Bits Secures €12M to Automate KYB, AML, and Onboarding Across Europe

Hey FinTech Fanatic!

This one caught my eye coming out of Stockholm.

Bits just raised €12M Series A to scale its compliance and onboarding infrastructure for regulated FinTechs and banks.

The round was led by Alstin Capital, with Cherry Ventures and others joining.

Bits is tackling a familiar tension. Teams need to grow, onboard faster, and expand cross-border. At the same time, regulators are tightening the screws.

Bits’ answer is to unify onboarding, fraud, and AML workflows into a single platform, turning compliance into something that scales with the business instead of slowing it down.

What’s interesting is the broader pattern. Capital keeps flowing into financial crime and risk infrastructure across Europe. Berlin-based Taktile raised €51.5M earlier this year to automate decisioning across credit, fraud, and compliance.

Compliance is shifting from point solutions to platforms. More auditability. For regulated FinTechs, this is quickly becoming core infrastructure, not back-office tooling.

More to unpack below 👇 I’ll be back tomorrow with the next set of signals.

Cheers,

BREAKING NEWS

🇺🇸 Turkish founder on Forbes 2025 list faces 52 years in the US for alleged $7 million fraud. Prosecutors allege that Gokce Guven, founder and CEO of Kalder, maintained two sets of financial books for her company, one accurate set prepared by an outside accounting firm for internal use, and another with inflated figures that she distributed to investors and prospective investors.

FEATURED NEWS

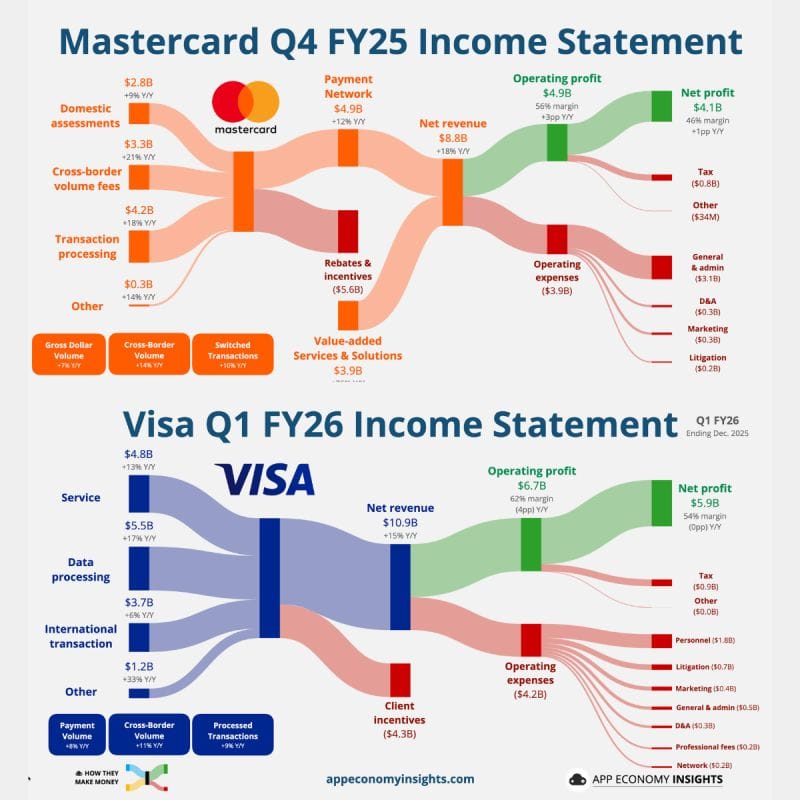

📈 Mastercard 🆚 Visa

A Comparison of Key Metrics in the Latest Income Statements👇

FINTECH NEWS

🇬🇧 Robinhood UK is launching a stocks & shares ISA. Robinhood’s ISA combines zero platform fees, commissions, low FX fees, and a 2% cash bonus, giving UK investors a simpler, more rewarding way to invest tax-efficiently. Customers can earn 2% back on new eligible ISA contributions when they fund their account before 5th April 2026

🇬🇧 BOE is working on direct retail payments from banks and sidestepping cards. The Bank of England is working on a payment system that allows consumers to pay retailers out of their bank accounts without using cards, a move that could lower costs for retailers and consumers.

