Brazil’s FinTech Heat Wave Continues as QI Tech Bags $63M

Hey FinTech Fanatic!

Just when you thought the Brazil FinTech race couldn’t get hotter, QI Tech steps in with a fresh $63 million in funding to double down on building the country’s financial infrastructure.

While Nubank ships SIM cards and Revolut chases market share, QI Tech is working behind the scenes to power the rails for it all. With $25 billion in AUM, a fast-growing insurance platform, and big plans for FX and M&A, the company is quietly becoming the engine room of Brazil’s digital finance future.

Scroll down to see how it’s building the tech stack every FinTech wants to sit on and other latest in FinTech 👇

See you tomorrow!

Cheers,

ARTICLE OF THE DAY

📈 Wise’s FY2025 results highlight strong growth and major momentum for its infrastructure arm, Wise Platform. The results show strong growth, with £1.2B in revenue (+15% YoY), £564.8M in profit before tax (+17%), and £21.5B in deposits (+33%). The company now serves 14.9 million individuals and 700,000 businesses, processing £145.2B in cross-border volume.

INSIGHTS

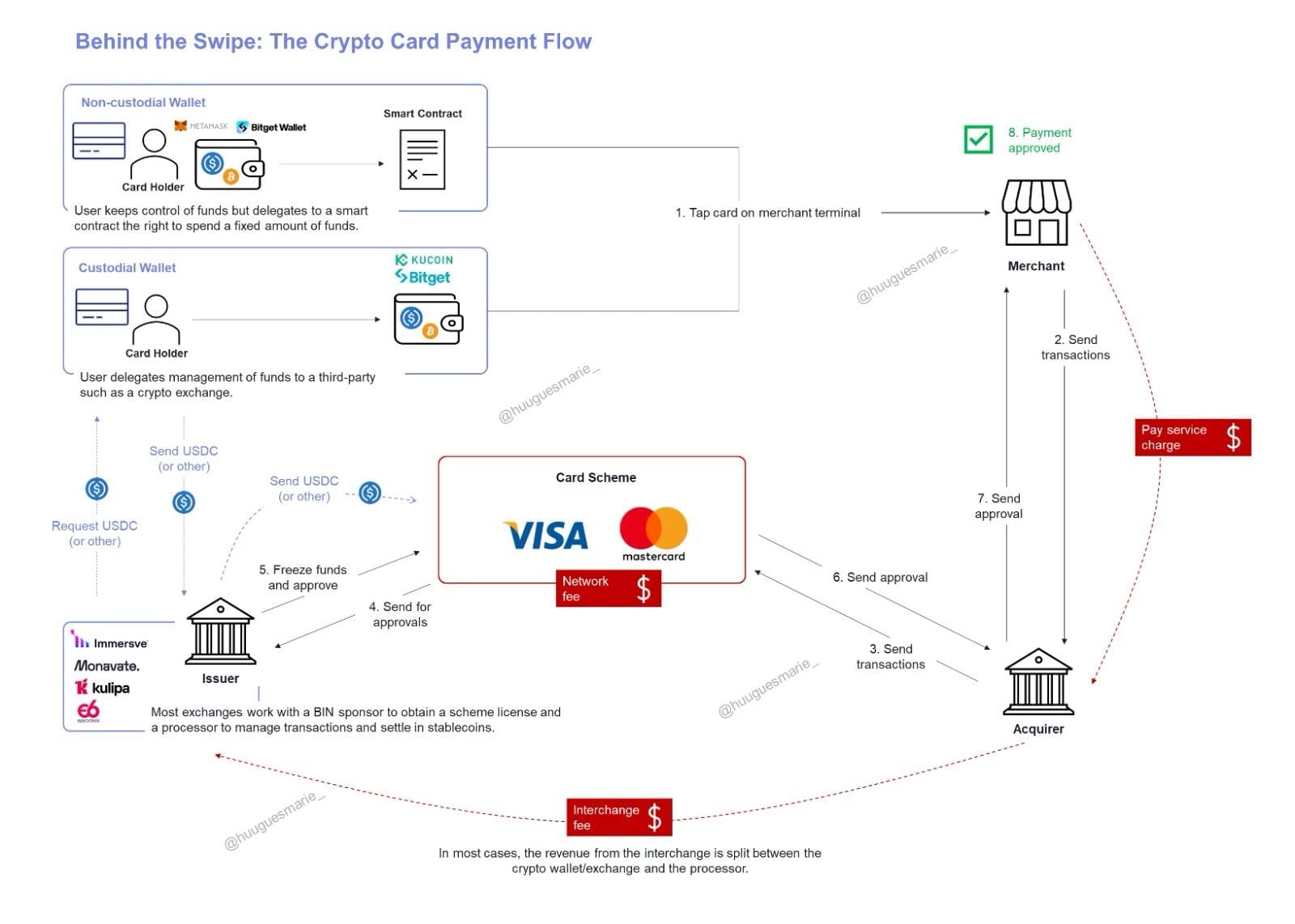

➡️ How do crypto payment cards really work?

PAYMENTS NEWS

🇨🇴 Instant payments by Sonia Gómez, Director of Solutions Consulting at ACI Worldwide. To combat rising fraud, financial institutions must adopt a data-driven approach. This includes leveraging the ISO 20022 messaging standard, using industry-wide information to close security gaps, and applying AI and machine learning for real-time fraud detection. ACI supports this strategy through its concept of "payment intelligence".

🇮🇳 UPI sets an all-time high with 19.47 Bn transactions in July. This marked a 5.8% rise in transaction volume and a 4.3% increase in value compared to June 2025, when UPI logged 18.40 billion transactions totaling Rs 24.04 lakh crore. Year-on-year, UPI maintained its strong growth momentum.

🇺🇸 Visa brings Google Pay integration to fleet cards, enabling tokenization and push-to-wallet across the digital wallet ecosystem. Now, fleet data tags can be configured by the issuer, FinTech, or processor, allowing custom data tags to be dynamically provisioned during the tokenization process.

