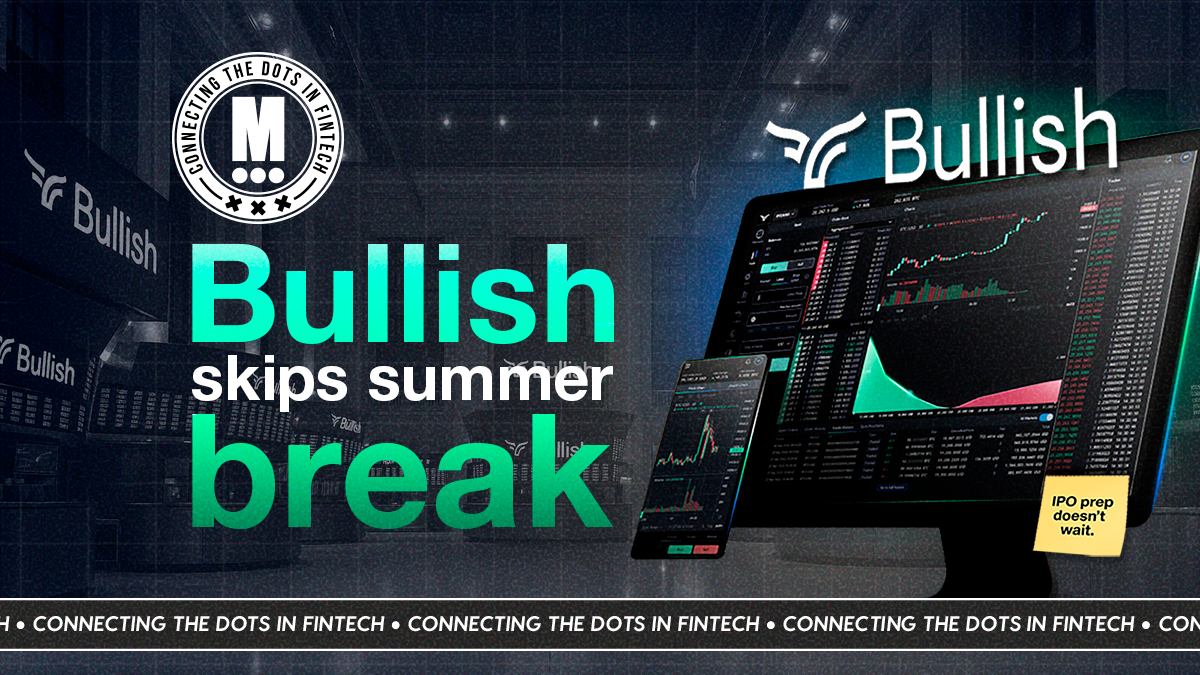

Bullish Files to Go Public at $4.23 Billion

Hey FinTech Fanatic!

I know it’s only early August, but it seems that US IPOs aren’t taking a summer break...

After shelving its SPAC plans back in 2022, one of crypto’s most talked-about IPO candidates is stepping back into the ring.

Bullish has filed for a New York listing, with plans to trade under the ticker “BLSH” and a target valuation of up to $4.23 billion.

Keep scrolling to learn more about Bullish and to get your daily dose of FinTech 👇

Cheers,

INSIGHTS

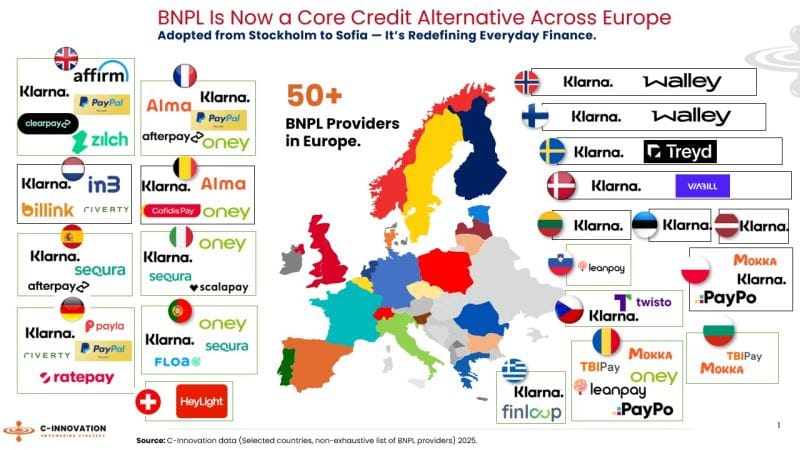

🌍Buy Now Pay Later (BNPL) European Market Map 2025

Who’s missing in this overview?

