bunq Becomes Europe's First AI Powered Bank & Revolut's Record Earnings

Hey FinTech Fanatic!

During the highly anticipated 'bunq Update 24' event, Amsterdam based neobank bunq unveiled a series of innovations that are set to redefine the banking experience for millions across the continent.

The first major announcement was the impressive growth of bunq's user base. The fintech firm has now reached a staggering 11 million users throughout the European Union. This exponential growth, a 55% increase since July 2023, has resulted in the company amassing a total of 7 billion euros in user deposits.

bunq also introduced the integration of Apple's Tap to Pay feature for its business users. This innovative functionality transforms an iPhone into a portable payment terminal, enabling on-the-go transactions and enhancing the flexibility of digital banking.

The most revolutionary announcement, however, centered around Finn, bunq's proprietary AI-powered platform.

Finn, driven by advanced Generative AI and Large Language Models (LLMs), is poised to transform how users interact with their banking app. Designed to replace traditional search functions, Finn offers a range of services from financial planning and budgeting to simplified navigation and transaction tracking.

According to Ali Niknam, bunq's founder and CEO, Finn is the culmination of years of AI innovation and user-focused development, set to "completely transform banking as you know it."

In a parallel development, Revolut, Europe's most valuable startup, is on a trajectory to surpass £1.5 billion in revenue for the year.

This surge in revenue, bolstered by rising interest rates across Europe, marks a significant uptick from the £850 million reported in 2022.

Despite a decline in cryptocurrency activity, which previously contributed substantially to the platform's volume, Revolut continues to attract a massive user base, now nearing 40 million globally.

However, it's not all smooth sailing for Revolut. The startup, valued at $33 billion in 2021, faces challenges in securing its banking license from UK regulators. Additionally, concerns have been raised regarding the completeness of the company's revenue data for 2021.

Despite these hurdles, Revolut's recent performance offers a glimmer of hope to investors who have weathered a tumultuous period with the company.

Enjoy more FinTech Industry updates I listed for you below👇 and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

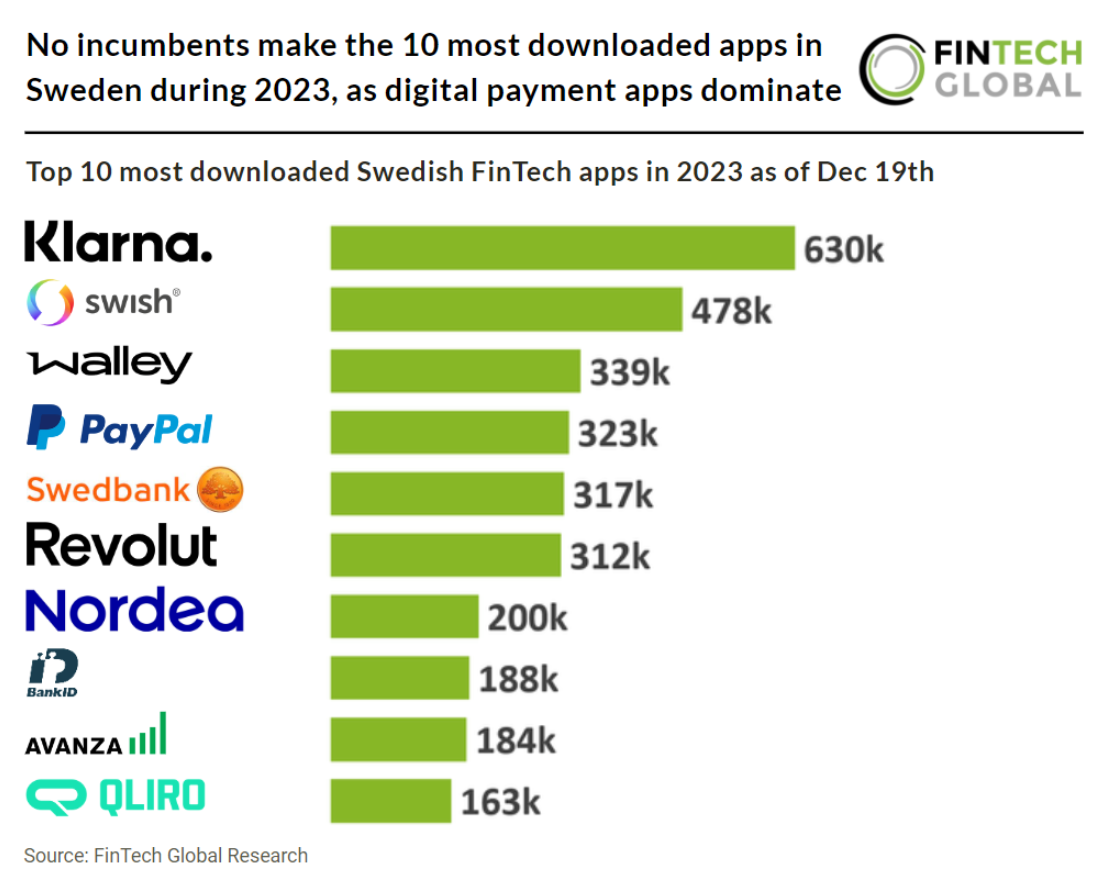

POST OF THE DAY

#FINTECHREPORT

A Real-Time Payment Systems World Tour 🌍 Discover the fascinating journey of RTPs across the globe through NORBr unique Notion page. It offers a detailed, up-to-date landscape of RTP systems, reflecting how they shape our global financial interactions.

