Bretton AI Raises $75M to Reinvent Financial Crime Compliance

Hey FinTech Fanatic!

Bretton AI just raised $75M to automate one of the least glamorous but most critical layers of financial services: financial crime remediation.

Bretton is betting generative AI can handle that complexity. Not just flagging risk, but helping compliance teams investigate and resolve it faster.

Founder Will Lawrence saw the problem firsthand at Facebook and Paxos. Detecting suspicious activity is one thing.

The round was led by Sapphire Ventures, with Greylock, Thomson Reuters Ventures, and Canvas Ventures also backing the thesis.

Actually investigating it, understanding counterparties, applying internal risk policies, and documenting decisions is another. That second layer is where most teams still drown in manual work.

Compliance is quietly becoming one of AI’s most practical use cases in FinTech.

And speaking of market reality…

Yesterday, I covered Agibank cutting its IPO ambitions. Today, the final numbers are in.

The Brazilian FinTech raised $240M in its US IPO, pricing at $12 per share, the bottom of the revised range, after initially marketing nearly double the shares at higher prices.

The deal was reportedly multiple times oversubscribed, but still had to be resized. At that price, Agibank lands around a $1.9B valuation. A reminder that even in a reopening IPO window, pricing discipline is back.

What does that signal to you about where capital is flowing next? I'll be back tomorrow with more industry stories. Scroll down to see today's highlights! 👇

Cheers,

ARTICLE OF THE DAY

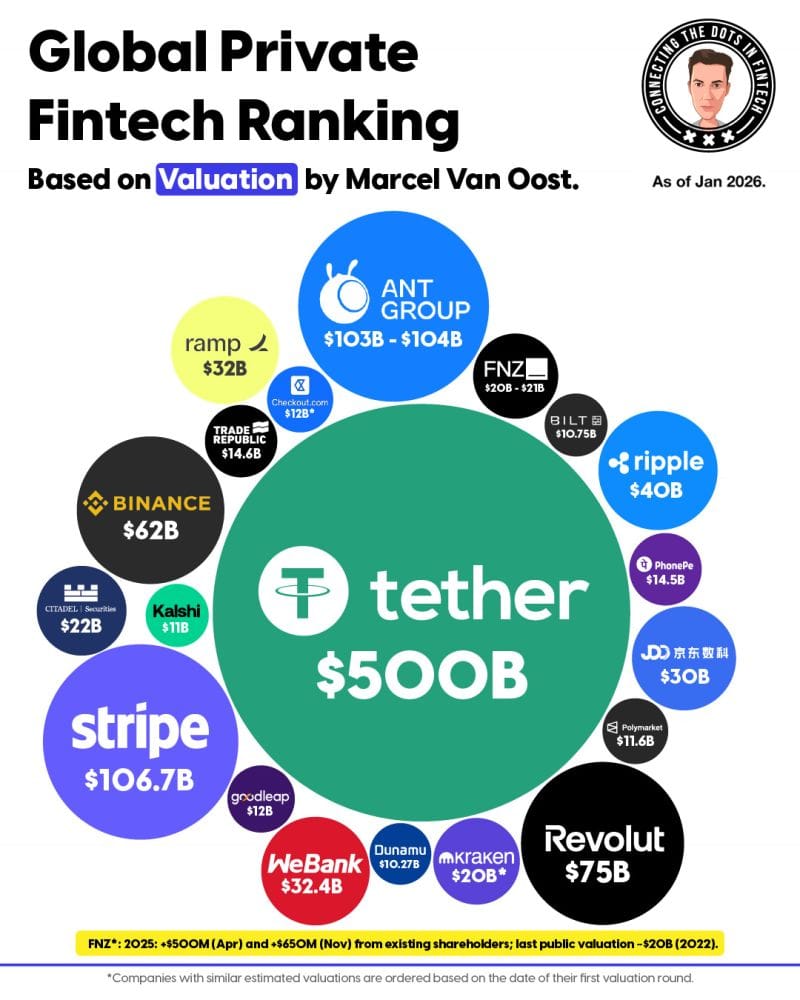

💰 The 20 Most Valuable Private FinTechs in the World

INSIGHTS

➡️ The Stablecoin Dilemma: Compete, Collaborate, or Be Disintermediated by DashDevs. Igor Tomych argues that stablecoins are evolving from a crypto experiment into a meaningful settlement layer for global payments, forcing banks to decide whether to compete, collaborate, or risk disintermediation. He highlights how stablecoin adoption is driven by speed, cost efficiency, and store-of-value demand, with wallets emerging as a key battleground. Explore this topic further here

