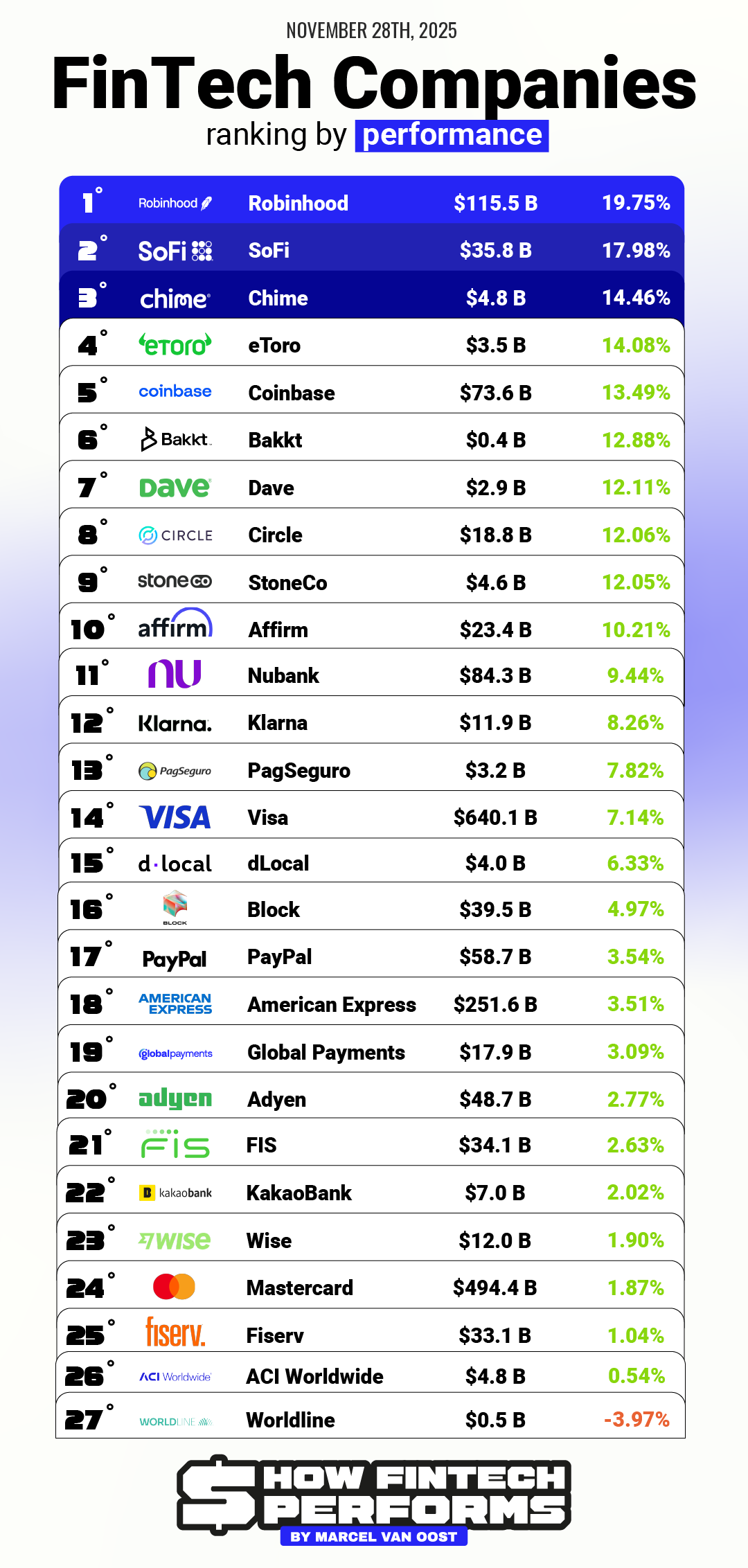

💰 FinTech Rebounds: Only One Player in the Red. 👇 Below is your full breakdown across market cap, performance, payments, digital banks, and crypto. Subscribe to my newsletter, How FinTech Performs, for more

FEATURED NEWS

➡️ Stripe built a captivating miniature city powered by real-time Black Friday and Cyber Monday data, showcasing peak activity across its global network. It’s a fun, visual way to explore how the platform handled 95k+ transactions per minute with near-perfect uptime. Check it out live:

INSIGHTS

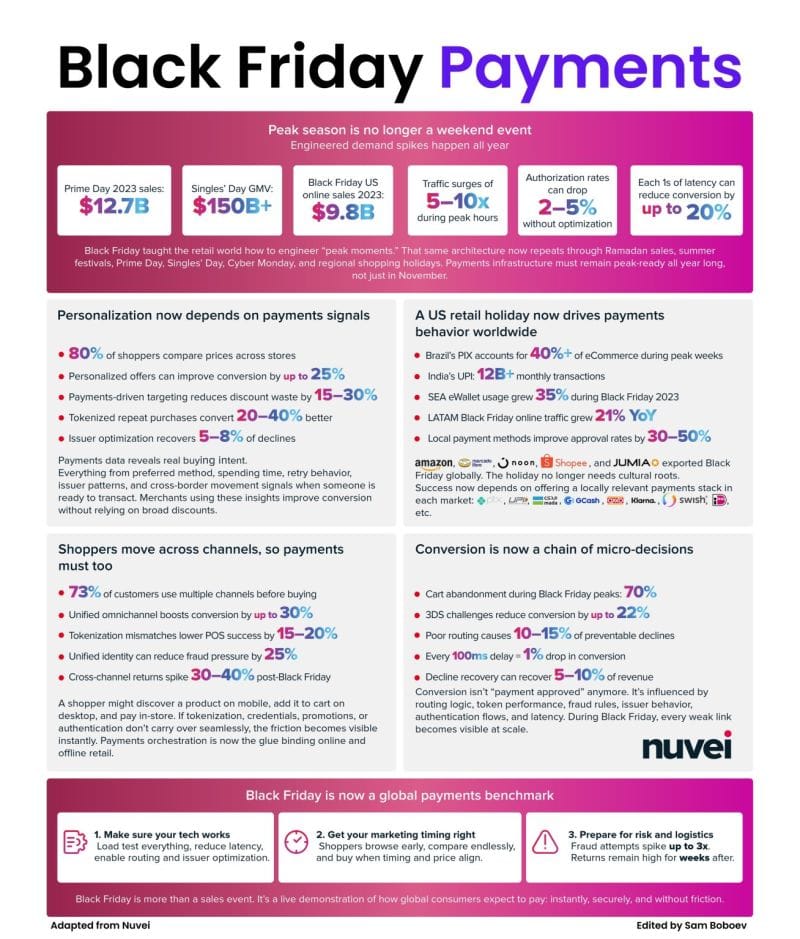

💰 Nuvei just shared a great breakdown of the 5 biggest shifts reshaping online payments.

Here’s what stood out to me the most👇

FINTECH NEWS

🌍 Your Chance to Host in 2026! The FinTech Running Club is growing fast, and this could be your moment to lead! If you’re passionate about FinTech, community, and networking, why not start your own chapter in your city? Are you curious? 👉 Sign up to become a host!

🇲🇦 Morocco’s Cash Plus hits $550m valuation as Mediterrania Capital Partners sells down stake in IPO. The deal was structured as a mix of growth capital and shareholder liquidity, marking a partial exit for private equity firm MCP, while the company’s founding families retained their full share count.

🇮🇳 Amazon and Flipkart aim for India's banks with new consumer loan offerings. Amazon is preparing to offer loans to small businesses as part of a broader financial services push, following its acquisition of non-bank lender Axio, which will restart SME lending and add cash-management tools. Additionally, Flipkart is preparing to launch BNPL products through its lending arm, Flipkart Finance, pending final RBI approval, with plans to offer no-cost instalments over 3–24 months and consumer durable loans at 18%–26% interest.

🇮🇳 Groww pumps INR 104.4 Cr into wealthtech subsidiary Fisdom. Groww said that, as per the share purchase agreement it entered into with Fisdom’s parent company, Finwizard Technology Pvt Ltd, in May, it was to infuse additional capital to facilitate certain payouts and other working capital requirements.

🇺🇸 CME data centre glitch halts futures and options trading. CME Group was hit by a data centre issue that halted trading for around 11 hours, disrupting stock futures and other key markets. “Due to a cooling issue at CyrusOne data centers, our markets are currently halted,” CME said in a statement.

PAYMENTS NEWS

🇧🇹 OxPay clinches a licence in Bhutan and will launch crypto B2B payments. Core offerings planned include merchant payment services that enable businesses to accept payments in the form of credit cards, e-wallets, and cryptocurrencies from a global customer base without ever being exposed to price volatility, OxPay said.

🇹🇭 Online payments player Omise debuts MCP server for agentic payments. With this release, businesses can now allow AI systems to access more than 60 Omise payment tools in a secure, structured, and reliable way, without building custom API integrations.

🇵🇱 PPRO adds Blik Pay Later for BNPL in Poland. This partnership enables online retailers to offer secure deferred payments via a consumer’s banking app, strengthening BLIK Pay Later’s presence in Poland’s domestic e-commerce market.

🇵🇪 Movii enters Peru as a new acquirer, seeking to connect payment aggregators to a 100% technological infrastructure that competes with traditional players. The entity has invested US$2.2 million, which will be used primarily to grow in the world of railway card acquisition and real-time rail payments.

REGTECH NEWS

🇿🇦 South Africa puts retail CBDC on Hold and prioritises payment system reforms. The South African Reserve Bank concluded that the country has no immediate need for a CBDC despite years of research. Instead, it plans to focus on strengthening the national payment system and improving access for non-bank financial participants.

🇧🇷 The Central Bank of Brazil prohibits financial institutions from using names unrelated to their activities. The regulation will affect Nubank, which is authorised to operate in the country as a payment institution, but not as a bank. The measure comes into effect immediately and will have an adjustment period.

DIGITAL BANKING NEWS

🇬🇷 Neobank Project advances despite the church of Greece's withdrawal. Despite losing Church backing, Filippidis is pressing on: the company approved issuing one million non-voting preferred shares at €35 each, raising €35 million, with €1 million added to share capital and €34 million booked as a share-premium reserve.