🇦🇪 PAY10 processes the UAE’s first open finance transaction under the Central Bank of the UAE's framework. The transaction was executed on Al Tareq, the CBUAE’s Open Finance platform established under the Financial Infrastructure Transformation (FIT) Programme to enable secure, consent-driven access to financial data and services.

🇧🇦 Apple Pay lands in Bosnia and Herzegovina, revolutionizing digital payments. Users in the country can now leverage their Apple devices for secure and convenient contactless transactions, integrating seamlessly with supported banks. Continue reading

🇦🇪 UAE Central Bank set to launch Digital Dirham in phases. Once launched, Digital Dirham, which is the digital alternative to physical money, will allow the public to use it for a wide range of payments, including online, in-store, commercial, and peer-to-peer transactions.

OPEN BANKING NEWS

🇬🇧 The Money Platform deploys open banking tech from Ecommpay. The company has enabled TMP to increase the breadth of pay-in methods and use API instructions for outward payment initiation using Faster Banking. The Money Platform provides a crowd-funded peer-to-peer lending platform.

🇦🇪 Spare receives in-principle approval from the Central Bank of the UAE for an open finance license. Spare provides merchants a secure and unified API platform for financial account-to-account payments and data access, enabling capabilities such as recurring payments, future-dated payments, account aggregation, identity verification, risk assessment, and many more.

REGTECH NEWS

🇬🇧 FCA imposes £1M fine on Sigma Broking for transaction reporting failures. The FCA’s monitoring systems identified issues with the transaction reports submitted by Sigma. These failures were caused by incorrect system setup and persisted uncorrected due to weaknesses in their reporting processes.

DIGITAL BANKING NEWS

🇧🇩 Cenbank to start digital bank licensing process in August. The Bangladesh Bank is set to open the application process for digital bank licences, according to the Governor. In an exclusive interview, he confirmed that entities that previously applied for a digital banking licence would be eligible to reapply.