The Stablecoin Dilemma: Compete, Collaborate, or Be Disintermediated

FINTECH NEWS

🇨🇴 Colombian paytech company DRUO plans its expansion with an investment of approximately US$550,000. As part of its strategy, the FinTech company plans to begin operations in the European Union during the second quarter of 2026, in addition to preparing its expansion to Brazil and Chile.

PAYMENTS NEWS

🇸🇾 Mastercard and the Central Bank of Syria launch knowledge-sharing exchanges under a strategic collaboration framework. Under the program, Mastercard’s global subject matter experts will deliver tailored technical sessions and knowledge transfer aligned with the Central Bank of Syria’s policy priorities.

🇳🇱 Adyen launches 'Personalize' to tailor checkout experiences in real-time. Personalize allows businesses to adjust their checkout pages in real-time based on individual shopper preferences, making it easier for customers to pay while reducing processing costs for the merchant.

🇺🇸 Zelle says payments sent last year surged 20% to $1.2 trillion. Zelle has been seeking to build out its operations, saying last year that it would expand internationally. The company has also boosted its work with small businesses, with nearly 30% of all the money sent on Zelle last year moving to or from those companies.

🇦🇪 E& money opens a new era in financial access following the Finance Company license. Under this new phase, e& money will progressively introduce a range of fit-for-purpose lending solutions, rolled out in stages. These will include buy-now-pay-later offerings, early wage access, credit cards, and other solutions.

🇬🇧 Volt integrates stablecoin acceptance into its real-time payments network, bridging crypto and fiat worlds. This development, which helps bring digital currencies firmly into the world of online payments, will unlock faster settlements for merchants and facilitate access to truly borderless commerce.

🇺🇸 Fiserv looks to AI and BNPL to spur its recovery. The FinTech vendor is increasingly investing in artificial intelligence, including tools to support agentic AI for small and mid-sized businesses, as part of its strategy to remain competitive with banks and merchants while controlling costs.

REGTECH NEWS

🇬🇧 New protections for BNPL users confirmed by the FCA. New protections aimed at people using buy now pay later (BNPL) credit products have been confirmed by UK financial regulators. BNPL will be subject to the Consumer Duty, which will regulate it in line with other loan products.

DIGITAL BANKING NEWS

🇧🇪 N26 surpasses 275,000 customers in Belgium and sets its sights on the under-18s. The neobank N26 is launching a debit card for children, managed by their parents. This offering is already available from Revolut, its competitor with nearly four times as many Belgian customers.

🇧🇷 Inter combines credit expansión with profitability and surpasses the rule of 40 in 2025, expanding its loan portfolio by 36% and increasing net profit by 45%. CFO Santiago Stel emphasizes the importance of not sacrificing the future for immediate results and of offering products that make sense for clients.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Circle is bringing native USDC and its Cross-Chain Transfer Protocol (CCTP) to EDGE Chain, following an investment from Circle Ventures into edgeX, the team behind the network. The integration will give the ecosystem access to regulated USDC liquidity and secure cross-chain transfers, enabling new use cases for institutions, developers, and market participants.

🇬🇧 Blockchain.com secures FCA registration, expands regulated crypto services in the UK. This registration enables Blockchain.com to deliver brokerage, custodial, and institutional-grade crypto services across the UK in compliance with one of the world's most respected financial regulations.

🇺🇸 Robinhood Chain launches Public Testnet. The testnet is live for developers to build infrastructure on Robinhood Chain, a financial-grade Ethereum Layer 2 built on Arbitrum, designed to support real-world assets. This phase lays the foundational infrastructure that will enable developers to start building and verifying apps on Robinhood Chain.