FINTECH NEWS

🇺🇸 How lenders can build more inclusive risk models with FairPlay and Taktile. By combining Taktile’s AI-powered Decision Platform with Fairplay’s Fairness-as-a-Service solutions, risk teams can more easily build systems that are fair by design, ensuring that every decision about a person’s life is accurate and inclusive.

🇸🇻 San Salvador Investment Discussion on the Move. At Bambu City Center, host Beatriz Alejandra Hernández led a FinTech Run + Investment talk. Reynaldo Rodríguez (CFA, Alcanza) shared Investing 101 insights post-run, blending miles with money mindset in a unique hybrid event.

🇸🇪 BNPL FinTech Klarna reports a decline in delinquency rates as consumer health improves. The FinTech announced a continued improvement in repayment performance among its extensive consumer base of 100 million. Globally, its delinquency rate on BNPL loans fell to 0.88% for Q2 2025, a 15 bps improvement from 1.03% in Q2 2024.

🇬🇧 UK digital wealth firm Vennre launches new VC investment platform. The company stated that the platform is fully digital and aims to lower traditional barriers to venture capital investing, including high entry minimums and limited access. Continue reading

🇳🇱 BUX launches Europe’s first self-directed active ETF portfolios in partnership with J.P. Morgan Asset Management. With this launch, BUX becomes the first neobroker in Europe to make actively managed multi-asset ETF portfolios available to retail investors in the form of automated, self-directed Plans.

🇮🇳 Tata Capital files for IPO, marks next big move by Tata Group. The IPO includes a fresh issue of 210 million shares and an offer for sale of 265.8 million shares by existing shareholders like Tata Sons and IFC. Keep reading

🇶🇦 Ooredoo bets big on AI and FinTech and invests in Africa-Middle East connectivity. The initiative is further supported by a QAR 2 billion financing facility from Qatari banks. Through partnerships with global players such as NVIDIA and Iron Mountain, Ooredoo is positioning itself as a hyperscale AI and cloud services provider for the region.

PAYMENTS NEWS

🇿🇦 ACI Worldwide’s advanced payment solutions enable real-time payments without risk. Outlining trends in global payments and new risks inherent in instant payments, ACI Worldwide experts noted that technologies such as cloud native payment hubs, advanced data analytics, and AI are making it safer for banks and financial institutions to embrace modernisation.

🇨🇴 $5.1 million will enter the financial system over the next three years. For ACI Worldwide, with technological support for the Bre-B system, more players will join. ACI Worldwide will help facilitate real-time electronic payments. The 50-year-old company manages infrastructure in several countries on five continents.

🌍 How Solidgate supports Tickets to make travel more accessible. Partnering with Solidgate helped Tickets open new revenue streams and overcome limitations in their traditional European-based setup, allowing them to expand confidently into previously underserved regions.

🇬🇧 Ecommpay shortlisted for three Women in Tech Employer Awards. CCO Willem Wellinghoff and CMO Miranda McLean have been shortlisted for advocacy awards in the Women in Tech category, while the company’s accessibility-focused website and payments platform overhaul is a finalist for Best Initiative of the Year.