🇧🇷 Juspay accelerates its expansion with one year in Brazil and over US$50 million in cash. According to Shakthidhar Bhaskar, Expansion Director at Juspay, the new capital injection will help the company maintain the investment plan announced when it arrived in the country.

PAYMENTS NEWS

🇸🇦 Hala Payment Solutions is now integrated with Samsung Wallet. Customers can now add their HALA card to Samsung Wallet and enjoy seamless, secure payments directly from their Samsung device. Learn more

🇨🇮 Flutterwave-backed CinetPay owes its partner USD 1.1m lost to a fraud incident. CinetPay is facing intensifying scrutiny as a new million-dollar dispute with a business partner emerges, compounding existing investigations into the company over alleged money-laundering and fraud in Senegal.

🇪🇬 CBE launches contactless “Soft POS” service, turning smartphones into payment terminals. The service enables merchants to convert their smart devices into electronic payment acceptance points, supporting transactions with various contactless cards.

🇧🇷 Pix will now be tracked across all banks to prevent fraud. According to the Central Bank, MED 2.0 allows tracking the flow of funds and sharing information with the financial institutions involved. This allows you to freeze funds in intermediary accounts and return the money within 11 days of filing a dispute.

🇺🇸 Klarna backs Google’s Universal Commerce Protocol to enable agentic commerce across platforms. UCP enables consumers to shop seamlessly in AI conversations while giving agents, merchant systems, and payment providers a standardized way to interact across multiple AI platforms.

🇺🇸 QuickBooks Payments to integrate Affirm’s flexible payment options. Affirm will be offered as a payment method to QuickBooks Online customers in the U.S. The addition of Affirm will strengthen the platform’s end-to-end financial management capabilities, enabling businesses to get paid up front while offering their customers the option of paying over time, the release said.

DIGITAL BANKING NEWS

🇺🇸 Bybit’s neobank plans test crypto exchanges’ push into banking. Bybit’s push to offer neobank-style services is testing how far crypto exchanges can expand into TradFi, highlighting regulatory hurdles and a growing reliance on licensed banking partners. Bybit is partnering with Pave Bank.

🇸🇬 Revolut plans to triple its Singapore workforce within three years. Revolut said Singapore will serve as its base to develop and scale products and services for Asian markets, as the company evaluates expansion into additional countries across the region. Additionally, Revolut surpasses Banca Transilvania in terms of the number of customers. The official figure sent by Revolut is 4.9 million Revolut card users, while Banca Transilvania announced that it has 4.6 million card users in BT Pay.

🇮🇪 Revolut lobbied the Irish government to exclude it from legislation requiring certain banks to ensure access to cash, arguing that such obligations could harm innovation and competition. In a letter to the Department of Finance, the UK FinTech warned against being classified as a “designated entity” under the Access to Cash Bill.

🇧🇷 Santander launches a free digital account for minors under 18 with Pix and a card. The new account is already integrated into the bank's app, offers basic banking services, Pix, debit card, savings, and is completely free. The account is controlled by the minor's parents and/or legal guardians through the Santander app.

🇳🇬 Kuda targets hybrid banking under new national licence. According to the bank, the national licence is about regulatory alignment and operational flexibility rather than a shift away from its digital-first model, so it will continue to lead with digital banking services.

🇬🇧 Raman Bhatia, Chief Executive of Starling Bank, highlights strong customer satisfaction and in-person collaboration as central to the digital lender’s culture, pointing to high Trustpilot ratings and a push to bring staff back into the office.

🇺🇸 Immigrant-focused banking app Seis to close down. In a statement posted to LinkedIn, CEO and co-founder Trevor McKendrick wrote: “I have a sad announcement to make today: Seis is shutting down.” Read more

🇺🇸 Starling targets US expansion by selling software to other banks. The London-based FinTech has called in advisers from Deloitte and PwC to find US clients for its Engine software, which allows lenders to design and build their own digital banking capabilities.