INSIGHTS

🇩🇪 Learn how Fleming Banking partnered with Swan to launch banking accounts and cards for medical professionals 75% faster than expected. Please click here to read the full article.

Big ideas in Fintech for 2024 by Andreessen Horowitz. For the final LinkedIn newsletter of 2023, a16z's Fintech partners previewed the one big idea they believe will drive innovation in 2024. Read the full piece here

FINTECH NEWS

Chipper Cash may be profitable in 2024. The prominent African fintech startup, once grappling with heavy losses, is now set to achieve profitability by early 2024, according to a former executive who claimed to have spearheaded the company’s dramatic turnaround.

🇺🇸 Atomic connects with OneSource Virtual, a collaboration designed to deliver a simplified and secure direct deposit management solution to millions of American workers. This partnership gives Atomic direct access to OneSource Virtual customers, empowering employees with increased financial control and flexibility.

🇬🇧 Thredd closes momentous year with record growth. The company announced that 2023 will deliver the best performance in its history. With strong support from investors, Thredd expanded its leadership role in the payment ecosystem, driving client-centric expansion across global markets.

🇳🇬 African fintech startup Bloc launches cutting-edge business banking platform. This launch is a milestone for Bloc, reinforcing its commitment to empower African enterprises globally. Bloc Business Banking will provide companies with a comprehensive suite of financial services.

🇵🇹 Portugal’s progressive policies fuel Fintech growth. The recently launched Portugal Fintech Report reveals a vibrant and dynamic fintech ecosystem in a country with a population of around 10 million. Explore further on this topic

Intermex partners with Visa to expand money transfer services. With this collaboration, Intermex customers will be able to make fast transfers to eligible Visa cards and bank accounts in those countries, Intermex said in a Tuesday (Dec. 19) press release.

PAYMENTS NEWS

🇺🇸 Affirm expands to self-checkout at Walmart stores. The company announced it has expanded its services with Walmart to bring Affirm’s transparent and flexible pay-over-time options to self-checkout kiosks at over 4,500 Walmart stores in the United States.

Worldline debuts Food Services Payments Suite, an end-to-end solution offering an enhanced, seamless and secure payment experience for the food and beverage industry and particularly for quick service restaurants and their guests.

Visa is letting members of its FinTech Fast Track program join its Visa Direct platform. This move expands the program beyond card issuance, providing members with real-time money movement capabilities. The enhanced program offers fintechs personalized tools and resources to innovate and excel.

DIGITAL BANKING NEWS

🇳🇱 bunq becomes the first AI-powered bank in Europe as it unveils its own GenAI platform. bunq launches Finn, a GenAI platform available to all its users. Effectively replacing the search function on the app, Finn will enable bunq users to live the life they want, with help of bunq.

🇬🇧 Revolut growth buoys investors after bruising year for Fintech. The startup is set to exceed £1.5 billion ($1.9 billion) in revenue this year, capitalizing on rising interest rates in Europe. Investors find a rare relief in the midst of Revolut's wild year.

🇺🇸 U.S. Bank will pay $36 million over allegations the company illegally blocked out-of-work consumers from accessing unemployment benefits during the coronavirus pandemic, top federal banking regulators announced on Tuesday.

🇧🇷 Nubank earmarks $1.2M for scholarships for talented youths in Brazil and Colombia. This investment forms part of the philanthropic Give Back fund and will be managed by entities such as Sitawi and the Phi Institute. More here

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Zodia Custody CEO: «Asia is Filling the Void» for US. The crypto industry is experiencing the «second generation» of rules, according to Julian Sawyer, CEO of Standard Chartered-backed Zodia Custody, in a conversation with finews.asia. Read full interview

DONEDEAL FUNDING NEWS

🇮🇳 Check out phonepe's funding spree in 2023👇Link here

🇧🇷 Stone raises $467.5 million from US development agency for receivable financing. The financing line primarily supports companies led by women or with a majority of women in their workforce, with a focus on benefiting entrepreneurs in the North and Northeast regions of Brazil.

🇸🇦 Saudi savings fintech Hakbah closes $5.2 million fund raise. Proceeds of the funding round will be used for further product development, with a strong focus on Machine Learning and further developing the Company’s easily integrable savings engine.

M&A

🇺🇸 CSI snaps up partner Hawthorn River for single-platform loan origination system. CSI says that the full integration of Hawthorn River this month will enable loan origination capabilities for all types of loans across both its commercial and consumer accounts.

MOVERS & SHAKERS

🇺🇸 US neobank Chime appoints Shara Chang as chief compliance officer. In her new role, Chang has been tasked with regulatory compliance for the company and “earn, maintain and build trust” with Chime members, banking partners and regulators, reporting to Chime’s general counsel, Adam Frankel.

🇺🇸 Bolt confirms another round of layoffs. The company, previously under federal investigation, has confirmed a 29% staff reduction. According to a company spokesperson, the layoffs were part of an effort to optimize Bolt's operating model for sustainable growth and efficiency.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()