Block's Surprise Profit Sends Stocks Soaring

Hey FinTech Fanatic!

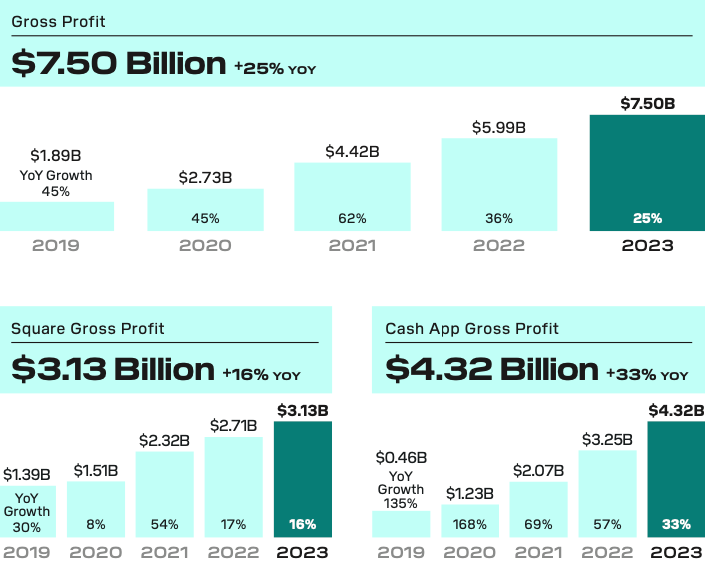

Block, the financial services company, experienced a significant increase in its stock value, rising up to 14% after revealing unexpectedly high fourth-quarter earnings.

The company, renowned for its Cash App and Square services, reported a revenue of $5.77 billion, surpassing the anticipated $5.70 billion.

This growth reflects a robust performance, particularly in gross profit, which surged 22% to $2.03 billion compared to the previous year, indicating the effectiveness of Block's core operations.

In a strategic move to enhance its financial outlook, Block adjusted its EBITDA expectations to a minimum of $2.63 billion, up from the initially projected $2.40 billion.

The company, led by Jack Dorsey, also highlighted its success in expanding its Cash App user base, reaching 56 million monthly active users in December.

Notably, the Cash App Card alone boasted 23 million monthly actives, showcasing a growth rate double that of the overall monthly active users.

This growth is part of Block's broader strategy to cement its position in the financial services sector by offering comprehensive banking solutions through Cash App. Despite recent operational streamlining, including significant layoffs, the company's financial performance and strategic adjustments suggest a positive outlook for its future endeavors.

Tomorrow morning I'm flying to Los Angeles, and I'll be attending FinTech Meetup in Las Vegas after. If you happen to be around, make sure you request an invite for the go to happy hour of the event on March 4th, organized by my friends at the FR, so we can have the opportunity to meet in person!

Have a great start to the week and I'll be back in your inbox tomorrow!