🇺🇸 SoFi hits billion-dollar milestone. The results, released on January 30, 2026, showcased a powerhouse performance across its lending and financial services segments, driven by record-breaking loan volumes and a surge in new member acquisitions.

BLOCKCHAIN/CRYPTO NEWS

🌎 Visa advances stablecoin settlements using the Ethereum network. Integrating a public blockchain into its settlement workflow signals that large financial institutions are increasingly viewing blockchain systems as mature and reliable enough for real-world financial operations.

🇺🇸 BitGo becomes the first public, federally chartered digital asset infrastructure company. BitGo’s federal charter enables the company to provide regulated custody, wallet infrastructure, settlement, and related digital asset services to clients across all 50 U.S. states under a single national regulatory framework.

🇱🇺 Ripple receives a full EU electronic money institution license in Luxembourg. "Europe has always been a strategic priority for us, and this authorization allows us to scale our mission of providing robust, compliant blockchain infrastructure to clients across the EU," said Cassie Craddock, Managing Director, UK & Europe at Ripple.

PARTNERSHIPS

🌍 Bancomat, Bizum, EPI, SIBS, and Vipps MobilePay sign MoU to accelerate the rollout of sovereign, pan-European payment solutions. The cooperation brings together solutions that currently serve approximately 130 million users, creating immediate value for both consumers and merchants operating across borders.

🇦🇪 NymCard enables stablecoin settlement with Visa in the GCC. By leveraging this alternative model, issuers can significantly lower operational costs, reduce collateral and prefunding requirements, and create a foundation for simpler multi-currency settlement in the future.

🌍 Scalapay connects with PPRO. The partnership enables merchants and payment service providers (PSPs) to offer Scalapay through PPRO’s platform, providing faster and simpler access to BNPL in France, Belgium, Spain, Portugal, and Italy.

🇬🇧 Bitpanda Technology Solutions partners with Ribbon PLC. Under the partnership, Bitpanda will, together with Ribbon Plc, launch a digital asset investment offering for the UK market, providing secure, end-to-end infrastructure covering trading, custody, and execution.

🇦🇪 Du Pay and Deem Finance partner to launch Flexi Cash Loan. Flexi Cash Loan is a new digital cash lending product designed to provide customers with fast, convenient access to short-term credit directly within the du Pay wallet. Keep reading