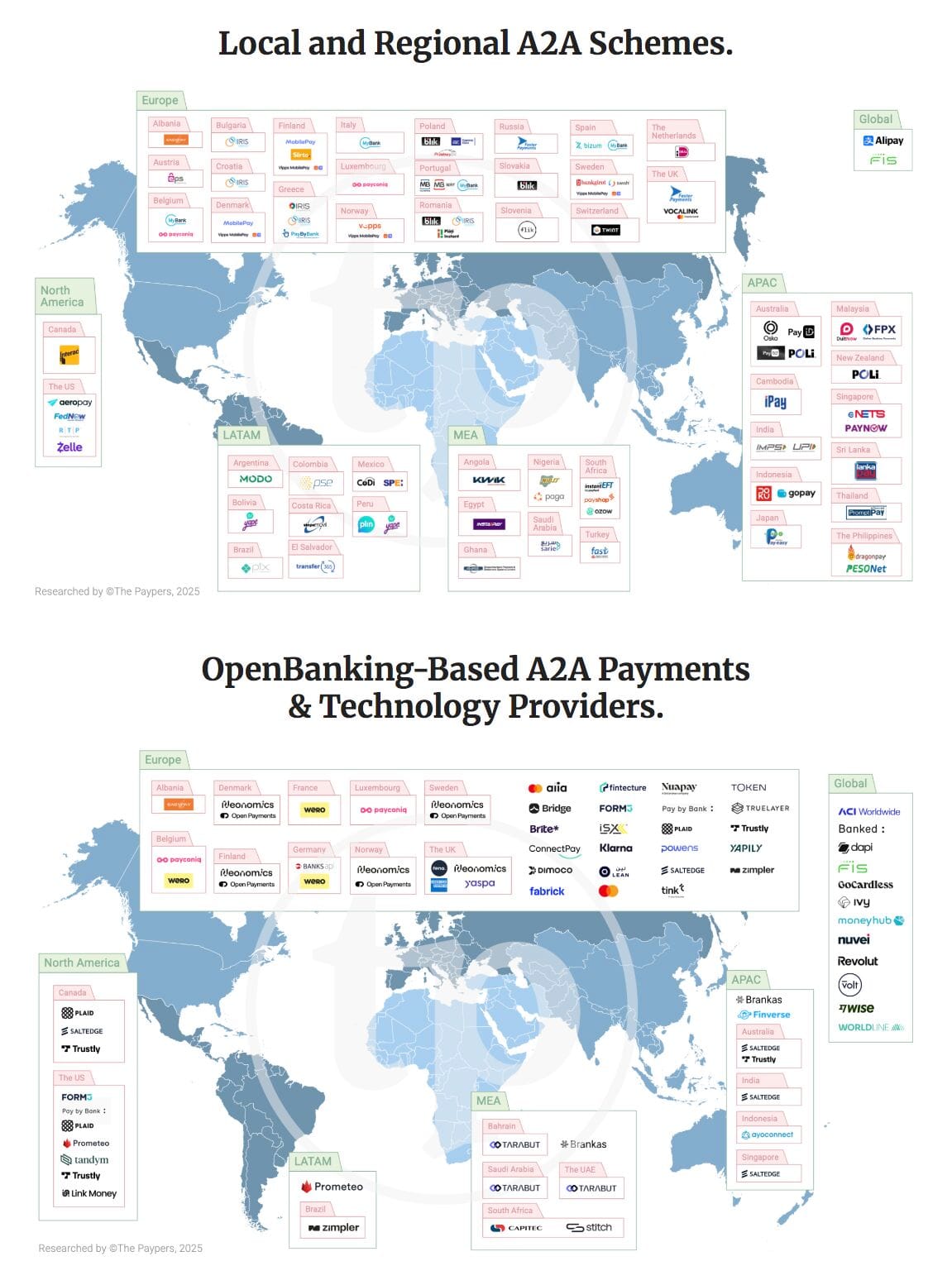

💰 Global Overview of the A2A Payments Ecosystem👇

Who's missing on this Market Map?

🇨🇴 Bre-B's instant payment system reaches more than 20 million users. The Bank of the Republic reported that more than 20 million keys have been registered, which are linked to nearly 11 million means of payment and more than eight million clients of the financial system.

🇮🇳 Mobikwik Q1 loss widens to $4.8m on lower revenue. The India-based FinTech company saw its revenue from operations fall 20.7% year-on-year to Rs 271.36 crore (US$31.1 million), while total income dropped 18.6% to 281.61 crore rupees (US$32.2 million).

🇬🇧 Circle bolsters stablecoin adoption with UK support, hyperliquid integration, and Aptos wallet expansion. These developments underscore Circle’s mission to enhance global financial accessibility, interoperability, and efficiency through USDC and its suite of developer tools.

🇨🇴 Kamin, the first platform to modernize instant payments for businesses, was born with Bre-B. With the new Colombian paytech, companies will now benefit from access to instant payment rails in Colombia and the region. The platform includes real-time collection and disbursement to bank accounts or digital wallets.

🇮🇳 ICICI Bank will start charging payment platforms like Google Pay and PhonePe for UPI transactions. According to reports, ICICI Bank has informed PAs that those maintaining an escrow account with the bank will pay 2 basis points per transaction, capped at Rs. 6. For those without an escrow account at the bank, the fee will be 4 basis points, capped at Rs. 10 per transaction.

🇨🇳 Payment connect goes live: How a single switch is re-wiring Mainland–Hong Kong payments. In practical terms, anyone with a mobile number on either side of the boundary can now push money across it, in renminbi or Hong Kong dollars, 24 hours a day, for the price of a milk-tea upgrade.

OPEN BANKING NEWS

🇬🇧 FinTech group Intelligent Lending launches Binq app for UK SMEs. Founder and CEO Jamie Stewart stated, “Binq was established within Intelligent Lending, a group of FinTech companies that includes CredAbility, Ocean, and TotallyMoney. This structure allows the company to leverage the scale, experience, and expertise of the wider group while maintaining a lean and agile approach.”

🇺🇸 Mastercard backs open banking. Its CEO, Michael Miebach, expects the open banking trend to keep gaining ground and seems to prefer that over banks charging for consumer data. The card network chief gave his view on the recent controversial practice of banks charging for consumer data after an analyst asked about it during the company’s second-quarter earnings call.