Cheers,

ARTICLE OF THE DAY

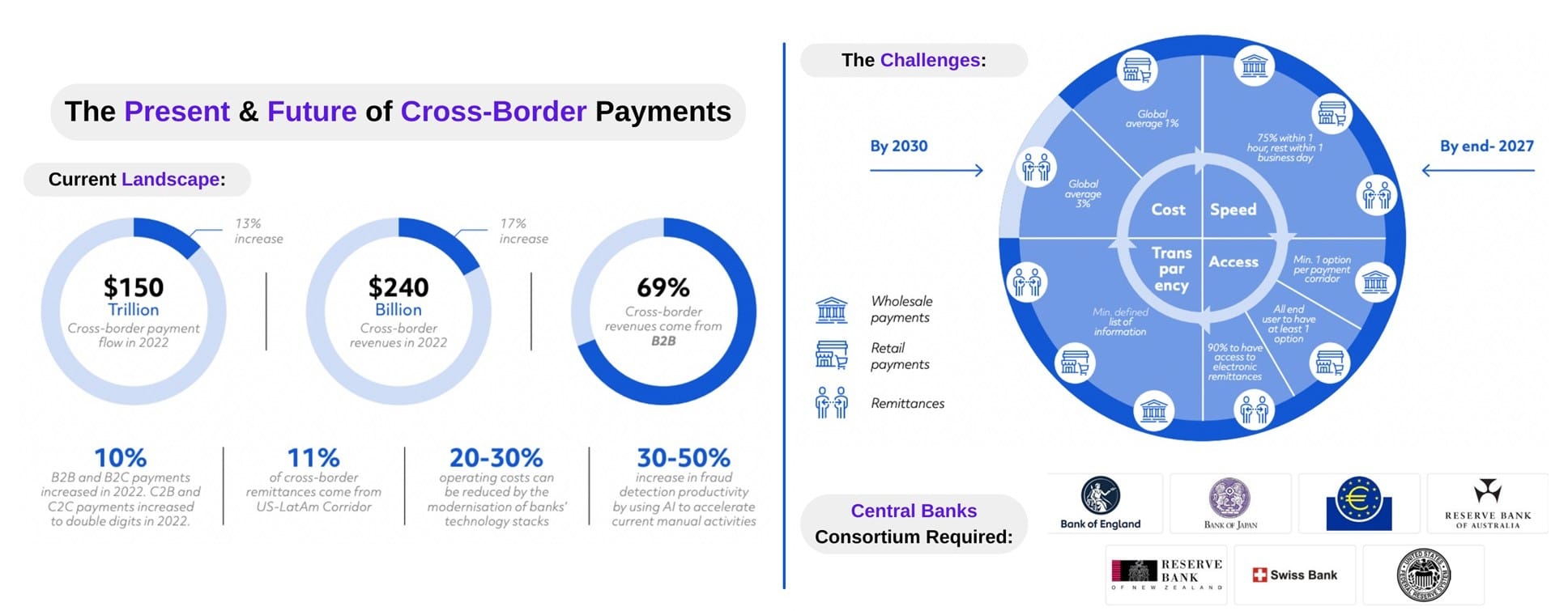

The latest edition of the Payments Newsletter with Arthur Bedel is out!

The present and Future of Cross-Border Payments:

#FINTECHREPORT

EPAM Continuum's 2024 Consumer Banking Report is out. The report unveils key consumer insights to help banks determine where they should focus their digital transformation efforts. Download the complete report here.

INSIGHTS

🇩🇪 European Central Bank posts first annual loss in two decades. The European Central Bank reported an annual loss of 1.3 billion euros ($1.4 billion) for 2023, its first loss since 2004, even as it released 6.6 billion euros in provision for financial risks.

FINTECH NEWS

🇳🇬 Kippa users demand access to data as the FinTech quietly pivots: Reportedly 500,000 business people used Nigerian FinTech app Kippa for bookkeeping, invoicing and the kind of documentation every small business owner needs. Since January 2024, the Kippa app has been inaccessible, leaving the business owners who had come to depend on it without access to critical data.

🇧🇷 Monnet Payment, a Peruvian FinTech specializing in collection and disbursement of funds, is gearing up to expand its operations to Brazil in the second half of 2024. The company, which has already established a presence in Mexico, Colombia, Peru (accounting for 50% of its processed volume), and Argentina, is also exploring the remittance industry.

🇦🇪 Fils partners with Telr to drive sustainability in finance and payments. They will also be able to demonstrate their positive impact on the environment with robust reporting functionality, reduced greenwashing, and the encouragement of businesses to invest in sustainable initiatives through Fils’ marketplace.

🇺🇾 Brazilian FinTech Koin is planning to invest US$ 5 million in Uruguay for the development of its fraud and payment platforms. Koin, which specializes in automatic online credit services under the “BNPL” model, has expanded its offerings to include fraud and payment services for other corporate clients, choosing Uruguay as the development center for these services.

🇨🇱 Prex, a Uruguayan FinTech company, is preparing to launch its operations in Chile in the first half of 2024. The company, which began its journey eight years ago in Montevideo, plans to enter the Chilean prepaid card market. The FinTech will provide both virtual and physical Mastercard cards for online and in-person transactions.

PAYMENTS NEWS

Google has announced that Google Pay is shutting down in the United States in June, as the standalone app has largely been replaced by Google Wallet. Meanwhile in India, it plans to roll out the SoundPod, its portable speaker designed to instantly validate and announce successful payments.

OPEN BANKING NEWS

🇨🇴 Belvo and Nequi lead the way in Colombia with the first Open Finance agreement. The firms have made a pioneering stride in Colombia's financial sector by signing the country's first Open Finance agreement within the regulated framework, a move that signifies a major advancement in the Colombian financial ecosystem, supported by Circular No. 004 of 2024.