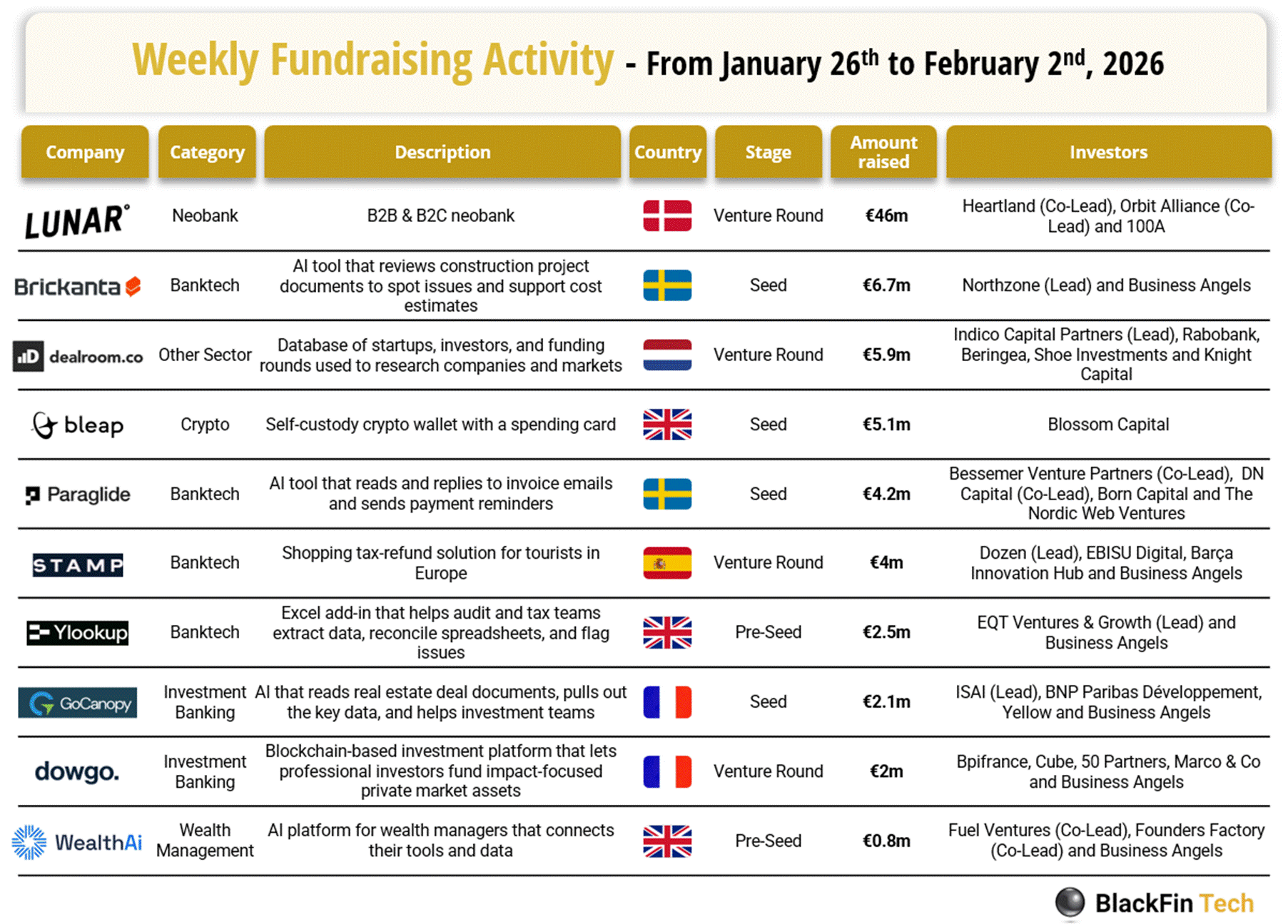

DONEDEAL FUNDING NEWS

💰 Over the last week, there were ten FinTech deals in Europe, raising a total of €79.3 million, including three transactions in the UK, two in France, two in Sweden, one in the Netherlands, one each in Denmark and one in Spain.

🇬🇧 Incard closes £10M Series A to expand its financial platform. Incard plans to focus on geographic expansion, continue investing in its app store, automation, and AI capabilities, and grow its engineering, compliance, and product development teams.

🇭🇰 Wonder raises USD 12 million venture debt from HSBC Innovation Banking to drive growth and expansion. The capital will help Wonder to scale its operations exponentially while continuing to innovate its full-stack omni-channel payments platform, serving a broad spectrum of industries.

🇸🇪 Swedish startup Bits raises €12 million to deepen automation across FinTech compliance workflows. The new funding will be directed toward expanding product capabilities, increasing automation across fraud and financial crime detection workflows, and adding further European data coverage.

🇧🇷 Ruvo raises US$4.6 million to modernize remittances between Brazil and the US. The company operates like a US dollar account, allowing Brazilians to receive payments, make transfers, spend, and invest as if they were based in the United States. The platform brings together Pix, stablecoins, bank transfers (ACH/wire), and Visa in a single application.

🇺🇸 Varo Bank announces growth investment led by Coliseum Capital Management. The all-digital, nationally chartered US bank also added former Executives Alice Milligan and Kevin Watters to its board. Varo uses technology-driven banking and lending products to expand access to credit and reported $547 million in lending volume in 2025.

