Capital One Strikes $5.2B Deal to Acquire Brex

Hey FinTech Fanatic!

Greetings from Santa Monica ☀️

A snowstorm rerouted my NYC flight, so I accidentally extended my stay in California. Tragic, I know. There are definitely worse places to be “stuck” than the LA sunshine 😉

Unexpected bonus: Los Angeles is buzzing with FinTech right now. Big shoutout to Seth Ross and the LA FinTech Meetup crew — packed room, sharp conversations, and a reminder that the ecosystem here is way more alive than people give it credit for. Loved dropping in for the night, already looking forward to round two.

Before I trade palm trees for snowbanks, I’m squeezing in one last long run along the coast.

Let’s get you a head start on the week:

Here’s the FinTech news I summarized for you over the weekend. 👇

Cheers,

FINTECH NEWS

🇧🇷 Now the city is moving again! Join Fathi de Souza for our next FinTech Running Club run in São Paulo: free, fun, and all about great people and good energy on the move!🏃➡️

🌎 MasterCard expands its security focus with a new monitoring center for Latin America. The newly launched unit offers 24/7 support in Spanish, Portuguese, and English for the entire región, real-time monitoring closer to regional customers, and greater resilience for payment operations in the región.

🇺🇸 Crypto security company Ledger plots $4bn New York listing. An IPO that could value the French crypto firm at more than $4 billion. Ledger is known for its hardware wallets used to store digital assets securely, and the listing would signal continued investor interest in crypto infrastructure companies.

🇺🇸 Donald Trump files lawsuit against JPMorgan and Jamie Dimon. The case, which was filed in Miami, Florida, on 22 January, is being brought on behalf of the US president and several of his companies. The US president had said that he would sue the bank for “incorrectly and inappropriately” debanking him.

PAYMENTS NEWS

🌎 Navro develops payroll services that handle all statutory and tax requirements across 95 countries. Statutory & Tax will enable three of Navro’s core client segments to manage all aspects of workforce and pension payouts in 95 countries through one provider.

DIGITAL BANKING NEWS

🇦🇪 Wio Bank joins NVIDIA Inception Program to accelerate AI-driven banking innovation. By joining NVIDIA Inception, Wio gains access to cutting-edge developer resources and advanced training, accelerating its mission to redefine banking for the region’s new economy.

🇺🇸 Revolut scraps plans to buy US lender in favour of push for standalone licence. The company has held talks with US officials about seeking a licence through the Office for the Comptroller of the Currency in hopes of a quick process amid the Trump administration's deregulatory push, according to the report.

🇧🇷 Nubank surpasses 112 million customers and becomes the largest private financial institution in Brazil, according to the Central Bank. The continued growth in its customer base was accompanied by record engagement, the result of a strategy to deepen customer relationships and increase the use of Nubank products and services, said Livia Chanes, CEO of Nubank Brazil.

🇺🇸 Affirm seeks a Nevada bank charter. Affirm is pursuing the creation of a banking subsidiary as it looks to expand beyond traditional FinTech offerings into services typically provided by banks in the U.S. Keep reading

🇲🇽 Hey Banco will begin operating as an independent bank on January 31, 2026, after receiving final authorization from Mexico’s National Banking and Securities Commission. The neobank serves more than 500,000 customers, focuses on consumer banking products, and holds about 1.5 billion pesos in assets.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto social platform Merkle Manufactory to repay $180 million to Venture Backers. The software firm behind a crypto-oriented social-media platform plans to repay venture capitalists the $180 million they had invested in the project, underscoring a period of consolidation for one of the more ambitious corners of the blockchain market.

🇬🇷 Binance applies for MiCA license in Greece ahead of July 2026. Approval would allow Binance offer crypto services across all EU member states legally soon. This approval would come ahead of the July 1 MiCA compliance deadline, when crypto firms must fully align with the new rules.

🇺🇸 UBS Group AG plans to make crypto investing available for some private banking clients. The Swiss banking giant is in the process of selecting partners for a crypto offering. High-net-worth individuals could access spot Bitcoin and Ethereum, as well as derivatives, with a potential rollout to Asia-Pacific and the US.

PARTNERSHIPS

🇨🇳 Tinaba extends Alipay+ Pact, enabling payments in China. The new service enables Tinaba users to pay at over 80 million merchants across China. Customers can complete these transactions by simply scanning a QR code directly within the app.

🇺🇸 Ripple Labs extends custody alliance with GarantiBBVA. By choosing to continue with Ripple’s custody technology, this banking giant is attesting to the vote of confidence that it has in the San Francisco-based blockchain payment company.