REGTECH NEWS

🇦🇪 The United Arab Emirates was removed from a global watchdog’s “gray list” on Friday, less than two years after the Gulf state’s demotion, capping a push by local authorities to clamp down on illicit financial flows. Read full article.

🇩🇪 Frankfurt wins race to host new EU Anti-Money Laundering agency. Frankfurt was chosen ahead of rivals Brussels, Dublin, Madrid, Paris, Riga, Rome, Vilnius and Vienna in a series of votes at the European Council and European Parliament. More here

DIGITAL BANKING NEWS

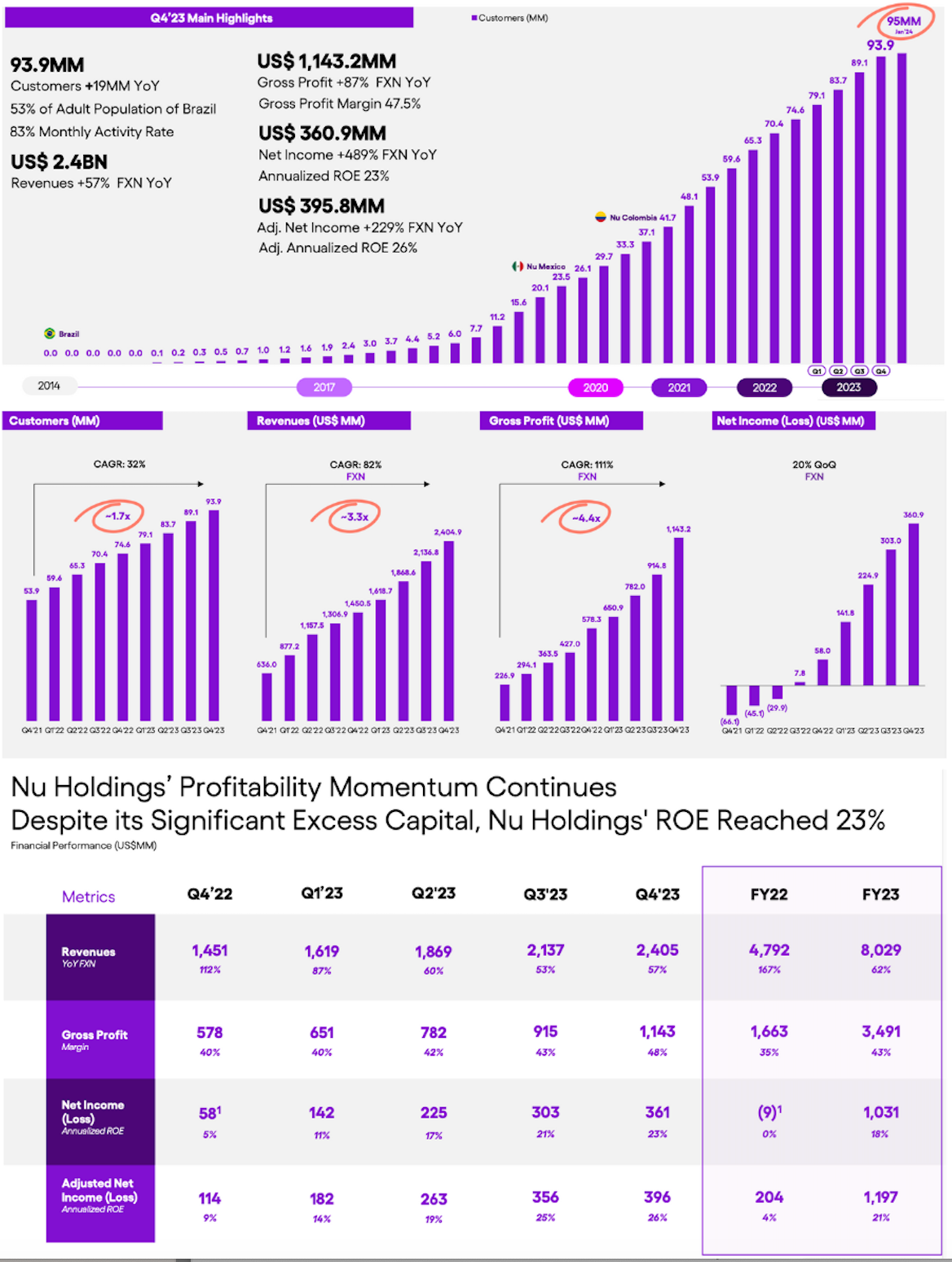

🇧🇷 Nubank Reports Fourth Quarter and Full Year 2023 Financial Results👇

Here is a Q4’23 and FY’23 Results Snapshot:

🇲🇽 Nubank, aims to "consolidate its presence in Mexico" in 2024, increasing investments without short-term break-even expectations, said CFO Guilherme Lago in an interview. He stated, "We do not expect to reach break-even in Mexico in 2024. The more successful we are in Mexico, the more we will need to invest there."