M&A

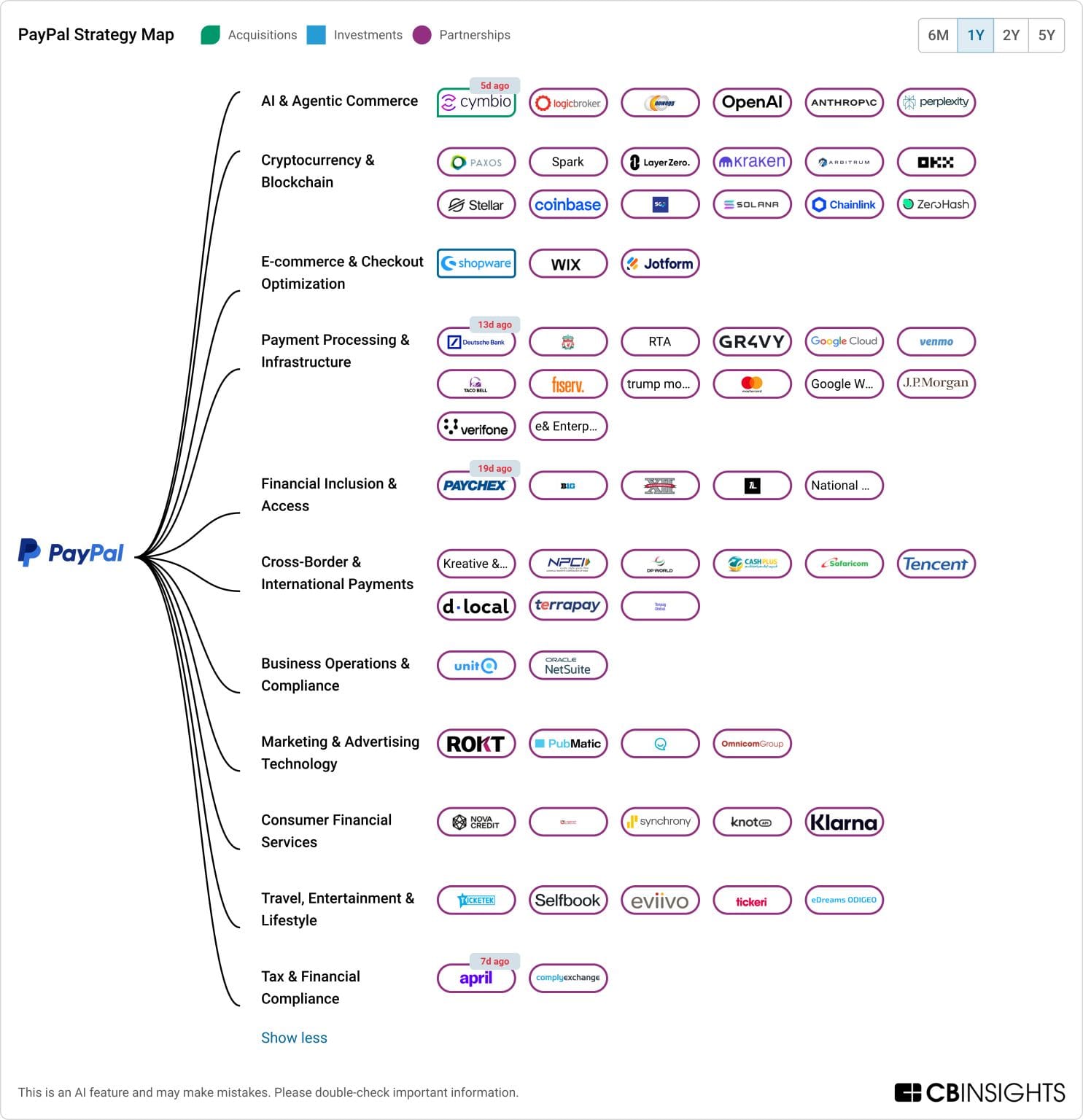

➡️ PayPal just broke a five-year acquisition drought.

And this move says a lot about PayPal's Strategy👇

MOVERS AND SHAKERS

🇩🇪 N26 strengthens its supervisory board with exan perienced banker, Stefan Ermisch. With Ermisch joining the supervisory board, N26 marks a new stage in its development. The bank aims to be perceived not just as an innovative startup, but as an established player in the European banking sector.

🇬🇧 Former Griffin CCO Adam Moulson takes helm at Visa Direct UK and Ireland. Taking to LinkedIn to announce his appointment, Moulson says he will be "leading the growth of the business" and working to "shape the future of money movement in our region".

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()