🇵🇭 GoTyme Bank unveils crypto trading feature with 11 digital assets. Go Crypto is a new in-app feature that allows users to buy, sell, and manage digital assets directly through the GoTyme platform. The feature supports 11 cryptocurrencies, offering Filipinos a way to invest in virtual assets without registering on external exchanges.

🇬🇧 Tandem unveils new portfolio Cash ISA. The Portfolio Cash ISA brings instant access and fixed-rate ISAs under one easy-to-manage portfolio, allowing customers to tailor savings to their needs. Savers can open up to 20 ISAs across any combination of instant access and fixed-term accounts, offering flexibility or guaranteed returns.

🇨🇴 Nu Colombia doubles its customer base and reaches 4 million users in just one year. The company reports a presence in 100% of the country's departments and more than 95% of its municipalities, a reach superior to that of several traditional banks with decades of operation.

🇳🇬 Bank78 MFB launches as Nigeria’s first fully private digital bank. Customers can expect effortless digital onboarding, intuitive navigation, and 24/7 AI-powered support through its virtual assistant, Ruby. The bank’s fully digital infrastructure eliminates the frustrations associated with traditional banking.

🇲🇽 Nu and Revolut lead FinTech quest for Mexico’s middle-class wealth. Their arrival is shaking up one of Latin America’s most competitive financial markets and pressuring major lenders to modernise, though newcomers will face tough regulators, weak infrastructure and fierce competition from both incumbents and local FinTechs.

BLOCKCHAIN/CRYPTO NEWS

🇰🇷 Bithumb to halt Tether-powered order book sharing service, which allowed customers to buy and sell Bitcoin and nine high-cap altcoins using USDT, following regulatory pressure. The crypto exchange said the service was still in Beta mode and involved an order book sharing agreement with the Australian crypto exchange Stellar.

🇹🇲 Turkmenistan passes a law regulating cryptocurrency mining and exchanges. The new law regulates the creation, storage, placement, use, and circulation of virtual assets in Turkmenistan, and defines their legal and economic status, the spokesperson said.

🇿🇦 Crypto Payments Startup Oobit accelerates global expansion strategy with launch in South Africa. Available on iOS and Android, the app is designed to deliver simple and seamless crypto payments, leveraging Visa rails to deliver the same experience as Apple Pay. Oobit allows users to pay with crypto, while merchants receive fiat currency.

🇦🇹 Crypto Exchange KuCoin's European arm wins MiCA License in Austria. MiCA came into effect late last year, allowing crypto companies to obtain a license in individual markets and then passport their services across the rest of the EEA. The license allows it to offer crypto exchange services legally in the country.

PARTNERSHIPS

🇦🇷 Reaquila and Pomelo roll out a new worker card in Argentina. This initiative aims to formalise a sector that handles over USD 1 billion annually and could meaningfully increase monthly income for recyclers through digitalisation, transparency and fairer pricing.

🌍 UnionPay International and Worldpay enable express pay and a 3DS e-commerce solution. The new collaboration features UnionPay 3D Secure and ExpressPay solutions, allowing UnionPay cardholders to transact in the US, UK, and Europe, and across various sectors, including airlines, retail, hospitality, and more.

🇯🇵 Nomura announces collaboration with OpenAI. By combining Nomura’s proprietary in-house data with the latest external datasets and information, Nomura aims to deliver differentiated, high-value-added investment advice, market analysis, and data solutions to clients.

DONEDEAL FUNDING NEWS

🇮🇳 Auxilo raises ₹225 Crore to expand student loans and support education. This infusion of capital is expected to boost Auxilo’s ability to provide financial assistance to students and educational institutions across India. Read more

🇺🇸 FinTech Pagaya hikes pricing on $399 million subprime debt deal. The deal, backed by subprime auto loans, came in seven tranches, with the largest, $112.7 million, rated AAA, pricing at 1.5% points above the benchmark, higher than the earlier 1.25–1.3 point guidance.

🇧🇷 Mercado de Recebíveis concludes fundraising of its own R$150M FIDC. CEO Henrique Echenique said having its own FIDC is key to scaling credit, after previously relying solely on banks and funds, noting the structure provides a stable funding source to meet client liquidity needs.

M&A

🇺🇸 Nice is reportedly looking to sell the Actimize division for up to $2bn. The reported sale of Actimize could therefore reflect a strategic shift, as Nice looks to reallocate resources to focus on expanding its cloud and AI capabilities through CXone and other related offerings.

🇩🇰 Dutch FinTech POM strengthens European position through acquisition of Denmark’s FarPay. By bringing FarPay and POM together, POM is creating a leading European platform that offers companies and their customers the best user experience and true peace of mind when paying and collecting outstanding invoices.

MOVERS AND SHAKERS

🇮🇳 Jupiter Money Marketing Head Adityan Kayalakal steps down after joining in May 2025. He announced the move on LinkedIn, writing, “Signing off from this incredible rocket ship… this astronaut is heading back to Earth.” Keep reading

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()