🇬🇧 Santander UK cuts over 2,000 Jobs amid restructuring. The job reductions come as the bank’s UK unit reported a 5% decrease in pre-tax profits, which fell to £764m for the six months ending June 2025. Keep reading

🇲🇾 Agrobank launches online account opening in Sabah. Agrobank CEO Dato Tengku Ahmad Badli Shah Raja Hussin said the digital system offers a faster, simpler, and more user-friendly experience. Customers can now open a deposit account anytime, anywhere, with just RM20, leveraging improved internet connectivity.

🇱🇾 Libyan Islamic Bank modernizes consumer banking services with Backbase. In collaboration with Backbase, the bank laid the groundwork for a customer-first operating model that is built for speed, flexibility, and long-term relevance in a rapidly evolving market.

🇵🇭 Revolut bets on Manila to anchor next phase of SE Asia growth. The hub will support global functions like engineering, risk, compliance, and customer operations. Backed by the Philippine government, the move is expected to create high-quality jobs and boost digital capabilities.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 VALR becomes the first African crypto exchange to launch tokenized US stock trading. The tokens provide 1:1 price exposure to real equities without ownership rights, tradeable against major cryptocurrencies and the rand. The CEO emphasizes breaking financial barriers for previously excluded African users seeking global investment opportunities.

🇨🇳 FinTech firms rush to raise equity in Hong Kong to tap crypto frenzy. FinTech companies are rushing to raise equity to fund expansions in cryptocurrencies, capitalising on investor fervour as the city starts accepting applications for stablecoin issuer licences.

PARTNERSHIPS

🇦🇺 Thunes and EzyRemit team up to enhance cross-border payments for expatriate communities. Through its direct integration into Thunes’ Network, EzyRemit now offers customers access to real-time payouts to billions of mobile wallets, bank accounts, cards, and cash pickup locations in over 45 countries.

🇺🇸 J.P. Morgan Payments launches cutting-edge supply chain finance solution with Oracle. J.P. Morgan Payments SCF is now integrated into Oracle Cloud ERP, enabling FedEx to accelerate working capital access and liquidity management. This Oracle ERP integration gives vendors early payment options and streamlines setup.

DONEDEAL FUNDING NEWS

🇺🇸 Handwave raises $4.2M to launch palm-based payments in Europe and the US. Using proprietary technology, the solution enables customers to easily onboard themselves, scan their palm using their phone camera, and link payment and loyalty cards, as well as identity credentials, to a secure digital wallet.

🇺🇸 Future FinTech secures $10M funding agreement. The company engages in equity financing and prepaid securities transactions, aiming to enhance its capital structure and market presence. Read more

🇧🇷 Brazil FinTech QI Tech lands $63M in Series B extension. QI Tech CEO Pedro Mac Dowell stated that the new investment strengthens the company’s ability to accelerate the development of solutions focused on modernizing Brazil’s financial infrastructure. He emphasized that QI Tech remains committed to expanding its portfolio with a focus on reliability, compliance, and scalability.

M&A

🇺🇸 StoneX closes acquisition of R.J. O’Brien. RJO’s clients can now access StoneX’s extensive range of markets, products, and services, including an expansive over-the-counter hedging platform, physical commodity hedging, financing, and logistics services.

🇺🇸 Payroc to purchase payment orchestrator BlueSnap. The acquisition aims to expand Payroc's service offerings by incorporating BlueSnap’s global and enterprise capabilities. Payroc said the integration will facilitate the acceptance of various payment methods, including card-not-present transactions and electronic checks.

MOVERS AND SHAKERS

🇦🇹 Lukas Enzersdorfer-Konrad replaces Paul Klanschek as Co-CEO of Bitpanda. Klanschek takes a new role as a Member of the Board of Directors. Lukas Enzersdorfer-Konrad, currently Deputy CEO, will now assume the CEO role alongside Eric Demuth, maintaining Bitpanda’s dual leadership structure.

🇦🇪 Tarabut CTO Mitul Sudra departs after a four-year tenure. Sudra says he is "exploring new ideas and gearing up to build something new again", while also advising start-ups through his company, F7&Partners. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()