BREAKING: Visa & Mastercard Agree To Landmark Deal Saving Merchants Up To 30 Billion On Fees

Hey FinTech Fanatic!

After almost two decades of legal disputes, Visa and Mastercard have finalized an agreement with American retailers to reduce and establish limits on credit card interchange fees, a move projected to yield $30 billion in savings for the merchants over the next five years.

This agreement marks one of the most significant resolutions in the history of US antitrust litigation, aiming to lower credit interchange fees and set a ceiling on these rates until 2030. Visa has noted that over 90% of the beneficiaries of this deal will be small businesses.

Additionally, the agreement allows merchants the flexibility to offer different pricing to customers depending on the credit cards used for payments.

The conflict between the card companies and retailers regarding transaction fees began in 2005. By 2012, Visa and Mastercard had consented to compensate retailers $7.25 billion for allegations of colluding to fix credit and debit card fees improperly.

Though the settlement addressed the financial damages claimed in the lawsuit, the aspect concerning injunctive relief continued to be a point of contention.

Read more FinTech news and updates below, and I'll be back with more in your inbox tomorrow!

Cheers,

BREAKING NEWS

🇺🇸 Visa and Mastercard agreed to a landmark settlement with U.S. Merchants reducing rates and guaranteeing no increases for at least Five Years. The agreement’s multi-year benefits for businesses include: Lower interchange rates, new ways to manage costs, and more. Read the full article here

#FINTECHREPORT

🇪🇺 Top Merchant Acquirers (web and card present volumes) in Europe from the Nilson Report. Click here to learn more

FINTECH NEWS

🇬🇧 UK wealth-building app Belong emerges from stealth. Belong aims to make forms of wealth-building that have traditionally been the realm of a wealthy few, accessible to a wider demographic, with a focus on professionally-employed millennials.

🇦🇺 Australian company Weel has announced its new partnership with Nium, a global payment platform provider. This strategic collaboration marks a significant milestone for Weel, as it transitions to using Visa as its primary payment network, to the benefit of thousands of businesses around Australia using Weel today.

🇬🇧 Oaknorth posts jump in profit as challenger bank targets US expansion and mulls public listing. The business-focused bank reported a 23 per cent increase in pretax profit to £187.3m in 2023 from £152.3m in 2022. The bank applied for a US representative office and is exploring M&A opportunities in the banking and FinTech sectors there, as well as providing its software to US banks.

🇦🇺 Australian FinTech startup Stables launches international remittances between Australia and The Philippines. From today, Stables users in over 130 countries can send Australian Dollars or Philippine Pesos to over 140 million people across Australia and the Philippines, all powered by stablecoins. Read on

🇺🇸 Russia-linked FinTechs hit with US sanctions. The US government has imposed sanctions on 13 FinTechs for offering crypto-based services to Russian firms looking to evade the economic restrictions in place since the outbreak of war in Ukraine.

PAYMENTS NEWS

🇳🇱 Adyen announced the expansion of its partnership with Cleeng, a SaaS platform for Subscriber Retention Management (SRM) in the media and entertainment sector into the United Arab Emirates (UAE) market. The strategic partnership aims to boost revenue in the Middle East’s media and entertainment industry.

🇺🇸 The federal real-time payments system may spool up slowly, but it could ultimately transform U.S. cross-border payments, ACI Worldwide’s CEO predicted. ACI CEO weighs in on FedNow, cross-border payments: Read the full piece here

REGTECH NEWS

🇬🇧 Form3 and Feedzai launch APP fraud prevention product. This new solution closes the gaps in intelligence that the fraudsters utilise to be able to use faster payments to target UK consumers and businesses. The solution’s model is then able to detect 95% of fraud at market-standard false positive rates.

DIGITAL BANKING NEWS

🇳🇱 Revolut has launched its global eSim service to customers in The Netherlands. Customers with a compatible phone can activate the eSim on the Revolut app in order to access mobile data roaming services around the world. Revolut Ultra customers receive 3 GB per month included with their subscription.

🇺🇸 Bank of America has given its mobile service a major overhaul, unifying apps for banking, investing and retirement into one personalised digital experience. BofA's 57 million digital customers can now view and manage their full financial lives through a platform that consolidates five apps - Bank of America, Merrill Edge, MyMerrill, Bank of America Private Bank and Benefits OnLine.

🇩🇰 BinckBank gives up Dutch banking licence to merge with Saxo. BinckBank will no longer fall under the direct supervision of the Dutch national bank and savings will be covered under the Danish, rather than Dutch, deposit guarantee up to a maximum of €100,000.

🇬🇧 Atom Bank boss on rapid growth, London IPO and why high street challengers are a ‘dying breed’. “We’re the highest-rated retail bank on Trustpilot by a distance, and we’ve got a net promoter score of plus 88 – it’s massively better than the industry average, which is still below 20,” CEO Mark Mullen says. Read more

🇺🇸 Varo adds line of credit product, which offers up to $2,000 in pre-approved credit for unexpected expenses like medical bills or car repairs. With transparent fixed pricing and no hidden fees, customers can pay it back over time. The more customers bank with Varo, the more they might be able to borrow.

BLOCKCHAIN/CRYPTO NEWS

Swift says a new round of sandbox testing has found that its central bank digital currency interlinking technology can enable financial institutions to carry out a wide range of transactions using CBDCs and other forms of digital tokens, easily incorporating them into their business practices.