DONEDEAL FUNDING NEWS

🇵🇰 Pakistani FinTech Neem secures Pre-Series A funding from Epic Angels, global investors. Funds will be used to scale Neem’s technology infrastructure, strengthen cybersecurity, and data protection. Continue reading

🇮🇳 Juspay raises $50 million from WestBridge and enters the unicorn club. Juspay said the secondary component will provide liquidity to early investors and employees holding employee stock ownership plans, marking the second such liquidity event enabled by the company within a year.

M&A

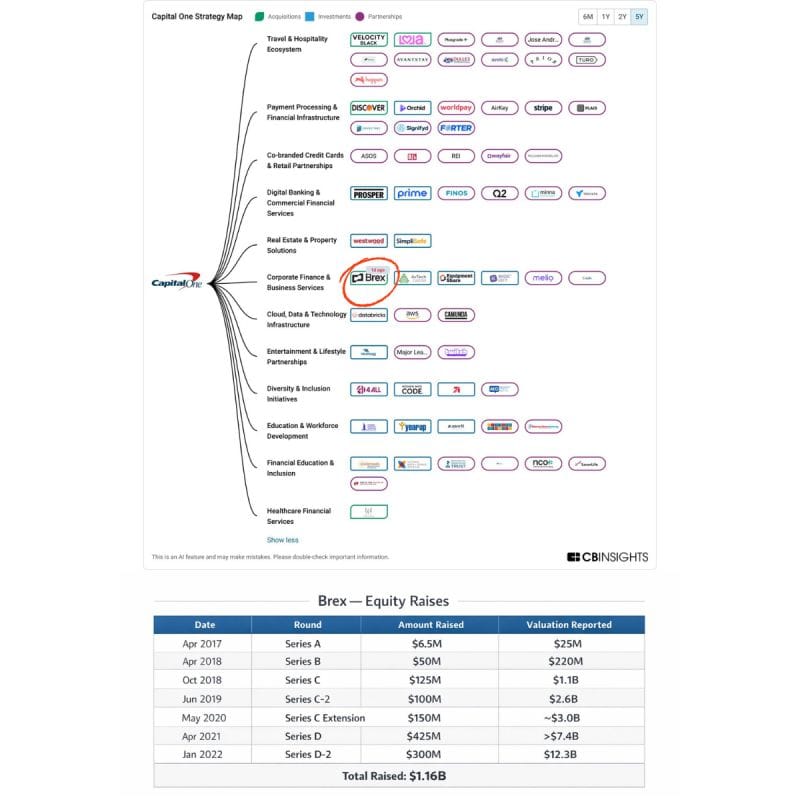

➡️ The $5.2 Billion Capital One X Brex deal feels like a turning point.

This deal signals the next phase of FinTech:

🇺🇸 Capital One is acquiring FinTech Brex for $5.2B. The deal, split evenly between cash and stock and expected to close in mid-2026, would expand Capital One’s presence in business banking, with Brex continuing to operate under its own brand and CEO Pedro Franceschi remaining in charge.

🇬🇧 Banking behemoth JP Morgan Nutmegs rivals with the purchase of WealthOS. JP Morgan Chase, the US-based banking giant, has swooped to buy a British pensions technology company as it tries to augment its retirement planning services to personal investing clients.

🇩🇪 Deutsche Börse inks €5.3bn Allfunds acquisition agreement. According to Deutsche Börse, its acquisition of Allfunds shows significant synergy potential. It claims that the combined group will be able to cut 15% (approximately €60 million) from its pre-tax operating expenses, as well as save €30 million on technology and infrastructure costs.

🇺🇸 UST acquires leading FinTech innovator Tailwind. With this strategic acquisition, UST will be able to increase its share of digital banking solutions implementation and support services for banks and credit unions. Read more

🇺🇸 Chainlink acquires FastLane’s Atlas to expand liquidation value recovery. Johann Eid, Chief Business Officer at Chainlink Labs, said the acquisition creates an effective value recovery system that increases revenue for DeFi through expansion to new blockchain networks.

🇬🇧 ClearScore accelerates mortgage push with Acre acquisition. Acre’s technology will power ClearScore’s mortgage strategy, allowing it to route demand for mortgages from its users to Acre’s broker ecosystem. ClearScore will provide the home-buying tools to its UK user base, with plans to expand the mortgage platform into South Africa, Australia, New Zealand, and Canada.

MOVERS AND SHAKERS

🇺🇸 Corpay appoints European Operating Executive David Bunch to its Board of Directors. “David is an accomplished, practical global operator. His deep experience in managing massive scale, platforming digital offers, and navigating international regulatory environments will be additive to our board as we continue to expand our global payments footprint,” said Ron Clarke, Chairman and CEO of Corpay.

🇺🇸 FIS has selected Anil Chakravarthy to join its board of directors. Jeffrey Goldstein, independent chairman of the board, comments: "We are pleased to welcome Anil to the FIS board. He is an accomplished technology leader who brings deep expertise in enterprise software, cloud transformation, and AI-powered enterprise solutions.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()