🇮🇳 Nine years after its launch, Jan Dhan still going strong; 31.5 million accounts added in FY24 so far. The no-frills Pradhan Mantri Jan Dhan Yojana (PMJDY) bank accounts with an accumulated Rs 2.21 trillion cash balance, continue to rise steadily even nine years after its launch.

🇬🇧 Molo Finance, the UK’s first fully digital mortgage lender, announces the launch of Expat buy-to-let mortgages for British nationals residing abroad. The new product introduces a 1-year fixed product available from 4.99%, along with 2 and 5-year fixed-rate products from 6.24%.

🇨🇴 Ualá, a neobank operating in Colombia, has announced an increase in the profitability rate of its account to 13% annual effective rate (E.A.), making it the savings entity offering the highest remuneration rate to its clients in the country. Starting March 1st, Ualá will raise the yield rate from 10% to 13% E.A., aiming to provide greater benefits to financial consumers.

🇺🇬 TerraPay, a global cross-border payments network company, and Diamond Trust Bank Uganda (DTBU), announced a strategic partnership to expand international money transfers and strengthen financial inclusion in Uganda. Together, both firms will deliver unparalleled benefits to customers worldwide.

BLOCKCHAIN/CRYPTO NEWS

New emails from Satoshi Nakamoto that are made public show that the bitcoin creator warned against pushing bitcoin’s anonymous angle, and warned against labeling bitcoin as an ‘investment’. The emails were shared as evidence by Martii Malmi in the Crypto Open Patent Alliance (COPA) vs. Craig Wright trial as part of his testimony.

🇨🇴 Akaunt, a new Colombian FinTech application, has launched a digital wallet service with a license from the Bermuda Monetary Authority to issue, distribute, and custody digital assets. In an increasingly connected and globalized world, akaunt represents an innovative solution for those looking to save in a stable currency like the dollar.

🇬🇧 Archax, the only FCA-regulated digital asset exchange, broker, and custodian, announced the introduction of its Stablecoin Yield Service. This enables individuals with assets in stablecoins to transition them into yield-generating instruments, such as regulated Money Market Funds (MMFs), which are also available in tokenised form.

🇦🇷 Argentinian FinTech Koibanx has introduced three innovative blockchain applications for the payment system and filed for international patents under the Patent Cooperation Treaty (PCT). This move underscores blockchain technology's growing significance, particularly in LatAm, a region experiencing rapid growth in digital transactions and financial technology adoption.

🇨🇴 Arch.Finance, a crypto asset manager from Chile, has announced its expansion into Colombia, in partnership with Koywe and Paloma. This move aims to provide Colombian users with a new and secure way to invest in cryptocurrencies amid the country's growing adoption of and interest in the crypto sector.

DONEDEAL FUNDING NEWS

🇸🇬 Singularity raises $2.2m to help institutions access DeFi. Founded in 2022, Singularity is developing a KYC/KYB-compliant institutional DeFi access layer, providing access to leading protocols for on-chain institutional participants while prioritising commercial confidentiality.

M&A

🇧🇷 Banco Master has announced its acquisition of a majority stake in Will Bank, a Brazilian digital bank boasting over 6 million customers and a strong presence in the Northeast of the country. The deal, announced Feb. 22, positions Master as a partner alongside the private equity fund of XP. However, the transaction is subject to approval by Cade and the Central Bank.

MOVERS & SHAKERS

🇬🇧 Cyrille Salle de Chou recently joined Starling Bank as its Chief Risk Officer (CRO). He spent the last seven years at HSBC in multiple CRO roles; first he was CRO for the European retail bank and wealth management divisions, but spent the bulk of his tenure as CRO of wealth and personal banking for HSBC UK.

PayComplete announces Simon James as CEO. Simon steps up to the role from his previous position as Co-President. As CEO, he will continue the ongoing centralisation process of the PayComplete brand, helping to foster closer working and collaboration across the business while expanding its retail and cash-in-transit offerings.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()