On a different note, Swift is planning a new platform in the next one to two years to connect the wave of central bank digital currencies now in development to the existing finance system, it has told Reuters.

🇬🇧 London Stock Exchange eyes crypto ETN listings in late May. Applications for bitcoin and ether ETNs can be made starting on April 8, the exchange said in a Monday notice. Issuers will have until April 15 to submit such proposals if they want to have the securities listed on May 28, it added.

DONEDEAL FUNDING NEWS

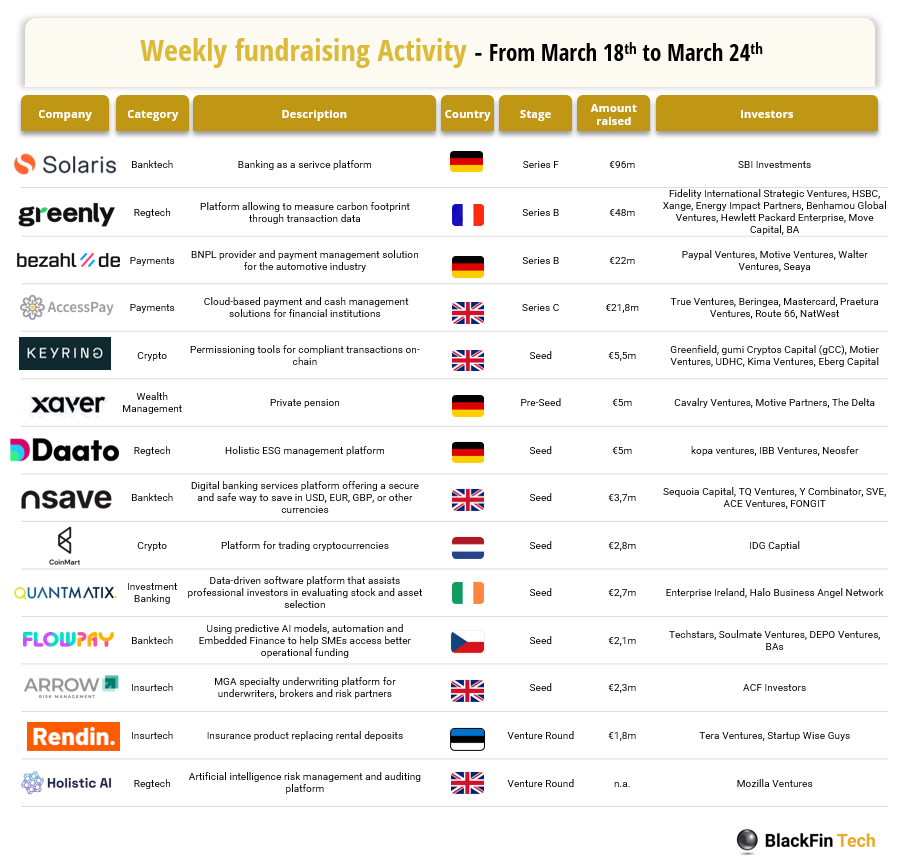

Last week we saw 14 official fintech deals in Europe for a total amount of 218,7m€ raised with 5 deals in the UK, 4 in Germany, 1 in France, 1 in the Netherlands, 1 in Ireland, 1 in the Czech Republic, and 1 in Estonia. Check out full article here

🇺🇸 Goalsetter raises $9.6m to help families build wealth. The new funding will be used to target more partnerships with financial institutions and to launch live bank and credit union product implementations to make it easier to add its technology across multiple technology platforms.

🇬🇧 Global Screening Services raises $47m. This funding milestone marks a pivotal moment for GSS as it officially transitions into operational mode, putting its progressive RegTech solutions into action. The infusion of funds propels the company to achieve its mission of reshaping regulatory compliance globally.

🇺🇸 Budgeting app Copilot is booming now that Mint is dead, leading to $6M Series A. Copilot has more than 100,000 subscribers with a majority of them coming into the app at least once a day. Others enter the app multiple times a week, with 20% of users being what founder Andrés Ugarte considers “heavy users,” using Copilot between five and 10 times a day.

🇿🇦 MTN Group to invest $1.8 billion in data, FinTech services in 2024. According to the company’s 2023 audited financial result released on Monday, the volume of FinTech transactions increased by around a third to 17.6 billion, with the value of transactions across the fintech platform up at $272 billion.

M&A

🇬🇧 Paynetics acquires Novus Neobank to amplify ESG mission. This landmark deal underscores Paynetics’ commitmentto advancing environmental, social, and governance goals while revolutionising the financial landscape with its powerful embedded finance suite.

🇦🇺 Australian fintech startup Yondr Money have announced the acquisition of the nano-gifting platform Shouta. The acquisition will expand loyalty and rewards solutions for customers and provide a more comprehensive, engaging, and personalised financial experience.

MOVERS & SHAKERS

🇬🇧 Tide appoints George Schmidt UK/Europe CEO. The appointment of George to this new role follows the recent announcement of Tide launch in Germany in the coming months. Germany is Tide’s second market outside the UK, after the successful entry of Tide into India in 2022 and is the Company’s first step onto the European continent.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()