DIGITAL BANKING NEWS

🇵🇭 GoTyme breaches 7M user count. The bank now has 7 million users, up from 5 million last year, as more Filipinos prefer the ease of opening digital bank accounts for quick transactions and usage. Nate Clarke, GoTyme CEO, confirmed to reporters last week that they wanted to get close to 9 million users within the year.

🇬🇧 UK’s Digital Bank Monzo leverages data-driven insights for fraud prevention. Recent updates from the UK’s digital bank Monzo highlight their approach to product development: the implementation of a reactive fraud prevention platform and a shift from traditional dashboards to a data-as-a-product solution.

🇦🇪 ADIB latest GCC bank to launch Visa's real-time cross-border money transfer. The 'Remit' service from ADIB allows its customers to send money to more than 11 billion cards, digital wallets, and accounts worldwide. The Visa instant fund transfer option will help banks in the UAE and the Gulf expand on gaining a bigger slice of the remittance market, too.

🇺🇸 Huntington Bank welcomes a new era with a refreshed brand, new products, and digital experiences. This includes an updated logo and visual identity, new products, and reimagined digital experiences built to enhance the financial well-being of its customers.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 CAD probing Tokenize Xchange operator; firm’s director charged with fraudulent trading. The Monetary Authority of Singapore and the Singapore Police Force’s Commercial Affairs Department said Amazing Tech, along with its related entities, is under investigation for potential offences, including fraudulent trading under the Insolvency, Restructuring and Dissolution Act 2018.

🇺🇸 US Banking giants are reportedly trying to disrupt Coinbase and Robinhood. These tactics, they argue, mirror a new form of “Operation Chokepoint” aimed at suppressing FinTech and crypto competition. Continue reading

🇬🇧 Bullish launches initial public offering. The initial public offering price is currently expected to be between $28.00 and $31.00 per ordinary share. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or other terms of the offering.

PARTNERSHIPS

🌍 Klarna expands programmatic retargeting across Europe. In collaboration with Criteo, Klarna is enabling more brands to tap into its high-intent shopper audience, helping reconnect with customers at key decision-making points across multiple channels.

🇬🇧 PingPong gets on board with ClearBank. Through this collaboration, PingPong will leverage ClearBank’s local agency banking solution to enhance its UK offering with virtual business accounts, GBP collections, and Confirmation of Payee (CoP) functionality.

🇬🇧 Lao Mobile Money signs digital payments partnership with Visa. Lao Mobile Money and Visa will integrate Visa's payment system into the MmoneyX platform to provide secure and convenient options for multiple forms of transactions, such as scanning payments, paying for goods in stores, mobile phone top-ups, and digital financial services, among other things.

🇬🇧 Stratiphy selects Moneyhub to unlock seamless funding of personalised investment strategies. Stratiphy’s partnership with Moneyhub provides users with a secure and efficient payment experience, enhancing their ability to manage investments with confidence and ease.

DONEDEAL FUNDING NEWS

💰 Maven leads £5 million investment in Approov. This funding milestone will enable Approov to bolster its R&D team in Edinburgh, driving the creation of advanced technologies to secure mobile applications and APIs against evolving threats in real time, including those powered by AI.

M&A

🇦🇺 Banking Circle completes acquisition of Australian Settlements Limited to revolutionise payments in Australia. This strategic acquisition unites ASL’s established ADI licence and deep domestic banking, payments, and settlement experience with Banking Circle’s world-class cross-border payments and infrastructure capabilities.

MOVERS AND SHAKERS

🇬🇧 Fignum appoints Steve Carruthers as Growth Director. With over 30 years of experience across the mortgage industry, Carruthers brings deep expertise from senior roles at Newcastle Building Society, where he was Head of Mortgage Distribution, and previously Head of Intermediary Sales at Aldermore Bank.

🇬🇧 FCA hires from Standard Chartered to bolster crypto and payments division. Anurag Bajaj joins the UK regulator as a Senior Adviser, specialising in payments, digital assets, and cross-border banking. The hire comes as the FCA looks to develop its expertise in the sector.

🇫🇷 Aquis Exchange names Noah Liot its Chief Technology Officer. In his new role, Mr Liot remains part of Aquis’ Executive Team and will continue to lead the Group’s growing technology division, which provides high-quality low-latency exchange technology to Aquis’ platforms as well as to its clients.

🇬🇧 UK FinTech Liberis promotes Rob Fairfield to CEO. Fairfield will succeed the FinTech’s long-standing CEO, Rob Straathof, who has decided to step down after nearly a decade leading the company. Keep reading

🇧🇷 Daniel Bergman is the new CEO of Dimensa. "Dimensa already has a solid foundation and a portfolio of solutions that meet the most complex market needs. My vision is to further drive innovation, ensuring that our solutions remain at the forefront of financial technology, enabling our clients.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()