PARTNERSHIPS

🇬🇧 Peter Schmeichel teams up with Mastercard to help Brits ditch manual card entry. For Click to Pay, this means UK shoppers will no longer have to enter their 16-digit card number when paying online, something 9 in 10 revealed they had done last year, and these details will no longer be shared with merchants.

🇺🇸 Polymarket to offer attention markets in partnership with Kaito AI. The partnership allows users to bet on the popularity and public opinion of trends, brands, and people. Continue reading

🇺🇸 Stripe taps Base for AI agent x402 payment protocol. Stripe has launched a new payment system designed for artificial intelligence agents, allowing them to pay for digital services automatically using cryptocurrency. Through this system, AI agents can quickly and easily make small payments using USD Coin USDC stablecoins.

🇺🇸 Interactive Brokers expands crypto futures offering with Coinbase Derivatives. The new Coinbase Derivatives contracts offer an easier way to manage cryptocurrency exposure, with lower capital requirements and transparent trading on a regulated exchange.

🌍 Lunar and Wolt enter a major Nordic partnership. Through the collaboration, all Lunar customers on the highest tier plans will gain access to Wolt+, which offers unlimited delivery at 0 kr, exclusive offers, and much more. Keep reading

🇺🇸 Franklin Templeton and Binance advance strategic collaboration with institutional off-exchange collateral program. Now live, eligible clients can use tokenized money market fund shares issued through Franklin Templeton’s Benji Technology Platform as off-exchange collateral when trading on Binance.

🇸🇦 Shahbandr partners with Tabby to bring flexible, interest-free payments to Saudi E-Commerce. Under this partnership, businesses on Shahbandr can offer Tabby’s flexible payment options, enhancing the shopping experience and increasing conversion by allowing customers to split purchases into interest-free payments.

DONEDEAL FUNDING NEWS

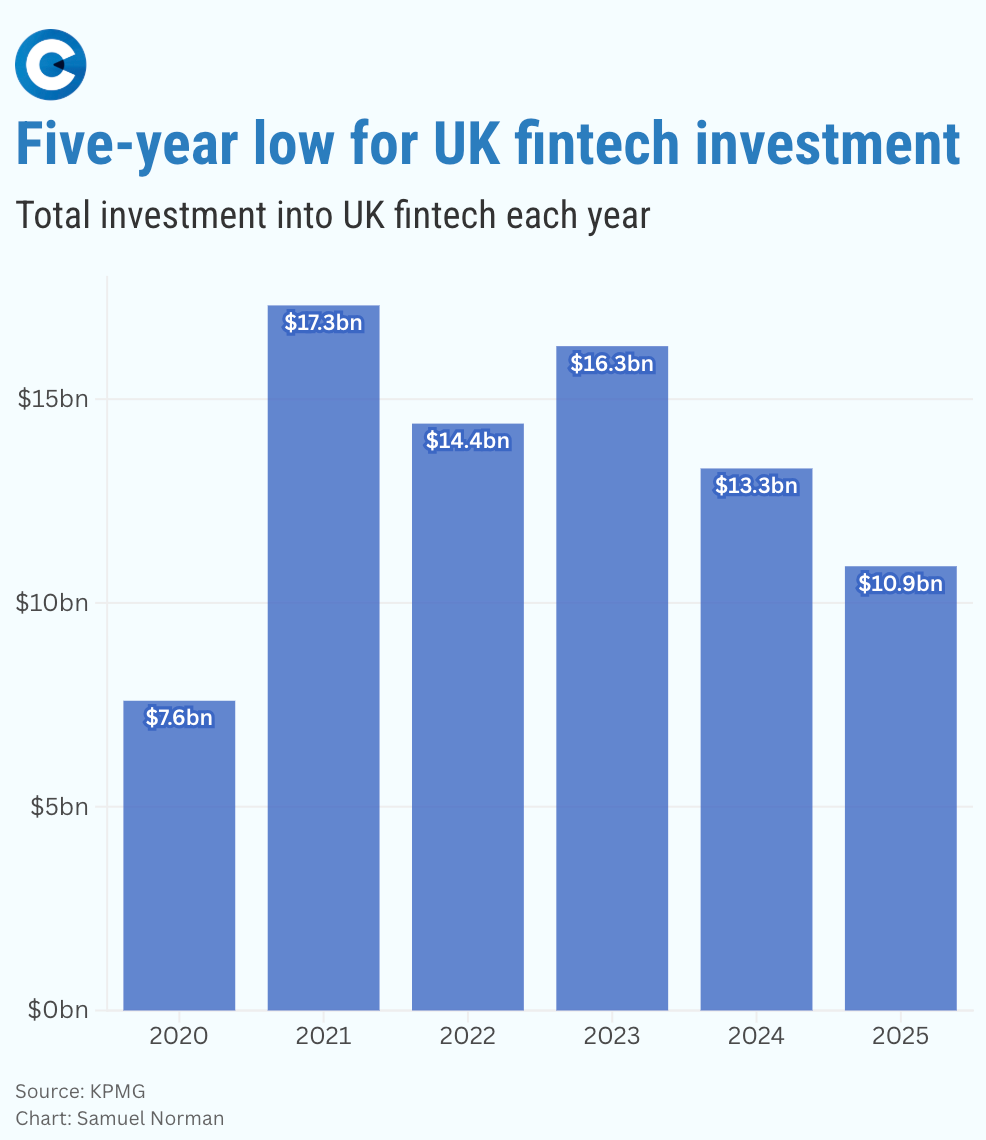

🇬🇧 UK FinTech investment hits lowest since pandemic despite Revolut boost.

🇺🇸 Bretton AI raises $75 million to use AI to combat financial crime. Bretton focuses on helping financial institutions conduct deeper investigations into suspicious transactions beyond basic automated risk detection. Read more

🇸🇪 Porters closes €2.7M pre-seed funding for financial services back-office software. Following the round, Porters plans to develop AI-based software for banking operations to automate regulated back-office workflows and improve efficiency for banks and FinTechs.

🇺🇸 Brazilian FinTech Agibank raises $240 million in US IPO. The company, known as Agibank, sold 20 million shares for $12 a piece, the bottom of the revised price range. Agibank had previously marketed 43.6 million shares for $15 to $18. Continue reading

🇺🇸 Levl secures $7m seed funding to revolutionize stablecoin payment infrastructure in emerging markets. Levl plans to allocate the new capital toward aggressive hiring and geographic expansion. The company specifically targets Latin America and Africa as primary growth markets.

M&A

🇬🇧 Wrisk acquires Atto to create an integrated embedded finance and protection platform. The acquisition brings financial intelligence further upstream into Wrisk's platform, creating a single integrated layer that supports embedded finance, insurance, and protection services within the same ecosystem.

🇬🇧 Rezolve Ai acquires Reward for $230m. The acquisition brings together Reward's engagement, intelligence, and activation capabilities with Rezolve Ai's conversational commerce and agentic AI platform to accelerate innovation in AI-powered banking and commerce.

MOVERS AND SHAKERS

🇬🇧 Checkout.com appoints Ashley Paulus to head up growth for the UK and Europe, reinforcing the company’s continued investment across the region. In her new role, Paulus will lead Checkout. com’s revenue and growth strategy across the UK and the European Economic Area (EEA).

🇺🇸 Crypto exchange Kraken fires chief financial officer ahead of long-awaited IPO. Kraken has moved Chief Financial Officer Stephanie Lemmerman to a strategic advisory role. Other people who have been promoted to senior roles include Curtis Ting and Kamo Asatryan, who was made chief data officer in January.

🇧🇷 Bitso announces Nicolás Alonso as the new Country Manager in Brazil. Alonso will lead efforts to expand Bitso Business as a payment infrastructure platform while maintaining Bitso’s position as a major crypto exchange in Brazil, working closely with regulators and the wider financial ecosystem.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()